(b) The CEO of Oceania National Airways (ONA) has already strongly rejected the re-positioning of ONA as a ‘nofrills’ low-cost budget airline.(i) Explain the key features of a ‘no frills’ low-cost strategy. (4 marks)

题目

(b) The CEO of Oceania National Airways (ONA) has already strongly rejected the re-positioning of ONA as a ‘no

frills’ low-cost budget airline.

(i) Explain the key features of a ‘no frills’ low-cost strategy. (4 marks)

相似考题

更多“(b) The CEO of Oceania National Airways (ONA) has already strongly rejected the re-positioning of ONA as a ‘nofrills’ low-cost budget airline.(i) Explain the key features of a ‘no frills’ low-cost strategy. (4 marks)”相关问题

-

第1题:

(b) Explain the advantages and the disadvantages of:

(i) the face to face interview between two people; (6 marks)

正确答案:

(b) (i) The face to face interview is the most common form. of interview. In this situation the candidate is interviewed by a single representative of the employing organisation.

The advantages of such interviews are that they establish an understanding between the participants, are cost effective for the organisation (only one member of the organisation’s staff is involved) and, because of the more personal nature, ensure that candidates feel comfortable.

The disadvantages are that the selection interview relies on the views and impression of a single interviewer that can be both subjective and biased. In addition, the interviewer may be selective in questioning and it is easier for the candidate to hide weaknesses or lack of ability.

-

第2题:

Roy Crawford has argued for a reduction in both the product range and customer base to improve company

performance.

(b) Assess the operational advantages and disadvantages to Bonar Paint of choosing such a strategy.

(15 marks)

正确答案:

(b) Divestment of products or parts of the business is one of the most difficult strategic decisions. As apparent in Bonar Paint a

reduction in the products and customers served by the firm is likely to cause significant changes to the firm’s value chain and

system. Currently Bonar Paint supplies its customers, regardless of size, directly and this inevitably means that their

distribution costs are increased. The reduction in products and customers may allow a choice to be made about the costs of

supplying customers directly as against using distributors to handle the smaller customers.

In using the value chain one is looking to identify the significant cost activities and how those costs behave. Some costs may

be affected by the overall size of the firm e.g. advertising while others affected by the batch size being processed. The changeto fewer products will lead to a bigger batch size and a number of positive consequences for costs. The value chain’s major

benefit is in identifying and quantifying the links that exist between various activities within the firm and between the firm

and its customers and suppliers. In Bonar Paint’s case does a reduction in product range lead to less product failures and

consequent warranty claims? Does simplifying the product range lead to shorter lead times and better delivery time

performance for its customers? Above all, a good understanding of its value chain will let it know if it changes an activity what

are the consequences for other parts of the system.

In terms of reducing the product range, before such a decision is taken Bonar Paint must carry out a thorough analysis of the

pattern of customer demand for each paint type. In all probability it will find that 80% of its sales come from 20% of its

product range. Having given this qualification, reducing the product range can have a number of beneficial results on other

parts of the value chain. The immediate effect is likely to be that Bonar Paint produces fewer batches over a given time period

but produces them in larger quantities. This will bring cost savings but the impact on other parts of the value chain is equally

important. The beneficial effects are:

– With a smaller product range the control of raw materials and finished inventory will be simplified affecting inbound and

outbound logistics. This will improve the inventory turn and make for better product availability.

– With an improved inventory turn this will reduce the firm’s working capital needs and release significant amounts of

cash.

– A simpler operations process should facilitate staff savings and support more automation.

– Warranty claims and support costs could be reduced.

– Bonar Paint will be purchasing fewer raw materials but in greater volume and on a more regular basis. This will lead to

improved price and delivery terms from its suppliers.

– Bonar Paint can offer improved product reliability and better delivery to its customers and should improve its market

share.

In terms of operational disadvantages, these therefore are largely in terms of the impact on customer service levels seen in

terms of product range availability. Once again it is important to have accurate information on the sales and profitability of

each product so informed divestment decisions could be taken. Care must be taken to identify any paints, which though

ordered infrequently, and in small quantities are a pre-cursor for customers ordering other paints. Some important customers

may require that the full range of their paint needs are met in order to continue buying from Bonar Paint.

Reduction of the product range and customer base is an important strategic decision. Eliminating non-contributors or ‘dog’

products both in terms of paints and customers is a key part of managing the product portfolio. However, inertia both in terms

of products and customers is a real strategic weakness. In terms of the three tests of suitability, acceptability and feasibility

the analysis suggests that only acceptability is likely to be an issue. Tony Edmunds needs to be convinced that it is an

appropriate strategy to adopt. It is the lack of accurate sales analysis that lies at the heart of the problem and that is his areaof responsibility! -

第3题:

(c) Identify and evaluate other strategic options ONA could consider to address the airline’s current financial and

operational weaknesses.

Note: requirement (c) includes 2 professional marks (10 marks)

正确答案:(c) Within the strategy clock, ONA might consider both differentiation and focus. A differentiation strategy seeks to provide

products or services that offer different benefits from those offered by competitors. These benefits are valued by customers

and so can lead to increased market share and, in the context of ONA, higher seat utilisation. Differentiation is particularly

attractive when it provides the opportunity of providing a price premium. In other words, margins are enhanced through

differentiation. Air travellers may be willing to pay more to travel with an airline that offers seat allocation and free in-flight

food and drinks.

However, such a broad-based differentiation strategy may be inappropriate for ONA because of the need to service both

business and leisure travellers. Consequently, the potential strategy also has to be considered in the context of the two sectors

that the company perceives that it services. In the regional sector a focused differentiation strategy looks particularly attractive.

Here, the strategy focuses on a selected niche or market segment. The most obvious focus is on business travel and building

the company’s strengths in this sector. This focus on the business traveller might be achieved through:

– Ensuring that flight times are appropriate for the business working day. This is already a perceived strength of the

company. This needs to be built on.

– Providing more space in the aircraft by changing the seating configuration – and the balance between business and

standard class. ONA currently has a low seat occupancy rate and a reduction in seat capacity could be borne.

– Fewer passengers in the aircraft may also lead to improved throughput times. Loading and unloading aircraft is quicker,

minimising the delays encountered by the traveller.

– Providing supporting business services – lounges with fax and internet facilities.

– Speeding the process of booking and embarkation (through electronic check-in), so making the process of booking and

embarkation easier and faster.

– Providing loyalty schemes that are aimed at the business traveller.

Although this focused differentiation is aimed at the business customer it is also likely that particular aspects of it will be

valued by certain leisure travellers. Given the strong regional brand (people from Oceania are likely to travel ONA) and the

nature of the leisure travel in this sector (families visiting relatives) it seems unlikely that there will be a significant fall off in

leisure travel in the regional sector.

In the international sector, the strategic customer is less clear. This sector is serving both the leisure and business market and

is also competing with strong ‘no frills’ competitors. The nature of customer and competition is different. A strategy of

differentiation could still be pursued, although perhaps general differentiation (without a price premium) may be more effective

with the aim of increasing seat occupancy rate. This sector would also benefit from most of the suggested improvements of

the regional sector – providing more space in aircraft, faster passenger throughput, electronic check-in etc. However, these

small changes will not address the relatively low flight frequency in this sector. This could be addressed through seeking

alliances with established airlines in the continental countries that it services. Simple code share agreements could double

ONA’s frequencies overnight. Obviously, ONA would be seeking a good cultural fit – the ‘no frills’ low-cost budget airlineswould not be candidates for code shares.ONA’s perception of market segmentation, reflected in splitting regional from international travel and distinguishing leisure

from business appears to be a sensible understanding of the marketplace. However, it might also be useful for them to

consider on-line customers and commission customers (travel agents) as different segments. Perceiving travel agents as the

strategic customer would lead to a different strategic focus, one in which the amount and structure of commission played an

important part.

Finally, whichever strategy ONA adopts, it must continue to review its operational efficiency. An important strategic capability

in any organisation is to ensure that attention is paid to cost-efficiency. It can be argued that a continual reduction in costs

is necessary for any organisation in a competitive market. Management of costs is a threshold competence for survival. ONA

needs to address some of the weaknesses identified earlier in the question. Specific points, not covered elsewhere, include:

– Improved employee productivity to address the downward decline in efficiency ratios.

– Progressive standardisation of the fleet to produce economies of scale in maintenance and training. This should reduce

the cost base.

– Careful monitoring of expenditure, particularly on wages and salaries, to ensure that these do not exceed revenue

increases.

Candidates may address this question in a number of ways. In the model answer given above, the strategy clock is used –

as it uses the term ‘no frills’ in its definition and so it seems appropriate to look at other options within this structure. However,

answers that use other frameworks (such as Ansoff’s product/market matrix) are perfectly acceptable. Furthermore, answerswhich focus on the suitability, acceptability and feasibility of certain options are also acceptable. -

第4题:

(b) Explain how the process of developing scenarios might help John better understand the macro-environmental

factors influencing Airtite’s future strategy. (8 marks)

正确答案:(b) Carrying out a systematic PESTEL analysis is a key step in developing alternative scenarios about the future. Johnson and

Scholes define scenarios as ‘detailed and plausible views of how the business environment of an organisation might develop

in the future based on groupings of key environmental influences and drivers of change about which there is a high level of

uncertainty’. In developing scenarios it is necessary to isolate the key drivers of change, which have the potential to have a

significant impact on the company and are associated with high levels of uncertainty. Development of scenarios enables

managers to share assumptions about the future and the key variables shaping that future. This provides an opportunity for

real organisational learning. They are then in a position to monitor these key variables and amend strategies accordingly. It

is important to note that different stakeholder groups will have different expectations about the future and each may provide

a key input to the process of developing scenarios. By their very nature scenarios should not attempt to allocate probabilities

to the key factors and in so doing creating ‘spurious accuracy’ about those factors. A positive scenario is shown below and

should provide a shared insight into the external factors most likely to have a significant impact on Airtite‘s future strategy.

For most companies operating in global environments the ability to respond flexibly and quickly to macro-environmental

change would seem to be a key capability.

The scenario as illustrated below, clearly could have a major impact on the success or otherwise of Airtite’s strategy for the

future. The key drivers for change would seem to be the link between technology and global emissions, fuel prices and the

stability of the global political environment. Through creating a process which considers the drivers which will have most

impact on Airtite and which are subject to the greatest uncertainty, Airtite will have a greater chance of its strategy adaptingto changing circumstances.

-

第5题:

(c) (i) Explain the capital gains tax (CGT) implications of a takeover where the consideration is in the form. of

shares (a ‘paper for paper’ transaction) stating any conditions that need to be satisfied. (4 marks)

正确答案:

(c) (i) Paper for paper rules

The proposed transaction broadly falls under the ‘paper for paper’ rules. Where this is the case, chargeable gains do not

arise. Instead, the new holding stands in the shoes (and inherits the base cost) of the original holding.

The company issuing the new shares must:

(i) end up with more than 25% of the ordinary share capital (or a majority of the voting power) of the old company,

OR

(ii) make a general offer to shareholders in the other company with a condition that, if satisfied, would give the

acquiring company control of the other company.

The exchange must be for bona fide commercial reasons and must not have as its main purpose (or one of its main

purposes) the avoidance of CGT or corporation tax. The acquiring company can obtain advance clearance from the

Inland Revenue that the conditions will be met.

If part of the offer consideration is in the form. of cash, a gain must be calculated using the part disposal rules. If the

cash received is not more than the higher of £3,000 or 5% of the total value on takeover, then the amount received in

cash can be deducted from the base cost of the securities under the small distribution rules. -

第6题:

(d) (i) Discuss why it may not be possible to provide a high level of assurance over the stated key performance

indicators; and (4 marks)

正确答案:

(d) (i) The main reason why it may not be possible to provide a high level of assurance is that the KPIs are not defined

precisely:

– The value of donated pharmaceutical products is compared to revenue to provide a percentage. However, it will be

difficult to accurately value the donated products – are they valued at cost, or at sales price? Are delivery costs

included in the valuation? The intrinsic value may be lower than sales value as Sci-Tech Co may decide to donate

products which are not useful or relevant to the charities they are donated to.

– The value of ‘cost of involvement with local charities’ is also not defined. If the donations are purely cash, then it

should be easy to verify donations using normal audit procedures to verify cash payments. However, the

‘involvement with local charities’ is not defined and will be difficult to quantify as a percentage of revenue. For

example, involvement may include:

? Time spent by Sci-Tech Co employees at local charity events

? Education and training provided to members of the local community in health care matters

– Number of serious accidents is also difficult to quantify as what constitutes a ‘serious’ accident is subjective. For

example, is an accident serious if it results in a hospitalisation of the employee? Or serious if it results in more than

five days absence from work while recovering?

In addition, the sufficiency of evidence available is doubtful, as such matters will not form. part of the accounting records

and thus there may be limited and possibly only unreliable sources of evidence available.

– Donated goods may not be separately recorded in inventory movement records. It may not be possible to

distinguish donated goods from sold or destroyed items.

– Unless time sheets are maintained, there is unlikely to be any detailed records of ‘involvement’ in local charities. -

第7题:

执行如下程序,最后S的显示值为 SET TALK OFF S=0 i=5 X=11 DO WHILE S<=x S=S +i I = I +l ENDDO ?s SET TALK ON

A.5

B.11

C.18

D.26

正确答案:C

解析:该循环语句中,变量s和i每次执行循环后值的变化如下:

s值 i值

第一次循环 5 6

第二次循环 11 7

第三次循环 18 8

程序在第四次执行循环时,因条件(18<;11)为假而退出循环。 -

第8题:

执行如下程序,最后S的显示值为( )。 SET TALK OFF s=0 i=2 x=10 DO WHILE s<一一X S=S+i i=i十l ENDDO ?S SET TALK ON

A.12

B.14

C.16

D.18

正确答案:B

B。【解析】DOWHILE—ENDD0语句的格式:DOWHILE<条件><命令序列>ENDD执行该语句时.先判断DOWHILE处的循环条件是否成立,如果条件为真,则执行DOWHILE与ENDDO之间的<命令序列>(循环体)。当执行到ENDDO时,返回到DOWHILE,再次判断循环条件是否为真,以确定是否再次执行循环体。若条件为假,则结束该循环语句,执行ENDD后面的语旬。先给三个变量赋初始值,使用一个DOWHILE循环语句来操作,判断条件是变量S是否小于等于X,如果大于x,则退出循环,否则执行循环体,执行S=S十i.S=2;再执行i=i+1后,i=3,重复此循环体的操作。所以S最终的显示值是l4。 -

第9题:

(a) List and explain FOUR methods of selecting a sample of items to test from a population in accordance with ISA 530 (Redrafted) Audit Sampling and Other Means of Testing. (4 marks)

(b) List and explain FOUR assertions from ISA 500 Audit Evidence that relate to the recording of classes of

transactions. (4 marks)

(c) In terms of audit reports, explain the term ‘modified’. (2 marks)

正确答案:

(a)SamplingmethodsMethodsofsamplinginaccordancewithISA530AuditSamplingandOtherMeansofTesting:Randomselection.Ensureseachiteminapopulationhasanequalchanceofselection,forexamplebyusingrandomnumbertables.Systematicselection.Inwhichanumberofsamplingunitsinthepopulationisdividedbythesamplesizetogiveasamplinginterval.Haphazardselection.Theauditorselectsthesamplewithoutfollowingastructuredtechnique–theauditorwouldavoidanyconsciousbiasorpredictability.Sequenceorblock.Involvesselectingablock(s)ofcontinguousitemsfromwithinapopulation.Tutorialnote:Othermethodsofsamplingareasfollows:MonetaryUnitSampling.Thisselectionmethodensuresthateachindividual$1inthepopulationhasanequalchanceofbeingselected.Judgementalsampling.Selectingitemsbasedontheskillandjudgementoftheauditor.(b)Assertions–classesoftransactionsOccurrence.Thetransactionsandeventsthathavebeenrecordedhaveactuallyoccurredandpertaintotheentity.Completeness.Alltransactionsandeventsthatshouldhavebeenrecordedhavebeenrecorded.Accuracy.Theamountsandotherdatarelatingtorecordedtransactionsandeventshavebeenrecordedappropriately.Cut-off.Transactionsandeventshavebeenrecordedinthecorrectaccountingperiod.Classification.Transactionsandeventshavebeenrecordedintheproperaccounts.(c)AuditreporttermModified.Anauditormodifiesanauditreportinanysituationwhereitisinappropriatetoprovideanunmodifiedreport.Forexample,theauditormayprovideadditionalinformationinanemphasisofmatter(whichdoesnotaffecttheauditor’sopinion)orqualifytheauditreportforlimitationofscopeordisagreement. -

第10题:

执行如下程序,最后S的显示值为 SET TALK OFF S=0 i=5 X=11 DO WHILE s<=X s=s+i i=i+1 ENDDO ?s SET TALK ON

A.5

B.11

C.18

D.26

正确答案:C

解析:该循环语句中,变量s和i每次执行循环后值的变化如下:s值i值第一次循环56第二次循环117第三次循环188程序在第四次执行循环时,因条件(18=11)为假而退出循环。 -

第11题:

YouhavejustpurchasedanewCisco3560switchrunningtheenhancedIOSandneedconfigureittobeinstalledinahighavailabilitynetwork.Ona3560EMIswitch,whichthreetypesofinterfacescanbeusedtoconfigureHSRP?()A.SVIinterface

B.Accessport

C.EtherChannelportchannel

D.Loopbackinterface

E.Routedport

F.BVIinterface

参考答案:A, C, E

-

第12题:

A company needs additional storage for a block I/O based database application. The application has low I/O bandwidth requirements across the campus. The customer has a TCP/IP infrastructure and is interested in low-cost products that are compatible with its environment. Which technology is most appropriate for this customer?()

- A、SAN

- B、FCoE

- C、FCIP

- D、iSCSI

正确答案:D -

第13题:

(b) Explain what is meant by McGregor’s

(i) Theory X; (5 marks)

正确答案:

(b) Douglas McGregor has suggested that the managers’ view of the individuals’ attitude to work can be divided into two categories, which he called Theory X and Theory Y. The style. of management adopted will stem from the view taken as to how subordinates behave. However, these two typologies are not distinct; they do in fact represent the two ends of a continuum.

(i) Theory X is based on traditional organisational thinking. It assumes that the average person is basically indolent and has an inherent dislike of work which should be avoided at all costs. The individual lacks ambition, shuns responsibility, has no ambition and is resistant to change. This theory holds that the individual seeks only security and is driven solely by self-interest. It follows that because of this dislike of work, most have to be directed, controlled, organised or coerced. Management is based on fear and punishment and will have an exploitative or authoritarian style. This reflects the thinking of the classical school of management, based on a scientific approach, specialisation, standardisation and obedience to superiors.

-

第14题:

(ii) Analyse why moving to a ‘no frills’ low-cost strategy would be inappropriate for ONA.

Note: requirement (b) (ii) includes 3 professional marks (16 marks)

正确答案:

(ii) ‘No frills’ low-cost budget airlines are usually associated with the following characteristics. Each of these characteristics

is considered in the context of Oceania National Airlines (ONA).

– Operational economies of scale

Increased flight frequency brings operational economies and is attractive to both business and leisure travellers. In

the international sector where ONA is currently experiencing competition from established ‘no frills’ low-cost budget

airlines ONA has, on average, one flight per day to each city. It would have to greatly extend its flight network, flight

frequency and the size of its aircraft fleet if it planned to become a ‘no frills’ carrier in this sector. This fleet

expansion appears counter to the culture of an organisation that has expanded very gradually since its formation.

Table 1 shows only three aircraft added to the fleet in the period 2004–2006. It is likely that the fleet size would

have to double for ONA to become a serious ‘no frills’ operator in the international sector. In the regional sector, the

flight density, an average of three flights per day, is more characteristic of a ‘no frills’ airline. However, ONA would

have to address the relatively low utilisation of its aircraft (see Tables 1 and 2) and the cost of maintenance

associated with a relatively old fleet of aircraft.

– Reduced costs through direct sales

On-line booking is primarily aimed at eliminating commission sales (usually made through travel agents). ‘No frills’

low-cost budget airlines typically achieve over 80% of their sales on-line. The comparative figure for ONA (see

Table 2) is 40% for regional sales and 60% for international sales, compared with an average of 84% for their

competitors. Clearly a major change in selling channels would have to take place for ONA to become a ‘no frills’

low-cost budget airline. It is difficult to know whether this is possible. The low percentage of regional on-line sales

seems to suggest that the citizens of Oceania may be more comfortable buying through third parties such as travel

agents.

– Reduced customer service

‘No frills’ low-cost budget airlines usually do not offer customer services such as free meals, free drinks and the

allocation of passengers to specific seats. ONA prides itself on its in-flight customer service and this was one of the

major factors that led to its accolade as Regional Airline of the Year. To move to a ‘no frills’ strategy, ONA would

have to abandon a long held tradition of excellent customer service. This would require a major cultural change

within the organisation. It would also probably lead to disbanding the award winning (Golden Bowl) catering

department and the redundancies of catering staff could prove difficult to implement in a heavily unionised

organisation.

Johnson, Scholes and Whittington have suggested that if an organisation is to ‘achieve competitive advantage through

a low price strategy then it has two basic choices. The first is to try and identify a market segment which is unattractive

(or inaccessible) to competitors and in this way avoid competitive pressures to erode price.’ It is not possible for ONA to

pursue this policy in the international sector because of significant competition from established continental ‘no frills’

low-cost budget airlines. It may be a candidate strategy for the regional sector, but the emergence of small ‘no frills’ lowcost

budget airlines in these countries threaten this. Many of these airlines enter the market with very low overheads

and use the ‘no frills’ approach as a strategy to gain market share before progressing to alternative strategies.

Secondly, a ‘no frills’ strategy depends for its success on margin. Johnson, Scholes and Whittington suggest that ‘in the

long run, a low price strategy cannot be pursued without a low-cost base’. Evidence from the scenario suggests that ONA

does not have a low cost base. It continues to maintain overheads (such as a catering department) that its competitors

have either disbanded or outsourced. More fundamentally (from Table 2), its flight crew enjoy above average wages and

the whole company is heavily unionised. The scenario acknowledges that the company pays above industry salaries and

offers excellent benefits such as a generous non-contributory pension. Aircraft utilisation and aircraft age also suggest a

relatively high cost base. The aircraft are older than their competitors and presumably incur greater maintenance costs.

ONA’s utilisation of its aircraft is also lower than its competitors. It seems highly unlikely that ONA can achieve the

changes required in culture, cost base and operations required for it to become a ‘no frills’ low-cost budget airline. Other

factors serve to reinforce this. For example:

– Many ‘no frills’ low-cost budget airlines fly into airports that offer cheaper taking off and landing fees. Many of these

airports are relatively remote from the cities they serve. This may be acceptable to leisure travellers, but not to

business travellers – ONA’s primary market in the regional sector.

– Most ‘no frills’ low-cost budget airlines have a standardised fleet leading to commonality and familiarity in

maintenance. Although ONA has a relatively small fleet it is split between three aircraft types. This is due to

historical reasons. The Boeing 737s and Airbus A320s appear to be very similar aircraft. However, the Boeings

were inherited from OceaniaAir and the Airbuses from Transport Oceania.

In conclusion, the CEO’s decision to reject a ‘no frills’ strategy for ONA appears to be justifiable. It would require major

changes in structure, cost and culture that would be difficult to justify given ONA’s current position. Revolution is the

term used by Baligan and Hope to describe a major rapid strategic change. It is associated with a sudden transformation

required to react to extreme pressures on the organisation. Such an approach is often required when the company is

facing a crisis and needs to quickly change direction. There is no evidence to support the need for a radical

transformation. This is why the CEO brands the change to a ‘no frills’ low-cost budget airline as ‘unnecessary’. The

financial situation (Table 3) is still relatively healthy and there is no evidence of corporate predators. It can be argued

that a more incremental approach to change would be beneficial, building on the strengths of the organisation and the

competencies of its employees. Moving ONA to a ‘no frills’ model would require seismic changes in cost and culture. If

ONA really wanted to move into this sector then they would be better advised to start afresh with a separate brand andairline and to concentrate on the regional sector where it has a head start over many of its competitors. -

第15题:

(b) Good Sports Limited has successfully followed a niche strategy to date.

Assess the extent to which an appropriate e-business strategy could help support such a niche strategy.

(8 marks)

正确答案:

(b) Good Sports has pursued a conscious niche or focus differentiation strategy, seeking to serve a local market in a way that

isolates it from the competition of the large national sports good retailers competing on the basis of supplying famous brands

at highly competitive prices. Does it make strategic sense for Good Sports to make the heavy investment necessary to supply

goods online? Will this enhance its ability to supply their chosen market?

In terms of price, e-business is bringing much greater price transparency – the problem for companies like Good Sports is

that customers may use their expertise to research into a particular type and brand of sports equipment and then simply

search the Internet for the cheapest supply. Porter in an article examining the impact of the Internet argues that rather than

making strategy obsolete it has in fact made it more important. The Internet has tended to weaken industry profitability and

made it more difficult to hold onto operational advantages. Choosing which customers you serve and how are even more

critical decisions.

However the personal advice and performance side of the business could be linked to new ways of promoting the product

and communicating with the customer. The development of customer communities referred to above could be a real way of

increasing customer loyalty. The partners are anxious to avoid head-on competition with the national retailers. One way of

increasing the size and strength of the niche they occupy is to use the Internet as a means of targeting their particular

customers and providing insights into the use and performance of certain types of equipment by local clubs and users. There

is considerable scope for innovation that enhances the service offered to their customers. As always there is a need to balance

the costs and benefits of time spent. The Internet can provide a relatively cost effective way of providing greater service to

their customers. There is little in the scenario to suggest they have reached saturation point in their chosen niche market.

Overall there is a need for Good Sports to decide what and where its market is and how this can be improved by the use ofe-business. -

第16题:

Matthew Black is well aware that the achievement of the growth targets for the 2005 to 2007 period will depend on

successful implementation of the strategy, affecting all parts of the company’s activities.

(c) Explain the key issues affecting implementation and the changes necessary to achieve Universal’s ambitious

growth strategy. (15 marks)

正确答案:

(c) Matthew has set ambitious growth goals for the 2005–7 period in his quest to become ‘unquestioned leader’ in their region

and to roll out the model nationally. Clearly there are choices to be made in terms of implementing the strategy and much of

the success of the strategy will depend on the extent to which appropriate resources, structure and systems are in place to

facilitate growth. Many alternative models consider how strategy is implemented, but one of the most popular is the McKinsey

7S model in which the 7S’s are strategy, structure, systems (the so called ‘hard’ or tangible variables) and staff, style, skills

and shared values (the ‘soft’ or less tangible variables). The 7S model has a number of key assumptions built into it. Normally

we tend to think of strategy being the first variable in the strategic management process, with all other variables dependent

on the chosen strategy. However, Peters and Waterman argue that the assertion, for instance, that a firm’s structure follows

from its strategy ignores the fact that a particular structure may equally influence the strategy chosen. If we have a simple

functional structure, this may severely limit the ability of the firm to move or diversify into other areas of business. Equally

important is to understand the linkages between the variables, just as with the value chain, recognising if you change one of

the variables you then have to see the consequences for each of the other variables.

Our earlier analysis will have provided us with an understanding of the strategy being pursued by Universal. It is now looking

to offer its service to other parts of the country and become a national provider. In strategy terms, this is a process of growth

by way of market development, with the same service in different regions or markets. Universal’s experience is dominated by

operating in one region and the consequences of moving into new regions should not be underestimated. There are interesting

examples of companies having conspicuous success in their home territory but finding competition and customer relationships

very different outside their home market, even in the same country.

Matthew has already recognised the need to create a new structure to handle the growth strategy. This is ‘growth by

geographic expansion’ and while it may be the most simple growth strategy to control and co-ordinate, the creation of regional

centres managing the sales and installations in the region will add an additional level of administration and complexity.

This structural change will have significant implications for the systems employed by the company. Development of a national

operation will necessitate new methods of communication and reporting. Customer service levels depend on the management

information systems available. There is an opportunity for the new regions to benchmark themselves against the home region.

Efficient systems lie at the heart of Universal’s ability to offer a higher value added service to the customer. Standardised

processes have allowed a ‘no surprises’ policy to be successfully implemented. The extent to which the same business models

can be simply repeated in region after region will have to be tested. There is little mention of IT systems, but the pace of

expansion should be closely linked to the system’s ability to cope with increased demands.

Staff – reference has been made earlier to Universal being a people business, able to deliver a better quality of service to the

customer. The heavy reliance on self-employed staff means that a very active recruitment and training process will have to

be in place as Universal moves into different regions. New layers and levels of management will have implications for the

recruitment and development of both managers and staff reporting to them. The degrees of autonomy given to each of the

regions will materially affect the way they operate. Reward systems clearly link both staff and systems dimensions and there

is need to ensure that the right number and calibre of staff are recruited to expand the market coverage. Does Universal have

a staffing model that is easily ‘rolled’ out into other regions?

Equally important are any changes to the skill set needed by staff to operate nationally. Matthew feels that the model is

relatively lowly skilled with staff controlled through standardised systems. However, change is inevitable and the recruitment

and retention of staff in a labour intensive service will be key to success.

Universal is very much a family business dominated by the two founding brothers. Even with expansion being entirely within

their local region the rate of growth to a £6 million turnover business predicted to treble in size over the next three years, will

necessitate changes in the style. of management. Time management issues amongst the owner-managers have already begun

to emerge and a move from involvement with day-to-day management to a more strategic role is needed. Certainly growth to

date has been more emergent than planned, but vision and planning will be equally necessary as the firm operates nationally.

There are tensions for Matthew in making sure that his change in role and responsibilities does not result in him becoming

remote from his management and staff. Communication of the core values of the company will become even more necessary

and communication is key to managing the growth process.

The 7S’s is not the only model that will be useful in understanding the problems of implementing the growth strategy.

Greiner’s growth model has merit in drawing attention to the stages a growing business following an organic growth strategy

can expect to go through. Johnson and Scholes now refer to strategic implementation as ‘strategy in action’ made up of three

key activities, structuring an organisation to support successful performance. Universal’s move from a regional to a national

company will call for different structures and relationships. Enabling links the particular strengths and competences, built

round separate resource areas, to be combined to support the strategy – which in turn recognises and builds on identified

strengths. Finally, growth strategies will involve change and the management of the change process. They argue that change

will involve the need to change day-to-day routines and cultural aspects of the firm, together with overcoming resistance to

change.

All too often, a company grows at a rate which exceeds the capacity to implement the necessary change. This can expose

the firm to high levels of risk. Growth pressures can stimulate positive change and innovation, but in companies such as

Universal where considerable stress is placed on performance, targets and quality may be a casualty. Equally concerning is

if the rate of growth exceeds the capacity to invest in more people and technology. Growing the people and the systems isalmost a prerequisite to growing the business. -

第17题:

(b) (i) Explain the matters you should consider to determine whether capitalised development costs are

appropriately recognised; and (5 marks)

正确答案:

(b) (i) Materiality

The net book value of capitalised development costs represent 7% of total assets in 2007 (2006 – 7·7%), and is

therefore material. The net book value has increased by 13%, a significant trend.

The costs capitalised during the year amount to $750,000. If it was found that the development cost had been

inappropriately capitalised, the cost should instead have been expensed. This would reduce profit before tax by

$750,000, representing 42% of the year’s profit. This is highly material. It is therefore essential to gather sufficient

evidence to support the assertion that development costs should be recognised as an asset.

In 2007, $750,000 capitalised development costs have been incurred, when added to $160,000 research costs

expensed, total research and development costs are $910,000 which represents 20·2% of total revenue, again

indicating a high level of materiality for this class of transaction.

Relevant accounting standard

Development costs should only be capitalised as an intangible asset if the recognition criteria of IAS 38 Intangible Assets

have been demonstrated in full:

– Intention to complete the intangible asset and use or sell it

– Technical feasibility and ability to use or sell

– Ability to generate future economic benefit

– Availability of technical, financial and other resources to complete

– Ability to measure the expenditure attributable to the intangible asset.

Research costs must be expensed, as should development costs which do not comply with the above criteria. The

auditors must consider how Sci-Tech Co differentiates between research and development costs.

There is risk that not all of the criteria have been demonstrated, especially due to the subjective nature of the

development itself:

– Pharmaceutical development is highly regulated. If the government does not license the product then the product

cannot be sold, and economic benefits will therefore not be received.

– Market research should justify the commercial viability of the product. The launch of a rival product to Flortex

means that market share is likely to be much lower than anticipated, and the ability to sell Flortex is reduced. This

could mean that Flortex will not generate an overall economic benefit if future sales will not recover the research

and development costs already suffered, and yet to be suffered, prior to launch. The existence of the rival product

could indicate that Flortex is no longer commercially viable, in which case the capitalised development costs

relating to Flortex should be immediately expensed.

– The funding on which development is dependent may be withdrawn, indicating that there are not adequate

resources to complete the development of the products. Sci-Tech has failed to meet one of its required key

performance indicators (KPI) in the year ended 30 November 2007, as products valued at 0·8% revenue have

been donated to charity, whereas the required KPI is 1% revenue.

Given that there is currently a breach of the target KPIs, this is likely to result in funding equivalent to 25% of

research and development expenditure being withdrawn. If Sci-Tech Co is unable to source alternative means of

finance, then it would seem that adequate resources may not be available to complete the development of new

products. -

第18题:

That man ( ) at the bus stop for the last half hour.--- Shall I tell him that the last bus ( )A.has stood … has already gone

B.has been standing… has already been

C.is standing… has already gone

D.has been standing…has already gone

答案:C

-

第19题:

______ is the sending and receiving of the messages by computer. It is a fast, low-cost way of communicating worldwide.

A.LAN

B.Post office

C.E-Mail

D.I-dimension array

正确答案:C

解析:译文的含义是:()通过计算机收发消息,它是快速的、低成本的与世界通信的方式。选项A、B、C、D的含义分别是局域网、邮局、电子邮件、I维数组。选项C符合题意,为所选。 -

第20题:

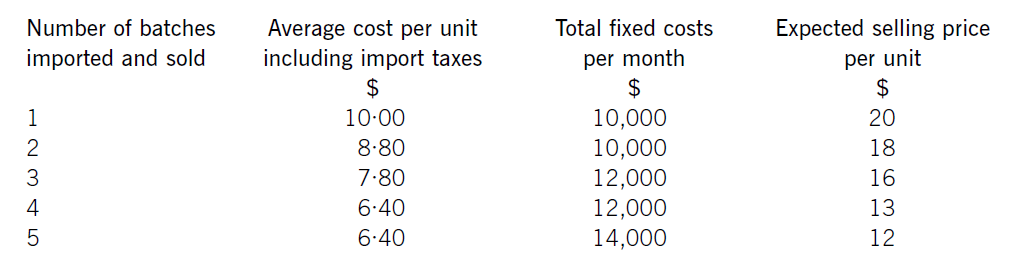

Jewel Co is setting up an online business importing and selling jewellery headphones. The cost of each set of headphones varies depending on the number purchased, although they can only be purchased in batches of 1,000 units. It also has to pay import taxes which vary according to the quantity purchased.

Jewel Co has already carried out some market research and identified that sales quantities are expected to vary depending on the price charged. Consequently, the following data has been established for the first month:

Required:

(a) Calculate how many batches Jewel Co should import and sell. (6 marks)

(b) Explain why Jewel Co could not use the algebraic method to establish the optimum price for its product.

(4 marks)

正确答案:

(b)Thealgebraicmodelrequiresseveralassumptionstobetrue.First,theremustbeaconsistentrelationshipbetweenprice(P)anddemand(Q),sothatademandequationcanbeestablished,usuallyintheform.P=a–bQ.Here,althoughthereisaclearrelationshipbetweenthetwo,itisnotaperfectlylinearrelationshipandsomorecomplicatedtechniquesarerequiredtocalculatethedemandequation.ItalsocannotbeassumedthatalinearrelationshipwillholdforallvaluesofPandQotherthanthefivegiven.Similarly,theremustbeaclearrelationshipbetweendemandandmarginalcost,usuallysatisfiedbyconstantvariablecostperunitandconstantfixedcosts.Thechangingvariablecostsperunitagaincomplicatetheissue,butitisthechangesinfixedcostswhichmakethealgebraicmethodlessusefulinJewel’scase.Thealgebraicmodelisonlysuitableforcompaniesoperatinginamonopolyanditisnotclearherewhetherthisisthecase,butitseemsunlikely,soany‘optimum’pricemightbecomeirrelevantifJewel’scompetitorschargesignificantlylowerprices.Othermoregeneralfactorsnotconsideredbythealgebraicmodelarepoliticalfactorswhichmightaffectimports,socialfactorswhichmayaffectcustomertastesandeconomicfactorswhichmayaffectexchangeratesorcustomerspendingpower.Thereliabilityoftheestimatesthemselves–forsalesprices,variablecostsandfixedcosts–couldalsobecalledintoquestion. -

第21题:

is the sending and receiving of the message by computer. It is a fast, low-cost way of communicating worldwide。

A.WWW

B.E-mail

C.TFTP

D.TELNET

正确答案:B

解析:E-mail通过计算机发送和接收消息,它是一种在全世界范围内快速、廉价的通信方式。 -

第22题:

Ona3550EMIswitch,whichthreetypesofinterfacescanbeusedtoconfigureHSRP?()A.Loopbackinterface

B.SVIinterfac

C.Routedport

D.Accessport

E.EtherChannelportchannel

F.BVIinterface

参考答案:B, C, E

-

第23题:

Waikie-rider pallet truck provide a low-cost method of materials handling utility.

正确答案:正确