(c) Critically discuss FOUR principal roles of non-executive directors and explain the potential tensions betweenthese roles that WM’s non-executive directors may experience in advising on the disclosure of theoverestimation of the mallerite reserve. (12

题目

(c) Critically discuss FOUR principal roles of non-executive directors and explain the potential tensions between

these roles that WM’s non-executive directors may experience in advising on the disclosure of the

overestimation of the mallerite reserve. (12 marks)

相似考题

更多“(c) Critically discuss FOUR principal roles of non-executive directors and explain the potential tensions betweenthese roles that WM’s non-executive directors may experience in advising on the disclosure of theoverestimation of the mallerite reserve. (12 ”相关问题

-

第1题:

(c) Explain the benefits of performance-related pay in rewarding directors and critically evaluate the implications

of the package offered to Choo Wang. (8 marks)

正确答案:

(c) Choo Wang’s remuneration package

Benefits of PRP

In general terms, performance-related pay serves to align directors’ and shareholders’ interests in that the performancerelated

element can be made to reflect those things held to be important to shareholders (such as financial targets). This, in

turn, serves to motivate directors, especially if they are directly responsible for a cost or revenue/profit budget or centre. The

possibility of additional income serves to motivate directors towards higher performance and this, in turn, can assist in

recruitment and retention. Finally, performance-related pay can increase the board’s control over strategic planning and

implementation by aligning rewards against strategic objectives.

Critical evaluation of Choo Wang’s package

Choo Wang’s package appears to have a number of advantages and shortcomings. It was strategically correct to include some

element of pay linked specifically to Southland success. This will increase Choo’s motivation to make it successful and indeed,

he has said as much – he appears to be highly motivated and aware that additional income rests upon its success. Against

these advantages, it appears that the performance-related component does not take account of, or discount in any way for,

the risk of the Southland investment. The bonus does not become payable on a sliding scale but only on a single payout basis

when the factory reaches an ‘ambitious’ level of output. Accordingly, Choo has more incentive to be accepting of risk with

decisions on the Southland investment than risk averse. This may be what was planned, but such a bias should be pointed

out. Clearly, the company should accept some risk but recklessness should be discouraged. In conclusion, Choo’s PRP

package could have been better designed, especially if the Southland investment is seen as strategically risky. -

第2题:

2 Chen Products produces four manufactured products: Products 1, 2, 3 and 4. The company’s risk committee recently

met to discuss how the company might respond to a number of problems that have arisen with Product 2. After a

number of incidents in which Product 2 had failed whilst being used by customers, Chen Products had been presented

with compensation claims from customers injured and inconvenienced by the product failure. It was decided that the

risk committee should meet to discuss the options.

When the discussion of Product 2 began, committee chairman Anne Ricardo reminded her colleagues that, apart from

the compensation claims, Product 2 was a highly profitable product.

Chen’s risk management committee comprised four non-executive directors who each had different backgrounds and

areas of expertise. None of them had direct experience of Chen’s industry or products. It was noted that it was

common for them to disagree among themselves as to how risks should be managed and that in some situations,

each member proposed a quite different strategy to manage a given risk. This was the case when they discussed

which risk management strategy to adopt with regard to Product 2.

Required:

(a) Describe the typical roles of a risk management committee. (6 marks)

正确答案:

(a) Typical roles of a risk management committee

The typical roles of a risk management committee are as follows:

To agree and approve the risk management strategy and policies. The design of risk policy will take into account the

environment, the strategic posture towards risk, the product type and a range of other relevant factors.

Receiving and reviewing risk reports from affected departments. Some departments will file regular reports on key risks (such

as liquidity assessments from the accounting department, legal risks from the company secretariat or product risks from the

sales manager).

Monitoring overall exposure and specific risks. If the risk policy places limits on the total risk exposure for a given risk then

this role ensures that limits are adhered to. In the case of certain strategic risks, monitoring could occur on a very frequent

basis whereas for more operational risks, monitoring will more typically occur to coincide with risk management committee

meetings.

Assessing the effectiveness of risk management systems. This involves getting feedback from departments and the internal

audit function on the workings of current management and risk mitigation systems.

Providing general and explicit guidance to the main board on emerging risks and to report on existing risks. This will involve

preparing reports on apparent risks and assessing their probability of being realised and their potential impact if they do.

To work with the audit committee on designing and monitoring internal controls for the management and mitigation of risks.

If the risk committee is part of the executive structure, it will likely have an advisory role in respect of its input into the audit

committee. If it is non-executive, its input may be more directly influential.

[Tutorial note: other roles may be suggested that, if relevant, will be rewarded] -

第3题:

(ii) Explain the ethical tensions between these roles that Anne is now experiencing. (4 marks)

正确答案:

(ii) Tensions in roles

On one hand, Anne needs to cultivate and manage her relationship with her manager (Zachary) who seems convinced

that Van Buren, and Frank in particular, are incapable of bad practice. He shows evidence of poor judgment and

compromised independence. Anne must decide how to deal with Zachary’s poor judgment.

On the other hand, Anne has a duty to both the public interest and the shareholders of Van Buren to ensure that the

accounts do contain a ‘true and fair view’. Under a materiality test, she may ultimately decide that the payment in

question need not hold up the audit signoff but the poor client explanation (from Frank) is also a matter of concern to

Anne as a professional accountant. -

第4题:

(b) Identify and explain THREE approaches that the directors of Moffat Ltd might apply in assessing the

QUALITATIVE benefits of the proposed investment in a new IT system. (6 marks)

正确答案:

(b) One approach that the directors of Moffat Ltd could adopt would be to ignore the qualitative benefits that may arise on the

basis that there is too much subjectivity involved in their assessment. The problem that this causes is that the investment will

probably look unattractive since all costs will be included in the evaluation whereas significant benefits and savings will have

been ignored. Hence such an approach is lacking in substance and is not recommended.

An alternative approach would involve attempting to attribute values to each of the identified benefits that are qualitative in

nature. Such an approach will necessitate the use of management estimates in order to derive the cash flows to be

incorporated in a cost benefit analysis. The problems inherent in this approach include gaining consensus among interested

parties regarding the footing of the assumptions from which estimated cash flows have been derived. Furthermore, if the

proposed investment does take place then it may well be impossible to prove that the claimed benefits of the new system

have actually been realised.

Perhaps the preferred approach is to acknowledge the existence of qualitative benefits and attempt to assess them in a

reasonable manner acceptable to all parties including the company’s bank. The financial evaluation would then not only

incorporate ‘hard’ facts relating to costs and benefits that are quantitative in nature, but also would include details of

qualitative benefits which management consider exist but have not attempted to assess in financial terms. Such benefits might

include, for example, the average time saved by location managers in analysing information during each operating period.

Alternatively the management of Moffat Ltd could attempt to express qualitative benefits in specific terms linked to a hierarchy

of organisational requirements. For example, qualitative benefits could be categorised as being:

(1) Essential to the business

(2) Very useful attributes

(3) Desirable, but not essential

(4) Possible, if funding is available

(5) Doubtful and difficult to justify. -

第5题:

(b) Explain how growth may be assessed, and critically discuss the advantages and issues that might arise as a

result of a decision by the directors of CSG to pursue the objective of growth. (8 marks)

正确答案:

(b) Growth may be measured in a number of ways which are as follows:

Cash flow

This is a very important measure of growth as it ultimately determines the amount of funds available for re-investment by any

business.

Sales revenue

Growth in sales revenues generated is only of real value to investors if it precipitates growth in profits.

Profitability

There are many measures relating to profit which include sales margin, earnings before interest, taxation, depreciation and

amortisation (EBITDA) and earnings per share. More sophisticated measures such as return on capital employed and residual

income consider the size of the investment relative to the level of profits earned. In general terms, measures of profitability

are only meaningful if they are used as a basis for comparisons over time or in conjunction with other measures of

performance. Growth rate in profitability are useful when compared with other companies and also with other industries.

Return on investment

A growing return upon invested capital suggests that capital is being used more and more productively. Indicators of a growing

return would be measured by reference to dividend payment and capital growth.

Market share

Growth in market share is generally seen as positive as it can generate economies of scale.

Number of products/service offerings

Growth is only regarded as useful if products and services are profitable.

Number of employees

Measures of productivity such as value added per employee and profit per employee are often used by shareholders in

assessing growth. Very often an increased headcount is a measure of success in circumstances where more people are

needed in order to deliver a service to a required standard. However it is incumbent on management to ensure that all

employees are utilised in an effective manner.

It is a widely held belief that growth requires profits and that growth produces profits. Profits are essential in order to prevent

a company which has achieved growth from becoming a target for a take-over or in a worse case scenario goes into

liquidation. Hence it is fundamental that a business is profitable throughout its existence. Growth accompanied by growth in

profits is also likely to aid the long-term survival of an organisation. CSG operates in Swingland which experiences fluctuations

in its economic climate and in this respect the exploitation of profitable growth opportunities will help CSG to survive at the

expense of its competitors who do not exploit such opportunities.

Note: Alternative relevant discussion and examples would be accepted. -

第6题:

(b) Explain FIVE critical success factors to the performance of HSC on which the directors must focus if HSC is

to achieve success in its marketplace. (10 marks)

正确答案:

(b) Critical success factors are as follows:

Product quality

The fact that the production staff have no previous experience in a food production environment is likely to prove problematic.

It is vital that a comprehensive training programme is put in place at the earliest opportunity. HSC need to reach and maintain

the highest level of product quality as soon as possible.

Supply quality

The quality of delivery into SFG supermarkets assumes critical significance. Time literally will be of the essence since 90%

of all sandwiches are sold in SFG’s supermarkets before 2 pm each day. Hence supply chain management must be extremely

robust as there is very little scope for error.

Technical quality

Compliance with existing regulations regarding food production including all relevant factory health and safety requirements

is vital in order to establish and maintain the reputation of HSC as a supplier of quality products. The ability to store products

at the correct temperature is critical because sandwiches are produced for human consumption and in extreme circumstance

could cause fatalities.

External credibility

Accreditation by relevant trade associations/regulators will be essential if nationwide acceptance of HSC as a major producer

of sandwiches is to be established.

New product development

Whilst HSC have developed a range of healthy eating sandwiches it must be recognised that consumer tastes change and

that in the face of competition there will always be a need for a continuous focus on new product development.

Margin

Whilst HSC need to recognise all other critical success factors they should always be mindful that the need to obtain the

desired levels of gross and net margin remain of the utmost importance.

Notes: (i) Only five critical success factors were required.

(ii) Alternative relevant discussion and examples would be acceptable. -

第7题:

(c) Identify and discuss the implications for the audit report if:

(i) the directors refuse to disclose the note; (4 marks)

正确答案:

(c) (i) Audit report implications

Audit procedures have shown that there is a significant level of doubt over Dexter Co’s going concern status. IAS 1

requires that disclosure is made in the financial statements regarding material uncertainties which may cast significant

doubt on the ability of the entity to continue as a going concern. If the directors refuse to disclose the note to the financial

statements, there is a clear breach of financial reporting standards.

In this case the significant uncertainty is caused by not knowing the extent of the future availability of finance needed

to fund operating activities. If the note describing this uncertainty is not provided, the financial statements are not fairly

presented.

The audit report should contain a qualified or an adverse opinion due to the disagreement. The auditors need to make

a decision as to the significance of the non-disclosure. If it is decided that without the note the financial statements are

not fairly presented, and could be considered misleading, an adverse opinion should be expressed. Alternatively, it could

be decided that the lack of the note is material, but not pervasive to the financial statements; then a qualified ‘except

for’ opinion should be expressed.

ISA 570 Going Concern and ISA 701 Modifications to the Independent Auditor’s Report provide guidance on the

presentation of the audit report in the case of a modification. The audit report should include a paragraph which contains

specific reference to the fact that there is a material uncertainty that may cast significant doubt about the entity’s ability

to continue as a going concern. The paragraph should include a clear description of the uncertainties and would

normally be presented immediately before the opinion paragraph. -

第8题:

Moonstar Co is a property development company which is planning to undertake a $200 million commercial property development. Moonstar Co has had some difficulties over the last few years, with some developments not generating the expected returns and the company has at times struggled to pay its finance costs. As a result Moonstar Co’s credit rating has been lowered, affecting the terms it can obtain for bank finance. Although Moonstar Co is listed on its local stock exchange, 75% of the share capital is held by members of the family who founded the company. The family members who are shareholders do not wish to subscribe for a rights issue and are unwilling to dilute their control over the company by authorising a new issue of equity shares. Moonstar Co’s board is therefore considering other methods of financing the development, which the directors believe will generate higher returns than other recent investments, as the country where Moonstar Co is based appears to be emerging from recession.

Securitisation proposals

One of the non-executive directors of Moonstar Co has proposed that it should raise funds by means of a securitisation process, transferring the rights to the rental income from the commercial property development to a special purpose vehicle. Her proposals assume that the leases will generate an income of 11% per annum to Moonstar Co over a ten-year period. She proposes that Moonstar Co should use 90% of the value of the investment for a collateralised loan obligation which should be structured as follows:

– 60% of the collateral value to support a tranche of A-rated floating rate loan notes offering investors LIBOR plus 150 basis points

– 15% of the collateral value to support a tranche of B-rated fixed rate loan notes offering investors 12%

– 15% of the collateral value to support a tranche of C-rated fixed rate loan notes offering investors 13%

– 10% of the collateral value to support a tranche as subordinated certificates, with the return being the excess of receipts over payments from the securitisation process

The non-executive director believes that there will be sufficient demand for all tranches of the loan notes from investors. Investors will expect that the income stream from the development to be low risk, as they will expect the property market to improve with the recession coming to an end and enough potential lessees to be attracted by the new development.

The non-executive director predicts that there would be annual costs of $200,000 in administering the loan. She acknowledges that there would be interest rate risks associated with the proposal, and proposes a fixed for variable interest rate swap on the A-rated floating rate notes, exchanging LIBOR for 9·5%.

However the finance director believes that the prediction of the income from the development that the non-executive director has made is over-optimistic. He believes that it is most likely that the total value of the rental income will be 5% lower than the non-executive director has forecast. He believes that there is some risk that the returns could be so low as to jeopardise the income for the C-rated fixed rate loan note holders.

Islamic finance

Moonstar Co’s chief executive has wondered whether Sukuk finance would be a better way of funding the development than the securitisation.

Moonstar Co’s chairman has pointed out that a major bank in the country where Moonstar Co is located has begun to offer a range of Islamic financial products. The chairman has suggested that a Mudaraba contract would be the most appropriate method of providing the funds required for the investment.

Required:

(a) Calculate the amounts in $ which each of the tranches can expect to receive from the securitisation arrangement proposed by the non-executive director and discuss how the variability in rental income affects the returns from the securitisation. (11 marks)

(b) Discuss the benefits and risks for Moonstar Co associated with the securitisation arrangement that the non-executive director has proposed. (6 marks)

(c) (i) Discuss the suitability of Sukuk finance to fund the investment, including an assessment of its appeal to potential investors. (4 marks)

(ii) Discuss whether a Mudaraba contract would be an appropriate method of financing the investment and discuss why the bank may have concerns about providing finance by this method. (4 marks)

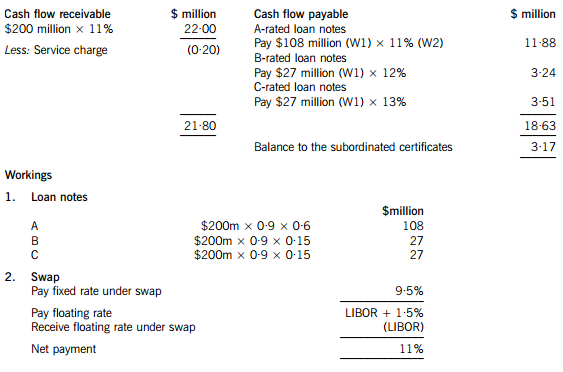

正确答案:(a) An annual cash flow account compares the estimated cash flows receivable from the property against the liabilities within the securitisation process. The swap introduces leverage into the arrangement.

The holders of the certificates are expected to receive $3·17million on $18 million, giving them a return of 17·6%. If the cash flows are 5% lower than the non-executive director has predicted, annual revenue received will fall to $20·90 million, reducing the balance available for the subordinated certificates to $2·07 million, giving a return of 11·5% on the subordinated certificates, which is below the returns offered on the B and C-rated loan notes. The point at which the holders of the certificates will receive nothing and below which the holders of the C-rated loan notes will not receive their full income will be an annual income of $18·83 million (a return of 9·4%), which is 14·4% less than the income that the non-executive director has forecast.

(b) Benefits

The finance costs of the securitisation may be lower than the finance costs of ordinary loan capital. The cash flows from the commercial property development may be regarded as lower risk than Moonstar Co’s other revenue streams. This will impact upon the rates that Moonstar Co is able to offer borrowers.

The securitisation matches the assets of the future cash flows to the liabilities to loan note holders. The non-executive director is assuming a steady stream of lease income over the next 10 years, with the development probably being close to being fully occupied over that period.

The securitisation means that Moonstar Co is no longer concerned with the risk that the level of earnings from the properties will be insufficient to pay the finance costs. Risks have effectively been transferred to the loan note holders.

Risks

Not all of the tranches may appeal to investors. The risk-return relationship on the subordinated certificates does not look very appealing, with the return quite likely to be below what is received on the C-rated loan notes. Even the C-rated loan note holders may question the relationship between the risk and return if there is continued uncertainty in the property sector.

If Moonstar Co seeks funding from other sources for other developments, transferring out a lower risk income stream means that the residual risks associated with the rest of Moonstar Co’s portfolio will be higher. This may affect the availability and terms of other borrowing.

It appears that the size of the securitisation should be large enough for the costs to be bearable. However Moonstar Co may face unforeseen costs, possibly unexpected management or legal expenses.

(c) (i) Sukuk finance could be appropriate for the securitisation of the leasing portfolio. An asset-backed Sukuk would be the same kind of arrangement as the securitisation, where assets are transferred to a special purpose vehicle and the returns and repayments are directly financed by the income from the assets. The Sukuk holders would bear the risks and returns of the relationship.

The other type of Sukuk would be more like a sale and leaseback of the development. Here the Sukuk holders would be guaranteed a rental, so it would seem less appropriate for Moonstar Co if there is significant uncertainty about the returns from the development.

The main issue with the asset-backed Sukuk finance is whether it would be as appealing as certainly the A-tranche of the securitisation arrangement which the non-executive director has proposed. The safer income that the securitisation offers A-tranche investors may be more appealing to investors than a marginally better return from the Sukuk. There will also be costs involved in establishing and gaining approval for the Sukuk, although these costs may be less than for the securitisation arrangement described above.

(ii) A Mudaraba contract would involve the bank providing capital for Moonstar Co to invest in the development. Moonstar Co would manage the investment which the capital funded. Profits from the investment would be shared with the bank, but losses would be solely borne by the bank. A Mudaraba contract is essentially an equity partnership, so Moonstar Co might not face the threat to its credit rating which it would if it obtained ordinary loan finance for the development. A Mudaraba contract would also represent a diversification of sources of finance. It would not require the commitment to pay interest that loan finance would involve.

Moonstar Co would maintain control over the running of the project. A Mudaraba contract would offer a method of obtaining equity funding without the dilution of control which an issue of shares to external shareholders would bring. This is likely to make it appealing to Moonstar Co’s directors, given their desire to maintain a dominant influence over the business.

The bank would be concerned about the uncertainties regarding the rental income from the development. Although the lack of involvement by the bank might appeal to Moonstar Co's directors, the bank might not find it so attractive. The bank might be concerned about information asymmetry – that Moonstar Co’s management might be reluctant to supply the bank with the information it needs to judge how well its investment is performing.

-

第9题:

Text 1 Ruth Simmons joined Goldman Sachs's board as an outside director in January 2000;a year later she became president of Brown University.For the rest of the decade she apparently managed both roles without attracting much criticism.But by the end of 2009 Ms.Simmons was under fire for having sat on Goldman's compensation committee;how could she have let those enormous bonus payouts pass unremarked?By February the next year Ms.Simmons had left the board.The position was just taking up too much time,she said.Outside directors are supposed to serve as helpful,yet less biased,advisers on a firm's board.Having made their wealth and their reputations elsewhere,they presumably have enough independence to disagree with the chief executive's proposals.If the sky,and the share price,is falling,outside directors should be able to give advice based on having weathered their own crises.The researchers from Ohio University used a database that covered more than 10,000 firms and more than 64,000 different directors between 1989 and 2004.Then they simply checked which directors stayed from one proxy statement to the next.The most likely reason for departing a board was age,so the researchers concentrated on those“surprise”disappearances by directors under the age of 70.They found that after a surprise departure,the probability that the company will subsequently have to restate earnings increases by nearly 20%.The likelihood of being named in a federal classaction lawsuit also increases,and the stock is likely to perform worse.The effect tended to be larger for larger firms.Although a correlation between them leaving and subsequent bad performance at the firm is suggestive,it does not mean that such directors are always jumping off a sinking ship.Often they“trade up,”leaving riskier,smaller firms for larger and more stable firms.But the researchers believe that outside directors have an easier time of avoiding a blow to their reputations if they leave a firm before bad news break,even if a review of history shows they were on the board at the time any wrongdoing occurred.Firms who want to keep their outside directors through tough times may have to create incentives.Otherwise outside directors will follow the example of Ms.Simmons,once again very popular on campus.

It can be inferred from the last paragraph that outside directors____A.may stay for the attractive offers from the firm

B.have often had records of wrongdoings in the firm

C.are accustomed to stressfree work in the firm

D.will decline incentives from the firm答案:A解析:推理题【命题思路】这是一道封闭式推理题,需要对最后一段进行锁定,从而得出答案。【直击答案】根据题干定位到最后一段第二句“Firms who…create incentives.”这句话的意思是“想要在困难时期留住外部董事的公司可能不得不采取一些激励政策。”由此可以推断出外部董事可能会因为公司采取的政策而留下。A项和原文意思吻合,故是正确答案。【干扰排除】B项与原文意思不符。原文最后一段最后一句只是说外部董事在公司犯错时还在公司任职,但并未说外部董事自己居公司留下劣迹,故不选。最后一段并没有提到外部董事的工作压力,C项属于无中生有,故不选。文末两句“Firms who…the example of Ms.Simmons…”只谈到了公司不得不采取一些激励措施,至于外部董事接受还是拒绝,没有提及。D项属于过度推理,不选。 -

第10题:

Text 1 Ruth Simmons joined Goldman Sachs's board as an outside director in January 2000;a year later she became president of Brown University.For the rest of the decade she apparently managed both roles without attracting much criticism.But by the end of 2009 Ms.Simmons was under fire for having sat on Goldman's compensation committee;how could she have let those enormous bonus payouts pass unremarked?By February the next year Ms.Simmons had left the board.The position was just taking up too much time,she said.Outside directors are supposed to serve as helpful,yet less biased,advisers on a firm's board.Having made their wealth and their reputations elsewhere,they presumably have enough independence to disagree with the chief executive's proposals.If the sky,and the share price,is falling,outside directors should be able to give advice based on having weathered their own crises.The researchers from Ohio University used a database that covered more than 10,000 firms and more than 64,000 different directors between 1989 and 2004.Then they simply checked which directors stayed from one proxy statement to the next.The most likely reason for departing a board was age,so the researchers concentrated on those“surprise”disappearances by directors under the age of 70.They found that after a surprise departure,the probability that the company will subsequently have to restate earnings increases by nearly 20%.The likelihood of being named in a federal classaction lawsuit also increases,and the stock is likely to perform worse.The effect tended to be larger for larger firms.Although a correlation between them leaving and subsequent bad performance at the firm is suggestive,it does not mean that such directors are always jumping off a sinking ship.Often they“trade up,”leaving riskier,smaller firms for larger and more stable firms.But the researchers believe that outside directors have an easier time of avoiding a blow to their reputations if they leave a firm before bad news break,even if a review of history shows they were on the board at the time any wrongdoing occurred.Firms who want to keep their outside directors through tough times may have to create incentives.Otherwise outside directors will follow the example of Ms.Simmons,once again very popular on campus.

The author's attitude toward the role of outside directors is_____A.permissive

B.positive

C.scornful

D.critical答案:B解析:态度题【命题思路】本题需要在理解文章主旨要义的前提下能够识别出作者对外部董事的态度。态度有正向答案,也有负向答案,此题首先考查考生锁定哪个方向的答案;其次考查考生在方向正确的基础上结合原文具体信息进行判断,从而得出作者对外部董事所持有的态度。【直击答案】根据题干信息“The author's attitude”和“the roleof outside directors”定位到第二段“Outside directors…on a firm's board.”。其中原文中的“be supposed to”等于题干中的“The author's attitude”,“serve as”等于题干中的“the role”。根据这句可知“外部董事在公司中应扮演有益而又相对公正的顾问角色。”由此可以判断出作者对外部董事这一角色持肯定态度。另外根据文章最后一段可知“想要在困难时期留住外部董事的公司可能不得不采取一些激励政策。”这说明外部董事对公司还是有积极作用的,综合全文,B项正确。【干扰排除】根据对文章第二段分析可知作者对外部董事的态度应是正向的,故C项和D项感情色彩错误,均不选。纵观整篇文章,作者只是对外部董事进行客观描述,并没有宽容放纵的态度,故A项错误。长难句解析 -

第11题:

资料:From: Iris Wu

To: Tim Appleby

Subject: Marketing issues

Date:May 3

Hi Tim,Can you schedule a conference call for all our marketing directors, me included, to discuss the launch of the new appliance line? Please note that our offices in the Philippines and France are respectively, twelve and six hours ahead of us. Threfore, kindly remind the directors that the call may have to occur outside of business hours.

The meeting should be arranged before the new product presentations on May 26. I recommend scheduling the call on May 14 or 15 to allow sufficient time for the appliance information charts to be updated with any suggested changes. Should a different date be more convenient for the other directors, please check with me to confirm my availability?

Thank you

Iris

Who most likely is Ms. Wu?A.graphic designer

B.marketing director

C.An appliance technician

D.An administrative assistant答案:B解析:本题考查的是细节推理。

【关键词】who; most likely;Ms. Wu

【主题句】第一段Can you schedule a conference call for all our marketing directors, me included, to discuss the launch of the new appliance line?(你能为所有的市场总监(包括我在内)安排一场电话会议吗?目的是讨论新款家用电器线投放市场的内容。);第二段Should a different date be more convenient for the other directors, please check with me to confirm my availability?(如果其他总监在别的时间有空,请与我核对我是否有时间。)

【解析】第3题问“吴小姐最有可能是谁”。这道题考察同学们对于发件人身份的确定。根据第一段第一句“你能为所有的市场总监(包括我在内)安排一场电话会议吗?”,吴小姐也是市场总监一员。此外,文章最后一句吴小姐说“如果其他总监在别的时间有空,请与我核对我是否有时间。”,说明吴小姐也要参加会议讨论,她应该就是一名市场总监,答案是B。D选项是陷阱选项,吴小姐可能是一个行政助理。首先,文章中并未体现出助理这一角色,如果是助理就应该她来安排这场会议;其次,如果是助理,她也不需要参与到会议讨论当中,不用让收件人确认她是否有空。总上所述,D选项应该被排除。A选项“graphic designer”是“美术设计员”,C选项“appliance technician”是“家电技师”,这两个角色原文并未提及。 -

第12题:

资料:From: Iris Wu

To: Tim Appleby

Subject: Marketing issues

Date:May 3

Hi Tim,Can you schedule a conference call for all our marketing directors, me included, to discuss the launch of the new appliance line? Please note that our offices in the Philippines and France are respectively, twelve and six hours ahead of us. Threfore, kindly remind the directors that the call may have to occur outside of business hours.

The meeting should be arranged before the new product presentations on May 26. I recommend scheduling the call on May 14 or 15 to allow sufficient time for the appliance information charts to be updated with any suggested changes. Should a different date be more convenient for the other directors, please check with me to confirm my availability?

Thank you

Iris

When are presentations scheduled?A.on May 3

B.on May 14

C.on May 15

D.on May 26答案:D解析:本题考查的是细节理解。

【关键词】when; presentations; scheduled

【主题句】第二段The meeting should be arranged before the new product presentations on May 26.(会议可以安排在5月26日的新产品发布会之前。)

【解析】第2题问“产品发布会安排在哪天?”。根据文章第二段第一句“会议可以安排在5月26日的新产品发布会之前。”,所以答案应该是D选项“May 26”。做这道题一定要认真审题,因为B和C两个选项都在原文出现。但仔细看会发现,发信人建议把电话会议安排在这两个日期中的任意一天(I recommend scheduling the call on May 14 or 15)。 -

第13题:

(b) Assess the benefits of the separation of the roles of chief executive and chairman that Alliya Yongvanich

argued for and explain her belief that ‘accountability to shareholders’ is increased by the separation of these

roles. (12 marks)

正确答案:

(b) Separation of the roles of CEO and chairman

Benefits of separation of roles

The separation of the roles of chief executive and chairman was first provided for in the UK by the 1992 Cadbury provisions

although it has been included in all codes since. Most relevant to the case is the terms of the ICGN clause s.11 and OECD

VI (E) both of which provide for the separation of these roles. In the UK it is covered in the combined code section A2.

The separation of roles offers the benefit that it frees up the chief executive to fully concentrate on the management of the

organisation without the necessity to report to shareholders or otherwise become distracted from his or her executive

responsibilities. The arrangement provides a position (that of chairman) that is expected to represent shareholders’ interests

and that is the point of contact into the company for shareholders. Some codes also require the chairman to represent the

interests of other stakeholders such as employees.

Having two people rather than one at the head of a large organisation removes the risks of ‘unfettered powers’ being

concentrated in a single individual and this is an important safeguard for investors concerned with excessive secrecy or

lack of transparency and accountability. The case of Robert Maxwell is a good illustration of a single dominating

executive chairman operating unchallenged and, in so doing, acting illegally. Having the two roles separated reduces

the risk of a conflict of interest in a single person being responsible for company performance whilst also reporting on

that performance to markets. Finally, the chairman provides a conduit for the concerns of non-executive directors who,

in turn, provide an important external representation of external concerns on boards of directors.

Tutorial note: Reference to codes other than the UK is also acceptable. In all cases, detailed (clause number) knowledge

of code provisions is not required.

Accountability and separation of roles

In terms of the separation of roles assisting in the accountability to shareholders, four points can be made.

The chairman scrutinises the chief executive’s management performance on behalf of the shareholders and will be

involved in approving the design of the chief executive’s reward package. It is the responsibility of the chairman to hold

the chief executive to account on shareholders’ behalfs.

Shareholders have an identified person (chairman) to hold accountable for the performance of their investment. Whilst

day-to-day contact will normally be with the investor relations department (or its equivalent) they can ultimately hold

the chairman to account.

The presence of a separate chairman ensures that a system is in place to ensure NEDs have a person to report to outside the

executive structure. This encourages the freedom of expression of NEDs to the chairman and this, in turn, enables issues to

be raised and acted upon when necessary.

The chairman is legally accountable and, in most cases, an experienced person. He/she can be independent and more

dispassionate because he or she is not intimately involved with day-to-day management issues. -

第14题:

(c) Risk committee members can be either executive or non-executive.

Required:

(i) Distinguish between executive and non-executive directors. (2 marks)

正确答案:

(c) Risk committee members can be either executive on non-executive.

(i) Distinguish between executive and non-executive directors

Executive directors are full time members of staff, have management positions in the organisation, are part of the

executive structure and typically have industry or activity-relevant knowledge or expertise, which is the basis of their

value to the organisation.

Non-executive directors are engaged part time by the organisation, bring relevant independent, external input and

scrutiny to the board, and typically occupy positions in the committee structure. -

第15题:

(b) Explain the roles of a nominations committee and assess the potential usefulness of a nominations committee

to the board of Rosh and Company. (8 marks)

正确答案:

(b) Nominations committees

General roles of a nominations committee.

It advises on the balance between executives and independent non-executive directors and establishes the appropriate

number and type of NEDs on the board. The nominations committee is usually made up of NEDs.

It establishes the skills, knowledge and experience possessed by current board and notes any gaps that will need to be filled.

It acts to meet the needs for continuity and succession planning, especially among the most senior members of the board.

It establishes the desirable and optimal size of the board, bearing in mind the current size and complexity of existing and

planned activities and strategies.

It seeks to ensure that the board is balanced in terms of it having board members from a diversity of backgrounds so as to

reflect its main constituencies and ensure a flow of new ideas and the scrutiny of existing strategies.

In the case of Rosh, the needs that a nominations committee could address are:

To recommend how many directors would be needed to run the business and plan for recruitment accordingly. The perceived

similarity of skills and interests of existing directors is also likely to be an issue.

To resolve the issues over numbers of NEDs. It seems likely that the current number is inadequate and would put Rosh in a

position of non-compliance with many of the corporate governance guidelines pertaining to NEDs.

To resolve the issues over the independence of NEDs. The closeness that the NEDs have to existing executive board members

potentially undermines their independence and a nominations committee should be able to identify this as an issue and make

recommendations to rectify it.

To make recommendations over the succession of the chairmanship. It may not be in the interests of Rosh for family members

to always occupy senior positions in the business. -

第16题:

3 The Chemical Services Group plc (CSG), which operates a divisionalised structure, provides services to industrial and

domestic customers in Swingland, a country whose economic climate is subject to significant variations. There have

been a number of recent changes at board level within CSG and therefore the managing director called a meeting of

the board of directors at which each of four recently appointed directors put forward their view as to what their primary

focus should be. These were as follows:

The research and development director stated that ‘my primary focus is upon ensuring that we continue to develop

the products and services that satisfy the requirements of our existing and potential customers’.

The finance director stated that ‘my primary focus is upon keeping our investors satisfied’.

The human resources director stated that ‘my primary focus is upon ensuring that we take all the steps necessary to

establish and maintain our reputation as a responsible employer’.

The corporate affairs director stated that ‘my primary focus is upon the need to ensure that we are recognised as a

socially responsible organisation’.

Required:

(a) Discuss the criteria that should be considered in deciding upon suitable performance measures in respect of

the primary focus of each of the FOUR directors of CSG providing THREE appropriate quantitative measures

for each primary focus.

Note: your answer may include financial or non-financial quantitative measures. (12 marks)

正确答案:

(a) The primary focus of the research and development director

There is a need to measure the ability of CSG to offer up to date services that are sought after by existing and potential

customers. In this regard it would be relatively easy to determine the number of new products/services introduced in previous

periods. The performance of individual innovations should also be assessed. Also the aggregate expenditure on the

development of new services may indicate how CSG has performed with regard to offering up to date, customer focused

services.

The primary focus of the finance director

CSG could use return on capital employed (ROCE), economic value added (EVA) or residual income (RI) as measures of

financial performance. EVA and RI are both superior to return on capital employed (ROCE) in that each method is more likely

to develop goal congruence in terms of acquisition and disposal decisions. It is vital that any performance measure chosen

is consistent with the NPV rule. The use of RI could prove problematic when managers adopt a short term outlook and use

short term performance measures as decisions may not be consistent with the NPV rule. EVA attempts to avoid the problems

associated with understated asset values that arise in the use of ROCE and RI. Current values should be used as opposed to

historical costs.

The primary focus of the human resources director

CSG could use measures such as the rate of staff turnover, the level of absenteeism, training costs per employee and the

number of applications received for each job vacancy. These measures may provide an indication of the extent to which CSG

can be regarded as a socially responsible employer.

These measures should be compared with those of prior periods and targets. Employee attitude surveys may also be

undertaken on a systematic basis in order to assess matters such as the degree of satisfaction with the payment systems that

are in operation, management style. and working conditions.

The primary focus of the corporate affairs director

CSG could use measures such as the amounts spent on the disposal of waste chemicals, the number of complaints received

from clients and members of the public and the total of contributions made to organisations which seek to meet social

objectives, e.g. charities, schools and hospitals. -

第17题:

(c) Briefly discuss why the directors of HFL might choose contract D irrespective of whether or not contract D

would have been selected using expected values as per part (a). (2 marks)

正确答案:

(c) The directors might select Contract D under which 360,000 kilograms of organic mushrooms would be supplied to HFL for

each outlet. This is the entire capacity of HFL which would ensure that competitors would not be able to supply the same

product and hence the competitive advantage held by HFL might be preserved. -

第18题:

(b) The Superior Fitness Co (SFC), which is well established in Mayland, operates nine centres. Each of SFC’s

centres is similar in size to those of HFG. SFC also provides dietary plans and fitness programmes to its clients.

The directors of HFG have decided that they wish to benchmark the performance of HFG with that of SFC.

Required:

Discuss the problems that the directors of HFG might experience in their wish to benchmark the performance

of HFG with the performance of SFC, and recommend how such problems might be successfully addressed.

(7 marks)

正确答案:

(b) There are a number of potential problems which the directors of HFG need to recognise. These are as follows:

(i) There needs to exist a sufficient incentive for SFO to share their information with HFG as the success of any

benchmarking programme is dependent upon obtaining accurate information about the comparator organisation. This is

not an easy task to accomplish, as many organisations are reluctant to reveal confidential information to competitors.

The directors of HFG must be able to convince the directors of SFO that entering into a benchmarking arrangement is a

potential ‘win-win situation’.

(ii) The value of the exercise must be sufficient to justify the cost involved. Also, it is inevitable that behavioural issues will

need to be addressed in any benchmarking programme. Management should give priority to the need to communicate

the reasons for undertaking a programme of benchmarking in order to gain the full co-operation of its personnel whilst

reducing the potential level of resistance to change.

(iii) Management need to handle the ethical implications relating to the introduction of benchmarking in a sensitive manner

and should endeavour, insofar as possible, to provide reassurance to employees that their status, remuneration and

working conditions will not suffer as a consequence of the introduction of any benchmarking initiatives. -

第19题:

(a) Contrast the role of internal and external auditors. (8 marks)

(b) Conoy Co designs and manufactures luxury motor vehicles. The company employs 2,500 staff and consistently makes a net profit of between 10% and 15% of sales. Conoy Co is not listed; its shares are held by 15 individuals, most of them from the same family. The maximum shareholding is 15% of the share capital.

The executive directors are drawn mainly from the shareholders. There are no non-executive directors because the company legislation in Conoy Co’s jurisdiction does not require any. The executive directors are very successful in running Conoy Co, partly from their training in production and management techniques, and partly from their ‘hands-on’ approach providing motivation to employees.

The board are considering a significant expansion of the company. However, the company’s bankers are

concerned with the standard of financial reporting as the financial director (FD) has recently left Conoy Co. The board are delaying provision of additional financial information until a new FD is appointed.

Conoy Co does have an internal audit department, although the chief internal auditor frequently comments that the board of Conoy Co do not understand his reports or provide sufficient support for his department or the internal control systems within Conoy Co. The board of Conoy Co concur with this view. Anders & Co, the external auditors have also expressed concern in this area and the fact that the internal audit department focuses work on control systems, not financial reporting. Anders & Co are appointed by and report to the board of Conoy Co.

The board of Conoy Co are considering a proposal from the chief internal auditor to establish an audit committee.

The committee would consist of one executive director, the chief internal auditor as well as three new appointees.

One appointee would have a non-executive seat on the board of directors.

Required:

Discuss the benefits to Conoy Co of forming an audit committee. (12 marks)

正确答案:

(a)Roleofinternalandexternalauditors–differencesObjectivesThemainobjectiveofinternalauditistoimproveacompany’soperations,primarilyintermsofvalidatingtheefficiencyandeffectivenessoftheinternalcontrolsystemsofacompany.Themainobjectiveoftheexternalauditoristoexpressanopiniononthetruthandfairnessofthefinancialstatements,andotherjurisdictionspecificrequirementssuchasconfirmingthatthefinancialstatementscomplywiththereportingrequirementsincludedinlegislation.ReportingInternalauditreportsarenormallyaddressedtotheboardofdirectors,orotherpeoplechargedwithgovernancesuchastheauditcommittee.Thosereportsarenotpubliclyavailable,beingconfidentialbetweentheinternalauditorandtherecipient.Externalauditreportsareprovidedtotheshareholdersofacompany.Thereportisattachedtotheannualfinancialstatementsofthecompanyandisthereforepubliclyavailabletotheshareholdersandanyreaderofthefinancialstatements.ScopeofworkTheworkoftheinternalauditornormallyrelatestotheoperationsoftheorganisation,includingthetransactionprocessingsystemsandthesystemstoproducetheannualfinancialstatements.Theinternalauditormayalsoprovideotherreportstomanagement,suchasvalueformoneyauditswhichexternalauditorsrarelybecomeinvolvedwith.Theworkoftheexternalauditorrelatesonlytothefinancialstatementsoftheorganisation.However,theinternalcontrolsystemsoftheorganisationwillbetestedastheseprovideevidenceonthecompletenessandaccuracyofthefinancialstatements.RelationshipwithcompanyInmostorganisations,theinternalauditorisanemployeeoftheorganisation,whichmayhaveanimpactontheauditor’sindependence.However,insomeorganisationstheinternalauditfunctionisoutsourced.Theexternalauditorisappointedbytheshareholdersofanorganisation,providingsomedegreeofindependencefromthecompanyandmanagement.(b)BenefitsofauditcommitteeinConoyCoAssistancewithfinancialreporting(nofinanceexpertise)TheexecutivedirectorsofConoyCodonotappeartohaveanyspecificfinancialskills–asthefinancialdirectorhasrecentlyleftthecompanyandhasnotyetbeenreplaced.ThismaymeanthatfinancialreportinginConoyCoislimitedorthattheothernon-financialdirectorsspendasignificantamountoftimekeepinguptodateonfinancialreportingissues.AnauditcommitteewillassistConoyCobyprovidingspecialistknowledgeoffinancialreportingonatemporarybasis–atleastoneofthenewappointeesshouldhaverelevantandrecentfinancialreportingexperienceundercodesofcorporategovernance.ThiswillallowtheexecutivedirectorstofocusonrunningConoyCo.EnhanceinternalcontrolsystemsTheboardofConoyCodonotnecessarilyunderstandtheworkoftheinternalauditor,ortheneedforcontrolsystems.ThismeansthatinternalcontrolwithinConoyComaybeinadequateorthatemployeesmaynotrecognisetheimportanceofinternalcontrolsystemswithinanorganisation.TheauditcommitteecanraiseawarenessoftheneedforgoodinternalcontrolsystemssimplybybeingpresentinConoyCoandbyeducatingtheboardontheneedforsoundcontrols.Improvingtheinternalcontrol‘climate’willensuretheneedforinternalcontrolsisunderstoodandreducecontrolerrors.RelianceonexternalauditorsConoyCo’sinternalauditorscurrentlyreporttotheboardofConoyCo.Aspreviouslynoted,thelackoffinancialandcontrolexpertiseontheboardwillmeanthatexternalauditorreportsandadvicewillnotnecessarilybeunderstood–andtheboardmayrelytoomuchonexternalauditorsIfConoyCoreporttoanauditcommitteethiswilldecreasethedependenceoftheboardontheexternalauditors.Theauditcommitteecantaketimetounderstandtheexternalauditor’scomments,andthenviathenon-executivedirector,ensurethattheboardtakeactiononthosecomments.AppointmentofexternalauditorsAtpresent,theboardofConoyCoappointtheexternalauditors.Thisraisesissuesofindependenceastheboardmaybecometoofamiliarwiththeexternalauditorsandsoappointonthisfriendshipratherthanmerit.Ifanauditcommitteeisestablished,thenthiscommitteecanrecommendtheappointmentoftheexternalauditors.Thecommitteewillhavethetimeandexpertisetoreviewthequalityofserviceprovidedbytheexternalauditors,removingtheindependenceissue.Corporategovernancerequirements–bestpracticeConoyCodonotneedtofollowcorporategovernancerequirements(thecompanyisnotlisted).However,notfollowingthoserequirementsmaystarttohaveadverseeffectsonConoy.Forexample,ConoyCo’sbankisalreadyconcernedaboutthelackoftransparencyinreporting.EstablishinganauditcommitteewillshowthattheboardofConoyCoarecommittedtomaintainingappropriateinternalsystemsinthecompanyandprovidingthestandardofreportingexpectedbylargecompanies.Obtainingthenewbankloanshouldalsobeeasierasthebankwillbesatisfiedwithfinancialreportingstandards.Givennonon-executives–independentadvicetoboardCurrentlyConoyCodoesnothaveanynon-executivedirectors.Thismeansthatthedecisionsoftheexecutivedirectorsarenotbeingchallengedbyotherdirectorsindependentofthecompanyandwithlittleornofinancialinterestinthecompany.Theappointmentofanauditcommitteewithonenon-executivedirectorontheboardofConoyCowillstarttoprovidesomenon-executiveinputtoboardmeetings.Whilenotsufficientintermsofcorporategovernancerequirements(aboutequalnumbersofexecutiveandnon-executivedirectorsareexpected)itdoesshowtheboardofConoyCoareattemptingtoestablishappropriategovernancesystems.AdviceonriskmanagementFinally,thereareothergeneralareaswhereConoyCowouldbenefitfromanauditcommittee.Forexample,lackofcorporategovernancestructuresprobablymeansConoyCodoesnothaveariskmanagementcommittee.Theauditcommitteecanalsoprovideadviceonriskmanagement,helpingtodecreasetheriskexposureofthecompany. -

第20题:

Text 1 Ruth Simmons joined Goldman Sachs's board as an outside director in January 2000;a year later she became president of Brown University.For the rest of the decade she apparently managed both roles without attracting much criticism.But by the end of 2009 Ms.Simmons was under fire for having sat on Goldman's compensation committee;how could she have let those enormous bonus payouts pass unremarked?By February the next year Ms.Simmons had left the board.The position was just taking up too much time,she said.Outside directors are supposed to serve as helpful,yet less biased,advisers on a firm's board.Having made their wealth and their reputations elsewhere,they presumably have enough independence to disagree with the chief executive's proposals.If the sky,and the share price,is falling,outside directors should be able to give advice based on having weathered their own crises.The researchers from Ohio University used a database that covered more than 10,000 firms and more than 64,000 different directors between 1989 and 2004.Then they simply checked which directors stayed from one proxy statement to the next.The most likely reason for departing a board was age,so the researchers concentrated on those“surprise”disappearances by directors under the age of 70.They found that after a surprise departure,the probability that the company will subsequently have to restate earnings increases by nearly 20%.The likelihood of being named in a federal classaction lawsuit also increases,and the stock is likely to perform worse.The effect tended to be larger for larger firms.Although a correlation between them leaving and subsequent bad performance at the firm is suggestive,it does not mean that such directors are always jumping off a sinking ship.Often they“trade up,”leaving riskier,smaller firms for larger and more stable firms.But the researchers believe that outside directors have an easier time of avoiding a blow to their reputations if they leave a firm before bad news break,even if a review of history shows they were on the board at the time any wrongdoing occurred.Firms who want to keep their outside directors through tough times may have to create incentives.Otherwise outside directors will follow the example of Ms.Simmons,once again very popular on campus.

We learn from Paragraph 2 that outside directors are supposed to be_____A.generous investors

B.unbiased executives

C.share price forecasters

D.independent advisers答案:D解析:细节题【命题思路】这是一道局部细节题,需要对第二段进行锁定,从而得出答案。【直击答案】根据题干直接定位到第二段首句“Outside directors…on a firm's board.”从这句话我们得知外部董事所扮演的角色是advisers(顾问),其特点是helpful,less biased。接下来,第二句话“they…the chief executive's proposals.”表明外部董事实际是具有独立性的顾问,因此,D项为正确答案。【干扰排除】A项属于无中生有,“made their wealth…elsewhere”“在别处创造了财富”并不等于“慷慨的投资者”。B项干扰来自yet less biased,文章中确实提到了“less biased advisers”,但是选项中是executive并不是advisers,另外less biased不等于选项中的unbiased,偷换了概念,故不对。C项的干扰来自文章第二段最后一句“If the sky,and the share price…having weathered their own crises”。这句话仍然说明outside director作用是advisers,并不是股价预测者。 -

第21题:

Text 1 Ruth Simmons joined Goldman Sachs's board as an outside director in January 2000;a year later she became president of Brown University.For the rest of the decade she apparently managed both roles without attracting much criticism.But by the end of 2009 Ms.Simmons was under fire for having sat on Goldman's compensation committee;how could she have let those enormous bonus payouts pass unremarked?By February the next year Ms.Simmons had left the board.The position was just taking up too much time,she said.Outside directors are supposed to serve as helpful,yet less biased,advisers on a firm's board.Having made their wealth and their reputations elsewhere,they presumably have enough independence to disagree with the chief executive's proposals.If the sky,and the share price,is falling,outside directors should be able to give advice based on having weathered their own crises.The researchers from Ohio University used a database that covered more than 10,000 firms and more than 64,000 different directors between 1989 and 2004.Then they simply checked which directors stayed from one proxy statement to the next.The most likely reason for departing a board was age,so the researchers concentrated on those“surprise”disappearances by directors under the age of 70.They found that after a surprise departure,the probability that the company will subsequently have to restate earnings increases by nearly 20%.The likelihood of being named in a federal classaction lawsuit also increases,and the stock is likely to perform worse.The effect tended to be larger for larger firms.Although a correlation between them leaving and subsequent bad performance at the firm is suggestive,it does not mean that such directors are always jumping off a sinking ship.Often they“trade up,”leaving riskier,smaller firms for larger and more stable firms.But the researchers believe that outside directors have an easier time of avoiding a blow to their reputations if they leave a firm before bad news break,even if a review of history shows they were on the board at the time any wrongdoing occurred.Firms who want to keep their outside directors through tough times may have to create incentives.Otherwise outside directors will follow the example of Ms.Simmons,once again very popular on campus.

According to the researchers from Ohio University,after an outside director's surprise departure,the firm is likely to_____A.become more stable

B.report increased earnings

C.do less well in the stock market

D.perform worse in lawsuits答案:C解析:细节题【命题思路】这是一道局部细节题,需要根据题干的关键信息对文章相关内容进行锁定,从而在准确定位之后得出答案。【直击答案】根据题干定位到第三段第四句和第五句,这两句列出了外部董事离开后可能出现的三种情况。其中“the stock is likely to perform worse”即为C项的意思,选项中的“do less well”等于原文中的“perform worse”,故C项正确。【干扰排除】从文中可知外部董事突然离开公司后,公司需要重申盈利的可能性增加了近20%,说明外部董事的离开会让公司境况变得不好,A项与原文信息完全相反,应排除。B项干扰来自文中“the probability…earnings increases…”分析句子主干“the probability increases by nearly 20%”可知不是earnings增加20%。D项干扰来自文中“The likelihood…also increases”。表现不佳是在“stock”中(the stock is likely to perform worse),选项把对“stock”的描述强加到“lawsuit”上,张冠李戴,故不选。 -

第22题:

Text 1 Ruth Simmons joined Goldman Sachs's board as an outside director in January 2000;a year later she became president of Brown University.For the rest of the decade she apparently managed both roles without attracting much criticism.But by the end of 2009 Ms.Simmons was under fire for having sat on Goldman's compensation committee;how could she have let those enormous bonus payouts pass unremarked?By February the next year Ms.Simmons had left the board.The position was just taking up too much time,she said.Outside directors are supposed to serve as helpful,yet less biased,advisers on a firm's board.Having made their wealth and their reputations elsewhere,they presumably have enough independence to disagree with the chief executive's proposals.If the sky,and the share price,is falling,outside directors should be able to give advice based on having weathered their own crises.The researchers from Ohio University used a database that covered more than 10,000 firms and more than 64,000 different directors between 1989 and 2004.Then they simply checked which directors stayed from one proxy statement to the next.The most likely reason for departing a board was age,so the researchers concentrated on those“surprise”disappearances by directors under the age of 70.They found that after a surprise departure,the probability that the company will subsequently have to restate earnings increases by nearly 20%.The likelihood of being named in a federal classaction lawsuit also increases,and the stock is likely to perform worse.The effect tended to be larger for larger firms.Although a correlation between them leaving and subsequent bad performance at the firm is suggestive,it does not mean that such directors are always jumping off a sinking ship.Often they“trade up,”leaving riskier,smaller firms for larger and more stable firms.But the researchers believe that outside directors have an easier time of avoiding a blow to their reputations if they leave a firm before bad news break,even if a review of history shows they were on the board at the time any wrongdoing occurred.Firms who want to keep their outside directors through tough times may have to create incentives.Otherwise outside directors will follow the example of Ms.Simmons,once again very popular on campus.

According to Paragraph 1,Ms.Simmons was criticized for_____A.gaining excessive profits

B.failing to fulfill her duty

C.refusing to make compromises

D.leaving the board in tough times答案:B解析:推理题【命题思路】这是一道封闭式推理题,需要对第一段进行锁定,从而得出答案。【直击答案】根据题干关键词Paragraph 1和Ms.Simmons was criticized for定位到首段第三句。文中短语“be under fire”是对题干中“criticized”一词的同义替换,答案在“for”后的部分。这句话用一个反问句说明她做的事情,作为薪酬委员会的成员让巨额款项流失,属失职行为,因此答案选B项。【干扰排除】A项的干扰来自“have let those enormous bonus payouts pass”,发放巨额奖金是对其他人而言,而获得太多利益是针对个人,主体不同,故A项不对。C项“拒绝妥协”属于无中生有,原文首段并未提到。D项属于因果颠倒,“the next year Ms.Simmons had left the board”,并不是受到批评的原因,而是结果。 -

第23题:

资料:From: Iris Wu

To: Tim Appleby

Subject: Marketing issues

Date:May 3

Hi Tim,Can you schedule a conference call for all our marketing directors, me included, to discuss the launch of the new appliance line? Please note that our offices in the Philippines and France are respectively, twelve and six hours ahead of us. Threfore, kindly remind the directors that the call may have to occur outside of business hours.

The meeting should be arranged before the new product presentations on May 26. I recommend scheduling the call on May 14 or 15 to allow sufficient time for the appliance information charts to be updated with any suggested changes. Should a different date be more convenient for the other directors, please check with me to confirm my availability?

Thank you

Iris

Why was the e-mail sent to Mr. Appleby?A.To notify him of a conference date

B.To ask him to share his marketing ideas

C.To approve his international business trip

D.To request that he organize a telephone meeting答案:D解析:本题考查的是细节理解。

【关键词】why; email; Mr. Appleby

【主题句】第一段Can you schedule a conference call for all our marketing directors, me included, to discuss the launch of the new appliance line?(你能为所有的市场总监(包括我在内)安排一场电话会议吗?目的是讨论新款家用电器线投放市场。)

【解析】第1题问“为什么给阿普尔比发这封邮件?”。找到这道题的答案,需要同学们了解邮件的写法。一般开头第一句都是写信人的目的,所以我们在第一段第一句找到了此封邮件的目的“为所有的市场总监(包括我在内)安排一场电话会议。”所以这道题的正确答案应该是D“要求他组织一场电话会议。”A选项“通知他会议的日期”;B选项“让他分享自己的销售想法”;C选项“批准他的国际商务旅行”。以上三个选项皆与原文无关。