(b) Using the unit cost information available and your calculations in (a), prepare a financial analysis of thedecision strategy which TOC may implement with regard to the manufacture of each product. (6 marks)

题目

(b) Using the unit cost information available and your calculations in (a), prepare a financial analysis of the

decision strategy which TOC may implement with regard to the manufacture of each product. (6 marks)

相似考题

更多“(b) Using the unit cost information available and your calculations in (a), prepare a financial analysis of thedecision strategy which TOC may implement with regard to the manufacture of each product. (6 marks)”相关问题

-

第1题:

(b) Prepare a consolidated statement of financial position of the Ribby Group at 31 May 2008 in accordance

with International Financial Reporting Standards. (35 marks)

正确答案:

-

第2题:

(b) Comment (with relevant calculations) on the performance of the business of Quicklink Ltd and Celer

Transport during the year ended 31 May 2005 and, insofar as the information permits, its projected

performance for the year ending 31 May 2006. Your answer should specifically consider:

(i) Revenue generation per vehicle

(ii) Vehicle utilisation and delivery mix

(iii) Service quality. (14 marks)

正确答案:

difference will reduce in the year ending 31 May 2006 due to the projected growth in sales volumes of the Celer Transport

business. The average mail/parcels delivery of mail/parcels per vehicle of the Quicklink Ltd part of the business is budgeted

at 12,764 which is still 30·91% higher than that of the Celer Transport business.

As far as specialist activities are concerned, Quicklink Ltd is budgeted to generate average revenues per vehicle amounting to

£374,850 whilst Celer Transport is budgeted to earn an average of £122,727 from each of the vehicles engaged in delivery

of processed food. It is noticeable that all contracts with major food producers were renewed on 1 June 2005 and it would

appear that there were no increases in the annual value of the contracts with major food producers. This might have been

the result of a strategic decision by the management of the combined entity in order to secure the future of this part of the

business which had been built up previously by the management of Celer Transport.

Each vehicle owned by Quicklink Ltd and Celer Transport is in use for 340 days during each year, which based on a

365 day year would give an in use % of 93%. This appears acceptable given the need for routine maintenance and repairs

due to wear and tear.

During the year ended 31 May 2005 the number of on-time deliveries of mail and parcel and industrial machinery deliveries

were 99·5% and 100% respectively. This compares with ratios of 82% and 97% in respect of mail and parcel and processed

food deliveries made by Celer Transport. In this critical area it is worth noting that Quicklink Ltd achieved their higher on-time

delivery target of 99% in respect of each activity whereas Celer Transport were unable to do so. Moreover, it is worth noting

that Celer Transport missed their target time for delivery of food products on 975 occasions throughout the year 31 May 2005

and this might well cause a high level of customer dissatisfaction and even result in lost business.

It is interesting to note that whilst the businesses operate in the same industry they have a rather different delivery mix in

terms of same day/next day demands by clients. Same day deliveries only comprise 20% of the business of Quicklink Ltd

whereas they comprise 75% of the business of Celer Transport. This may explain why the delivery performance of Celer

Transport with regard to mail and parcel deliveries was not as good as that of Quicklink Ltd.

The fact that 120 items of mail and 25 parcels were lost by the Celer Transport business is most disturbing and could prove

damaging as the safe delivery of such items is the very substance of the business and would almost certainly have resulted

in a loss of customer goodwill. This is an issue which must be addressed as a matter of urgency.

The introduction of the call management system by Quicklink Ltd on 1 June 2004 is now proving its worth with 99% of calls

answered within the target time of 20 seconds. This compares favourably with the Celer Transport business in which only

90% of a much smaller volume of calls were answered within a longer target time of 30 seconds. Future performance in this

area will improve if the call management system is applied to the Celer Transport business. In particular, it is likely that the

number of abandoned calls will be reduced and enhance the ‘image’ of the Celer Transport business.

-

第3题:

(b) Using the information contained in Appendix 1.1, discuss the financial performance of HLP and MAS,

incorporating details of the following in your discussion:

(i) Overall client fees (total and per consultation)

(ii) Advisory protection scheme consultation ‘utilisation levels’ for both property and commercial clients

(iii) Cost/expense levels. (10 marks)

正确答案:

(ii) As far as annual agreements relating to property work are concerned, HLP had a take up rate of 82·5% whereas MAS

had a take up rate of only 50%. Therefore, HLP has ‘lost out’ to competitor MAS in relative financial terms as regards

the ‘take-up’ of consultations relating to property work. This is because both HLP and MAS received an annual fee from

each property client irrespective of the number of consultations given. MAS should therefore have had a better profit

margin from this area of business than HLP. However, the extent to which HLP has ‘lost out’ cannot be quantified since

we would need to know the variable costs per consultation and this detail is not available. What we do know is that

HLP earned actual revenue per effective consultation amounting to £90·90 whereas the budgeted revenue per

consultation amounted to £100. MAS earned £120 per effective consultation.

The same picture emerges from annual agreements relating to commercial work. HLP had a budgeted take up rate of

50%, however the actual take up rate during the period was 90%. MAS had an actual take up rate of 50%. The actual

revenue per effective consultation earned by HLP amounted to £167 whereas the budgeted revenue per consultation

amounted to £300. MAS earned £250 per effective consultation.

There could possibly be an upside to this situation for HLP in that it might be the case that the uptake of 90% of

consultations without further charge by clients holding annual agreements in respect of commercial work might be

indicative of a high level of customer satisfaction. It could on the other hand be indicative of a mindset which says ‘I

have already paid for these consultations therefore I am going to request them’.

(iii) Budgeted and actual salaries in HLP were £50,000 per annum, per advisor. Two additional advisors were employed

during the year in order to provide consultations in respect of commercial work. MAS paid a salary of £60,000 to each

advisor which is 20% higher than the salary of £50,000 paid to each advisor by HLP. Perhaps this is indicative that

the advisors employed by MAS are more experienced and/or better qualified than those employed by HLP.

HLP paid indemnity insurance of £250,000 which is £150,000 (150%) more than the amount of £100,000 paid by

MAS. This excess cost may well have arisen as a consequence of successful claims against HLP for negligence in

undertaking commercial work. It would be interesting to know whether HLP had been the subject of any successful

claims for negligent work during recent years as premiums invariably reflect the claims history of a business. Rather

worrying is the fact that HLP was subject to three such claims during the year ended 31 May 2007.

Significant subcontract costs were incurred by HLP during the year probably in an attempt to satisfy demand and retain

the goodwill of its clients. HLP incurred subcontract costs in respect of commercial properties which totalled £144,000.

These consultations earned revenue amounting to (320 x £150) = £48,000, hence a loss of £96,000 was incurred

in this area of the business.

HLP also paid £300,000 for 600 subcontract consultations in respect of litigation work. These consultations earned

revenue amounting to (600 x £250) = £150,000, hence a loss of £150,000 was incurred in this area of the business.

In contrast, MAS paid £7,000 for 20 subcontract consultations in respect of commercial work and an identical amount

for 20 subcontract consultations in respect of litigation work. These consultations earned revenue amounting to

20 x (£150 + £200) =£7,000. Therefore, a loss of only £7,000 was incurred in respect of subcontract consultations

by MAS.

Other operating expenses were budgeted at 53·0% of sales revenue. The actual level incurred was 40·7% of sales

revenue. The fixed/variable split of such costs is not given but it may well be the case that the fall in this percentage is

due to good cost control by HLP. However, it might simply be the case that the original budget was flawed. Competitor

MAS would appear to have a slightly superior cost structure to that of HLP since its other operating expenses amounted

to 38·4% of sales revenue. Further information is required in order to draw firmer conclusions regarding cost control

within both businesses. -

第4题:

(b) The marketing director of CTC has suggested the introduction of a new toy ‘Nellie the Elephant’ for which the

following estimated information is available:

1. Sales volumes and selling prices per unit

Year ending, 31 May 2009 2010 2011

Sales units (000) 80 180 100

Selling price per unit ($) 50 50 50

2. Nellie will generate a contribution to sales ratio of 50% throughout the three year period.

3. Product specific fixed overheads during the year ending 31 May 2009 are estimated to be $1·6 million. It

is anticipated that these fixed overheads would decrease by 10% per annum during each of the years ending

31 May 2010 and 31 May 2011.

4. Capital investment amounting to $3·9 million would be required in June 2008. The investment would have

no residual value at 31 May 2011.

5. Additional working capital of $500,000 would be required in June 2008. A further $200,000 would be

required on 31 May 2009. These amounts would be recovered in full at the end of the three year period.

6. The cost of capital is expected to be 12% per annum.

Assume all cash flows (other than where stated) arise at the end of the year.

Required:

(i) Determine whether the new product is viable purely on financial grounds. (4 marks)

正确答案:

-

第5题:

(b) Explain by reference to Hira Ltd’s loss position why it may be beneficial for it not to claim any capital

allowances for the year ending 31 March 2007. Support your explanation with relevant calculations.

(6 marks)

正确答案:

(b) The advantage of Hira Ltd not claiming any capital allowances

In the year ending 31 March 2007 Hira Ltd expects to make a tax adjusted trading loss, before deduction of capital

allowances, of £55,000 and to surrender the maximum amount possible of trading losses to Belgrove Ltd and Dovedale Ltd.

For the first nine months of the year from 1 April 2006 to 31 December 2006 Hira Ltd is in a loss relief group with Belgrove

Ltd. The maximum surrender to Belgrove Ltd for this period is the lower of:

– the available loss of £41,250 (£55,000 x 9/12); and

– the profits chargeable to corporation tax of Belgrove of £28,500 (£38,000 x 9/12).

i.e. £28,500. This leaves losses of £12,750 (£41,250 – £28,500) unrelieved.

For the remaining three months from 1 January 2007 to 31 March 2007 Hira Ltd is a consortium company because at least

75% of its share capital is owned by companies, each of which own at least 5%. It can surrender £8,938 (£55,000 x 3/12

x 65%) to Dovedale Ltd and £4,812 (£55,000 x 3/12 x 35%) to Belgrove Ltd as both companies have sufficient taxable

profits to offset the losses. Accordingly, there are no losses remaining from the three-month period.

The unrelieved losses from the first nine months must be carried forward as Hira Ltd has no income or gains in that year or

the previous year. However, the losses cannot be carried forward beyond 1 January 2007 (the date of the change of

ownership of Hira Ltd) if there is a major change in the nature or conduct of the trade of Hira Ltd. Even if the losses can be

carried forward, the earliest year in which they can be relieved is the year ending 31 March 2009 as Hira Ltd is expected to

make a trading loss in the year ending 31 March 2008.

Any capital allowances claimed by Hira Ltd in the year ending 31 March 2007 would increase the tax adjusted trading loss

for that year and consequently the unrelieved losses arising in the first nine months.

If the capital allowances are not claimed, the whole of the tax written down value brought forward of £96,000 would be

carried forward to the year ending 31 March 2008 thus increasing the capital allowances and the tax adjusted trading loss,

for that year. By not claiming any capital allowances, Hira Ltd can effectively transfer a current period trading loss, which

would be created by capital allowances, of £24,000 (25% x £96,000) from the year ending 31 March 2007 to the following

year where it can be surrendered to the two consortium members. -

第6题:

(c) Explanatory notes, together with relevant supporting calculations, in connection with the loan. (8 marks)

Additional marks will be awarded for the appropriateness of the format and presentation of the schedules, the

effectiveness with which the information is communicated and the extent to which the schedules are structured in

a logical manner. (3 marks)

Notes: – you should assume that the tax rates and allowances for the tax year 2006/07 and for the financial year

to 31 March 2007 apply throughout the question.

– you should ignore value added tax (VAT).

正确答案:

(c) Tax implications of there being a loan from Flores Ltd to Banda

Flores Ltd should have paid tax to HMRC equal to 25% of the loan, i.e. £5,250. The tax should have been paid on the

company’s normal due date for corporation tax in respect of the accounting period in which the loan was made, i.e. 1 April

following the end of the accounting period.

The tax is due because Flores Ltd is a close company that has made a loan to a participator and that loan is not in the ordinary

course of the company’s business.

HMRC will repay the tax when the loan is either repaid or written off.

Flores Ltd should have included the loan on Banda’s Form. P11D in order to report it to HMRC.

Banda should have paid income tax on an annual benefit equal to 5% of the amount of loan outstanding during each tax

year. Accordingly, for each full year for which the loan was outstanding, Banda should have paid income tax of £231

(£21,000 x 5% x 22%).

Interest and penalties may be charged in respect of the tax underpaid by both Flores Ltd and Banda and in respect of the

incorrect returns made to HMRC

Willingness to act for Banda

We would not wish to be associated with a client who has engaged in deliberate tax evasion as this poses a threat to the

fundamental principles of integrity and professional behaviour. Accordingly, we should refuse to act for Banda unless she is

willing to disclose the details regarding the loan to HMRC and pay the ensuing tax liabilities. Even if full disclosure is made,

we should consider whether the loan was deliberately hidden from HMRC or Banda’s previous tax adviser.

In addition, companies are prohibited from making loans to directors under the Companies Act. We should advise Banda to

seek legal advice on her own position and that of Flores Ltd. -

第7题:

(b) State, with reasons, the principal additional information that should be made available for your review of

Robson Construction Co. (8 marks)

正确答案:

(b) Principal additional information

■ Any service contracts with the directors or other members of the management team (e.g. the quantity surveyor). These

may contain ‘exit’ or other settlement terms in the event that their services are no longer required after a takeover/buyout.

■ Prior period financial statements (to 30 June 2005) disclosing significant accounting policies and the key assumptions

concerning the future (and other key sources of estimation uncertainty) that have a significant risk of causing a material

adjustment to the carrying amounts of assets and liabilities in the year to 30 June 2006.

For example, concerning:

– the outcome on the Sarwar dispute;

– estimates for guarantees/claims for rectification;

– assumptions made in estimating costs to completion (e.g. for increases in costs of materials or labour).

Tutorial note: Under IAS 1 ‘Presentation of Financial Statements’ the judgements made by management that have the

most significant effect on amounts recognised in financial statements (other than those involving estimations) should

also be disclosed.

■ The most recent management accounts and cash flow forecasts to assess the quality of management information being

used for decision-making and control. In particular, in providing Robson with the means of keeping its cash flows within

its overdraft limit.

Tutorial note: Note that Prescott has substantial cash resources. Therefore Robson’s lack of finance might be a reason

why its management are interested in selling the business.

■ A copy of the signed bank agreement for the overdraft facility (and any other agreements with finance providers). Any

breaches in debt covenants might result in penalties of contingent liabilities that Prescott would have to bear if it acquired

Robson.

■ The standard terms of contracts with customers for construction works. In particular, for:

– guarantees given (e.g. for rectification under warranty);

– penalty clauses (e.g. in the event of overruns or non-completion);

– disclaimers (including conditions for invoking force majeure).

Prescott will want to make some allowance for settlement of liabilities arising on contracts already completed/in-progress

when offering a price for Robson.

Tutorial note: A takeover might excuse Robson from fulfilling a contract.

■ Legal/correspondence files dealing with matters such as the claims of the residents of the housing development and

Robson’s claim against Sarwar Services Co. Also, fee notes rendered by Robson’s legal advisers showing the costs

incurred on matters referred to them.

■ Robson’s insurer’s ‘cover note’ to determine Robson’s exposure to claims for rectification work, damages, injuries to

employees, etc.

■ The quantity surveyor’s working papers for the last quarterly count (presumably at 31 March 2006) and the latest

available rolling budgets. Particular attention should be given to loss-making contracts and contracts that have not been

started. (Prescott might seek to settle rather than fulfil them.) The pattern of taking profits on contracts will be of

interest, for example, to determine the accuracy of the quantity surveyor’s estimates.

Tutorial note: A regular pattern of taking too much profit too soon might be due to underestimating costs to completion

or be evidence of cost overruns due to rectification.

■ Type and frequency of constructions undertaken. Prescott is interested in the building and refurbishment of hotels and

leisure facilities. Robson’s experience in this area may not be extensive.

■ Non-current asset register showing location of plant and equipment so that some test checking on physical existence

might be undertaken (if an agreed-upon-procedure). -

第8题:

(b) Seymour offers health-related information services through a wholly-owned subsidiary, Aragon Co. Goodwill of

$1·8 million recognised on the purchase of Aragon in October 2004 is not amortised but included at cost in the

consolidated balance sheet. At 30 September 2006 Seymour’s investment in Aragon is shown at cost,

$4·5 million, in its separate financial statements.

Aragon’s draft financial statements for the year ended 30 September 2006 show a loss before taxation of

$0·6 million (2005 – $0·5 million loss) and total assets of $4·9 million (2005 – $5·7 million). The notes to

Aragon’s financial statements disclose that they have been prepared on a going concern basis that assumes that

Seymour will continue to provide financial support. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Goodwill

(i) Matters

■ Cost of goodwill, $1·8 million, represents 3·4% consolidated total assets and is therefore material.

Tutorial note: Any assessments of materiality of goodwill against amounts in Aragon’s financial statements are

meaningless since goodwill only exists in the consolidated financial statements of Seymour.

■ It is correct that the goodwill is not being amortised (IFRS 3 Business Combinations). However, it should be tested

at least annually for impairment, by management.

■ Aragon has incurred losses amounting to $1·1 million since it was acquired (two years ago). The write-off of this

amount against goodwill in the consolidated financial statements would be material (being 61% cost of goodwill,

8·3% PBT and 2·1% total assets).

■ The cost of the investment ($4·5 million) in Seymour’s separate financial statements will also be material and

should be tested for impairment.

■ The fair value of net assets acquired was only $2·7 million ($4·5 million less $1·8 million). Therefore the fair

value less costs to sell of Aragon on other than a going concern basis will be less than the carrying amount of the

investment (i.e. the investment is impaired by at least the amount of goodwill recognised on acquisition).

■ In assessing recoverable amount, value in use (rather than fair value less costs to sell) is only relevant if the going

concern assumption is appropriate for Aragon.

■ Supporting Aragon financially may result in Seymour being exposed to actual and/or contingent liabilities that

should be provided for/disclosed in Seymour’s financial statements in accordance with IAS 37 Provisions,

Contingent Liabilities and Contingent Assets.

(ii) Audit evidence

■ Carrying values of cost of investment and goodwill arising on acquisition to prior year audit working papers and

financial statements.

■ A copy of Aragon’s draft financial statements for the year ended 30 September 2006 showing loss for year.

■ Management’s impairment test of Seymour’s investment in Aragon and of the goodwill arising on consolidation at

30 September 2006. That is a comparison of the present value of the future cash flows expected to be generated

by Aragon (a cash-generating unit) compared with the cost of the investment (in Seymour’s separate financial

statements).

■ Results of any impairment tests on Aragon’s assets extracted from Aragon’s working paper files.

■ Analytical procedures on future cash flows to confirm their reasonableness (e.g. by comparison with cash flows for

the last two years).

■ Bank report for audit purposes for any guarantees supporting Aragon’s loan facilities.

■ A copy of Seymour’s ‘comfort letter’ confirming continuing financial support of Aragon for the foreseeable future. -

第9题:

A manufacturing company, Man Co, has two divisions: Division L and Division M. Both divisions make a single standardised product. Division L makes component L, which is supplied to both Division M and external customers.

Division M makes product M using one unit of component L and other materials. It then sells the completed

product M to external customers. To date, Division M has always bought component L from Division L.

The following information is available:

Division L charges the same price for component L to both Division M and external customers. However, it does not incur the selling and distribution costs when transferring internally.

Division M has just been approached by a new supplier who has offered to supply it with component L for $37 per unit. Prior to this offer, the cheapest price which Division M could have bought component L for from outside the group was $42 per unit.

It is head office policy to let the divisions operate autonomously without interference at all.

Required:

(a) Calculate the incremental profit/(loss) per component for the group if Division M accepts the new supplier’s

offer and recommend how many components Division L should sell to Division M if group profits are to be

maximised. (3 marks)

(b) Using the quantities calculated in (a) and the current transfer price, calculate the total annual profits of each division and the group as a whole. (6 marks)

(c) Discuss the problems which will arise if the transfer price remains unchanged and advise the divisions on a suitable alternative transfer price for component L. (6 marks)

正确答案:

(a)MaximisinggroupprofitDivisionLhasenoughcapacitytosupplybothDivisionManditsexternalcustomerswithcomponentL.Therefore,incrementalcostofDivisionMbuyingexternallyisasfollows:CostperunitofcomponentLwhenboughtfromexternalsupplier:$37CostperunitforDivisionLofmakingcomponentL:$20.ThereforeincrementalcosttogroupofeachunitofcomponentLbeingboughtinbyDivisionMratherthantransferredinternally:$17($37–20).Fromthegroup’spointofview,themostprofitablecourseofactionisthereforethatall120,000unitsofcomponentLshouldbetransferredinternally.(b)CalculatingtotalgroupprofitTotalgroupprofitswillbeasfollows:DivisionL:Contributionearnedpertransferredcomponent=$40–$20=$20Profitearnedpercomponentsoldexternally=$40–$24=$16(c)ProblemswithcurrenttransferpriceandsuggestedalternativeTheproblemisthatthecurrenttransferpriceof$40perunitisnowtoohigh.Whilstthishasnotbeenaproblembeforesinceexternalsupplierswerecharging$42perunit,itisaproblemnowthatDivisionMhasbeenofferedcomponentLfor$37perunit.IfDivisionMnowactsinitsowninterestsratherthantheinterestsofthegroupasawhole,itwillbuycomponentLfromtheexternalsupplierratherthanfromDivisionL.ThiswillmeanthattheprofitsofthegroupwillfallsubstantiallyandDivisionLwillhavesignificantunusedcapacity.Consequently,DivisionLneedstoreduceitsprice.Thecurrentpricedoesnotreflectthefactthattherearenosellinganddistributioncostsassociatedwithtransferringinternally,i.e.thecostofsellinginternallyis$4lessforDivisionLthansellingexternally.So,itcouldreducethepriceto$36andstillmakethesameprofitonthesesalesasonitsexternalsales.ThiswouldthereforebethesuggestedtransferpricesothatDivisionMisstillsaving$1perunitcomparedtotheexternalprice.Atransferpriceof$37wouldalsopresumablybeacceptabletoDivisionMsincethisisthesameastheexternalsupplierisoffering. -

第10题:

Which statement most accurately describes the account planning service component in the prepare phase for Cisco Unified Communications()

- A、It performs a detailed financial analysis, including current phone network costs, training, and return of investment.

- B、It researches unique challenges and conducts competitive analysis to determine a vertical approach and strategy.

- C、It identifies the key players, high-level solution requirements, timelines, and scope of the opportunity.

- D、It provides the partner with information regarding customer acceptance of the new solution.

正确答案:B -

第11题:

You design a Business Intelligence (BI) solution by using SQL Server 2008. You plan to design the report strategy for a new report project that will be used by a financial application. The application uses five calculations that are implemented in Microsoft .NET Framework 3.5 assemblies. The assemblies are written in the C# language and use the static methods. You need to ensure that the calculations can be used by the expressions in all reports. You also need to ensure consistency within the reports by using the least amount of development effort. What should you do?()

- A、 Add a reference to the assemblies in the Report Properties References tab.

- B、 Write the calculation logic used by the calculations by using T-SQL functions.

- C、 Write the code of the calculation logic into the Report Properties Custom Code tab.

- D、 Write the calculation logic in each report by using the mathematical functions available natively to SQL Server 2008 Reporting Services (SSRS).

正确答案:A -

第12题:

单选题You design a Business Intelligence (BI) solution by using SQL Server 2008. You plan to design the report strategy for a new report project that will be used by a financial application. The application uses five calculations that are implemented in Microsoft .NET Framework 3.5 assemblies. The assemblies are written in the C# language and use the static methods. You need to ensure that the calculations can be used by the expressions in all reports. You also need to ensure consistency within the reports by using the least amount of development effort. What should you do?()AAdd a reference to the assemblies in the Report Properties References tab.

BWrite the calculation logic used by the calculations by using T-SQL functions.

CWrite the code of the calculation logic into the Report Properties Custom Code tab.

DWrite the calculation logic in each report by using the mathematical functions available natively to SQL Server 2008 Reporting Services (SSRS).

正确答案: A解析: 暂无解析 -

第13题:

(b) Using the TARA framework, construct four possible strategies for managing the risk presented by Product 2.

Your answer should describe each strategy and explain how each might be applied in the case.

(10 marks)

正确答案:

(b) Risk management strategies and Chen Products

Risk transference strategy

This would involve the company accepting a portion of the risk and seeking to transfer a part to a third party. Although an

unlikely possibility given the state of existing claims, insurance against future claims would serve to limit Chen’s potential

losses and place a limit on its losses. Outsourcing manufacture may be a way of transferring risk if the ourtsourcee can be

persuaded to accept some of the product liability.

Risk avoidance strategy

An avoidance strategy involves discontinuing the activity that is exposing the company to risk. In the case of Chen this would

involve ceasing production of Product 2. This would be pursued if the impact (hazard) and probability of incurring an

acceptable level of liability were both considered to be unacceptably high and there were no options for transference or

reduction.

Risk reduction strategy

A risk reduction strategy involves seeking to retain a component of the risk (in order to enjoy the return assumed to be

associated with that risk) but to reduce it and thereby limit its ability to create liability. Chen produces four products and it

could reconfigure its production capacity to produce proportionately more of Products 1, 3 and 4 and proportionately less of

Product 2. This would reduce Product 2 in the overall portfolio and therefore Chen’s exposure to its risks. This would need

to be associated with instructions to other departments (e.g. sales and marketing) to similarly reconfigure activities to sell

more of the other products and less of Product 2.

Risk acceptance strategy

A risk acceptance strategy involves taking limited or no action to reduce the exposure to risk and would be taken if the returns

expected from bearing the risk were expected to be greater than the potential liabilities. The case mentions that Product 2 is

highly profitable and it may be that the returns attainable by maintaining and even increasing Product 2’s sales are worth the

liabilities incurred by compensation claims. This is a risk acceptance strategy. -

第14题:

(ii) Recommend which of the refrigeration systems should be purchased. You should state your reasons

which must be supported by relevant calculations. (3 marks)

正确答案:

-

第15题:

(c) Suggest ways in which each of the six problems chosen in (a) above may be overcome. (6 marks)

正确答案:

(c) Ways in which each of the problems might be overcome are as follows:

Meeting only the lowest targets

– To overcome the problem there must be some additional incentive. This could be through a change in the basis of bonus

payment which currently only provides an incentive to achieve the 100,000 tonnes of output.

Using more resources than necessary

– Overcoming the problem may require a change in the bonus system which currently does not provide benefit from any

output in excess of 100,000 tonnes. This may not be perceived as sufficiently focused in order to achieve action. It may

be that engendering a culture of continuous improvement would help ensure that employees actively sought ways of

reducing idle time levels.

Making the bonus – whatever it takes

– It is likely that efforts to change the ‘work ethos’ at all levels is required, while not necessarily removing the concept of

a bonus payable to all employees for achievement of targets. This may require the fostering of a culture for success within

the company. Dissemination of information to all staff relating to trends in performance, meeting targets, etc may help

to improve focus on continuous improvement.

Competing against other divisions, business units and departments

– The problem may need some input from the directors of TRG. For example, could a ‘dual-cost’ transfer pricing system

be explained to management at both the Bettamould division and also the Division with spare capacity in order to

overcome resistance to problems on transfer pricing and its impact on divisional budgets and reported results? In this

way it may be possible for the Bettamould division to source some of its input materials at a lower cost (particularly from

TRG’s viewpoint) and yet be acceptable to the management at the supplying division.

Ensuring that what is in the budget is spent

– In order to overcome the problem it may be necessary to educate management into acceptance of aspects of budgeting

such as the need to consider the committed, engineered and discretionary aspects of costs. For example, it may be

possible to reduce the number of salaried staff involved in the current quality checking of 25% of throughput on a daily

basis.

Providing inaccurate forecasts

– In order to overcome this problem there must be an integrated approach to the budget setting process. This may be

achieved to some extent through all aspects of the budget having to be agreed by all functions involved. For example,

engineers as well as production line management in reaching the agreed link between percentage process losses and

the falling efficiency of machinery due to age. In addition, TRC may insist an independent audit of aspects of budget

revisions by group staff.

Meeting the target but not beating it

– To overcome the problem may require that the bonus system should be altered to reflect any failure to control costs per

tonne at the budget level.

Avoiding risks

– In order to overcome such problems, TRC would have to provide some guarantees to Bettamould management that the

supply would be available during the budget period at the initially agreed price and that the quality would be maintained

at the required level. This would remove the risk element that the management of the Bettamould division may consider

currently exists. -

第16题:

(iii) Identify and discuss an alternative strategy that may assist in improving the performance of CTC with

effect from 1 May 2009 (where only the products in (a) and (b) above are available for manufacture).

(4 marks)

正确答案:

(iii) If no new products are available then CTC must look to boost revenues obtained from its existing product portolio whilst

seeking to reduce product specific fixed overheads and the company’s other fixed overheads. In order to do this attention

should be focused on the marketing activities currently undertaken.

CTC should consider selling all of its products in ‘multi product’ packages as it might well be the case that the increased

contribution achieved from increased sales volumes would outweigh the diminution in contribution arising from

reductions in the selling price per unit of each product.

CTC could also apply target costing principles in order to reduce costs and thereby increase the margins on each of its

products. Value analysis should be undertaken in order to evaluate the value-added features of each product. For

example, the use of non-combustible materials in manufacture would be a valued added feature of such products

whereas the use of pins and metal fastenings which are potentially harmful to children would obviously not comprise

value added features. CTC should focus on delivering ‘value’ to the customer and in attempting to do so should seek to

identify all non-value activities in order that they may be eliminated and hence margins improved. -

第17题:

(iii) The effect of the restructuring on the group’s ability to recover directly and non-directly attributable input

tax. (6 marks)

You are required to prepare calculations in respect of part (ii) only of this part of this question.

Note: – You should assume that the corporation tax rates and allowances for the financial year 2006 apply

throughout this question.

正确答案:(iii) The effect of the restructuring on the group’s ability to recover its input tax

Prior to the restructuring

Rapier Ltd and Switch Ltd make wholly standard rated supplies and are in a position to recover all of their input tax

other than that which is specifically blocked. Dirk Ltd and Flick Ltd are unable to register for VAT as they do not make

taxable supplies. Accordingly, they cannot recover any of their input tax.

Following the restructuring

Rapier Ltd will be carrying on four separate trades, two of which involve the making of exempt supplies such that it will

be a partially exempt trader. Its recoverable input tax will be calculated as follows.

– Input tax in respect of inputs wholly attributable to taxable supplies is recoverable.

– Input tax in respect of inputs wholly attributable to exempt supplies cannot be recovered (subject to the de minimis

limits below).

– A proportion of the company’s residual input tax, i.e. input tax in respect of inputs which cannot be directly

attributed to particular supplies, is recoverable. The proportion is taxable supplies (VAT exclusive) divided by total

supplies (VAT exclusive). This proportion is rounded up to the nearest whole percentage where total residual input

tax is no more than £400,000 per quarter.

The balance of the residual input tax cannot be recovered (subject to the de minimis limits below).

– If the de minimis limits are satisfied, Rapier Ltd will be able to recover all of its input tax (other than that which is

specifically blocked) including that which relates to exempt supplies. The de minimis limits are satisfied where the

irrecoverable input tax:

– is less than or equal to £625 per month on average; and

– is less than or equal to 50% of total input tax.

The impact of the restructuring on the group’s ability to recover its input tax will depend on the level of supplies made

by the different businesses and the amounts of input tax involved. The restructuring could result in the group being able

to recover all of its input tax (if the de minimis limits are satisfied). Alternatively the amount of irrecoverable input tax

may be more or less than the amounts which cannot be recovered by Dirk Ltd and Flick Ltd under the existing group

structure.

-

第18题:

(b) Using the information provided, state the financial statement risks arising and justify an appropriate audit

approach for Indigo Co for the year ending 31 December 2005. (14 marks)

正确答案:

(b) Financial statement risks

Assets

■ There is a very high risk that inventory could be materially overstated in the balance sheet (thereby overstating profit)

because:

? there is a high volume of metals (hence material);

? valuable metals are made more portable;

? subsidy gives an incentive to overstate purchases (and hence inventory);

? inventory may not exist due to lack of physical controls (e.g. aluminium can blow away);

? scrap metal in the stockyard may have zero net realisable value (e.g. iron is rusty and slow-moving);

? quantities per counts not attended by an auditor have increased by a third.

■ Inventory could be otherwise misstated (over or under) due to:

? the weighbridge being inaccurate;

? metal qualities being estimated;

? different metals being mixed up; and

? the lack of an independent expert to identify/measure/value metals.

■ Tangible non-current assets are understated as the parts of the furnaces that require replacement (the linings) are not

capitalised (and depreciated) as separate items but treated as repairs/maintenance/renewals and expensed.

■ Cash may be understated due to incomplete recording of sales.

■ Recorded cash will be overstated if it does not exist (e.g. if it has been stolen).

■ Trade receivables may be understated if cash receipts from credit customers have been misappropriated.

Liabilities

■ The provision for the replacement of the furnace linings is overstated by the amount provided in the current and previous

year (i.e. in its entirety).

Tutorial note: Last replacement was two years ago.

Income statement

■ Revenue will be understated in respect of unrecorded cash sales of salvaged metals and ‘clinker’.

■ Scrap metal purchases (for cash) are at risk of overstatement:

? to inflate the 15% subsidy;

? to conceal misappropriated cash.

■ The income subsidy will be overstated if quantities purchased are overstated and/or overvalued (on the quarterly returns)

to obtain the amount of the subsidy.

■ Cash receipts/payments that were recorded only in the cash book in November are at risk of being unrecorded (in the

absence of cash book postings for November), especially if they are of a ‘one-off’ nature.

Tutorial note: Cash purchases of scrap and sales of salvaged metal should be recorded elsewhere (i.e. in the manual

inventory records). However, a one-off expense (of a capital or revenue nature) could be omitted in the absence of

another record.

■ Expenditure is overstated in respect of the 25% provision for replacing the furnace linings. However, as depreciation

will be similarly understated (as the furnace linings have not been capitalised) there is no risk of material misstatement

to the income statement overall.

Disclosure risk

■ A going concern (‘failure’) risk may arise through the loss of:

? sales revenue (e.g. through misappropriation of salvaged metals and/or cash);

? the subsidy (e.g. if returns are prepared fraudulently);

? cash (e.g. if material amounts stolen).

Any significant doubts about going concern must be suitably disclosed in the notes to the financial statements.

Disclosure risk arises if the requirements of IAS 1 ‘Presentation of Financial Statements’ are not met.

■ Disclosure risk arises if contingent liabilities in connection with the dumping of ‘clinker’ (e.g. for fines and penalties) are

not adequately disclosed in accordance with IAS 37 ‘Provisions, Contingent Liabilities and Contingent Assets’.

Appropriate audit approach

Tutorial note: In explaining why AN audit approach is appropriate for Indigo it can be relevant to comment on the

unsuitability of other approaches.

■ A risk-based approach is suitable because:

? inherent risk is high at the entity and financial assertion levels;

? material errors are likely to arise in inventory where a high degree of subjectivity will be involved (regarding quality

of metals, quantities, net realisable value, etc);

? it directs the audit effort to inventory, purchases, income (sales and subsidy) and other risk areas (e.g. contingent

liabilities).

■ A systems-based/compliance approach is not suited to the risk areas identified because controls are lacking/ineffective

(e.g. over inventory and cash). Also, as the audit appointment was not more than three months ago and no interim

audit has been conducted (and the balance sheet date is only three weeks away) testing controls is likely to be less

efficient than a substantive approach.

■ A detailed substantive/balance sheet approach would be suitable to direct audit effort to the appropriate valuation of

assets (and liabilities) existing at balance sheet date. Principal audit work would include:

? attendance at a full physical inventory count at 31 December 2005;

? verifying cash at bank (through bank confirmation and reconciliation) and in hand (through physical count);

? confirming the accuracy of the quarterly returns to the local authority.

■ A cyclical approach/directional testing is unlikely to be suitable as cycles are incomplete. For example the purchases

cycle for metals is ‘purchase/cash’ rather than ‘purchase/payable/cash’ and there is no independent third party evidence

to compensate for that which would be available if there were trade payables (i.e. suppliers’ statements). Also the cycles

are inextricably inter-related to cash and inventory – amounts of which are subject to high inherent risk.

■ Analytical procedures may be of limited use for substantive purposes. Factors restricting the use of substantive analytical

procedures include:

? fluctuating margins (e.g. as many factors will influence the price at which scrap is purchased and subsequently

sold, when salvaged, sometime later);

? a lack of reliable/historic information on which to make comparisons. -

第19题:

(b) A sale of industrial equipment to Deakin Co in May 2005 resulted in a loss on disposal of $0·3 million that has

been separately disclosed on the face of the income statement. The equipment cost $1·2 million when it was

purchased in April 1996 and was being depreciated on a straight-line basis over 20 years. (6 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Keffler Co for the year ended

31 March 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Sale of industrial equipment

(i) Matters

■ The industrial equipment was in use for nine years (from April 1996) and would have had a carrying value of

$660,000 at 31 March 2005 (11/20 × $1·2m – assuming nil residual value and a full year’s depreciation charge

in the year of acquisition and none in the year of disposal). Disposal proceeds were therefore only $360,000.

■ The $0·3m loss represents 15% of PBT (for the year to 31 March 2006) and is therefore material. The equipment

was material to the balance sheet at 31 March 2005 representing 2·6% of total assets ($0·66/$25·7 × 100).

■ Separate disclosure, of a material loss on disposal, on the face of the income statement is in accordance with

IAS 16 ‘Property, Plant and Equipment’. However, in accordance with IAS 1 ‘Presentation of Financial Statements’,

it should not be captioned in any way that might suggest that it is not part of normal operating activities (i.e. not

‘extraordinary’, ‘exceptional’, etc).

Tutorial note: However, note that if there is a prior period error to be accounted for (see later), there would be

no impact on the current period income statement requiring consideration of any disclosure.

■ The reason for the sale. For example, whether the equipment was:

– surplus to operating requirements (i.e. not being replaced); or

– being replaced with newer equipment (thereby contributing to the $8·1m increase (33·8 – 25·7) in total

assets).

■ The reason for the loss on sale. For example, whether:

– the sale was at an under-value (e.g. to a related party);

– the equipment had a bad maintenance history (or was otherwise impaired);

– the useful life of the equipment is less than 20 years;

– there is any deferred consideration not yet recorded;

– any non-cash disposal proceeds have been overlooked (e.g. if another asset was acquired in a part-exchange).

■ If the useful life was less than 20 years, tangible non-current assets may be materially overstated in respect of other

items of equipment that are still in use and being depreciated on the same basis.

■ If the sale was to a related party then additional disclosure should be required in a note to the financial statements

for the year to 31 March 2006 (IAS 24 ‘Related Party Disclosures’).

Tutorial note: Since there are no specific pointers to a related party transaction (RPT), this point is not expanded

on.

■ Whether the sale was identified in the prior year audit’s post balance sheet event review. If so:

– the disclosure made in the prior year’s financial statements (IAS 10 ‘Events After the Balance Sheet Date’);

– whether an impairment loss was recognised at 31 March 2005.

■ If not, and the equipment was impaired at 31 March 2005, a prior period error should be accounted for (IAS 8

‘Accounting Policies, Changes in Accounting Estimates and Errors’). An impairment loss of $0·3m would have

been material to prior year profit (12·5%).

Tutorial note: Unless this was a RPT or the impairment arose after 31 March 2005 a prior period adjustment

should be made.

■ Failure to account for a prior period error (if any) would result in modification of the audit opinion ‘except for’ noncompliance

with IAS 8 (in the current year) and IAS 36 (in the prior period).

(ii) Audit evidence

■ Carrying amount ($0·66m as above) agreed to the non-current asset register balances at 31 March 2005 and

recalculation of the loss on disposal.

■ Cost and accumulated depreciation removed from the asset register in the year to 31 March 2006.

■ Receipt of proceeds per cash book agreed to bank statement.

■ Sales invoice transferring title to Deakin.

■ A review of maintenance expenses and records (e.g. to confirm reason for loss on sale).

■ Post balance sheet event review on prior year audit working papers file.

■ Management representation confirming that Deakin is not a related party (provided that there is no evidence to

suggest otherwise). -

第20题:

In relation to the law of contract, distinguish between and explain the effect of:

(a) a term and a mere representation; (3 marks)

(b) express and implied terms, paying particular regard to the circumstances under which terms may be implied in contracts. (7 marks)

正确答案:This question requires candidates to consider the law relating to terms in contracts. It specifically requires the candidates to distinguish between terms and mere representations and then to establish the difference between express and implied terms in contracts.

(a) As the parties to a contract will be bound to perform. any promise they have contracted to undertake, it is important to distinguish between such statements that will be considered part of the contract, i.e. terms, and those other pre-contractual statements which are not considered to be part of the contract, i.e. mere representations. The reason for distinguishing between them is that there are different legal remedies available if either statement turns out to be incorrect.

A representation is a statement that induces a contract but does not become a term of the contract. In practice it is sometimes difficult to distinguish between the two, but in attempting to do so the courts will focus on when the statement was made in relation to the eventual contract, the importance of the statement in relation to the contract and whether or not the party making the statement had specialist knowledge on which the other party relied (Oscar Chess v Williams (1957) and Dick

Bentley v Arnold Smith Motors (1965)).

(b) Express terms are statements actually made by one of the parties with the intention that they become part of the contract and

thus binding and enforceable through court action if necessary. It is this intention that distinguishes the contractual term from

the mere representation, which, although it may induce the contractual agreement, does not become a term of the contract.

Failure to comply with the former gives rise to an action for breach of contract, whilst failure to comply with the latter only gives rise to an action for misrepresentation.Such express statements may be made by word of mouth or in writing as long as they are sufficiently clear for them to be enforceable. Thus in Scammel v Ouston (1941) Ouston had ordered a van from the claimant on the understanding that the balance of the purchase price was to be paid ‘on hire purchase terms over two years’. When Scammel failed to deliver the van Ouston sued for breach of contract without success, the court holding that the supposed terms of the contract were too

uncertain to be enforceable. There was no doubt that Ouston wanted the van on hire purchase but his difficulty was that

Scammel operated a range of hire purchase terms and the precise conditions of his proposed hire purchase agreement were

never sufficiently determined.

Implied terms, however, are not actually stated or expressly included in the contract, but are introduced into the contract by implication. In other words the exact meaning and thus the terms of the contract are inferred from its context. Implied terms can be divided into three types.

Terms implied by statute

In this instance a particular piece of legislation states that certain terms have to be taken as constituting part of an agreement, even where the contractual agreement between the parties is itself silent as to that particular provision. For example, under s.5 of the Partnership Act 1890, every member of an ordinary partnership has the implied power to bind the partnership in a contract within its usual sphere of business. That particular implied power can be removed or reduced by the partnership agreement and any such removal or reduction of authority would be effective as long as the other party was aware of it. Some implied terms, however, are completely prescriptive and cannot be removed.

Terms implied by custom or usage

An agreement may be subject to terms that are customarily found in such contracts within a particular market, trade or locality. Once again this is the case even where it is not actually specified by the parties. For example, in Hutton v Warren (1836), it was held that customary usage permitted a farm tenant to claim an allowance for seed and labour on quitting his tenancy. It should be noted, however, that custom cannot override the express terms of an agreement (Les Affreteurs Reunnis SA v Walford (1919)).

Terms implied by the courts Generally, it is a matter for the parties concerned to decide the terms of a contract, but on occasion the court will presume that the parties intended to include a term which is not expressly stated. They will do so where it is necessary to give business efficacy to the contract.Whether a term may be implied can be decided on the basis of the officious bystander test. Imagine two parties, A and B, negotiating a contract, when a third party, C, interrupts to suggest a particular provision. A and B reply that that particular term is understood. In just such a way, the court will decide that a term should be implied into a contract.

In The Moorcock (1889), the appellants, owners of a wharf, contracted with the respondents to permit them to discharge their ship at the wharf. It was apparent to both parties that when the tide was out the ship would rest on the riverbed. When the tide was out, the ship sustained damage by settling on a ridge. It was held that there was an implied warranty in the contract that the place of anchorage should be safe for the ship. As a consequence, the ship owner was entitled to damages for breach of that term.

Alternatively the courts will imply certain terms into unspecific contracts where the parties have not reduced the general agreement into specific details. Thus in contracts of employment the courts have asserted the existence of implied terms to impose duties on both employers and employees, although such implied terms can be overridden by express contractual provision to the contrary. -

第21题:

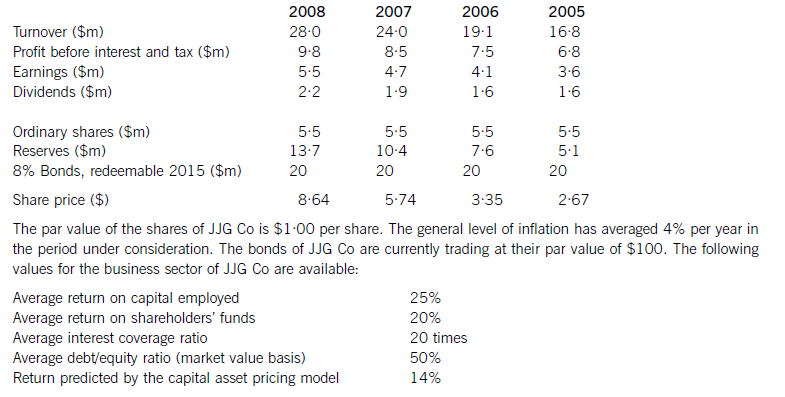

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion. -

第22题:

WebSphere Commerce Accelerator will be used to create a product. The product has 6 variations determined by attributes Size, which has three values and Color, which has two values. What is the PREFERRED method to create the product and its SKUs using the Product Management tool?()

- A、Create the product. Create each SKU. For each SKU create two descriptive attributes with the correct values.

- B、Create the product. Create two defining attributes. Create each SKU and during creation assign theattributes to the SKU with the correct values.

- C、Create the product. Create two defining attributes with the permitted values. Generate the SKUs.

- D、Create the product. Create two descriptive attributes with the permitted values. Generate the SKUs.

正确答案:C -

第23题:

单选题Which statement most accurately describes the account planning service component in the prepare phase for Cisco Unified Communications()AIt performs a detailed financial analysis, including current phone network costs, training, and return of investment.

BIt researches unique challenges and conducts competitive analysis to determine a vertical approach and strategy.

CIt identifies the key players, high-level solution requirements, timelines, and scope of the opportunity.

DIt provides the partner with information regarding customer acceptance of the new solution.

正确答案: B解析: 暂无解析