2 The draft financial statements of Choctaw, a limited liability company, for the year ended 31 December 2004 showeda profit of $86,400. The trial balance did not balance, and a suspense account with a credit balance of $3,310 wasincluded in the balance s

题目

2 The draft financial statements of Choctaw, a limited liability company, for the year ended 31 December 2004 showed

a profit of $86,400. The trial balance did not balance, and a suspense account with a credit balance of $3,310 was

included in the balance sheet.

In subsequent checking the following errors were found:

(a) Depreciation of motor vehicles at 25 per cent was calculated for the year ended 31 December 2004 on the

reducing balance basis, and should have been calculated on the straight-line basis at 25 per cent.

Relevant figures:

Cost of motor vehicles $120,000, net book value at 1 January 2004, $88,000

(b) Rent received from subletting part of the office accommodation $1,200 had been put into the petty cash box.

No receivable balance had been recognised when the rent fell due and no entries had been made in the petty

cash book or elsewhere for it. The petty cash float in the trial balance is the amount according to the records,

which is $1,200 less than the actual balance in the box.

(c) Bad debts totalling $8,400 are to be written off.

(d) The opening accrual on the motor repairs account of $3,400, representing repair bills due but not paid at

31 December 2003, had not been brought down at 1 January 2004.

(e) The cash discount totals for December 2004 had not been posted to the discount accounts in the nominal ledger.

The figures were:

$

Discount allowed 380

Discount received 290

After the necessary entries, the suspense account balanced.

Required:

Prepare journal entries, with narratives, to correct the errors found, and prepare a statement showing the

necessary adjustments to the profit.

(10 marks)

相似考题

更多“2 The draft financial statements of Choctaw, a limited liability company, for the year ended 31 December 2004 showeda profit of $86,400. The trial balance did not balance, and a suspense account with a credit balance of $3,310 wasincluded in the balance s”相关问题

-

第1题:

2 Tyre, a public limited company, operates in the vehicle retailing sector. The company is currently preparing its financial

statements for the year ended 31 May 2006 and has asked for advice on how to deal with the following items:

(i) Tyre requires customers to pay a deposit of 20% of the purchase price when placing an order for a vehicle. If the

customer cancels the order, the deposit is not refundable and Tyre retains it. If the order cannot be fulfilled by

Tyre, the company repays the full amount of the deposit to the customer. The balance of the purchase price

becomes payable on the delivery of the vehicle when the title to the goods passes. Tyre proposes to recognise

the revenue from the deposits immediately and the balance of the purchase price when the goods are delivered

to the customer. The cost of sales for the vehicle is recognised when the balance of the purchase price is paid.

Additionally, Tyre had sold a fleet of cars to Hub and gave Hub a discount of 30% of the retail price on the

transaction. The discount given is normal for this type of transaction. Tyre has given Hub a buyback option which

entitles Hub to require Tyre to repurchase the vehicles after three years for 40% of the purchase price. The normal

economic life of the vehicles is five years and the buyback option is expected to be exercised. (8 marks)

Required:

Advise the directors of Tyre on how to treat the above items in the financial statements for the year ended

31 May 2006.

(The mark allocation is shown against each of the above items)

正确答案:

2 Advice on sundry accounting issues: year ended 31 May 2006

The following details the nature of the advice relevant to the accounting issues.

Revenue recognition

(i) Sale to customers

IAS18 ‘Revenue’ requires that revenue relating to the sale of goods is recognised when the significant risks and rewards are

transferred to the buyer. Also the company should not retain any continuing managerial involvement associated with

ownership or control of the goods. Additionally the revenue and costs must be capable of reliable measurement and it should

be probable that the economic benefits of the transaction will go to the company.

Although the deposit is non refundable on cancellation of the order by the customer, there is a valid expectation that the

deposit will be repaid where the company does not fulfil its contractual obligation in supplying the vehicle. The deposit should,

therefore, only be recognised in revenue when the vehicle has been delivered and accepted by the customer. It should be

treated as a liability up to this point. At this point also, the balance of the sale proceeds will be recognised. If the customer

does cancel the order, then the deposit would be recognised in revenue at the date of the cancellation of the order.

The appendix to IAS18, although not part of the standard, agrees that revenue is recognised when goods of this nature are

delivered to the buyer.

Sale of Fleet cars

The company has not transferred the significant risks and rewards of ownership as required by IAS18 as the buyback option

is expected to occur. The reason for this conclusion is that the company has retained the risk associated with the residual

value of the vehicles. Therefore, the transaction should not be treated as a sale. The vehicles should be treated as an operating

lease as essentially only 60% of the purchase price will be received by Tyre. Ownership of the assets are not expected to be

transferred to Hub, the lease term is arguably not for the major part of the assets’ life, and the present value of the minimum

lease payments will not be substantially equivalent to the fair value of the asset. Therefore it is an operating lease (IAS17).

No ‘outright sale profit’ will be recognised as the risks and rewards of ownership have been retained and no sale has occurred.

The vehicles will be shown in property, plant and equipment at their carrying amount. The lease income should be recognised

on a straight line basis over the lease term of three years unless some other basis is more representative. The vehicles will

be depreciated in accordance with IAS16, ‘Property, Plant and Equipment’. If there is any indication of impairment then the

company will apply IAS36 ‘Impairment of Assets’. As the discount given is normal for this type of transaction, it will not be

taken into account in estimating the fair value of the assets.

The buyback option will probably meet the definition of a financial liability and will be accounted for under IAS39 ‘Financial

Instruments: recognition and measurement’. The liability should be measured at ‘fair value’ and subsequently at amortisedcost unless designated at the outset as being at fair value through profit or loss. -

第2题:

22 Which of the following statements about limited liability companies’ accounting is/are correct?

1 A revaluation reserve arises when a non-current asset is sold at a profit.

2 The authorised share capital of a company is the maximum nominal value of shares and loan notes the company

may issue.

3 The notes to the financial statements must contain details of all adjusting events as defined in IAS10 Events after

the balance sheet date.

A All three statements

B 1 and 2 only

C 2 and 3 only

D None of the statements

正确答案:D

-

第3题:

5 Which of the following events after the balance sheet date would normally qualify as adjusting events according

to IAS 10 Events after the balance sheet date?

1 The bankruptcy of a credit customer with a balance outstanding at the balance sheet date.

2 A decline in the market value of investments.

3 The declaration of an ordinary dividend.

4 The determination of the cost of assets purchased before the balance sheet date.

A 1, 3, and 4

B 1 and 2 only

C 2 and 3 only

D 1 and 4 only

正确答案:D

-

第4题:

2 The draft financial statements of Rampion, a limited liability company, for the year ended 31 December 2005

included the following figures:

$

Profit 684,000

Closing inventory 116,800

Trade receivables 248,000

Allowance for receivables 10,000

No adjustments have yet been made for the following matters:

(1) The company’s inventory count was carried out on 3 January 2006 leading to the figure shown above. Sales

between the close of business on 31 December 2005 and the inventory count totalled $36,000. There were no

deliveries from suppliers in that period. The company fixes selling prices to produce a 40% gross profit on sales.

The $36,000 sales were included in the sales records in January 2006.

(2) $10,000 of goods supplied on sale or return terms in December 2005 have been included as sales and

receivables. They had cost $6,000. On 10 January 2006 the customer returned the goods in good condition.

(3) Goods included in inventory at cost $18,000 were sold in January 2006 for $13,500. Selling expenses were

$500.

(4) $8,000 of trade receivables are to be written off.

(5) The allowance for receivables is to be adjusted to the equivalent of 5% of the trade receivables after allowing for

the above matters, based on past experience.

Required:

(a) Prepare a statement showing the effect of the adjustments on the company’s net profit for the year ended

31 December 2005. (5 marks)

正确答案:

-

第5题:

(b) Seymour offers health-related information services through a wholly-owned subsidiary, Aragon Co. Goodwill of

$1·8 million recognised on the purchase of Aragon in October 2004 is not amortised but included at cost in the

consolidated balance sheet. At 30 September 2006 Seymour’s investment in Aragon is shown at cost,

$4·5 million, in its separate financial statements.

Aragon’s draft financial statements for the year ended 30 September 2006 show a loss before taxation of

$0·6 million (2005 – $0·5 million loss) and total assets of $4·9 million (2005 – $5·7 million). The notes to

Aragon’s financial statements disclose that they have been prepared on a going concern basis that assumes that

Seymour will continue to provide financial support. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Goodwill

(i) Matters

■ Cost of goodwill, $1·8 million, represents 3·4% consolidated total assets and is therefore material.

Tutorial note: Any assessments of materiality of goodwill against amounts in Aragon’s financial statements are

meaningless since goodwill only exists in the consolidated financial statements of Seymour.

■ It is correct that the goodwill is not being amortised (IFRS 3 Business Combinations). However, it should be tested

at least annually for impairment, by management.

■ Aragon has incurred losses amounting to $1·1 million since it was acquired (two years ago). The write-off of this

amount against goodwill in the consolidated financial statements would be material (being 61% cost of goodwill,

8·3% PBT and 2·1% total assets).

■ The cost of the investment ($4·5 million) in Seymour’s separate financial statements will also be material and

should be tested for impairment.

■ The fair value of net assets acquired was only $2·7 million ($4·5 million less $1·8 million). Therefore the fair

value less costs to sell of Aragon on other than a going concern basis will be less than the carrying amount of the

investment (i.e. the investment is impaired by at least the amount of goodwill recognised on acquisition).

■ In assessing recoverable amount, value in use (rather than fair value less costs to sell) is only relevant if the going

concern assumption is appropriate for Aragon.

■ Supporting Aragon financially may result in Seymour being exposed to actual and/or contingent liabilities that

should be provided for/disclosed in Seymour’s financial statements in accordance with IAS 37 Provisions,

Contingent Liabilities and Contingent Assets.

(ii) Audit evidence

■ Carrying values of cost of investment and goodwill arising on acquisition to prior year audit working papers and

financial statements.

■ A copy of Aragon’s draft financial statements for the year ended 30 September 2006 showing loss for year.

■ Management’s impairment test of Seymour’s investment in Aragon and of the goodwill arising on consolidation at

30 September 2006. That is a comparison of the present value of the future cash flows expected to be generated

by Aragon (a cash-generating unit) compared with the cost of the investment (in Seymour’s separate financial

statements).

■ Results of any impairment tests on Aragon’s assets extracted from Aragon’s working paper files.

■ Analytical procedures on future cash flows to confirm their reasonableness (e.g. by comparison with cash flows for

the last two years).

■ Bank report for audit purposes for any guarantees supporting Aragon’s loan facilities.

■ A copy of Seymour’s ‘comfort letter’ confirming continuing financial support of Aragon for the foreseeable future. -

第6题:

You are an audit manager responsible for providing hot reviews on selected audit clients within your firm of Chartered

Certified Accountants. You are currently reviewing the audit working papers for Pulp Co, a long standing audit client,

for the year ended 31 January 2008. The draft statement of financial position (balance sheet) of Pulp Co shows total

assets of $12 million (2007 – $11·5 million).The audit senior has made the following comment in a summary of

issues for your review:

‘Pulp Co’s statement of financial position (balance sheet) shows a receivable classified as a current asset with a value

of $25,000. The only audit evidence we have requested and obtained is a management representation stating the

following:

(1) that the amount is owed to Pulp Co from Jarvis Co,

(2) that Jarvis Co is controlled by Pulp Co’s chairman, Peter Sheffield, and

(3) that the balance is likely to be received six months after Pulp Co’s year end.

The receivable was also outstanding at the last year end when an identical management representation was provided,

and our working papers noted that because the balance was immaterial no further work was considered necessary.

No disclosure has been made in the financial statements regarding the balance. Jarvis Co is not audited by our firm

and we have verified that Pulp Co does not own any shares in Jarvis Co.’

Required:

(b) In relation to the receivable recognised on the statement of financial position (balance sheet) of Pulp Co as

at 31 January 2008:

(i) Comment on the matters you should consider. (5 marks)

正确答案:

(b) (i) Matters to consider

Materiality

The receivable represents only 0·2% (25,000/12 million x 100) of total assets so is immaterial in monetary terms.

However, the details of the transaction could make it material by nature.

The amount is outstanding from a company under the control of Pulp Co’s chairman. Readers of the financial statements

would be interested to know the details of this transaction, which currently is not disclosed. Elements of the transaction

could be subject to bias, specifically the repayment terms, which appear to be beyond normal commercial credit terms.

Paul Sheffield may have used his influence over the two companies to ‘engineer’ the transaction. Disclosure is necessary

due to the nature of the transaction, the monetary value is irrelevant.

A further matter to consider is whether this is a one-off transaction, or indicative of further transactions between the two

companies.

Relevant accounting standard

The definitions in IAS 24 must be carefully considered to establish whether this actually constitutes a related party

transaction. The standard specifically states that two entities are not necessarily related parties just because they have

a director or other member of key management in common. The audit senior states that Jarvis Co is controlled by Peter

Sheffield, who is also the chairman of Pulp Co. It seems that Peter Sheffield is in a position of control/significant influence

over the two companies (though this would have to be clarified through further audit procedures), and thus the two

companies are likely to be perceived as related.

IAS 24 requires full disclosure of the following in respect of related party transactions:

– the nature of the related party relationship,

– the amount of the transaction,

– the amount of any balances outstanding including terms and conditions, details of security offered, and the nature

of consideration to be provided in settlement,

– any allowances for receivables and associated expense.

There is currently a breach of IAS 24 as no disclosure has been made in the notes to the financial statements. If not

amended, the audit opinion on the financial statements should be qualified with an ‘except for’ disagreement. In

addition, if practicable, the auditor’s report should include the information that would have been included in the financial

statements had the requirements of IAS 24 been adhered to.

Valuation and classification of the receivable

A receivable should only be recognised if it will give rise to future economic benefit, i.e. a future cash inflow. It appears

that the receivable is long outstanding – if the amount is unlikely to be recovered then it should be written off as a bad

debt and the associated expense recognised. It is possible that assets and profits are overstated.

Although a representation has been received indicating that the amount will be paid to Pulp Co, the auditor should be

sceptical of this claim given that the same representation was given last year, and the amount was not subsequently

recovered. The $25,000 could be recoverable in the long term, in which case the receivable should be reclassified as

a non-current asset. The amount advanced to Jarvis Co could effectively be an investment rather than a short term

receivable. Correct classification on the statement of financial position (balance sheet) is crucial for the financial

statements to properly show the liquidity position of the company at the year end.

Tutorial note: Digressions into management imposing a limitation in scope by withholding evidence are irrelevant in this

case, as the scenario states that the only evidence that the auditors have asked for is a management representation.

There is no indication in the scenario that the auditors have asked for, and been refused any evidence. -

第7题:

What is the type of account and normal balance of Allowance for Doubtful Accounts ().A.Contra asset, debit

B.Contra asset, credit

C.Asset, debit

D.Asset, credit

正确答案:B

-

第8题:

听力原文:M: Can you tell me something about a balance sheet?

W: Yes. It is divided into three sections: assets, liabilities, and owner's equity and it is used to summarize a company's financial position on a given date.

Q: Which of the following is not a section of a balance sheet?

(15)

A.Profit and Joss

B.Owner's equity.

C.Liabilities

D.Assets.

正确答案:A

解析:根据女士回答资产负债表分为三部分,即"assets", "liabilities" 和"owner's equity",A项未提及。 -

第9题:

A balance sheet is simply the enumeration of the various assets of a business on one side of a ledger and the enumeration of various liabilities and (61) accounts on the other side. The two sides must be equal, or balance. Only one further point should be (62) : A balance sheet refers to a single point in time, for example, the close of business on December 31. Taken by itself, a balance sheet does not show (63) over time. It is what economists call a stock concept, not a (64) concept. That is, the balance sheet shows the stock of goods a firm has on hand at any particular instant and does not show the flow of goods through the firm over time. For this reason, a balance sheet does not show business (65) , which are a flow.

(46)

A.profit

B.capital

C.income

D.cash

正确答案:B

解析:资产负债表分为三部分:资产、负债、所有者权益。capital accounts等于owner's equity。 -

第10题:

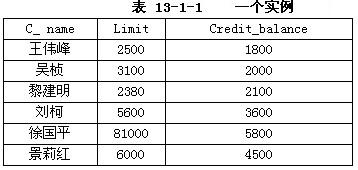

● 某银行信贷额度关系 credit-in(C_no, C_name, limit, Credit_balance)中的四个属性分别表示用户号、用户姓名、信贷额度和累计消费额。该关系的 (60) 属性可以作为主键。下表为关系 credit-in 的一个具体实例。

查询累计消费额大于 3000 的用户姓名以及剩余消费额的 SQL 语句应为:

Select (61)

From credit-in

Where (62) ;

(60)

A. C_no

B. C_name

C. Credit_balance

D. limit

(61)

A. C_name,Credit_balance - limit

B. C_name,limit - Credit_balance

C. C_name,limit,Credit_balance

D. C_name,Credit_balance

(62)

A. limit>3000

B. Credit_balance>3000

C. limit - Credit_balance>3000

D. Credit_balance - limit>3000

正确答案:A,B,B

-

第11题:

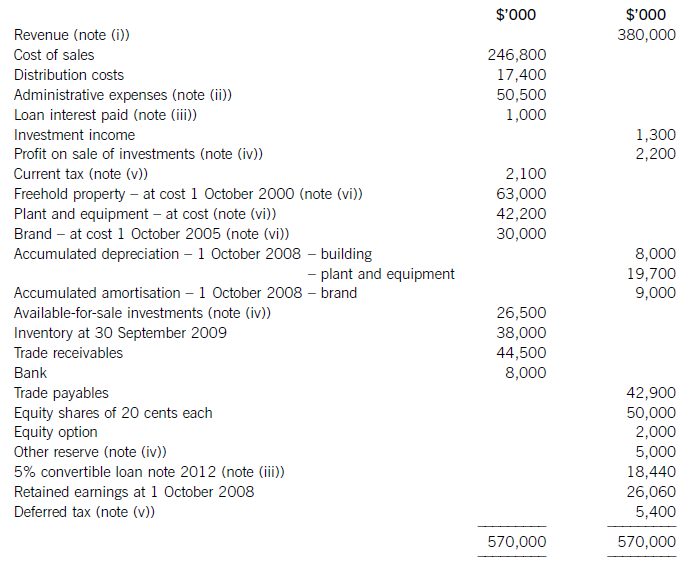

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

正确答案:

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities. -

第12题:

信贷额度关系credit-in(C_ name,Limit,Credit_ balance)中的三个属性分别表示用户姓名、信贷额度和到目前为止的花费。表13-1为关系credit-in的一个具体实例。若要查询每个用户还能花费多少,相应的SQL语句应为:Select(31)From credit-in。

A.C_ name,Credit balance-limit

B.C_ name, limit-Credit_ balance

C.C_ name, limit, Credit_ balance

D.C_ name, Credit_ balance

正确答案:D

解析:在Select语句中,要查询出的结果不但可以是属性列,还可以是算术表达式、聚集函数等。要求用户还能花费多少,用limitCredit_balance即可算出。 -

第13题:

8 P and Q are in partnership, sharing profits in the ratio 2:1. On 1 July 2004 they admitted P’s son R as a partner. P

guaranteed that R’s profit share would not be less than $25,000 for the six months to 31 December 2004. The profitsharing

arrangements after R’s admission were P 50%, Q 30%, R 20%. The profit for the year ended 31 December

2004 is $240,000, accruing evenly over the year.

What should P’s final profit share be for the year ended 31 December 2004?

A $140,000

B $139,000

C $114,000

D $139,375

正确答案:B

80,000 + 60,000 – 1,000 = 139,000 -

第14题:

5 The directors of Quapaw, a limited liability company, are reviewing the company’s draft financial statements for the

year ended 31 December 2004.

The following material matters are under discussion:

(a) During the year the company has begun selling a product with a one-year warranty under which manufacturing

defects are remedied without charge. Some claims have already arisen under the warranty. (2 marks)

Required:

Advise the directors on the correct treatment of these matters, stating the relevant accounting standard which

justifies your answer in each case.

NOTE: The mark allocation is shown against each of the three matters

正确答案:

(a) The correct treatment is to provide for the best estimate of the costs likely to be incurred under the warranty, as required by

IAS37 Provisions, contingent liabilities and contingent assets. -

第15题:

The following information is relevant for questions 9 and 10

A company’s draft financial statements for 2005 showed a profit of $630,000. However, the trial balance did not agree,

and a suspense account appeared in the company’s draft balance sheet.

Subsequent checking revealed the following errors:

(1) The cost of an item of plant $48,000 had been entered in the cash book and in the plant account as $4,800.

Depreciation at the rate of 10% per year ($480) had been charged.

(2) Bank charges of $440 appeared in the bank statement in December 2005 but had not been entered in the

company’s records.

(3) One of the directors of the company paid $800 due to a supplier in the company’s payables ledger by a personal

cheque. The bookkeeper recorded a debit in the supplier’s ledger account but did not complete the double entry

for the transaction. (The company does not maintain a payables ledger control account).

(4) The payments side of the cash book had been understated by $10,000.

9 Which of the above items would require an entry to the suspense account in correcting them?

A All four items

B 3 and 4 only

C 2 and 3 only

D 1, 2 and 4 only

正确答案:B

-

第16题:

(b) You are the audit manager of Johnston Co, a private company. The draft consolidated financial statements for

the year ended 31 March 2006 show profit before taxation of $10·5 million (2005 – $9·4 million) and total

assets of $55·2 million (2005 – $50·7 million).

Your firm was appointed auditor of Tiltman Co when Johnston Co acquired all the shares of Tiltman Co in March

2006. Tiltman’s draft financial statements for the year ended 31 March 2006 show profit before taxation of

$0·7 million (2005 – $1·7 million) and total assets of $16·1 million (2005 – $16·6 million). The auditor’s

report on the financial statements for the year ended 31 March 2005 was unmodified.

You are currently reviewing two matters that have been left for your attention on the audit working paper files for

the year ended 31 March 2006:

(i) In December 2004 Tiltman installed a new computer system that properly quantified an overvaluation of

inventory amounting to $2·7 million. This is being written off over three years.

(ii) In May 2006, Tiltman’s head office was relocated to Johnston’s premises as part of a restructuring.

Provisions for the resulting redundancies and non-cancellable lease payments amounting to $2·3 million

have been made in the financial statements of Tiltman for the year ended 31 March 2006.

Required:

Identify and comment on the implications of these two matters for your auditor’s reports on the financial

statements of Johnston Co and Tiltman Co for the year ended 31 March 2006. (10 marks)

正确答案:

(b) Tiltman Co

Tiltman’s total assets at 31 March 2006 represent 29% (16·1/55·2 × 100) of Johnston’s total assets. The subsidiary is

therefore material to Johnston’s consolidated financial statements.

Tutorial note: Tiltman’s profit for the year is not relevant as the acquisition took place just before the year end and will

therefore have no impact on the consolidated income statement. Calculations of the effect on consolidated profit before

taxation are therefore inappropriate and will not be awarded marks.

(i) Inventory overvaluation

This should have been written off to the income statement in the year to 31 March 2005 and not spread over three

years (contrary to IAS 2 ‘Inventories’).

At 31 March 2006 inventory is overvalued by $0·9m. This represents all Tiltmans’s profit for the year and 5·6% of

total assets and is material. At 31 March 2005 inventory was materially overvalued by $1·8m ($1·7m reported profit

should have been a $0·1m loss).

Tutorial note: 1/3 of the overvaluation was written off in the prior period (i.e. year to 31 March 2005) instead of $2·7m.

That the prior period’s auditor’s report was unmodified means that the previous auditor concurred with an incorrect

accounting treatment (or otherwise gave an inappropriate audit opinion).

As the matter is material a prior period adjustment is required (IAS 8 ‘Accounting Policies, Changes in Accounting

Estimates and Errors’). $1·8m should be written off against opening reserves (i.e. restated as at 1 April 2005).

(ii) Restructuring provision

$2·3m expense has been charged to Tiltman’s profit and loss in arriving at a draft profit of $0·7m. This is very material.

(The provision represents 14·3% of Tiltman’s total assets and is material to the balance sheet date also.)

The provision for redundancies and onerous contracts should not have been made for the year ended 31 March 2006

unless there was a constructive obligation at the balance sheet date (IAS 37 ‘Provisions, Contingent Liabilities and

Contingent Assets’). So, unless the main features of the restructuring plan had been announced to those affected (i.e.

redundancy notifications issued to employees), the provision should be reversed. However, it should then be disclosed

as a non-adjusting post balance sheet event (IAS 10 ‘Events After the Balance Sheet Date’).

Given the short time (less than one month) between acquisition and the balance sheet it is very possible that a

constructive obligation does not arise at the balance sheet date. The relocation in May was only part of a restructuring

(and could be the first evidence that Johnston’s management has started to implement a restructuring plan).

There is a risk that goodwill on consolidation of Tiltman may be overstated in Johnston’s consolidated financial

statements. To avoid the $2·3 expense having a significant effect on post-acquisition profit (which may be negligible

due to the short time between acquisition and year end), Johnston may have recognised it as a liability in the

determination of goodwill on acquisition.

However, the execution of Tiltman’s restructuring plan, though made for the year ended 31 March 2006, was conditional

upon its acquisition by Johnston. It does not therefore represent, immediately before the business combination, a

present obligation of Johnston. Nor is it a contingent liability of Johnston immediately before the combination. Therefore

Johnston cannot recognise a liability for Tiltman’s restructuring plans as part of allocating the cost of the combination

(IFRS 3 ‘Business Combinations’).

Tiltman’s auditor’s report

The following adjustments are required to the financial statements:

■ restructuring provision, $2·3m, eliminated;

■ adequate disclosure of relocation as a non-adjusting post balance sheet event;

■ current period inventory written down by $0·9m;

■ prior period inventory (and reserves) written down by $1·8m.

Profit for the year to 31 March 2006 should be $3·9m ($0·7 + $0·9 + $2·3).

If all these adjustments are made the auditor’s report should be unmodified. Otherwise, the auditor’s report should be

qualified ‘except for’ on grounds of disagreement. If none of the adjustments are made, the qualification should still be

‘except for’ as the matters are not pervasive.

Johnston’s auditor’s report

If Tiltman’s auditor’s report is unmodified (because the required adjustments are made) the auditor’s report of Johnston

should be similarly unmodified. As Tiltman is wholly-owned by Johnston there should be no problem getting the

adjustments made.

If no adjustments were made in Tiltman’s financial statements, adjustments could be made on consolidation, if

necessary, to avoid modification of the auditor’s report on Johnston’s financial statements.

The effect of these adjustments on Tiltman’s net assets is an increase of $1·4m. Goodwill arising on consolidation (if

any) would be reduced by $1·4m. The reduction in consolidated total assets required ($0·9m + $1·4m) is therefore

the same as the reduction in consolidated total liabilities (i.e. $2·3m). $2·3m is material (4·2% consolidated total

assets). If Tiltman’s financial statements are not adjusted and no adjustments are made on consolidation, the

consolidated financial position (balance sheet) should be qualified ‘except for’. The results of operations (i.e. profit for

the period) should be unqualified (if permitted in the jurisdiction in which Johnston reports).

Adjustment in respect of the inventory valuation may not be required as Johnston should have consolidated inventory

at fair value on acquisition. In this case, consolidated total liabilities should be reduced by $2·3m and goodwill arising

on consolidation (if any) reduced by $2·3m.

Tutorial note: The effect of any possible goodwill impairment has been ignored as the subsidiary has only just been

acquired and the balance sheet date is very close to the date of acquisition. -

第17题:

(b) You are the audit manager of Petrie Co, a private company, that retails kitchen utensils. The draft financial

statements for the year ended 31 March 2007 show revenue $42·2 million (2006 – $41·8 million), profit before

taxation of $1·8 million (2006 – $2·2 million) and total assets of $30·7 million (2006 – $23·4 million).

You are currently reviewing two matters that have been left for your attention on Petrie’s audit working paper file

for the year ended 31 March 2007:

(i) Petrie’s management board decided to revalue properties for the year ended 31 March 2007 that had

previously all been measured at depreciated cost. At the balance sheet date three properties had been

revalued by a total of $1·7 million. Another nine properties have since been revalued by $5·4 million. The

remaining three properties are expected to be revalued later in 2007. (5 marks)

Required:

Identify and comment on the implications of these two matters for your auditor’s report on the financial

statements of Petrie Co for the year ended 31 March 2007.

NOTE: The mark allocation is shown against each of the matters above.

正确答案:

(b) Implications for auditor’s report

(i) Selective revaluation of premises

The revaluations are clearly material to the balance sheet as $1·7 million and $5·4 million represent 5·5% and 17·6%

of total assets, respectively (and 23·1% in total). As the effects of the revaluation on line items in the financial statements

are clearly identified (e.g. revalued amount, depreciation, surplus in statement of changes in equity) the matter is not

pervasive.

The valuations of the nine properties after the year end provide additional evidence of conditions existing at the year end

and are therefore adjusting events per IAS 10 Events After the Balance Sheet Date.

Tutorial note: It is ‘now’ still less than three months after the year end so these valuations can reasonably be expected

to reflect year end values.

However, IAS 16 Property, Plant and Equipment does not permit the selective revaluation of assets thus the whole class

of premises would need to have been revalued for the year to 31 March 2007 to change the measurement basis for this

reporting period.

The revaluation exercise is incomplete. Unless the remaining three properties are revalued before the auditor’s report on

the financial statements for the year ended 31 March 2007 is signed off:

(1) the $7·1 revaluation made so far must be reversed to show all premises at depreciated cost as in previous years;

OR

(2) the auditor’s report would be qualified ‘except for’ disagreement regarding non-compliance with IAS 16.

When it is appropriate to adopt the revaluation model (e.g. next year) the change in accounting policy (from a cost model

to a revaluation model) should be accounted for in accordance with IAS 16 (i.e. as a revaluation).

Tutorial note: IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors does not apply to the initial

application of a policy to revalue assets in accordance with IAS 16.

Assuming the revaluation is written back, before giving an unmodified opinion, the auditor should consider why the three

properties were not revalued. In particular if there are any indicators of impairment (e.g. physical dilapidation) there

should be sufficient evidence on the working paper file to show that the carrying amount of these properties is not

materially greater than their recoverable amount (i.e. the higher of value in use and fair value less costs to sell).

If there is insufficient evidence to confirm that the three properties are not impaired (e.g. if the auditor was prevented

from inspecting the properties) the auditor’s report would be qualified ‘except for’ on grounds of limitation on scope.

If there is evidence of material impairment but management fail to write down the carrying amount to recoverable

amount the auditor’s report would be qualified ‘except for’ disagreement regarding non-compliance with IAS 36

Impairment of Assets.

-

第18题:

听力原文: At the end of the total accounting period and after all transactions have been journalized and posted, the equality of the debit and credit entries is checked by preparing a trial balance. A trial balance is a schedule that lists the titles of the accounts in the general ledger and their debit or credit balances. If the trial balance is in balance, the financial statements can be prepared. If a trial balance does not agree, it implies that an error or errors have been made. The account balances, postings and the journal entries must be checked until the error is found. A trial balance does not prove that all transactions have been recorded or that the ledger is correct. The trial balance may still agree when a transaction is not journalized, a journal entry is not posted, an entry is posted twice, incorrect accounts are used in journalizing or posting, or offsetting errors are made in recording the amount of a transaction.

24. How does the accountant check the equality of the debit and credit entries?

25.What is a trial balance?

26.What is implied if a trial balance does not agree?

(24)

A.By posting all the entries.

B.By preparing a trial balance.

C.By comparing the entries on both sides.

D.By recording all the entries once more.

正确答案:B

解析:录音原文提到...the equality of the debit and credit entries is checked by preparing a trial balance,故答案为B项。 -

第19题:

The income statement is prepared from ().A.the income statement columns of the work sheet

B.the adjusted trial balance

C.either the adjusted trial balance or the income statement columns of the work sheet

D.both the adjusted trial balance and the income statement columns of the work sheet

正确答案:C

-

第20题:

Government securities would appear on a commercial bank's balance sheet as ______.

A.an asset

B.reserves

C.part of net worth

D.a liability

正确答案:A

解析:商业银行持有政府债券是其资产,因此在资产负债表上体现为资产。asset资产。reserves准备金。net worth (NW) 净值。liability负债。balance sheet,资产负债表。 -

第21题:

Sales Discounts is a revenue account with a credit balance.()

正确答案:错

-

第22题:

信贷额度关系credit-in(C_name, limit, Credit_balance)中的三个属性分别表示用户姓名、信贷额度和到目前为止的花费。正确的SQL语言是()

A.C_name, Credit_balance-limit

B.C_name, limit-Credit_balance

C.C_name, limit, Credit_balance

D.C_name,Credit_balance

正确答案:B

解析:要查询每个用户还能花费多少,需要给出每个用户的名字和花费,花费是Credit_balance,所以,正确的SQL语言如下:SelectC_name,limit-Credit_balanceFromcredit-in本题正确答案为选项B -

第23题:

You are an audit manager at Rockwell & Co, a firm of Chartered Certified Accountants. You are responsible for the audit of the Hopper Group, a listed audit client which supplies ingredients to the food and beverage industry worldwide.

The audit work for the year ended 30 June 2015 is nearly complete, and you are reviewing the draft audit report which has been prepared by the audit senior. During the year the Hopper Group purchased a new subsidiary company, Seurat Sweeteners Co, which has expertise in the research and design of sugar alternatives. The draft financial statements of the Hopper Group for the year ended 30 June 2015 recognise profit before tax of $495 million (2014 – $462 million) and total assets of $4,617 million (2014: $4,751 million). An extract from the draft audit report is shown below:

Basis of modified opinion (extract)

In their calculation of goodwill on the acquisition of the new subsidiary, the directors have failed to recognise consideration which is contingent upon meeting certain development targets. The directors believe that it is unlikely that these targets will be met by the subsidiary company and, therefore, have not recorded the contingent consideration in the cost of the acquisition. They have disclosed this contingent liability fully in the notes to the financial statements. We do not feel that the directors’ treatment of the contingent consideration is correct and, therefore, do not believe that the criteria of the relevant standard have been met. If this is the case, it would be appropriate to adjust the goodwill balance in the statement of financial position.

We believe that any required adjustment may materially affect the goodwill balance in the statement of financial position. Therefore, in our opinion, the financial statements do not give a true and fair view of the financial position of the Hopper Group and of the Hopper Group’s financial performance and cash flows for the year then ended in accordance with International Financial Reporting Standards.

Emphasis of Matter Paragraph

We draw attention to the note to the financial statements which describes the uncertainty relating to the contingent consideration described above. The note provides further information necessary to understand the potential implications of the contingency.

Required:

(a) Critically appraise the draft audit report of the Hopper Group for the year ended 30 June 2015, prepared by the audit senior.

Note: You are NOT required to re-draft the extracts from the audit report. (10 marks)

(b) The audit of the new subsidiary, Seurat Sweeteners Co, was performed by a different firm of auditors, Fish Associates. During your review of the communication from Fish Associates, you note that they were unable to obtain sufficient appropriate evidence with regard to the breakdown of research expenses. The total of research costs expensed by Seurat Sweeteners Co during the year was $1·2 million. Fish Associates has issued a qualified audit opinion on the financial statements of Seurat Sweeteners Co due to this inability to obtain sufficient appropriate evidence.

Required:

Comment on the actions which Rockwell & Co should take as the auditor of the Hopper Group, and the implications for the auditor’s report on the Hopper Group financial statements. (6 marks)

(c) Discuss the quality control procedures which should be carried out by Rockwell & Co prior to the audit report on the Hopper Group being issued. (4 marks)

正确答案:(a) Critical appraisal of the draft audit report

Type of opinion

When an auditor issues an opinion expressing that the financial statements ‘do not give a true and fair view’, this represents an adverse opinion. The paragraph explaining the modification should, therefore, be titled ‘Basis of Adverse Opinion’ rather than simply ‘Basis of Modified Opinion’.

An adverse opinion means that the auditor considers the misstatement to be material and pervasive to the financial statements of the Hopper Group. According to ISA 705 Modifications to Opinions in the Independent Auditor’s Report, pervasive matters are those which affect a substantial proportion of the financial statements or fundamentally affect the users’ understanding of the financial statements. It is unlikely that the failure to recognise contingent consideration is pervasive; the main effect would be to understate goodwill and liabilities. This would not be considered a substantial proportion of the financial statements, neither would it be fundamental to understanding the Hopper Group’s performance and position.

However, there is also some uncertainty as to whether the matter is even material. If the matter is determined to be material but not pervasive, then a qualified opinion would be appropriate on the basis of a material misstatement. If the matter is not material, then no modification would be necessary to the audit opinion.

Wording of opinion/report

The auditor’s reference to ‘the acquisition of the new subsidiary’ is too vague; the Hopper Group may have purchased a number of subsidiaries which this phrase could relate to. It is important that the auditor provides adequate description of the event and in these circumstances it would be appropriate to name the subsidiary referred to.

The auditor has not quantified the amount of the contingent element of the consideration. For the users to understand the potential implications of any necessary adjustments, they need to know how much the contingent consideration will be if it becomes payable. It is a requirement of ISA 705 that the auditor quantifies the financial effects of any misstatements, unless it is impracticable to do so.

In addition to the above point, the auditor should provide more description of the financial effects of the misstatement, including full quantification of the effect of the required adjustment to the assets, liabilities, incomes, revenues and equity of the Hopper Group.

The auditor should identify the note to the financial statements relevant to the contingent liability disclosure rather than just stating ‘in the note’. This will improve the understandability and usefulness of the contents of the audit report.

The use of the term ‘we do not feel that the treatment is correct’ is too vague and not professional. While there may be some interpretation necessary when trying to apply financial reporting standards to unique circumstances, the expression used is ambiguous and may be interpreted as some form. of disclaimer by the auditor with regard to the correct accounting treatment. The auditor should clearly explain how the treatment applied in the financial statements has departed from the requirements of the relevant standard.

Tutorial note: As an illustration to the above point, an appropriate wording would be: ‘Management has not recognised the acquisition-date fair value of contingent consideration as part of the consideration transferred in exchange for the acquiree, which constitutes a departure from International Financial Reporting Standards.’

The ambiguity is compounded by the use of the phrase ‘if this is the case, it would be appropriate to adjust the goodwill’. This once again suggests that the correct treatment is uncertain and perhaps open to interpretation.

If the auditor wishes to refer to a specific accounting standard they should refer to its full title. Therefore instead of referring to ‘the relevant standard’ they should refer to International Financial Reporting Standard 3 Business Combinations.

The opinion paragraph requires an appropriate heading. In this case the auditors have issued an adverse opinion and the paragraph should be headed ‘Adverse Opinion’.

As with the basis paragraph, the opinion paragraph lacks authority; suggesting that the required adjustments ‘may’ materially affect the financial statements implies that there is a degree of uncertainty. This is not the case; the amount of the contingent consideration will be disclosed in the relevant purchase agreement, so the auditor should be able to determine whether the required adjustments are material or not. Regardless, the sentence discussing whether the balance is material or not is not required in the audit report as to warrant inclusion in the report the matter must be considered material. The disclosure of the nature and financial effect of the misstatement in the basis paragraph is sufficient.

Finally, the emphasis of matter paragraph should not be included in the audit report. An emphasis of matter paragraph is only used to draw attention to an uncertainty/matter of fundamental importance which is correctly accounted for and disclosed in the financial statements. An emphasis of matter is not required in this case for the following reasons:

– Emphasis of matter is only required to highlight matters which the auditor believes are fundamental to the users’ understanding of the business. An example may be where a contingent liability exists which is so significant it could lead to the closure of the reporting entity. That is not the case with the Hopper Group; the contingent liability does not appear to be fundamental.

– Emphasis of matter is only used for matters where the auditor has obtained sufficient appropriate evidence that the matter is not materially misstated in the financial statements. If the financial statements are materially misstated, in this regard the matter would be fully disclosed by the auditor in the basis of qualified/adverse opinion paragraph and no emphasis of matter is necessary.

(b) Communication from the component auditor

The qualified opinion due to insufficient evidence may be a significant matter for the Hopper Group audit. While the possible adjustments relating to the current year may not be material to the Hopper Group, the inability to obtain sufficient appropriate evidence with regard to a material matter in Seurat Sweeteners Co’s financial statements may indicate a control deficiency which the auditor was not aware of at the planning stage and it could indicate potential problems with regard to the integrity of management, which could also indicate a potential fraud. It could also indicate an unwillingness of management to provide information, which could create problems for future audits, particularly if research and development costs increase in future years. If the group auditor suspects that any of these possibilities are true, they may need to reconsider their risk assessment and whether the audit procedures performed are still appropriate.

If the detail provided in the communication from the component auditor is insufficient, the group auditor should first discuss the matter with the component auditor to see whether any further information can be provided. The group auditor can request further working papers from the component auditor if this is necessary. However, if Seurat Sweeteners has not been able to provide sufficient appropriate evidence, it is unlikely that this will be effective.

If the discussions with the component auditor do not provide satisfactory responses to evaluate the potential impact on the Hopper Group, the group auditor may need to communicate with either the management of Seurat Sweeteners or the Hopper Group to obtain necessary clarification with regard to the matter.

Following these procedures, the group auditor needs to determine whether they have sufficient appropriate evidence to draw reasonable conclusions on the Hopper Group’s financial statements. If they believe the lack of information presents a risk of material misstatement in the group financial statements, they can request that further audit procedures be performed, either by the component auditor or by themselves.

Ultimately the group engagement partner has to evaluate the effect of the inability to obtain sufficient appropriate evidence on the audit opinion of the Hopper Group. The matter relates to research expenses totalling $1·2 million, which represents 0·2% of the profit for the year and 0·03% of the total assets of the Hopper Group. It is therefore not material to the Hopper Group’s financial statements. For this reason no modification to the audit report of the Hopper Group would be required as this does not represent a lack of sufficient appropriate evidence with regard to a matter which is material to the Group financial statements.

Although this may not have an impact on the Hopper Group audit opinion, this may be something the group auditor wishes to bring to the attention of those charged with governance. This would be particularly likely if the group auditor believed that this could indicate some form. of fraud in Seurat Sweeteners Co, a serious deficiency in financial reporting controls or if this could create problems for accepting future audits due to management’s unwillingness to provide access to accounting records.

(c) Quality control procedures prior to issuing the audit report

ISA 220 Quality Control for an Audit of Financial Statements and ISQC 1 Quality Control for Firms that Perform. Audits and Reviews of Historical Financial Information, and Other Assurance and Related Services Agreements require that an engagement quality control reviewer shall be appointed for audits of financial statements of listed entities. The audit engagement partner then discusses significant matters arising during the audit engagement with the engagement quality control reviewer.

The engagement quality control reviewer and the engagement partner should discuss the failure to recognise the contingent consideration and its impact on the auditor’s report. The engagement quality control reviewer must review the financial statements and the proposed auditor’s report, in particular focusing on the conclusions reached in formulating the auditor’s report and consideration of whether the proposed auditor’s opinion is appropriate. The audit documentation relating to the acquisition of Seurat Sweeteners Co will be carefully reviewed, and the reviewer is likely to consider whether procedures performed in relation to these balances were appropriate.

Given the listed status of the Hopper Group, any modification to the auditor’s report will be scrutinised, and the firm must be sure of any decision to modify the report, and the type of modification made. Once the engagement quality control reviewer has considered the necessity of a modification, they should consider whether a qualified or an adverse opinion is appropriate in the circumstances. This is an important issue, given that it requires judgement as to whether the matters would be material or pervasive to the financial statements.

The engagement quality control reviewer should ensure that there is adequate documentation regarding the judgements used in forming the final audit opinion, and that all necessary matters have been brought to the attention of those charged with governance.

The auditor’s report must not be signed and dated until the completion of the engagement quality control review.

Tutorial note: In the case of the Hopper Group’s audit, the lack of evidence in respect of research costs is unlikely to be discussed unless the audit engagement partner believes that the matter could be significant, for example, if they suspected the lack of evidence is being used to cover up a financial statements fraud.