(ii) Explain why the disclosure of voluntary information in annual reports can enhance the company’saccountability to equity investors. (4 marks)

题目

(ii) Explain why the disclosure of voluntary information in annual reports can enhance the company’s

accountability to equity investors. (4 marks)

相似考题

更多“(ii) Explain why the disclosure of voluntary information in annual reports can enhance the company’saccountability to equity investors. (4 marks)”相关问题

-

第1题:

(ii) Explain the accounting treatment under IAS39 of the loan to Bromwich in the financial statements of

Ambush for the year ended 30 November 2005. (4 marks)

正确答案:

(ii) There is objective evidence of impairment because of the financial difficulties and reorganisation of Bromwich. The

impairment loss on the loan will be calculated by discounting the estimated future cash flows. The future cash flows

will be $100,000 on 30 November 2007. This will be discounted at an effective interest rate of 8% to give a present

value of $85,733. The loan will, therefore, be impaired by ($200,000 – $85,733) i.e. $114,267.

(Note: IAS 39 requires accrual of interest on impaired loans at the original effective interest rate. In the year to

30 November 2006 interest of 8% of $85,733 i.e. $6,859 would be accrued.)

-

第2题:

4 (a) A company may choose to finance its activities mainly by equity capital, with low borrowings (low gearing) or by

relying on high borrowings with relatively low equity capital (high gearing).

Required:

Explain why a highly geared company is generally more risky from an investor’s point of view than a company

with low gearing. (3 marks)

正确答案:

(a) A highly-geared company has an obligation to pay interest on its loans regardless of its profit level. It will show high profits if

its overall rate of return on capital is greater than the rate of interest being paid on its borrowings, but a low profit or a loss if

there is a down-turn in its profit such that the rate of interest to be paid exceeds the return on its assets. -

第3题:

(c) Mr Cobar, the chief executive of SHC, has decided to draft two alternative statements to explain both possible

outcomes of the secrecy/licensing decision to shareholders. Once the board has decided which one to pursue,

the relevant draft will be included in a voluntary section of the next corporate annual report.

Required:

(i) Draft a statement in the event that the board chooses the secrecy option. It should make a convincing

business case and put forward ethical arguments for the secrecy option. The ethical arguments should

be made from the stockholder (or pristine capitalist) perspective. (8 marks)

(ii) Draft a statement in the event that the board chooses the licensing option. It should make a convincing

business case and put forward ethical arguments for the licensing option. The ethical arguments should

be made from the wider stakeholder perspective. (8 marks)

(iii) Professional marks for the persuasiveness and logical flow of arguments: two marks per statement.

(4 marks)

正确答案:(c) (i) For the secrecy option

Important developments at SHC

This is an exciting time for the management and shareholders of Swan Hill Company. The research and development

staff at SHC have made a groundbreaking discovery (called the ‘sink method’) that will enable your company to produce

its major product at lower cost, in higher volumes and at a much higher quality than our competitors will be able to

using, as they do, the existing production technology. The sink process also produces at a lower rate of environmental

emissions which, as I’m sure shareholders will agree, is a very welcome development.

When considering the options following the discovery, your board decided that we should press ahead with the

investment needed to transform. the production facilities without offering the use of the technology to competitors under

a licensing arrangement. This means that once the new sink production comes on stream, SHC shareholders can, your

board believes, look forward to a significant strengthening of our competitive position.

The business case for this option is overwhelming. By pushing ahead with the investment needed to implement the sink

method, the possibility exists to gain a substantial competitive advantage over all of SHC’s competitors. It will place SHC

in a near monopolist position in the short term and in a dominant position long term. This will, in turn, give the company

pricing power in the industry and the likelihood of superior profits for many years to come. We would expect SHC to

experience substantial ‘overnight’ growth and the returns from this will reward shareholders’ loyalty and significantly

increase the value of the company. Existing shareholders can reasonably expect a significant increase in the value of

their holdings over the very short term and also over the longer term.

Ethical implications of the secrecy option

In addition to the overwhelming business case, however, there is a strong ethical case for the secrecy option. SHC

recognises that it is the moral purpose of SHC to make profits in order to reward those who have risked their own money

to support it over many years. Whilst some companies pursue costly programmes intended to serve multiple stakeholder

interests, SHC recognises that it is required to comply with the demands of its legal owners, its shareholders, and not

to dilute those demands with other concerns that will reduce shareholder returns. This is an important part of the agency

relationship: the SHC board will always serve the best economic interests of its shareholders: its legal owners. The SHC

board believes that any action taken that renders shareholder returns suboptimal is a threat to shareholder value and an

abuse of the agency position. Your board will always seek to maximise shareholder wealth; hence our decision to pursue

the secrecy option in this case. The secrecy option offers the possibility of optimal shareholder value and because

shareholders invest in SHC to maximise returns, that is the only ethical action for the board to pursue. Happily, this

option will also protect the employees’ welfare in SHC’s hometown of Swan Hill and demonstrate its commitment to the

locality. This, in turn, will help to manage two of the key value-adding resources in the company, its employees and its

reputation. This will help in local recruitment and staff retention in future years.

(ii) For the licensing option

Important developments at SHC

Your board was recently faced with a very difficult business and ethical decision. After the discovery by SHC scientists

of the groundbreaking sink production method, we had a choice of keeping the new production technology secret or

sharing the breakthrough under a licensing arrangement with our competitors. After a lengthy discussion, your board

decided that we should pursue the licensing option and I would like to explain our reasons for this on both business and

ethical grounds.

In terms of the business case for licensing, I would like shareholders to understand that although the secrecy option may

have offered SHC the possibility of an unassailable competitive advantage, in reality, it would have incurred a number

of risks. Because of the speed with which we would have needed to have acted, it would have necessitated a large

increase in our borrowing, bringing about a substantial change in our financial structure. This would, in turn, increase

liquidity pressures and make us more vulnerable to rising interest rates. A second risk with the secrecy option would

involve the security of the sink technology ‘secret’. If the sink process was leaked or discovered by competitors and

subsequently copied, our lack of a legally binding patent would mean we would have no legal way to stop them

proceeding with their own version of the sink process.

As well as avoiding the risks, however, the licensing option offers a number of specific business advantages. The royalties

from the licences granted to competitors are expected to be very large indeed. These will be used over the coming years

to extend our existing competitive advantage in the future. Finally, the ‘improvement sharing’ clause in the licensing

contract will ensure that the sink process will be improved and perfected with several manufacturers using the

technology at the same time. SHC’s sink production may, in consequence, improve at a faster rate than would have

been the case were we to have pursued the secrecy option.

Ethical implications of the licensing option

In addition to the business case, there is also a powerful ethical case for the decision we have taken. As a good,

responsible corporate citizen, Swan Hill Company acknowledges its many stakeholders and recognises the impacts that

a business decision has on others. Your board recognises that in addition to external stakeholders having influence over

our operations, our decisions can also affect others. In this case, we have carefully considered the likelihood that keeping

the new technology a secret from our competitors would radically reshape the industry. The superior environmental

performance of the sink process over existing methods will also mean that when fully adopted, the environmental

emissions of the entire industry will be reduced. SHC is very proud of this contribution to this reduction in overall

environmental impact.

There seems little doubt that the secrecy option would have had far-reaching and unfortunate effects upon our industry

and our competitors. The licensing option will allow competitors, and their employees and shareholders, to survive. It

is a compassionate act on our part and shows mercy to the other competitors in the industry. It recognises the number

of impacts that a business decision has and would be the fairest (and most just) option given the number of people

affected. -

第4题:

(b) ‘Strategic positioning’ is about the way that a company as a whole is placed in its environment and concerns its

‘fit’ with the factors in its environment.

With reference to the case as appropriate, explain how a code of ethics can be used as part of a company’s

overall strategic positioning. (7 marks)

正确答案:

(b) Code of ethics and strategic positioning

Strategic positioning is about the way that a whole company is placed in its environment as opposed to the operational level,

which considers the individual parts of the organisation.

Ethical reputation and practice can be a key part of environmental ‘fit’, along with other strategic issues such as generic

strategy, quality and product range.

The ‘fit’ enables the company to more fully meet the expectations, needs and demands of its relevant stakeholders – in this

case, European customers.

The ‘quality’ of the strategic ‘fit’ is one of the major determinants of business performance and so is vital to the success of

the business.

HPC has carefully manoeuvred itself to have the strategic position of being the highest ethical performer locally and has won

orders on that basis.

It sees its strategic position as being the ethical ‘benchmark’ in its industry locally and protects this position against its parent

company seeking to impose a new code of ethics.

The ethical principles are highly internalised in Mr Hogg and in the company generally, which is essential for effective strategic

implementation. -

第5题:

(c) Define ‘retirement by rotation’ and explain its importance in the context of Rosh and Company.

(5 marks)

正确答案:

(c) Retirement by rotation.

Definition

Retirement by rotation is an arrangement in a director’s contract that specifies his or her contract to be limited to a specific

period (typically three years) after which he or she must retire from the board or offer himself (being eligible) for re-election.

The director must be actively re-elected back onto the board to serve another term. The default is that the director retires

unless re-elected.

Importance of

Retirement by rotation reduces the cost of contract termination for underperforming directors. They can simply not be

re-elected after their term of office expires and they will be required to leave the service of the board as a retiree (depending

on contract terms).

It encourages directors’ performance (they know they are assessed by shareholders and reconsidered every three years) and

focuses their minds upon the importance of meeting objectives in line with shareholders’ aims.

It is an opportunity, over time, to replace the board membership whilst maintaining medium term stability of membership

(one or two at a time).

Applied to Rosh

Retirement by rotation would enable the board of Rosh to be changed over time. There is evidence that some directors may

have stayed longer than is ideal because of links with other board members going back many years. -

第6题:

(ii) List the additional information required in order to calculate the employment income benefit in respect

of the provision of the furnished flat for 2007/08 and advise Benny of the potential income tax

implications of requesting a more centrally located flat in accordance with the company’s offer.

(4 marks)

正确答案:

(ii) The flat

The following additional information is required in order to calculate the employment income benefit in respect of the

flat.

– The flat’s annual value.

– The cost of any improvements made to the flat prior to 6 April 2007.

– The cost of power, water, repairs and maintenance etc borne by Summer Glow plc.

– The cost of the furniture provided by Summer Glow plc.

– Any use of the flat by Benny wholly, exclusively and necessarily for the purposes of his employment.

Tutorial note

The market value of the flat is not required as Summer Glow plc has owned it for less than six years.

One element of the employment income benefit in respect of the flat is calculated by reference to its original cost plus

the cost of any capital improvements prior to 6 April 2007. If Benny requests a flat in a different location, this element

of the benefit will be computed instead by reference to the cost of the new flat, which in turn equals the proceeds of

sale of the old flat.

Accordingly, if, as is likely, the value of the flat has increased since it was purchased, Benny’s employment income

benefit will also increase. The increase in the employment income benefit will be the flat’s sales proceeds less its original

cost less the cost of any capital improvements prior to 6 April 2007 multiplied by 5%. -

第7题:

(ii) Set out the information required by Jane in connection with the administration of the company’s tax

affairs and identify any penalties that may already be payable. (3 marks)

正确答案:

(ii) Administration of the company’s tax affairs

The corporation tax return must be submitted within 12 months of the end of the accounting period, i.e. by 5 April

2008.

Corporation tax is due nine months and one day after the end of the accounting period, i.e. by 6 January 2008.

HMRC have 12 months from the filing date to enquire into the corporation tax return. This deadline is extended if the

return is submitted late. Once this deadline has passed the return can be regarded as agreed provided it includes all

necessary information and there has been no loss of tax due to the company’s fraud or negligence.

Jane should have notified HMRC by 5 July 2006 that Speak Write Ltd’s first accounting period began on 6 April 2006.

The penalty for failing to notify is a maximum of £3,000. -

第8题:

(ii) Explain whether or not Carver Ltd will become a close investment-holding company as a result of

acquiring either the office building or the share portfolio and state the relevance of becoming such a

company. (2 marks)

正确答案:

(ii) Close investment holding company status

Carver Ltd will not become a close investment-holding company if it purchases the office building as, although it will no

longer be a trading company, it intends to rent out the building to a number of tenants none of whom is connected to

the company.

Carver Ltd will become a close investment holding company if it purchases a portfolio of quoted shares as it will no

longer be a trading company. As a result it will pay corporation tax at the full rate of 30% regardless of the level of its

profits. -

第9题:

4 (a) Explain the auditor’s responsibilities for other information in documents containing audited financial

statements. (5 marks)

正确答案:

4 HEGAS

(a) Auditor’s responsibilities for ‘other information’

■ The auditor has a professional responsibility to read other information to identify material inconsistencies with the

audited financial statements (ISA 720 ‘Other Information in Documents Containing Audited Financial Statements’).

■ A ‘material inconsistency’ arises when other information contradicts that which is contained in the audited financial

statements. It may give rise to doubts about:

– the auditor’s conclusions drawn from audit evidence; and

– the basis for the auditor’s opinion on the financial statements.

■ In certain circumstances, the auditor may have a statutory obligation (under national legislation) to report on other

information (e.g. Management Report).

■ Even where there is no such obligation (e.g. chairman’s statement), the auditor should consider it, as the credibility of

the financial statements may be undermined by any inconsistency.

■ The auditor must arrange to have access to the other information on a timely basis prior to dating the auditor’s report.

Material inconsistency

■ If a material inconsistency is identified, the auditor should determine whether it is the audited financial statements or

the other information which needs amending.

■ If an amendment to the audited financial statements is required but not made, there will be disagreement, resulting in

the expression of a qualified or adverse opinion. (Such a situation would be extremely rare.)

■ Where an amendment to other information is necessary, but refused, the auditor’s report may include an emphasis of

matter paragraph (since the audit opinion cannot be other than unqualified with respect to this matter).

Material misstatement of fact

■ A material misstatement of fact in other information exists when information which is not related to matters appearing

in the audited financial statements is incorrectly stated or presented in a misleading manner.

■ If management do not act on advice to correct a material misstatement the auditors should document their concerns to

those charged with corporate governance and obtain legal advice.

Tutorial note: Marks would be awarded here for the implications for the auditor’s report. However, such marks, which are

for the restatement of knowledge would NOT be awarded again if repeated in answers to (b). -

第10题:

4 (a) ISA 701 Modifications to The Independent Auditor’s Report includes ‘suggested wording of modifying phrases

for use when issuing modified reports’.

Required:

Explain and distinguish between each of the following terms:

(i) ‘qualified opinion’;

(ii) ‘disclaimer of opinion’;

(iii) ‘emphasis of matter paragraph’. (6 marks)

正确答案:

4 PETRIE CO

(a) Independent auditor’s report terms

(i) Qualified opinion – A qualified opinion is expressed when the auditor concludes that an unqualified opinion cannot be

expressed but that the effect of any disagreement with management, or limitation on scope is not so material and

pervasive as to require an adverse opinion or a disclaimer of opinion.

(ii) Disclaimer of opinion – A disclaimer of opinion is expressed when the possible effect of a limitation on scope is so

material and pervasive that the auditor has not been able to obtain sufficient appropriate audit evidence and accordingly

is unable to express an opinion on the financial statements.

(iii) Emphasis of matter paragraph – An auditor’s report may be modified by adding an emphasis of matter paragraph to

highlight a matter affecting the financial statements that is included in a note to the financial statements that more

extensively discusses the matter. Such an emphasis of matter paragraph does not affect the auditor’s opinion. An

emphasis of matter paragraph may also be used to report matters other than those affecting the financial statements

(e.g. if there is a misstatement of fact in other information included in documents containing audited financial

statements).

(iii) is clearly distinguishable from (i) and (ii) because (i) and (ii) affect the opinion paragraph, whereas (iii) does not.

(i) and (ii) are distinguishable by the degree of their impact on the financial statements. In (i) the effects of any disagreement

or limitation on scope can be identified with an ‘except for …’ opinion. In (ii) the matter is pervasive, that is, affecting the

financial statements as a whole.

(ii) can only arise in respect of a limitation in scope (i.e. insufficient evidence) that has a pervasive effect. (i) is not pervasive

and may also arise from disagreement (i.e. where there is sufficient evidence). -

第11题:

(ii) From the information provided above, recommend the matters which should be included as ‘findings

from the audit’ in your report to those charged with governance, and explain the reason for their

inclusion. (7 marks)

正确答案:

(ii) Control weakness

ISA 260 contains guidance on the type of issues that should be communicated. One of the matters identified is a control

weakness in the capital expenditure transaction cycle. The assets for which no authorisation was obtained amount to

0·3% of total assets (225,000/78 million x 100%), which is clearly immaterial. However, regardless of materiality, the

auditor should ensure that the weakness is brought to the attention of the management, with a clear indication of the

implication of the weakness, and recommendations as to how the control weakness should be eliminated.

The auditor is providing information to help those charged with governance improve the internal systems and controls

and ultimately reduce business risk. In this case there is a high risk of fraud, as the lack of authorisation for purchase

of office equipment could allow expenditure on assets not used for bona fide business purposes.

Disagreement with accounting treatment of brand

Audit procedures have revealed a breach of IAS 38 Intangible Assets, in which internally generated brand names are

specifically prohibited from being recognised. Blod Co has recognised an internally generated brand name which is

material to the statement of financial position (balance sheet) as it represents 12·8% of total assets (10/78 x 100%).

The statement of financial position (balance sheet) therefore contains a material misstatement.

The report to those charged with governance should clearly explain the rules on recognition of internally generated brand

names, to ensure that the management has all relevant technical facts available. In the report the auditors should

request that the financial statements be corrected, and clarify that if the brand is not derecognised, then the audit opinion

will be qualified on the grounds of a material disagreement – an ‘except for’ opinion would be provided. Once the breach

of IAS 38 is made clear to the management in the report, they then have the opportunity to discuss the matter and

decide whether to amend the financial statements, thereby avoiding a qualified audit opinion.

Audit inefficiencies

Documentation relating to inventories was not always made readily available to the auditors. This seems to be due to

poor administration by the client rather than a deliberate attempt to conceal information. The report should contain a

brief description of the problems encountered by the audit team. The management should be made aware that

significant delay to the receipt of necessary paperwork can cause inefficiencies in the audit process. This may seem a

relatively trivial issue, but it could lead to an increase in audit fee. Management should react to these comments by

ensuring as far as possible that all requested documentation is made available to the auditors in a timely fashion. -

第12题:

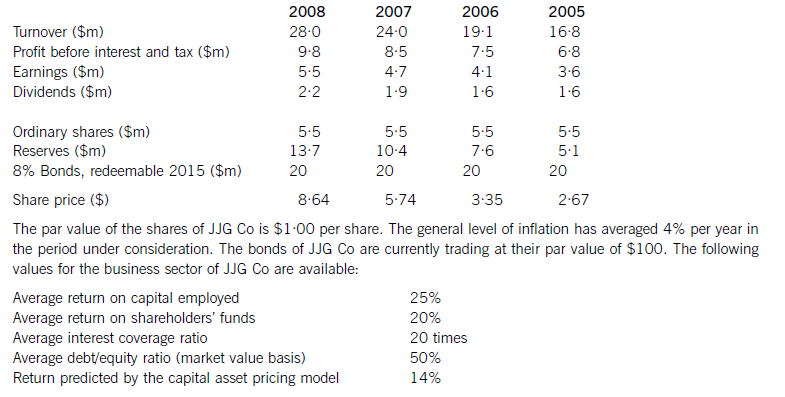

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion. -

第13题:

4 Whilst acknowledging the importance of high quality corporate reporting, the recommendations to improve it are

sometimes questioned on the basis that the marketplace for capital can determine the nature and quality of corporate

reporting. It could be argued that additional accounting and disclosure standards would only distort a market

mechanism that already works well and would add costs to the reporting mechanism, with no apparent benefit. It

could be said that accounting standards create costly, inefficient, and unnecessary regulation. It could be argued that

increased disclosure reduces risks and offers a degree of protection to users. However, increased disclosure has several

costs to the preparer of financial statements.

Required:

(a) Explain why accounting standards are needed to help the market mechanism work effectively for the benefit

of preparers and users of corporate reports. (9 marks)

正确答案:

(a) It could be argued that the marketplace already offers powerful incentives for high-quality reporting as it rewards such by

easing or restricting access to capital or raising or lowering the cost of borrowing capital depending on the quality of the entity’s

reports. However, accounting standards play an important role in helping the market mechanism work effectively. Accounting

standards are needed because they:

– Promote a common understanding of the nature of corporate performance and this facilitates any negotiations between

users and companies about the content of financial statements. For example, many loan agreements specify that a

company provide the lender with financial statements prepared in accordance with generally accepted accounting

principles or International Financial Reporting Standards. Both the company and the lender understand the terms and

are comfortable that statements prepared according to those standards will meet certain information needs. Without

standards, the statements would be less useful to the lender, and the company and the lender would have to agree to

create some form. of acceptable standards which would be inefficient and less effective.

– Assist neutral and unbiased reporting. Companies may wish to portray their past performance and future prospects in

the most favourable light. Users are aware of this potential bias and are sceptical about the information they receive.

Standards build credibility and confidence in the capital marketplace to the benefit of both users and companies.

– Improve the comparability of information across companies and national boundaries. Without standards, there would be

little basis to compare one company with others across national boundaries which is a key feature of relevant

information.

– Create credibility in financial statements. Auditors verify that information is reported in accordance with standards and

this creates public confidence in financial statements

– Facilitate consistency of information by producing data in accordance with an agreed conceptual framework. A consistent

approach to the development and presentation of information assists users in accessing information in an efficient

manner and facilitates decision-making. -

第14题:

4 (a) Explain the meaning of the term ‘working capital cycle’ for a trading company. (4 marks)

正确答案:

(a) The working capital cycle illustrates the changing make-up of working capital in the course of the trading operations of a

business:

1 Purchases are made on credit and the goods go into inventory.

2 Inventory is sold and converted into receivables

3 Credit customers pay their accounts

4 Cash is used to pay suppliers. -

第15题:

(d) Corporate annual reports contain both mandatory and voluntary disclosures.

Required:

(i) Distinguish, using examples, between mandatory and voluntary disclosures in the annual reports of

public listed companies. (6 marks)

正确答案:

(d) (i) Mandatory and voluntary disclosures

Mandatory disclosures

These are components of the annual report mandated by law, regulation or accounting standard.

Examples include (in most jurisdictions) statement of comprehensive income (income or profit and loss statement),

statement of financial position (balance sheet), cash flow statement, statement of changes in equity, operating segmental

information, auditors’ report, corporate governance disclosure such as remuneration report and some items in the

directors’ report (e.g. summary of operating position). In the UK, the business review is compulsory.

Voluntary disclosures

These are components of the annual report not mandated in law or regulation but disclosed nevertheless. They are

typically mainly narrative rather than numerical in nature.

Examples include (in most jurisdictions) risk information, operating review, social and environmental information, and

the chief executive’s review. -

第16题:

(ii) Explain the ethical tensions between these roles that Anne is now experiencing. (4 marks)

正确答案:

(ii) Tensions in roles

On one hand, Anne needs to cultivate and manage her relationship with her manager (Zachary) who seems convinced

that Van Buren, and Frank in particular, are incapable of bad practice. He shows evidence of poor judgment and

compromised independence. Anne must decide how to deal with Zachary’s poor judgment.

On the other hand, Anne has a duty to both the public interest and the shareholders of Van Buren to ensure that the

accounts do contain a ‘true and fair view’. Under a materiality test, she may ultimately decide that the payment in

question need not hold up the audit signoff but the poor client explanation (from Frank) is also a matter of concern to

Anne as a professional accountant. -

第17题:

(b) (i) Advise Benny of the income tax implications of the grant and exercise of the share options in Summer

Glow plc on the assumption that the share price on 1 September 2007 and on the day he exercises the

options is £3·35 per share. Explain why the share option scheme is not free from risk by reference to

the rules of the scheme and the circumstances surrounding the company. (4 marks)

正确答案:

(b) (i) The share options

There are no income tax implications on the grant of the share options.

In the tax year in which Benny exercises the options and acquires the shares, the excess of the market value of the

shares over the price paid, i.e. £11,500 ((£3·35 – £2·20) x 10,000) will be subject to income tax.

Benny’s financial exposure is caused by the rule within the share option scheme obliging him to hold the shares for a

year before he can sell them. If the company’s expansion into Eastern Europe fails, such that its share price

subsequently falls to less than £2·20 before Benny has the chance to sell the shares, Benny’s financial position may be

summarised as follows:

– Benny will have paid £22,000 (£2·20 x 10,000) for shares which are now worth less than that.

– He will also have paid income tax of £4,600 (£11,500 x 40%). -

第18题:

(ii) Explain, with reasons, the relief available in respect of the fall in value of the shares in All Over plc,

identify the years in which it can be claimed and state the time limit for submitting the claim.

(3 marks)

正确答案:

-

第19题:

(ii) State the taxation implications of both equity and loan finance from the point of view of a company.

(3 marks)

正确答案:

(ii) A company needs to be aware of the following issues:

Equity

(1) Costs incurred in issuing share capital are not allowed as a trading deduction.

(2) Distributions to investors are not allowed as a trading deduction.

(3) The cost of making distributions to shareholders are disallowable.

(4) Where profits are taxed at an effective rate of less than 19%, any profits used to make a distribution to noncorporate

shareholders will themselves be taxed at the full 19% rate.

Loan finance/debt

(1) The incidental costs of obtaining/raising loan finance are broadly deductible as a trading expense.

(2) Capital costs of raising loan finance (for example, loans issued at a discount) are not deductible for tax purposes.

(3) Interest incurred on a loan to finance a business is deductible from trading income. -

第20题:

(ii) Explain why Galileo is able to pay the inheritance tax due in instalments, state when the instalments are

due and identify any further issues relevant to Galileo relating to the payments. (3 marks)

正确答案:

(ii) Payment by instalments

The inheritance tax can be paid by instalments because Messier Ltd is an unquoted company controlled by Kepler at

the time of the gift and is still unquoted at the time of his death.

The tax is due in ten equal annual instalments starting on 30 November 2008.

Interest will be charged on any instalments paid late; otherwise the instalments will be interest free because Messier is

a trading company that does not deal in property or financial assets.

All of the outstanding inheritance tax will become payable if Galileo sells the shares in Messier Ltd.

Tutorial note

Candidates were also given credit for stating that payment by instalments is available because the shares represent at

least 10% of the company’s share capital and are valued at £20,000 or more. -

第21题:

In relation to company law, explain:

(a) the limitations on the use of company names; (4 marks)

(b) the tort of ‘passing off’; (4 marks)

(c) the role of the company names adjudicators under the Companies Act 2006. (2 marks)

正确答案:(a) Except in relation to specifically exempted companies, such as those involved in charitable work, companies are required to indicate that they are operating on the basis of limited liability. Thus private companies are required to end their names, either with the word ‘limited’ or the abbreviation ‘ltd’, and public companies must end their names with the words ‘public limited company’ or the abbreviation ‘plc’. Welsh companies may use the Welsh language equivalents (Companies Act (CA)2006 ss.58, 59 & 60).

Companies Registry maintains a register of business names, and will refuse to register any company with a name that is the same as one already on that index (CA 2006 s.66).

Certain categories of names are, subject to the decision of the Secretary of State, unacceptable per se, as follows:

(i) names which in the opinion of the Secretary of State constitute a criminal offence or are offensive (CA 2006 s.53)

(ii) names which are likely to give the impression that the company is connected with either government or local government authorities (s.54).

(iii) names which include a word or expression specified under the Company and Business Names Regulations 1981 (s.26(2)(b)). This category requires the express approval of the Secretary of State for the use of any of the names or expressions contained on the list, and relates to areas which raise a matter of public concern in relation to their use.

Under s.67 of the Companies Act 2006 the Secretary of State has power to require a company to alter its name under the following circumstances:

(i) where it is the same as a name already on the Registrar’s index of company names.

(ii) where it is ‘too like’ a name that is on that index.

The name of a company can always be changed by a special resolution of the company so long as it continues to comply with the above requirements (s.77).(b) The tort of passing off was developed to prevent one person from using any name which is likely to divert business their way by suggesting that the business is actually that of some other person or is connected in any way with that other business. It thus enables people to protect the goodwill they have built up in relation to their business activity. In Ewing v Buttercup

Margarine Co Ltd (1917) the plaintiff successfully prevented the defendants from using a name that suggested a link with

his existing dairy company. It cannot be used, however, if there is no likelihood of the public being confused, where for example the companies are conducting different businesses (Dunlop Pneumatic Tyre Co Ltd v Dunlop Motor Co Ltd (1907)

and Stringfellow v McCain Foods GB Ltd (1984). Nor can it be used where the name consists of a word in general use (Aerators Ltd v Tollitt (1902)).

Part 41 of the Companies Act (CA) 2006, which repeals and replaces the Business Names Act 1985, still does not prevent one business from using the same, or a very similar, name as another business so the tort of passing off will still have an application in the wider business sector. However the Act introduced a new procedure to deal specifically with company names. As previously under the CA 1985, a company cannot register with a name that was the same as any already registered (s.665 Companies Act (CA) 2006) and under CA s.67 the Secretary of State may direct a company to change its name if it has been registered in a name that is the same as, or too like a name appearing on the registrar’s index of company names. In addition, however, a completely new system of complaint has been introduced.(c) Under ss.69–74 of CA 2006 a new procedure has been introduced to cover situations where a company has been registered with a name

(i) that it is the same as a name associated with the applicant in which he has goodwill, or

(ii) that it is sufficiently similar to such a name that its use in the United Kingdom would be likely to mislead by suggesting a connection between the company and the applicant (s.69).

Section 69 can be used not just by other companies but by any person to object to a company names adjudicator if a company’s name is similar to a name in which the applicant has goodwill. There is list of circumstances raising a presumption that a name was adopted legitimately, however even then, if the objector can show that the name was registered either, to obtain money from them, or to prevent them from using the name, then they will be entitled to an order to require the company to change its name.

Under s.70 the Secretary of State is given the power to appoint company names adjudicators and their staff and to finance their activities, with one person being appointed Chief Adjudicator.

Section 71 provides the Secretary of State with power to make rules for the proceedings before a company names adjudicator.

Section 72 provides that the decision of an adjudicator and the reasons for it, are to be published within 90 days of the decision.

Section 73 provides that if an objection is upheld, then the adjudicator is to direct the company with the offending name to change its name to one that does not similarly offend. A deadline must be set for the change. If the offending name is not changed, then the adjudicator will decide a new name for the company.

Under s.74 either party may appeal to a court against the decision of the company names adjudicator. The court can either uphold or reverse the adjudicator’s decision, and may make any order that the adjudicator might have made. -

第22题:

(ii) Identify and explain the principal audit procedures to be performed on the valuation of the investment

properties. (6 marks)

正确答案:

(ii) Additional audit procedures

Audit procedures should focus on the appraisal of the work of the expert valuer. Procedures could include the following:

– Inspection of the written instructions provided by Poppy Co to the valuer, which should include matters such as

the objective and scope of the valuer’s work, the extent of the valuer’s access to relevant records and files, and

clarification of the intended use by the auditor of their work.

– Evaluation, using the valuation report, that any assumptions used by the valuer are in line with the auditor’s

knowledge and understanding of Poppy Co. Any documentation supporting assumptions used by the valuer should

be reviewed for consistency with the auditor’s business understanding, and also for consistency with any other

audit evidence.

– Assessment of the methodology used to arrive at the fair value and confirmation that the method is consistent with

that required by IAS 40.

– The auditor should confirm, using the valuation report, that a consistent method has been used to value each

property.

– It should also be confirmed that the date of the valuation report is reasonably close to the year end of Poppy Co.

– Physical inspection of the investment properties to determine the physical condition of the properties supports the

valuation.

– Inspect the purchase documentation of each investment property to ascertain the cost of each building. As the

properties were acquired during this accounting period, it would be reasonable to expect that the fair value at the

year end is not substantially different to the purchase price. Any significant increase or decrease in value should

alert the auditor to possible misstatement, and lead to further audit procedures.

– Review of forecasts of rental income from the properties – supporting evidence of the valuation.

– Subsequent events should be monitored for any additional evidence provided on the valuation of the properties.

For example, the sale of an investment property shortly after the year end may provide additional evidence relating

to the fair value measurement.

– Obtain a management representation regarding the reasonableness of any significant assumptions, where relevant,

to fair value measurements or disclosures. -

第23题:

(a) List and explain FOUR methods of selecting a sample of items to test from a population in accordance with ISA 530 (Redrafted) Audit Sampling and Other Means of Testing. (4 marks)

(b) List and explain FOUR assertions from ISA 500 Audit Evidence that relate to the recording of classes of

transactions. (4 marks)

(c) In terms of audit reports, explain the term ‘modified’. (2 marks)

正确答案:

(a)SamplingmethodsMethodsofsamplinginaccordancewithISA530AuditSamplingandOtherMeansofTesting:Randomselection.Ensureseachiteminapopulationhasanequalchanceofselection,forexamplebyusingrandomnumbertables.Systematicselection.Inwhichanumberofsamplingunitsinthepopulationisdividedbythesamplesizetogiveasamplinginterval.Haphazardselection.Theauditorselectsthesamplewithoutfollowingastructuredtechnique–theauditorwouldavoidanyconsciousbiasorpredictability.Sequenceorblock.Involvesselectingablock(s)ofcontinguousitemsfromwithinapopulation.Tutorialnote:Othermethodsofsamplingareasfollows:MonetaryUnitSampling.Thisselectionmethodensuresthateachindividual$1inthepopulationhasanequalchanceofbeingselected.Judgementalsampling.Selectingitemsbasedontheskillandjudgementoftheauditor.(b)Assertions–classesoftransactionsOccurrence.Thetransactionsandeventsthathavebeenrecordedhaveactuallyoccurredandpertaintotheentity.Completeness.Alltransactionsandeventsthatshouldhavebeenrecordedhavebeenrecorded.Accuracy.Theamountsandotherdatarelatingtorecordedtransactionsandeventshavebeenrecordedappropriately.Cut-off.Transactionsandeventshavebeenrecordedinthecorrectaccountingperiod.Classification.Transactionsandeventshavebeenrecordedintheproperaccounts.(c)AuditreporttermModified.Anauditormodifiesanauditreportinanysituationwhereitisinappropriatetoprovideanunmodifiedreport.Forexample,theauditormayprovideadditionalinformationinanemphasisofmatter(whichdoesnotaffecttheauditor’sopinion)orqualifytheauditreportforlimitationofscopeordisagreement.