2 Your audit client, Prescott Co, is a national hotel group with substantial cash resources. Its accounting functions arewell managed and the group accounting policies are rigorously applied. The company’s financial year end is31 December.Prescott has bee

题目

2 Your audit client, Prescott Co, is a national hotel group with substantial cash resources. Its accounting functions are

well managed and the group accounting policies are rigorously applied. The company’s financial year end is

31 December.

Prescott has been seeking to acquire a construction company for some time in order to bring in-house the building

and refurbishment of hotels and related leisure facilities (e.g. swimming pools, squash courts and restaurants).

Prescott’s management has recently identified Robson Construction Co as a potential target and has urgently requested

that you undertake a limited due diligence review lasting two days next week.

Further to their preliminary talks with Robson’s management, Prescott has provided you with the following brief on

Robson Construction Co:

The chief executive, managing director and finance director are all family members and major shareholders. The

company name has an established reputation for quality constructions.

Due to a recession in the building trade the company has been operating at its overdraft limit for the last 18

months and has been close to breaching debt covenants on several occasions.

Robson’s accounting policies are generally less prudent than those of Prescott (e.g. assets are depreciated over

longer estimated useful lives).

Contract revenue is recognised on the percentage of completion method, measured by reference to costs incurred

to date. Provisions are made for loss-making contracts.

The company’s management team includes a qualified and experienced quantity surveyor. His main

responsibilities include:

(1) supervising quarterly physical counts at major construction sites;

(2) comparing costs to date against quarterly rolling budgets; and

(3) determining profits and losses by contract at each financial year end.

Although much of the labour is provided under subcontracts all construction work is supervised by full-time site

managers.

In August 2005, Robson received a claim that a site on which it built a housing development in 2002 was not

properly drained and is now subsiding. Residents are demanding rectification and claiming damages. Robson

has referred the matter to its lawyers and denied all liability, as the site preparation was subcontracted to Sarwar

Services Co. No provisions have been made in respect of the claims, nor has any disclosure been made.

The auditor’s report on Robson’s financial statements for the year to 30 June 2005 was signed, without

modification, in March 2006.

Required:

(a) Identify and explain the specific matters to be clarified in the terms of engagement for this due diligence

review of Robson Construction Co. (6 marks)

相似考题

更多“2 Your audit client, Prescott Co, is a national hotel group with substantial cash resources. Its accounting functions arewell managed and the group accounting policies are rigorously applied. The company’s financial year end is31 December.Prescott has bee”相关问题

-

第1题:

5 You are an audit manager in Fox & Steeple, a firm of Chartered Certified Accountants, responsible for allocating staff

to the following three audits of financial statements for the year ending 31 December 2006:

(a) Blythe Co is a new audit client. This private company is a local manufacturer and distributor of sportswear. The

company’s finance director, Peter, sees little value in the audit and put it out to tender last year as a cost-cutting

exercise. In accordance with the requirements of the invitation to tender your firm indicated that there would not

be an interim audit.

(b) Huggins Co, a long-standing client, operates a national supermarket chain. Your firm provided Huggins Co with

corporate financial advice on obtaining a listing on a recognised stock exchange in 2005. Senior management

expects a thorough examination of the company’s computerised systems, and are also seeking assurance that

the annual report will not attract adverse criticism.

(c) Gray Co has been an audit client since 1999 after your firm advised management on a successful buyout. Gray

provides communication services and software solutions. Your firm provides Gray with technical advice on

financial reporting and tax services. Most recently you have been asked to conduct due diligence reviews on

potential acquisitions.

Required:

For these assignments, compare and contrast:

(i) the threats to independence;

(ii) the other professional and practical matters that arise; and

(iii) the implications for allocating staff.

(15 marks)

正确答案:

5 FOX & STEEPLE – THREE AUDIT ASSIGNMENTS

(i) Threats to independence

Self-interest

Tutorial note: This threat arises when a firm or a member of the audit team could benefit from a financial interest in, or

other self-interest conflict with, an assurance client.

■ A self-interest threat could potentially arise in respect of any (or all) of these assignments as, regardless of any fee

restrictions (e.g. per IFAC’s ‘Code of Ethics for Professional Accountants’), the auditor is remunerated by clients for

services provided.

■ This threat is likely to be greater for Huggins Co (larger/listed) and Gray Co (requires other services) than for Blythe Co

(audit a statutory necessity).

■ The self-interest threat may be greatest for Huggins Co. As a company listed on a recognised stock exchange it may

give prestige and credibility to Fox & Steeple (though this may be reciprocated). Fox & Steeple could be pressurised into

taking evasive action to avoid the loss of a listed client (e.g. concurring with an inappropriate accounting treatment).

Self-review

Tutorial note: This arises when, for example, any product or judgment of a previous engagement needs to be re-evaluated

in reaching conclusions on the audit engagement.

■ This threat is also likely to be greater for Huggins and Gray where Fox & Steeple is providing other (non-audit) services.

■ A self-review threat may be created by Fox & Steeple providing Huggins with a ‘thorough examination’ of its computerised

systems if it involves an extension of the procedures required to conduct an audit in accordance with International

Standards on Auditing (ISAs).

■ Appropriate safeguards must be put in place if Fox & Steeple assists Huggins in the performance of internal audit

activities. In particular, Fox & Steeple’s personnel must not act (or appear to act) in a capacity equivalent to a member

of Huggins’ management (e.g. reporting, in a management role, to those charged with governance).

■ Fox & Steeple may provide Gray with accounting and bookkeeping services, as Gray is not a listed entity, provided that

any self-review threat created is reduced to an acceptable level. In particular, in giving technical advice on financial

reporting, Fox & Steeple must take care not to make managerial decisions such as determining or changing journal

entries without obtaining Gray’s approval.

■ Taxation services comprise a broad range of services, including compliance, planning, provision of formal taxation

opinions and assistance in the resolution of tax disputes. Such assignments are generally not seen to create threats to

independence.

Tutorial note: It is assumed that the provision of tax services is permitted in the jurisdiction (i.e. that Fox and Steeple

are not providing such services if prohibited).

■ The due diligence reviews for Gray may create a self-review threat (e.g. on the fair valuation of net assets acquired).

However, safeguards may be available to reduce these threats to an acceptable level.

■ If staff involved in providing other services are also assigned to the audit, their work should be reviewed by more senior

staff not involved in the provision of the other services (to the extent that the other service is relevant to the audit).

■ The reporting lines of any staff involved in the audit of Huggins and the provision of other services for Huggins should

be different. (Similarly for Gray.)

Familiarity

Tutorial note: This arises when, by virtue of a close relationship with an audit client (or its management or employees) an

audit firm (or a member of the audit team) becomes too sympathetic to the client’s interests.

■ Long association of a senior member of an audit team with an audit client may create a familiarity threat. This threat

is likely to be greatest for Huggins, a long-standing client. It may also be significant for Gray as Fox & Steeple have had

dealings with this client for seven years now.

■ As Blythe is a new audit client this particular threat does not appear to be relevant.

■ Senior personnel should be rotated off the Huggins and Gray audit teams. If this is not possible (for either client), an

additional professional accountant who was not a member of the audit team should be required to independently review

the work done by the senior personnel.

■ The familiarity threat of using the same lead engagement partner on an audit over a prolonged period is particularly

relevant to Huggins, which is now a listed entity. IFAC’s ‘Code of Ethics for Professional Accountants’ requires that the

lead engagement partner should be rotated after a pre-defined period, normally no more than seven years. Although it

might be time for the lead engagement partner of Huggins to be changed, the current lead engagement partner may

continue to serve for the 2006 audit.

Tutorial note: Two additional years are permitted when an existing client becomes listed, since it may not be in the

client’s best interests to have an immediate rotation of engagement partner.

Intimidation

Tutorial note: This arises when a member of the audit team may be deterred from acting objectively and exercising

professional skepticism by threat (actual or perceived), from the audit client.

■ This threat is most likely to come from Blythe as auditors are threatened with a tendering process to keep fees down.

■ Peter may have already applied pressure to reduce inappropriately the extent of audit work performed in order to reduce

fees, by stipulating that there should not be an interim audit.

■ The audit senior allocated to Blythe will need to be experienced in standing up to client management personnel such as

Peter.

Tutorial note: ‘Correct’ classification under ‘ethical’, ‘other professional’, ‘practical’ or ‘staff implications’ is not as important

as identifying the matters.

(ii) Other professional and practical matters

Tutorial note: ‘Other professional’ includes quality control.

■ The experience of staff allocated to each assignment should be commensurate with the assessment of associated risk.

For example, there may be a risk that insufficient audit evidence is obtained within the budget for the audit of Blythe.

Huggins, as a listed client, carries a high reputational risk.

■ Sufficient appropriate staff should be allocated to each audit to ensure adequate quality control (in particular in the

direction, supervision, review of each assignment). It may be appropriate for a second partner to be assigned to carry

out a ‘hot review’ (before the auditor’s report is signed) of:

– Blythe, because it is the first audit of a new client; and

– Huggins, as it is listed.

■ Existing clients (Huggins and Gray) may already have some expectation regarding who should be assigned to their

audits. There is no reason why there should not be some continuity of staff providing appropriate safeguards are put in

place (e.g. to overcome any familiarity threat).

■ Senior staff assigned to Blythe should be alerted to the need to exercise a high degree of professional skepticism (in the

light of Peter’s attitude towards the audit).

■ New staff assigned to Huggins and Gray would perhaps be less likely to assume unquestioned honesty than staff

previously involved with these audits.

Logistics (practical)

■ All three assignments have the same financial year end, therefore there will be an element of ‘competition’ for the staff

to be assigned to the year-end visits and final audit assignments. As a listed company, Huggins is likely to have the

tightest reporting deadline and so have a ‘priority’ for staff.

■ Blythe is a local and private company. Staff involved in the year-end visit (e.g. to attend the physical inventory count)

should also be involved in the final audit. As this is a new client, staff assigned to this audit should get involved at every

stage to increase their knowledge and understanding of the business.

■ Huggins is a national operation and may require numerous staff to attend year-end procedures. It would not be expected

that all staff assigned to year-end visits should all be involved in the final audit.

Time/fee/staff budgets

■ Time budgets will need to be prepared for each assignment to determine manpower requirements (and to schedule audit

work).

(iii) Implications for allocating staff

■ Fox & Steeple should allocate staff so that those providing other services to Huggins and Gray (that may create a selfreview

threat) do not participate in the audit engagement.

Competence and due care (Qualifications/Specialisation)

■ All audit assignments will require competent staff.

■ Huggins will require staff with an in-depth knowledge of their computerised system.

■ Gray will require senior audit staff to be experienced in financial reporting matters specific to communications and

software solutions (e.g. in revenue recognition issues and accounting for internally-generated intangible assets).

■ Specialists providing tax services and undertaking the due diligence reviews for Gray may not be required to have any

involvement in the audit assignment. -

第2题:

4 You are an audit manager in Nate & Co, a firm of Chartered Certified Accountants. You are reviewing three situations,

which were recently discussed at the monthly audit managers’ meeting:

(1) Nate & Co has recently been approached by a potential new audit client, Fisher Co. Your firm is keen to take the

appointment and is currently carrying out client acceptance procedures. Fisher Co was recently incorporated by

Marcellus Fisher, with its main trade being the retailing of wooden storage boxes.

(2) Nate & Co provides the audit service to CF Co, a national financial services organisation. Due to a number of

errors in the recording of cash deposits from new customers that have been discovered by CF Co’s internal audit

team, the directors of CF Co have requested that your firm carry out a review of the financial information

technology systems. It has come to your attention that while working on the audit planning of CF Co, Jin Sayed,

one of the juniors on the audit team, who is a recent information technology graduate, spent three hours

providing advice to the internal audit team about how to improve the system. As far as you know, this advice has

not been used by the internal audit team.

(3) LA Shots Co is a manufacturer of bottled drinks, and has been an audit client of Nate & Co for five years. Two

audit juniors attended the annual inventory count last Monday. They reported that Brenda Mangle, the new

production manager of LA Shots Co, wanted the inventory count and audit procedures performed as quickly as

possible. As an incentive she offered the two juniors ten free bottles of ‘Super Juice’ from the end of the

production line. Brenda also invited them to join the LA Shots Co office party, which commenced at the end of

the inventory count. The inventory count and audit procedures were completed within two hours (the previous

year’s procedures lasted a full day), and the juniors then spent four hours at the office party.

Required:

(a) Define ‘money laundering’ and state the procedures specific to money laundering that should be considered

before, and on the acceptance of, the audit appointment of Fisher Co. (5 marks)

正确答案:

4 NATE & CO

(a) – Money laundering is the process by which criminals attempt to conceal the true origin and ownership of the proceeds

of criminal activity, allowing them to maintain control over the proceeds, and ultimately providing a legitimate cover for

their sources of income. The objective of money laundering is to break the connection between the money, and the crime

that it resulted from.

– It is widely defined, to include possession of, or concealment of, the proceeds of any crime.

– Examples include proceeds of fraud, tax evasion and benefits of bribery and corruption.

Client procedures should include the following:

– Client identification:

? Establish the identity of the entity and its business activity e.g. by obtaining a certificate of incorporation

? If the client is an individual, obtain official documentation including a name and address, e.g. by looking at

photographic identification such as passports and driving licences

? Consider whether the commercial activity makes business sense (i.e. it is not just a ‘front’ for illegal activities)

? Obtain evidence of the company’s registered address e.g. by obtaining headed letter paper

? Establish the current list of principal shareholders and directors.

– Client understanding:

? Pre-engagement communication may be considered, to explain to Marcellus Fisher and the other directors the

nature and reason for client acceptance procedures.

? Best practice recommends that the engagement letter should also include a paragraph outlining the auditor’s

responsibilities in relation to money laundering. -

第3题:

You are an audit manager responsible for providing hot reviews on selected audit clients within your firm of Chartered

Certified Accountants. You are currently reviewing the audit working papers for Pulp Co, a long standing audit client,

for the year ended 31 January 2008. The draft statement of financial position (balance sheet) of Pulp Co shows total

assets of $12 million (2007 – $11·5 million).The audit senior has made the following comment in a summary of

issues for your review:

‘Pulp Co’s statement of financial position (balance sheet) shows a receivable classified as a current asset with a value

of $25,000. The only audit evidence we have requested and obtained is a management representation stating the

following:

(1) that the amount is owed to Pulp Co from Jarvis Co,

(2) that Jarvis Co is controlled by Pulp Co’s chairman, Peter Sheffield, and

(3) that the balance is likely to be received six months after Pulp Co’s year end.

The receivable was also outstanding at the last year end when an identical management representation was provided,

and our working papers noted that because the balance was immaterial no further work was considered necessary.

No disclosure has been made in the financial statements regarding the balance. Jarvis Co is not audited by our firm

and we have verified that Pulp Co does not own any shares in Jarvis Co.’

Required:

(b) In relation to the receivable recognised on the statement of financial position (balance sheet) of Pulp Co as

at 31 January 2008:

(i) Comment on the matters you should consider. (5 marks)

正确答案:

(b) (i) Matters to consider

Materiality

The receivable represents only 0·2% (25,000/12 million x 100) of total assets so is immaterial in monetary terms.

However, the details of the transaction could make it material by nature.

The amount is outstanding from a company under the control of Pulp Co’s chairman. Readers of the financial statements

would be interested to know the details of this transaction, which currently is not disclosed. Elements of the transaction

could be subject to bias, specifically the repayment terms, which appear to be beyond normal commercial credit terms.

Paul Sheffield may have used his influence over the two companies to ‘engineer’ the transaction. Disclosure is necessary

due to the nature of the transaction, the monetary value is irrelevant.

A further matter to consider is whether this is a one-off transaction, or indicative of further transactions between the two

companies.

Relevant accounting standard

The definitions in IAS 24 must be carefully considered to establish whether this actually constitutes a related party

transaction. The standard specifically states that two entities are not necessarily related parties just because they have

a director or other member of key management in common. The audit senior states that Jarvis Co is controlled by Peter

Sheffield, who is also the chairman of Pulp Co. It seems that Peter Sheffield is in a position of control/significant influence

over the two companies (though this would have to be clarified through further audit procedures), and thus the two

companies are likely to be perceived as related.

IAS 24 requires full disclosure of the following in respect of related party transactions:

– the nature of the related party relationship,

– the amount of the transaction,

– the amount of any balances outstanding including terms and conditions, details of security offered, and the nature

of consideration to be provided in settlement,

– any allowances for receivables and associated expense.

There is currently a breach of IAS 24 as no disclosure has been made in the notes to the financial statements. If not

amended, the audit opinion on the financial statements should be qualified with an ‘except for’ disagreement. In

addition, if practicable, the auditor’s report should include the information that would have been included in the financial

statements had the requirements of IAS 24 been adhered to.

Valuation and classification of the receivable

A receivable should only be recognised if it will give rise to future economic benefit, i.e. a future cash inflow. It appears

that the receivable is long outstanding – if the amount is unlikely to be recovered then it should be written off as a bad

debt and the associated expense recognised. It is possible that assets and profits are overstated.

Although a representation has been received indicating that the amount will be paid to Pulp Co, the auditor should be

sceptical of this claim given that the same representation was given last year, and the amount was not subsequently

recovered. The $25,000 could be recoverable in the long term, in which case the receivable should be reclassified as

a non-current asset. The amount advanced to Jarvis Co could effectively be an investment rather than a short term

receivable. Correct classification on the statement of financial position (balance sheet) is crucial for the financial

statements to properly show the liquidity position of the company at the year end.

Tutorial note: Digressions into management imposing a limitation in scope by withholding evidence are irrelevant in this

case, as the scenario states that the only evidence that the auditors have asked for is a management representation.

There is no indication in the scenario that the auditors have asked for, and been refused any evidence. -

第4题:

听力原文:M: Accounting controls refer to plans, procedures and records required for safeguarding assets and producing reliable financial accounts.

W: Yes. Accounting controls are important elements of a bank's internal control system, the soundness of which is vital for bank's survival.

Q: What are the important elements of a bank's internal control system?

(15)

A.Accounting basis.

B.Cash basis accounting.

C.Accounting control.

D.The chart of accounts of a bank.

正确答案:C

解析:对话谈论的是内部会计控制的问题,根据女士的话"accounting controls are important elements of a bank's internal control system", 可知答案为C选项。 -

第5题:

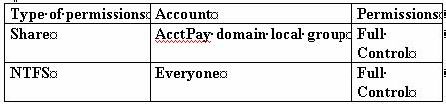

One of the file servers in the domain is a Windows 2000 Server computer named Ezonexamfiles.

Ezonexamfiles contains a shared folder named Accounting, which is used to store data for the company's accounts payable department.

The permissions on the Accounting folder are configured as shown in the following table.

Mr. King is an employee in the operations department. He uses a Windows 2000 Professional client computer. His manager requests that King be granted access to the files in the Accounting folder.

You add King's user account to the AcctPay domain local group, but he still cannot access the files in the Accounting folder.

You need to ensure that King can access the files. What should you do?

A.Instruct King to log off his computer and log on again.

B.Move King's user account to the same Active Directory organizational unit (OU) as Ezonexamfiles.

C.Modify the NTFS permissions on the Accounting folder to grant King Full Control permissions.

D.Modify the NTFS permissions on the Accounting folder to grant the AcctPay domain local group Full Control permission.

正确答案:A

解析:Explanation:YouhavegivenKingaccesstothefilesbyaddinghimtoagroupthathasaccesstothefiles(theAcctPaygroup).Kingwillneedtologoffandlogonagaintoreflecthisnewgroupmembership.IncorrectAnswers:B:King'saccountdoesnotneedtobeinthesameOUastheserver(Corpfiles).C:KinghasbeenaddedtoagroupthathasFullControlpermissiononthefiles.Thisissufficienttogivehimaccesstothefiles.YoudonotneedtogiveKing'saccountexplicitpermissionstothefiles.D:TheAcctPaydomainlocalgroupalreadyhasFullControlNTFSpermissionsontheaccountingfolder. -

第6题:

You are an audit manager at Rockwell & Co, a firm of Chartered Certified Accountants. You are responsible for the audit of the Hopper Group, a listed audit client which supplies ingredients to the food and beverage industry worldwide.

The audit work for the year ended 30 June 2015 is nearly complete, and you are reviewing the draft audit report which has been prepared by the audit senior. During the year the Hopper Group purchased a new subsidiary company, Seurat Sweeteners Co, which has expertise in the research and design of sugar alternatives. The draft financial statements of the Hopper Group for the year ended 30 June 2015 recognise profit before tax of $495 million (2014 – $462 million) and total assets of $4,617 million (2014: $4,751 million). An extract from the draft audit report is shown below:

Basis of modified opinion (extract)

In their calculation of goodwill on the acquisition of the new subsidiary, the directors have failed to recognise consideration which is contingent upon meeting certain development targets. The directors believe that it is unlikely that these targets will be met by the subsidiary company and, therefore, have not recorded the contingent consideration in the cost of the acquisition. They have disclosed this contingent liability fully in the notes to the financial statements. We do not feel that the directors’ treatment of the contingent consideration is correct and, therefore, do not believe that the criteria of the relevant standard have been met. If this is the case, it would be appropriate to adjust the goodwill balance in the statement of financial position.

We believe that any required adjustment may materially affect the goodwill balance in the statement of financial position. Therefore, in our opinion, the financial statements do not give a true and fair view of the financial position of the Hopper Group and of the Hopper Group’s financial performance and cash flows for the year then ended in accordance with International Financial Reporting Standards.

Emphasis of Matter Paragraph

We draw attention to the note to the financial statements which describes the uncertainty relating to the contingent consideration described above. The note provides further information necessary to understand the potential implications of the contingency.

Required:

(a) Critically appraise the draft audit report of the Hopper Group for the year ended 30 June 2015, prepared by the audit senior.

Note: You are NOT required to re-draft the extracts from the audit report. (10 marks)

(b) The audit of the new subsidiary, Seurat Sweeteners Co, was performed by a different firm of auditors, Fish Associates. During your review of the communication from Fish Associates, you note that they were unable to obtain sufficient appropriate evidence with regard to the breakdown of research expenses. The total of research costs expensed by Seurat Sweeteners Co during the year was $1·2 million. Fish Associates has issued a qualified audit opinion on the financial statements of Seurat Sweeteners Co due to this inability to obtain sufficient appropriate evidence.

Required:

Comment on the actions which Rockwell & Co should take as the auditor of the Hopper Group, and the implications for the auditor’s report on the Hopper Group financial statements. (6 marks)

(c) Discuss the quality control procedures which should be carried out by Rockwell & Co prior to the audit report on the Hopper Group being issued. (4 marks)

正确答案:(a) Critical appraisal of the draft audit report

Type of opinion

When an auditor issues an opinion expressing that the financial statements ‘do not give a true and fair view’, this represents an adverse opinion. The paragraph explaining the modification should, therefore, be titled ‘Basis of Adverse Opinion’ rather than simply ‘Basis of Modified Opinion’.

An adverse opinion means that the auditor considers the misstatement to be material and pervasive to the financial statements of the Hopper Group. According to ISA 705 Modifications to Opinions in the Independent Auditor’s Report, pervasive matters are those which affect a substantial proportion of the financial statements or fundamentally affect the users’ understanding of the financial statements. It is unlikely that the failure to recognise contingent consideration is pervasive; the main effect would be to understate goodwill and liabilities. This would not be considered a substantial proportion of the financial statements, neither would it be fundamental to understanding the Hopper Group’s performance and position.

However, there is also some uncertainty as to whether the matter is even material. If the matter is determined to be material but not pervasive, then a qualified opinion would be appropriate on the basis of a material misstatement. If the matter is not material, then no modification would be necessary to the audit opinion.

Wording of opinion/report

The auditor’s reference to ‘the acquisition of the new subsidiary’ is too vague; the Hopper Group may have purchased a number of subsidiaries which this phrase could relate to. It is important that the auditor provides adequate description of the event and in these circumstances it would be appropriate to name the subsidiary referred to.

The auditor has not quantified the amount of the contingent element of the consideration. For the users to understand the potential implications of any necessary adjustments, they need to know how much the contingent consideration will be if it becomes payable. It is a requirement of ISA 705 that the auditor quantifies the financial effects of any misstatements, unless it is impracticable to do so.

In addition to the above point, the auditor should provide more description of the financial effects of the misstatement, including full quantification of the effect of the required adjustment to the assets, liabilities, incomes, revenues and equity of the Hopper Group.

The auditor should identify the note to the financial statements relevant to the contingent liability disclosure rather than just stating ‘in the note’. This will improve the understandability and usefulness of the contents of the audit report.

The use of the term ‘we do not feel that the treatment is correct’ is too vague and not professional. While there may be some interpretation necessary when trying to apply financial reporting standards to unique circumstances, the expression used is ambiguous and may be interpreted as some form. of disclaimer by the auditor with regard to the correct accounting treatment. The auditor should clearly explain how the treatment applied in the financial statements has departed from the requirements of the relevant standard.

Tutorial note: As an illustration to the above point, an appropriate wording would be: ‘Management has not recognised the acquisition-date fair value of contingent consideration as part of the consideration transferred in exchange for the acquiree, which constitutes a departure from International Financial Reporting Standards.’

The ambiguity is compounded by the use of the phrase ‘if this is the case, it would be appropriate to adjust the goodwill’. This once again suggests that the correct treatment is uncertain and perhaps open to interpretation.

If the auditor wishes to refer to a specific accounting standard they should refer to its full title. Therefore instead of referring to ‘the relevant standard’ they should refer to International Financial Reporting Standard 3 Business Combinations.

The opinion paragraph requires an appropriate heading. In this case the auditors have issued an adverse opinion and the paragraph should be headed ‘Adverse Opinion’.

As with the basis paragraph, the opinion paragraph lacks authority; suggesting that the required adjustments ‘may’ materially affect the financial statements implies that there is a degree of uncertainty. This is not the case; the amount of the contingent consideration will be disclosed in the relevant purchase agreement, so the auditor should be able to determine whether the required adjustments are material or not. Regardless, the sentence discussing whether the balance is material or not is not required in the audit report as to warrant inclusion in the report the matter must be considered material. The disclosure of the nature and financial effect of the misstatement in the basis paragraph is sufficient.

Finally, the emphasis of matter paragraph should not be included in the audit report. An emphasis of matter paragraph is only used to draw attention to an uncertainty/matter of fundamental importance which is correctly accounted for and disclosed in the financial statements. An emphasis of matter is not required in this case for the following reasons:

– Emphasis of matter is only required to highlight matters which the auditor believes are fundamental to the users’ understanding of the business. An example may be where a contingent liability exists which is so significant it could lead to the closure of the reporting entity. That is not the case with the Hopper Group; the contingent liability does not appear to be fundamental.

– Emphasis of matter is only used for matters where the auditor has obtained sufficient appropriate evidence that the matter is not materially misstated in the financial statements. If the financial statements are materially misstated, in this regard the matter would be fully disclosed by the auditor in the basis of qualified/adverse opinion paragraph and no emphasis of matter is necessary.

(b) Communication from the component auditor

The qualified opinion due to insufficient evidence may be a significant matter for the Hopper Group audit. While the possible adjustments relating to the current year may not be material to the Hopper Group, the inability to obtain sufficient appropriate evidence with regard to a material matter in Seurat Sweeteners Co’s financial statements may indicate a control deficiency which the auditor was not aware of at the planning stage and it could indicate potential problems with regard to the integrity of management, which could also indicate a potential fraud. It could also indicate an unwillingness of management to provide information, which could create problems for future audits, particularly if research and development costs increase in future years. If the group auditor suspects that any of these possibilities are true, they may need to reconsider their risk assessment and whether the audit procedures performed are still appropriate.

If the detail provided in the communication from the component auditor is insufficient, the group auditor should first discuss the matter with the component auditor to see whether any further information can be provided. The group auditor can request further working papers from the component auditor if this is necessary. However, if Seurat Sweeteners has not been able to provide sufficient appropriate evidence, it is unlikely that this will be effective.

If the discussions with the component auditor do not provide satisfactory responses to evaluate the potential impact on the Hopper Group, the group auditor may need to communicate with either the management of Seurat Sweeteners or the Hopper Group to obtain necessary clarification with regard to the matter.

Following these procedures, the group auditor needs to determine whether they have sufficient appropriate evidence to draw reasonable conclusions on the Hopper Group’s financial statements. If they believe the lack of information presents a risk of material misstatement in the group financial statements, they can request that further audit procedures be performed, either by the component auditor or by themselves.

Ultimately the group engagement partner has to evaluate the effect of the inability to obtain sufficient appropriate evidence on the audit opinion of the Hopper Group. The matter relates to research expenses totalling $1·2 million, which represents 0·2% of the profit for the year and 0·03% of the total assets of the Hopper Group. It is therefore not material to the Hopper Group’s financial statements. For this reason no modification to the audit report of the Hopper Group would be required as this does not represent a lack of sufficient appropriate evidence with regard to a matter which is material to the Group financial statements.

Although this may not have an impact on the Hopper Group audit opinion, this may be something the group auditor wishes to bring to the attention of those charged with governance. This would be particularly likely if the group auditor believed that this could indicate some form. of fraud in Seurat Sweeteners Co, a serious deficiency in financial reporting controls or if this could create problems for accepting future audits due to management’s unwillingness to provide access to accounting records.

(c) Quality control procedures prior to issuing the audit report

ISA 220 Quality Control for an Audit of Financial Statements and ISQC 1 Quality Control for Firms that Perform. Audits and Reviews of Historical Financial Information, and Other Assurance and Related Services Agreements require that an engagement quality control reviewer shall be appointed for audits of financial statements of listed entities. The audit engagement partner then discusses significant matters arising during the audit engagement with the engagement quality control reviewer.

The engagement quality control reviewer and the engagement partner should discuss the failure to recognise the contingent consideration and its impact on the auditor’s report. The engagement quality control reviewer must review the financial statements and the proposed auditor’s report, in particular focusing on the conclusions reached in formulating the auditor’s report and consideration of whether the proposed auditor’s opinion is appropriate. The audit documentation relating to the acquisition of Seurat Sweeteners Co will be carefully reviewed, and the reviewer is likely to consider whether procedures performed in relation to these balances were appropriate.

Given the listed status of the Hopper Group, any modification to the auditor’s report will be scrutinised, and the firm must be sure of any decision to modify the report, and the type of modification made. Once the engagement quality control reviewer has considered the necessity of a modification, they should consider whether a qualified or an adverse opinion is appropriate in the circumstances. This is an important issue, given that it requires judgement as to whether the matters would be material or pervasive to the financial statements.

The engagement quality control reviewer should ensure that there is adequate documentation regarding the judgements used in forming the final audit opinion, and that all necessary matters have been brought to the attention of those charged with governance.

The auditor’s report must not be signed and dated until the completion of the engagement quality control review.

Tutorial note: In the case of the Hopper Group’s audit, the lack of evidence in respect of research costs is unlikely to be discussed unless the audit engagement partner believes that the matter could be significant, for example, if they suspected the lack of evidence is being used to cover up a financial statements fraud.

-

第7题:

资料:Many people think of internal control as a means of safeguarding cash and preventing fraud. Although internal control is an important factor in protecting assets and preventing fraud, this is only a part of its roles. Remember that business decisions are based on accounting data and the system of internal control provides assurance of the dependability of the accounting data used in making decisions.

The decisions made by management are communicated throughout the organization and become company policy. The results of the policies-----the consequences of managerial decisions----must be reported back to management so that the soundness of company policies can be evaluated. Among the means of communication included in the system of internal control are organization charts, manuals of accounting policies and procedures, flow charts, financial forecasts, purchase orders, receiving reports, invoices, and other documents. The term documentation refers to all the charts, forms, reports, and other business papers that guide and describe the working of a company's system of accounting and internal control.

Internal controls fall into two major classes: administrative controls and accounting controls. Administrative controls are measures that increase operational efficiency and compliance with policies in all parts of organization. For example, an administrative control may be a requirement that traveling salespersons submit reports showing the number of calls made on customers each day. Another example is a directive require airline pilots to have regular medical examinations. These internal administrative controls have no direct bearing on the reliability of the financial statements. Consequently, administrative controls are not of direct interest on accountants and independent auditors.

Internal accounting controls are measures that relate to protection of assets and to the reliability of accounting and financial reports. An example is the requirement that a person whose duties involve handling cash shall not also maintain accounting records. More broadly stated, the accounting function must be kept separate from the custody of assets. Another accounting control is the requirement that checks, purchase orders, and other documents be serially numbered. Still another example is the rule that a person who orders merchandise and supplies should not be the one to receive them and should not sign checks to pay for them.

The results of managerial decisions must be reported back to managements so that ( )can be evaluated?A.The means of communication

B.The level of performance in all divisions of the company

C.The effectiveness of company policies

D.The financial reports答案:C解析:本题考查细节理解。

【关键词】The results of managerial decisions must be reported back to managements

【主题句】第2自然段The results of the policies-----the consequences of managerial decisions----must be reported back to management so that the soundness of company policies can be evaluated. 政策的结果-----管理层决定的执行结果-----必须被反馈给管理层,这样公司政策的合理性才能被评估。

【解析】题干意为“管理层决定的执行结果必须被反馈的原因是________”。选项A意为“交流的手段”;选项B意为“公司各部门的业绩水平”;选项C意为“公司政策的有效性”;选项D意为“财务报告”。根据主题句可知,管理层决定的执行结果必须被反馈后,公司政策的合理性才能被评估。故选项C符合题意。 -

第8题:

资料:Many people think of internal control as a means of safeguarding cash and preventing fraud. Although internal control is an important factor in protecting assets and preventing fraud, this is only a part of its roles. Remember that business decisions are based on accounting data and the system of internal control provides assurance of the dependability of the accounting data used in making decisions.

The decisions made by management are communicated throughout the organization and become company policy. The results of the policies-----the consequences of managerial decisions----must be reported back to management so that the soundness of company policies can be evaluated. Among the means of communication included in the system of internal control are organization charts, manuals of accounting policies and procedures, flow charts, financial forecasts, purchase orders, receiving reports, invoices, and other documents. The term documentation refers to all the charts, forms, reports, and other business papers that guide and describe the working of a company's system of accounting and internal control.

Internal controls fall into two major classes: administrative controls and accounting controls. Administrative controls are measures that increase operational efficiency and compliance with policies in all parts of organization. For example, an administrative control may be a requirement that traveling salespersons submit reports showing the number of calls made on customers each day. Another example is a directive require airline pilots to have regular medical examinations. These internal administrative controls have no direct bearing on the reliability of the financial statements. Consequently, administrative controls are not of direct interest on accountants and independent auditors.

Internal accounting controls are measures that relate to protection of assets and to the reliability of accounting and financial reports. An example is the requirement that a person whose duties involve handling cash shall not also maintain accounting records. More broadly stated, the accounting function must be kept separate from the custody of assets. Another accounting control is the requirement that checks, purchase orders, and other documents be serially numbered. Still another example is the rule that a person who orders merchandise and supplies should not be the one to receive them and should not sign checks to pay for them.

Which of the following is an example of internal accounting controls?( ).A.person is required to keep the custody of asset as well as accounting records.

B.person is required to order merchandise and supplies and to receive them as well.

C.person is required to handle cash and another one to maintain accounting records.

D.traveling salesperson is required to present reports showing the number of calls made on customers.答案:C解析:本题考查细节理解。

【关键词】an example of internal accounting controls

【主题句】第4自然段An example is the requirement that a person whose duties involve handling cash shall not also maintain accounting records. More broadly stated, the accounting function must be kept separate from the custody of assets. Still another example is the rule that a person who orders merchandise and supplies should not be the one to receive them and should not sign checks to pay for them. 举例来说,要求管理现金的人不能同时管理会计记录。更大范围来说,会计职能与资产监管必须分开。最后,负责采购与供应的和负责接受并签字支付的不能是同一人。

【解析】题干意为“下列哪一项是会计控制的例子?” 选项A意为“保管资产和管理会计记录应是同一人”;选项B意为“订购商品和用品与接收它们的应是同一人”;选项C意为“一个人处理现金,而另一个维护会计记录”;选项D意为“旅行销售员需要每天提交拨打客户电话数量”。根据主题句可知,选项A、B与原文不符,选项D是行政控制的例子,故选项C符合题意。 -

第9题:

资料:Many people think of internal control as a means of safeguarding cash and preventing fraud. Although internal control is an important factor in protecting assets and preventing fraud, this is only a part of its roles. Remember that business decisions are based on accounting data and the system of internal control provides assurance of the dependability of the accounting data used in making decisions.

The decisions made by management are communicated throughout the organization and become company policy. The results of the policies-----the consequences of managerial decisions----must be reported back to management so that the soundness of company policies can be evaluated. Among the means of communication included in the system of internal control are organization charts, manuals of accounting policies and procedures, flow charts, financial forecasts, purchase orders, receiving reports, invoices, and other documents. The term documentation refers to all the charts, forms, reports, and other business papers that guide and describe the working of a company's system of accounting and internal control.

Internal controls fall into two major classes: administrative controls and accounting controls. Administrative controls are measures that increase operational efficiency and compliance with policies in all parts of organization. For example, an administrative control may be a requirement that traveling salespersons submit reports showing the number of calls made on customers each day. Another example is a directive require airline pilots to have regular medical examinations. These internal administrative controls have no direct bearing on the reliability of the financial statements. Consequently, administrative controls are not of direct interest on accountants and independent auditors.

Internal accounting controls are measures that relate to protection of assets and to the reliability of accounting and financial reports. An example is the requirement that a person whose duties involve handling cash shall not also maintain accounting records. More broadly stated, the accounting function must be kept separate from the custody of assets. Another accounting control is the requirement that checks, purchase orders, and other documents be serially numbered. Still another example is the rule that a person who orders merchandise and supplies should not be the one to receive them and should not sign checks to pay for them.

An airline pilot having regular medical examinations is an example of( ).A.internal accounting controls

B.internal financial controls

C.administrative controls

D.external controls答案:C解析:本题考查细节理解。

【关键词】An airline pilot having regular medical examinations; an example of

【主题句】第3自然段For example, an administrative control may be a requirement that traveling salespersons submit reports showing the number of calls made on customers each day. Another example is a directive require airline pilots to have regular medical examinations. 举例来说,行政控制可能是要求旅行销售员每天提交拨打客户电话数量;另一个例子是要求飞机驾驶员定期体检。

【解析】题干意为“飞机驾驶员定期体检是________的例子”。选项A意为“内部会计控制”;选项B意为“内部财务控制”;选项C意为“管理控制”;选项D意为“外部控制”。根据主题句可知,飞行员要定期进行体检是举例说明行政控制的,故选项C符合题意。 -

第10题:

You are the network administrator for Your network consists of two Active Directory domains. Each department has its own organizational unit (OU) for departmental user accounts. Each OU has a separate Group Policy object (GPO) A single terminal server named TestKingTerm1 is reserved for remote users. In addition, several departments have their own terminal servers for departmental use. Your help desk reports that user sessions on TestKingTerm1 remain connected even if the sessions are inactive for days. Users in the accounting department report slow response times on their terminal server. You need to ensure that users of TestKingTerm1 are automatically logged off when their sessions are inactive for more than two hours. Your solution must not affect users of any other terminal servers. What should you do?()

- A、For all accounting users, change the session limit settings.

- B、On TestKingTerm1, use the Terminal Services configuration tool to change the session limit settings.

- C、Modify the GPO linked to the Accounting OU by changing the session limit settings in user-level group polices.

- D、Modify the GPO linked to the Accounting OU by changing the session limit settings in computer-level group polices.

正确答案:B -

第11题:

Your company ahs an active direcotyr domain. The company also has a server named Server1 that runs Windows Server 2008. You install the file server role on Server1. you create a shared folder named AcctgShare on Server1 The permissions for the shared folder are configured as shown in the following table. ( missing again!) You need to ensure members of the Managers group can only view and open files in the shared folder. What should you do()?

- A、Modify the share permissions for the Managers group to Reader

- B、Modify the share permisisons for the Accounting Users group to Contributor

- C、Modify the NTFS permisisons for the Managers group to Modify

- D、Modify the NTFS permissions for the authenticated users group to modify and the share permissions to contributer.

正确答案:A -

第12题:

单选题Your company has an Active Directory domain. The company also has a server named Server1 that runs Windows Server 2008. You install the File Server role on Server1. You create a shared folder named AcctgShare on Server1. The permissions for the shared folder are configured as shown in the following table. (AGAIN EXHIBIT IS MISSING FROM PASS4SURE) You need to ensure members of the managers group can only view and open files in the shared folder. ()AModify the share permissions for the Managers group to Reader.

BModify the share permissions for the Accounting Users group to Contributer

CModify the NTFS permissions for the Managers group to Modify

DModify the NTFS permissions for the Authenticated Users group to Modify and the share permissions to contributer

正确答案: C解析: 暂无解析 -

第13题:

(b) You are an audit manager in a firm of Chartered Certified Accountants currently assigned to the audit of Cleeves

Co for the year ended 30 September 2006. During the year Cleeves acquired a 100% interest in Howard Co.

Howard is material to Cleeves and audited by another firm, Parr & Co. You have just received Parr’s draft

auditor’s report for the year ended 30 September 2006. The wording is that of an unmodified report except for

the opinion paragraph which is as follows:

Audit opinion

As more fully explained in notes 11 and 15 impairment losses on non-current assets have not been

recognised in profit or loss as the directors are unable to quantify the amounts.

In our opinion, provision should be made for these as required by International Accounting Standard 36

(Impairment). If the provision had been so recognised the effect would have been to increase the loss before

and after tax for the year and to reduce the value of tangible and intangible non-current assets. However,

as the directors are unable to quantify the amounts we are unable to indicate the financial effect of such

omissions.

In view of the failure to provide for the impairments referred to above, in our opinion the financial statements

do not present fairly in all material respects the financial position of Howard Co as of 30 September 2006

and of its loss and its cash flows for the year then ended in accordance with International Financial Reporting

Standards.

Your review of the prior year auditor’s report shows that the 2005 audit opinion was worded identically.

Required:

(i) Critically appraise the appropriateness of the audit opinion given by Parr & Co on the financial

statements of Howard Co, for the years ended 30 September 2006 and 2005. (7 marks)

正确答案:(b) (i) Appropriateness of audit opinion given

Tutorial note: The answer points suggested by the marking scheme are listed in roughly the order in which they might

be extracted from the information presented in the question. The suggested answer groups together some of these

points under headings to give the analysis of the situation a possible structure.

Heading

■ The opinion paragraph is not properly headed. It does not state the form. of the opinion that has been given nor

the grounds for qualification.

■ The opinion ‘the financial statements do not give a true and fair view’ is an ‘adverse’ opinion.

■ That ‘provision should be made’, but has not, is a matter of disagreement that should be clearly stated as noncompliance

with IAS 36. The title of IAS 36 Impairment of Assets should be given in full.

■ The opinion should be headed ‘Disagreement on Accounting Policies – Inappropriate Accounting Method – Adverse

Opinion’.

1 ISA 250 does not specify with whom agreement should be reached but presumably with those charged with corporate governance (e.g audit committee or

2 other supervisory board).

20

6D–INTBA

Paper 3.1INT

Content

■ It is appropriate that the opinion paragraph should refer to the note(s) in the financial statements where the matter

giving rise to the modification is more fully explained. However, this is not an excuse for the audit opinion being

‘light’ on detail. For example, the reason for impairment could be summarised in the auditor’s report.

■ The effects have not been quantified, but they should be quantifiable. The maximum possible loss would be the

carrying amount of the non-current assets identified as impaired.

■ It is not clear why the directors have been ‘unable to quantify the amounts’. Since impairments should be

quantifiable any ‘inability’ suggest a limitation in scope of the audit, in which case the opinion should be disclaimed

(or ‘except for’) on grounds of lack of evidence rather than disagreement.

■ The wording is confusing. ‘Failure to provide’ suggests disagreement. However, there must be sufficient evidence

to support any disagreement. Although the directors cannot quantify the amounts it seems the auditors must have

been able to (estimate at least) in order to form. an opinion that the amounts involved are sufficiently material to

warrant a qualification.

■ The first paragraph refers to ‘non-current assets’. The second paragraph specifies ‘tangible and intangible assets’.

There is no explanation why or how both tangible and intangible assets are impaired.

■ The first paragraph refers to ‘profit or loss’ and the second and third paragraphs to ‘loss’. It may be clearer if the

first paragraph were to refer to recognition in the income statement.

■ It is not clear why the failure to recognise impairment warrants an adverse opinion rather than ‘except for’. The

effects of non-compliance with IAS 36 are to overstate the carrying amount(s) of non-current assets (that can be

specified) and to understate the loss. The matter does not appear to be pervasive and so an adverse opinion looks

unsuitable as the financial statements as a whole are not incomplete or misleading. A loss is already being reported

so it is not that a reported profit would be turned into a loss (which is sometimes judged to be ‘pervasive’).

Prior year

■ As the 2005 auditor’s report, as previously issued, included an adverse opinion and the matter that gave rise to

the modification:

– is unresolved; and

– results in a modification of the 2006 auditor’s report,

the 2006 auditor’s report should also be modified regarding the corresponding figures (ISA 710 Comparatives).

■ The 2006 auditor’s report does not refer to the prior period modification nor highlight that the matter resulting in

the current period modification is not new. For example, the report could say ‘As previously reported and as more

fully explained in notes ….’ and state ‘increase the loss by $x (2005 – $y)’. -

第14题:

5 You are the audit manager for three clients of Bertie & Co, a firm of Chartered Certified Accountants. The financial

year end for each client is 30 September 2007.

You are reviewing the audit senior’s proposed audit reports for two clients, Alpha Co and Deema Co.

Alpha Co, a listed company, permanently closed several factories in May 2007, with all costs of closure finalised and

paid in August 2007. The factories all produced the same item, which contributed 10% of Alpha Co’s total revenue

for the year ended 30 September 2007 (2006 – 23%). The closure has been discussed accurately and fully in the

chairman’s statement and Directors’ Report. However, the closure is not mentioned in the notes to the financial

statements, nor separately disclosed on the financial statements.

The audit senior has proposed an unmodified audit opinion for Alpha Co as the matter has been fully addressed in

the chairman’s statement and Directors’ Report.

In October 2007 a legal claim was filed against Deema Co, a retailer of toys. The claim is from a customer who slipped

on a greasy step outside one of the retail outlets. The matter has been fully disclosed as a material contingent liability

in the notes to the financial statements, and audit working papers provide sufficient evidence that no provision is

necessary as Deema Co’s lawyers have stated in writing that the likelihood of the claim succeeding is only possible.

The amount of the claim is fixed and is adequately covered by cash resources.

The audit senior proposes that the audit opinion for Deema Co should not be qualified, but that an emphasis of matter

paragraph should be included after the audit opinion to highlight the situation.

Hugh Co was incorporated in October 2006, using a bank loan for finance. Revenue for the first year of trading is

$750,000, and there are hopes of rapid growth in the next few years. The business retails luxury hand made wooden

toys, currently in a single retail outlet. The two directors (who also own all of the shares in Hugh Co) are aware that

due to the small size of the company, the financial statements do not have to be subject to annual external audit, but

they are unsure whether there would be any benefit in a voluntary audit of the first year financial statements. The

directors are also aware that a review of the financial statements could be performed as an alternative to a full audit.

Hugh Co currently employs a part-time, part-qualified accountant, Monty Parkes, who has prepared a year end

balance sheet and income statement, and who produces summary management accounts every three months.

Required:

(a) Evaluate whether the audit senior’s proposed audit report is appropriate, and where you disagree with the

proposed report, recommend the amendment necessary to the audit report of:

(i) Alpha Co; (6 marks)

正确答案:

5 BERTIE & CO

(a) (i) Alpha Co

The factory closures constitute a discontinued operation per IFRS 5 Non-Current Assets Held for Sale and Discontinued

Operations, due to the discontinuance of a separate major component of the business. It is a major component due to

the 10% contribution to revenue in the year to 30 September 2007 and 23% contribution in 2006. It is a separate

business component of the company due to the factories having made only one item, indicating a separate income

generating unit.

Under IFRS 5 there must be separate disclosure on the face of the income statement of the post tax results of the

discontinued operation, and of any profit or loss resulting from the closures. The revenue and costs of the discontinued

operation should be separately disclosed either on the face of the income statement or in the notes to the financial

statements. Cash flows relating to the discontinued operation should also be separately disclosed per IAS 7 Cash Flow

Statements.

In addition, as Alpha Co is a listed company, IFRS 8 Operating Segments requires separate segmental disclosure of

discontinued operations.

Failure to disclose the above information in the financial statements is a material breach of International Accounting

Standards. The audit opinion should therefore be qualified on the grounds of disagreement on disclosure (IFRS 5,

IAS 7 and IFRS 8). The matter is material, but not pervasive, and therefore an ‘except for’ opinion should be issued.

The opinion paragraph should clearly state the reason for the disagreement, and an indication of the financial

significance of the matter.

The audit opinion relates only to the financial statements which have been audited, and the contents of the other

information (chairman’s statement and Directors’ Report) are irrelevant when deciding if the financial statements show

a true and fair view, or are fairly presented.

Tutorial note: there is no indication in the question scenario that Alpha Co is in financial or operational difficulty

therefore no marks are awarded for irrelevant discussion of going concern issues and the resultant impact on the audit

opinion. -

第15题:

4 You are an audit manager in Smith & Co, a firm of Chartered Certified Accountants. You have recently been made

responsible for reviewing invoices raised to clients and for monitoring your firm’s credit control procedures. Several

matters came to light during your most recent review of client invoice files:

Norman Co, a large private company, has not paid an invoice from Smith & Co dated 5 June 2007 for work in respect

of the financial statement audit for the year ended 28 February 2007. A file note dated 30 November 2007 states

that Norman Co is suffering poor cash flows and is unable to pay the balance. This is the only piece of information

in the file you are reviewing relating to the invoice. You are aware that the final audit work for the year ended

28 February 2008, which has not yet been invoiced, is nearly complete and the audit report is due to be issued

imminently.

Wallace Co, a private company whose business is the manufacture of industrial machinery, has paid all invoices

relating to the recently completed audit planning for the year ended 31 May 2008. However, in the invoice file you

notice an invoice received by your firm from Wallace Co. The invoice is addressed to Valerie Hobson, the manager

responsible for the audit of Wallace Co. The invoice relates to the rental of an area in Wallace Co’s empty warehouse,

with the following comment handwritten on the invoice: ‘rental space being used for storage of Ms Hobson’s

speedboat for six months – she is our auditor, so only charge a nominal sum of $100’. When asked about the invoice,

Valerie Hobson said that the invoice should have been sent to her private address. You are aware that Wallace Co

sometimes uses the empty warehouse for rental income, though this is not the main trading income of the company.

In the ‘miscellaneous invoices raised’ file, an invoice dated last week has been raised to Software Supply Co, not a

client of your firm. The comment box on the invoice contains the note ‘referral fee for recommending Software Supply

Co to several audit clients regarding the supply of bespoke accounting software’.

Required:

Identify and discuss the ethical and other professional issues raised by the invoice file review, and recommend

what action, if any, Smith & Co should now take in respect of:

(a) Norman Co; (8 marks)

正确答案:

4 Smith & Co

(a) Norman Co

The invoice is 12 months old and it appears doubtful whether the amount outstanding is recoverable. The fact that such an

old debt is unsettled indicates poor credit control by Smith & Co. Part of good practice management is to run a profitable,

cash generating audit function. The debt should not have been left outstanding for such a long period. It seems that little has

been done to secure payment since the file note was attached to the invoice in November 2007.

There is also a significant ethical issue raised. Overdue fees are a threat to objectivity and independence. Due to Norman Co

not yet paying for the 2007 year end audit, it could be perceived that the audit has been performed for free. Alternatively the

amount outstanding could be perceived as a loan to the client, creating a self-interest threat to independence.

The audit work for the year ended 28 February 2008 should not have been carried out without some investigation into the

unpaid invoice relating to the prior year audit. This also represents a self-interest threat – if fees are not collected before the

audit report is issued, an unmodified report could be seen as enhancing the prospect of securing payment. It seems that a

check has not been made to see if the prior year fee has been paid prior to the audit commencing.

It is also concerning that the audit report for the 2008 year end is about to be issued, but no invoice has been raised relating

to the work performed. To maximise cash inflow, the audit firm should invoice the client as soon as possible for work

performed.

Norman Co appears to be suffering financial distress. In this case there is a valid commercial reason why payment has not

been made – the client simply lacks cash. While this fact does not eliminate the problems noted above, it means that the

auditors can continue so long as adequate ethical safeguards are put in place, and after the monetary significance of the

amount outstanding has been evaluated.

It should also be considered whether Norman Co’s financial situation casts any doubt over the going concern of the company.

Continued cash flow problems are certainly a financial indicator of going concern problems, and if the company does not

resolve the cash flow problem then it may be unable to continue in operational existence.

Action to be taken:

– Discuss with the audit committee (if any) or those charged with governance of Norman Co:

The ethical problems raised by the non-payment of invoices, and a payment programme to secure cash payment in

stages if necessary, rather than demanding the total amount outstanding immediately.

– Notify the ethics partner of Smith & Co of the situation – the ethics partner should evaluate the ethical threat posed by

the situation and document the decision to continue to act for Norman Co.

– The documentation should include an evaluation of the monetary significance of the amount outstanding, as it will be

more difficult to justify the continuance of the audit appointment if the amount is significant.

– The ethics partner should ensure that a firm-wide policy is communicated to all audit managers requiring them to check

the payment of previous invoices before commencing new client work. This check should be documented.

– Consider an independent partner review of the working papers prepared for the 28 February 2008 audit.

– The audit working papers on going concern should be reviewed to ensure that sufficient evidence has been gathered to

support the audit opinion. Further procedures may be found to be necessary given the continued cash flow problems.

– Smith & Co have already acted to improve credit control by making a manager responsible for reviewing invoices and

monitoring subsequent cash collection. It is important that credit control procedures are quickly put into place to prevent

similar situations arising. -

第16题:

听力原文:Although the said company is a sun-rising firm, its accounting management should be improved before the loan is extended to it.

(9)

A.The company is a sun-rising firm so it is worthwhile to extend the loan.

B.The company has some accounting problems, some improvement is needed.

C.The company is short of funds because it is sun-rising.

D.The company has some accounting problems because it is sun-rising.

正确答案:B

解析:单句意思为“尽管我们谈及的企业是成长性企业,但是在我们贷款给对方之前,它应该要完善它的财务会计管理。” -

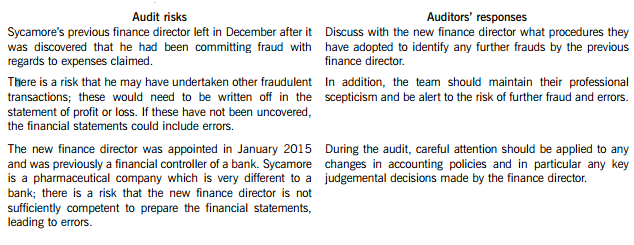

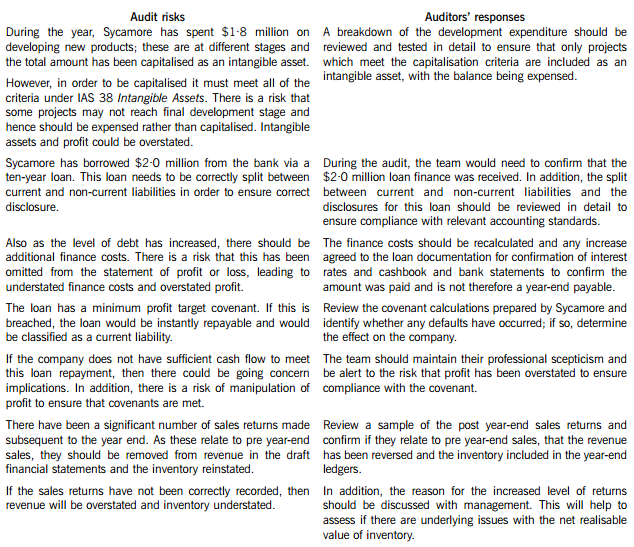

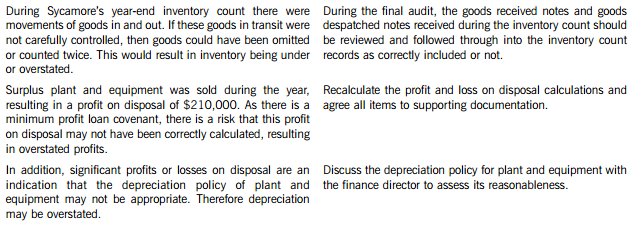

第17题:

You are the audit supervisor of Maple & Co and are currently planning the audit of an existing client, Sycamore Science Co (Sycamore), whose year end was 30 April 2015. Sycamore is a pharmaceutical company, which manufactures and supplies a wide range of medical supplies. The draft financial statements show revenue of $35·6 million and profit before tax of $5·9 million.

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

正确答案:(a) Fraud responsibility

Maple & Co must conduct an audit in accordance with ISA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements and are responsible for obtaining reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error.

In order to fulfil this responsibility, Maple & Co is required to identify and assess the risks of material misstatement of the financial statements due to fraud.

They need to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses. In addition, Maple & Co must respond appropriately to fraud or suspected fraud identified during the audit.

When obtaining reasonable assurance, Maple & Co is responsible for maintaining professional scepticism throughout the audit, considering the potential for management override of controls and recognising the fact that audit procedures which are effective in detecting error may not be effective in detecting fraud.

To ensure that the whole engagement team is aware of the risks and responsibilities for fraud and error, ISAs require that a discussion is held within the team. For members not present at the meeting, Sycamore’s audit engagement partner should determine which matters are to be communicated to them.

(b) Audit risks and auditors’ responses

(c) (i) Review engagements

Review engagements are often undertaken as an alternative to an audit, and involve a practitioner reviewing financial data, such as six-monthly figures. This would involve the practitioner undertaking procedures to state whether anything has come to their attention which causes the practitioner to believe that the financial data is not in accordance with the financial reporting framework.

A review engagement differs to an external audit in that the procedures undertaken are not nearly as comprehensive as those in an audit, with procedures such as analytical review and enquiry used extensively. In addition, the practitioner does not need to comply with ISAs as these only relate to external audits.

(ii) Levels of assurance

The level of assurance provided by audit and review engagements is as follows:

External audit – A high but not absolute level of assurance is provided, this is known as reasonable assurance. This provides comfort that the financial statements present fairly in all material respects (or are true and fair) and are free of material misstatements.

Review engagements – where an opinion is being provided, the practitioner gathers sufficient evidence to be satisfied that the subject matter is plausible; in this case negative assurance is given whereby the practitioner confirms that nothing has come to their attention which indicates that the subject matter contains material misstatements.

-

第18题:

You are the audit manager of Chestnut & Co and are reviewing the key issues identified in the files of two audit clients.

Palm Industries Co (Palm)