6 Discuss how developments in each of the following areas has affected the scope of the audit and the audit workundertaken:(a) fair value accounting; (6 marks)

题目

6 Discuss how developments in each of the following areas has affected the scope of the audit and the audit work

undertaken:

(a) fair value accounting; (6 marks)

相似考题

参考答案和解析

6 DEVELOPMENTS

General comments

Tutorial note: The following comments, that could be made in respect of any of the three areas of development, will be given

credit only once.

■ Audit scope – the scope of a statutory audit should be as necessary to form. an audit opinion (i.e. unlimited).

■ Audit work undertaken – the nature, timing and extent of audit procedures should be as necessary to implement the overall

audit plan.

(a) Fair value accounting

■ Different definitions of fair value exist (among financial reporting frameworks or for different assets and liabilities within

a particular framework). For example, under IFRS it is ‘the amount for which an asset could be exchanged (or a liability

settled) between knowledgeable, willing parties in an arm’s length transaction’.

■ The term ‘fair value accounting’ is used to describe the measurement and disclosure of assets and/or liabilities at fair

value and the charging to profit and loss (or directly to equity) of any changes in fair value measurements.

■ Fair value accounting concerns measurements and disclosures but not initial recognition of assets and liabilities in

financial statements. It does not then, for example, affect the nature, timing and extent of audit procedures to confirm

the existence and completeness of rights and obligations.

■ Fair value may be determined with varying degrees of subjectivity. For example, there will be little (if any) subjectivity

for assets bought and sold in active and open markets that readily provide reliable information on the prices at which

exchange transactions occur. However, the valuation of assets with unique characteristics (or entity-specific assets) often

requires the projection and discounting of future cash flows.

■ The audit of estimates of fair values based on valuation models/techniques can be approached like other accounting

estimates (in accordance with ISA 540 ‘Audit of Accounting Estimates’). However, although the auditor should be able

to review and test the process used by management to develop the estimate, there may be:

? a much greater need for an independent estimate (and hence greater reliance on the work of experts in accordance

with ISA 620);

? no suitable subsequent events to confirm the estimate made (e.g. for assets that are held for use and not for

trading).

Tutorial note: Consider, for example, how the audit of ‘in-process research and development’ might compare with that

for an allowance for slow-moving inventory.

■ Different financial reporting frameworks require or permit a variety of fair value measures and disclosures in financial

statements. They also vary in the level of guidance provided (to preparers of the financial statements – and hence their

auditors). Under IFRS, certain fair values are based on management intent and ‘reasonable supportable assumptions’.

■ The audit of management intent potentially increases the auditor’s reliance on management representations. The auditor

must obtain such representations from the highest level of management and exercise an appropriate degree of

professional scepticism, being particularly alert to the implications of any conflicting evidence.

■ A significant development in international financial reporting is that it is no longer sufficient to report transactions and

past and future events that may only be possible. IAS 1 ‘Presentation of Financial Statements’ (Revised) requires that

key assumptions (and other key sources of estimation uncertainty) be disclosed. This requirement gives rise to yet

another area on which auditors may qualify their audit opinion, on grounds of disagreement, where such disclosure is

incorrect or inadequate.

■ Perhaps one of the most significant impacts of fair value accounting on audit work is that it necessarily increases it.

Consider for example, that even where the fair value of an asset is as easily vouched as original cost, fair value is

determined at least annually whereas historic cost is unchanged (and not re-vouched to original purchase

documentation).

更多“6 Discuss how developments in each of the following areas has affected the scope of the audit and the audit workundertaken:(a) fair value accounting; (6 marks)”相关问题

-

第1题:

(b) Discuss the view that fair value is a more relevant measure to use in corporate reporting than historical cost.

(12 marks)

正确答案:

(b) The main disagreement over a shift to fair value measurement is the debate over relevance versus reliability. It is argued that

historical cost financial statements are not relevant because they do not provide information about current exchange values

for the entity’s assets which to some extent determine the value of the shares of the entity. However, the information provided

by fair values may be unreliable because it may not be based on arm’s-length transactions. Proponents of fair value

accounting argue that this measurement is more relevant to decision makers even if it is less reliable and would produce

balance sheets that are more representative of a company’s value. However it can be argued that relevant information that is

unreliable is of no use to an investor. One advantage of historical cost financial information is that it produces earnings

numbers that are not based on appraisals or other valuation techniques. Therefore, the income statement is less likely to be

subject to manipulation by management. In addition, historical cost balance sheet figures comprise actual purchase prices,

not estimates of current values that can be altered to improve various financial ratios. Because historical cost statements rely

less on estimates and more on ‘hard’ numbers, it can be said that historical cost financial statements are more reliable than

fair value financial statements. Furthermore, fair value measurements may be less reliable than historical costs measures

because fair value accounting provides management with the opportunity to manipulate the reported profit for the period.

Developing reliable methods of measuring fair value so that investors trust the information reported in financial statements is

critical.

Fair value measurement could be said to be more relevant than historical cost as it is based on market values and not entity

specific measurement on initial recognition, so long as fair values can be reliably measured. Generally the fair value of the

consideration given or received (effectively historical cost) also represents the fair value of the item at the date of initial

recognition. However there are many cases where significant differences between historical cost and fair value can arise on

initial recognition.

Historical cost does not purport to measure the value received. It cannot be assumed that the price paid can be recovered in

the market place. Hence the need for some additional measure of recoverable value and impairment testing of assets.

Historical cost can be an entity specific measurement. The recorded historical cost can be lower or higher than its fair value.

For example the valuation of inventory is determined by the costing method adopted by the entity and this can vary from

entity to entity. Historical cost often requires the allocation of costs to an asset or liability. These costs are attributed to assets,

liabilities and expenses, and are often allocated arbitrarily. An example of this is self constructed assets. Rules set out in

accounting standards help produce some consistency of historical cost measurements but such rules cannot improve

representational faithfulness.

Another problem with historical cost arises as regards costs incurred prior to an asset being recognised. Historical costs

recorded from development expenditure cannot be capitalised if they are incurred prior to the asset meeting the recognition

criteria in IAS38 ‘Intangible Assets’. Thus the historical cost amount does not represent the fair value of the consideration

given to create the asset.

The relevance of historical cost has traditionally been based on a cost/revenue matching principle. The objective has been to

expense the cost of the asset when the revenue to which the asset has contributed is recognised. If the historical cost of the

asset differs from its fair value on initial recognition then the matching process in future periods becomes arbitrary. The

measurement of assets at fair value will enhance the matching objective. Historical cost may have use in predicting future

net reported income but does not have any necessary implications for future cash flows. Fair value does embody the market’s

expectations for those future cash flows.

However, historical cost is grounded in actual transaction amounts and has existed for many years to the extent that it is

supported by practical experience and familiarity. Historical cost is accepted as a reliable measure especially where no other

relevant measurement basis can be applied.

-

第2题:

(b) Describe the principal audit work to be performed in respect of the useful lives of Shire Oil Co’s rig platforms.

(6 marks)

正确答案:

(b) Principal audit work – useful life of rig platforms

Tutorial notes: The platforms are just one item of each rig. Candidates should not be awarded marks here for the matters

to be considered in the assessment of useful lives (since this is illustrated in the scenario). No marks will be awarded for

criticising management for estimating useful lives on a per platform. basis or for audit work on depreciation charges/carrying

amounts unrelated to the determination of useful lives.

■ Review of management’s annual assessment of the useful life of each rig at 31 December 2005 and corroboration of

any information that has led to a change in previous estimates. For example, for the abandoned rig, where useful life

has been assessed to be at an end, obtain:

? weather reports;

? incident report supported by photographs;

? insurance claim, etc.

■ Consider management’s past experience and expertise in estimating useful lives. For example, if all lives initially

assessed as short (c. 15 years) are subsequently lengthened (or long lives consistently shortened) this would suggest

that management is being over (under) prudent in its initial estimates.

■ Review of industry comparatives as published in the annual reports of other oil producers.

■ Comparison of actual maintenance costs against budgeted to confirm that the investment needed in maintenance, to

achieve expected life expectancy, is being made.

■ Comparison of actual output (oil extracted) against budgeted. If actual output is less than budgeted the economic life

of the platform. may be:

? shorter (e.g. because there is less oil to be extracted than originally surveyed); or

? longer (e.g. because the rate of extraction is less than budgeted).

Tutorial note: An increase in actual output can be explained conversely.

■ A review of the results of management’s impairment testing of each rig (i.e. the cash-generating unit of which each

platform. is a part).

■ Recalculations of cash flow projections (based on reasonable and supportable assumptions) discounted at a suitable

pre-tax rate.

Tutorial note: As the rigs will not have readily determinable net selling prices (each one being unique and not available

for sale) any impairment will be assessed by a comparison of value in use against carrying amount.

■ Review of working papers of geologist/quantity surveyor(s) employed by Shire supporting estimations of reserves used

in the determination of useful lives of rigs. -

第3题:

(c) Explain the extent to which you should plan to place reliance on analytical procedures as audit evidence.

(6 marks)

正确答案:

(c) Extent of reliance on analytical procedures as audit evidence

Tutorial note: In the requirement ‘… reliance … as audit evidence’ is a direction to consider only substantive analytical

procedures. Answer points concerning planning and review stages were not asked for and earn no marks.

■ Although there is likely to be less reliance on analytical procedures than if this had been an existing audit client, the fact

that this is a new assignment does not preclude placing some reliance on such procedures.

■ Analytical procedures will not be relied on in respect of material items that require 100% testing. For example, additions

to property is likely to represent a very small number of transactions.

■ Analytical procedures alone may provide sufficient audit evidence on line items that are not individually material. For

example, inventory (less than 1/2% revenue and less than 1% total assets) may be shown to be materially correctly

stated through analytical procedures on consumable stores (i.e. fuel, lubricants, materials for servicing vehicles etc).

■ Substantive analytical procedures are best suited to large volume transactions (e.g. revenue, materials expense, staff

costs). If controls over the completeness, accuracy and validity of recording transactions in these areas are effective then

substantive analytical procedures showing that there are no unexpected fluctuations should reduce the need for

substantive detailed tests.

■ The extent of planned use will be dependent on the relationships expected between variables. (e.g. between items of

financial information and between items of financial and non-financial information). For example, if material costs rise

due to an increase in the level of business then a commensurate increase in revenue and staff costs might be expected

also.

■ ‘Proofs in total’ (or reasonableness tests) provide substantive evidence that income statement items are not materially

misstated. In the case of Yates these might be applied to staff costs (number of employees in each category ×

wage/salary rates, grossed up for social security, etc) and finance expense (interest rate × average monthly overdraft

balance).

■ However, such tests may have limited application, if any, if the population is not homogenous and cannot be subdivided.

For example, all the categories of non-current asset have a wide range of useful life. Therefore it would be

difficult/meaningless to apply an ‘average’ depreciation rate to all assets in the class to substantiate the total depreciation

expense for the year. (Although it might highlight a risk of potential over or understatement requiring further

investigation.)

■ Substantive analytical procedures are more likely to be used if there is relevant information available that is being used

by Yates. For example, as fuel costs will be significant, Yates may monitor consumption (e.g. miles per gallon (MPG)).

■ Analytical procedures may supplement alternative procedures that provide evidence regarding the same assertion. For

example, the review of after-date payments to confirm the completeness of trade payables may be supplemented by

calculations of average payment period on a monthly basis.

Tutorial note: Credit will be given for other relevant points drawn from the scenario. For example, the restructuring during

the previous year is likely to have caused fluctuations that may result in less reliance being placed on analytical procedures. -

第4题:

(b) Illustrate how you might use analytical procedures to provide audit evidence and reduce the level of detailed

substantive procedures. (7 marks)

正确答案:

(b) Illustration of use of analytical procedures as audit evidence

Tutorial note: Note that ‘as audit evidence’ requires consideration of substantive analytical procedures rather that the

identification of risks (relevant to part (a)).

Revenue

Analytical procedures may be used in testing revenue for completeness of recording (‘understatement’). The average selling

price of a vehicle in 2005 was $68,830 ($526·0 million ÷ 7,642 vehicles). Applying this to the number of vehicles sold

in 2006, might be projected to generate $698·8 million ($68,830 × 10,153) revenue from the sale of vehicles. The draft

financial statements therefore show a potential shortfall of $110·8 million ($(698·8 – 588·0) million) that is, 15·6%.

This should be investigated and substantiated through more detailed analytical procedures. For example, the number of

vehicles sold should be analysed into models and multiplied by the list price of each for a more accurate estimate of potential

revenue. The impact of discounts and other incentives (e.g. 0% finance) on the list prices should then be allowed for. If

recorded revenue for 2006 (as per draft income statement adjusted for cutoff and consignment inventories) is materially lower

than that calculated, detailed substantive procedures may be required in order to show that there is no material error.

‘Proof in total’/reasonableness tests

The material correctness, or otherwise, of income statement items (in particular) may be assessed through appropriate ‘proof

in total’ calculations (or ‘reasonableness’ tests). For example:

■ Employee benefits costs: the average number of employees by category (waged/salaried/apprenticed) × the average pay

rate for each might prove that in total $91·0 million (as adjusted to actual at 31 December 2006) is not materially

misstated. The average number of employees needs to be checked substantively (e.g. recalculated based on the number

of employees on each payroll) and the average pay rates (e.g. to rates agreed with employee representatives).

Tutorial note: An alternative reasonableness might be to take last year’s actual adjusted for 2006 numbers of

employees grossed-up for any pay increases during the year (pro-rated as necessary).

■ Depreciation: the cost (or net book value) of each category of asset × by the relevant straight-line (or reducing balance)

depreciation rate. If a ‘ballpark’ calculation for the year is materially different to the annual charge a more detailed

calculation can be made using monthly depreciation calculations. The cost (or net book value) on which depreciation

is calculated should be substantively tested, for example by agreeing brought forward balances to prior year working

papers and additions to purchase invoices (costings in respect of assets under construction).

Tutorial note: Alternatively, last year’s depreciation charge may be reconciled to this year’s by considering depreciation

rates applied to brought forward balances with adjustments for additions/disposals.

■ Interest income: an average interest rate for the year can be applied to the monthly balance invested (e.g. in deposit

accounts) and compared with the amount recognised for the year to 31 December 2006 (as adjusted for any accrued

interest per the bank letter for audit purposes). The monthly balances (or averages) on which the calculation is

performed should be substantiated to bank deposit statements.

■ Interest expense: if the cash balances do not go into overdraft then this may be similar expenses (e.g. prompt payment

discounts to customers). If this is to particular dealers then a proof in total might be to apply the discount rate to the

amounts invoiced to the dealer during the period.

Immaterial items

For immaterial items analytical procedures alone may provide sufficient audit evidence that amounts in the financial

statements are not materially misstated so that detailed substantive procedures are not required. For example, a comparison

of administration and distribution, maintenance and insurance costs for 2006 compared with 2005 may be sufficient to show

that material error is highly unlikely. If necessary, further reasonableness tests could be performed. For example, considering

insurance costs to value of assets insured or maintenance costs to costs of assets maintained.

Ratio analysis

Ratio analysis can provide substantive evidence that income statement and balance sheet items are not materially misstated

by considering their inter-relationships. For example:

■ Asset turnover: Based on the draft financial statements property, plant and equipment has turned over 5·2 times

($645·5/124·5) compared with 5·9 times in 2005. This again highlights that income may be overstated, or assets

overstated (e.g. if depreciation is understated).

■ Inventory turnover: Using cost of materials adjusted for changes in inventories this has remained stable at 10·9 times.

Tutorial note: This is to be expected as in (a) the cost in the income statement has increased by 9% and the value of

inventories by 8·5%.

Inventories represent the smallest asset value on the balance sheet at 31 December 2006 (7·8% of total assets).

Therefore substantive procedures may be limited to agreeing physical count of material items (vehicles) and agreeing

cutoff.

■ Average collection period: This has increased to 41 days (73·1/645·5 × 365) from 30 days. Further substantive analysis

is required, for example, separating out non-current amounts (for sales on 0% finance terms). Substantive procedures

may be limited to confirmation of amounts due from dealers (and/or receipt of after-date cash) and agreeing cutoff of

goods on consignment.

■ Payment periods: This has remained constant at 37 days (2005 – 38 days). Detailed substantive procedures may be

restricted to reconciling only major suppliers’ statements and agreeing the cutoff on parts purchased from them. -

第5题:

3 You are the manager responsible for the audit of Lamont Co. The company’s principal activity is wholesaling frozen

fish. The draft consolidated financial statements for the year ended 31 March 2007 show revenue of $67·0 million

(2006 – $62·3 million), profit before taxation of $11·9 million (2006 – $14·2 million) and total assets of

$48·0 million (2006 – $36·4 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In early 2007 a chemical leakage from refrigeration units owned by Lamont caused contamination of some of its

property. Lamont has incurred $0·3 million in clean up costs, $0·6 million in modernisation of the units to

prevent future leakage and a $30,000 fine to a regulatory agency. Apart from the fine, which has been expensed,

these costs have been capitalised as improvements. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Lamont Co for the year ended

31 March 2007.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

3 LAMONT CO

(a) Chemical leakage

(i) Matters

■ $30,000 fine is very immaterial (just 1/4% profit before tax). This is revenue expenditure and it is correct that it

has been expensed to the income statement.

■ $0·3 million represents 0·6% total assets and 2·5% profit before tax and is not material on its own. $0·6 million

represents 1·2% total assets and 5% profit before tax and is therefore material to the financial statements.

■ The $0·3 million clean-up costs should not have been capitalised as the condition of the property is not improved

as compared with its condition before the leakage occurred. Although not material in isolation this amount should

be adjusted for and expensed, thereby reducing the aggregate of uncorrected misstatements.

■ It may be correct that $0·6 million incurred in modernising the refrigeration units should be capitalised as a major

overhaul (IAS 16 Property, Plant and Equipment). However, any parts scrapped as a result of the modernisation

should be treated as disposals (i.e. written off to the income statement).

■ The carrying amount of the refrigeration units at 31 March 2007, including the $0·6 million for modernisation,

should not exceed recoverable amount (i.e. the higher of value in use and fair value less costs to sell). If it does,

an allowance for the impairment loss arising must be recognised in accordance with IAS 36 Impairment of Assets.

(ii) Audit evidence

■ A breakdown/analysis of costs incurred on the clean-up and modernisation amounting to $0·3 million and

$0·6 million respectively.

■ Agreement of largest amounts to invoices from suppliers/consultants/sub-contractors, etc and settlement thereof

traced from the cash book to the bank statement.

■ Physical inspection of the refrigeration units to confirm their modernisation and that they are in working order. (Do

they contain frozen fish?)

■ Sample of components selected from the non-current asset register traced to the refrigeration units and inspected

to ensure continuing existence.

■ $30,000 penalty notice from the regulatory agency and corresponding cash book payment/payment per the bank

statement.

■ Written management representation that there are no further penalties that should be provided for or disclosed other

than the $30,000 that has been accounted for. -

第6题:

(c) Lamont owns a residential apartment above its head office. Until 31 December 2006 it was let for $3,000 a

month. Since 1 January 2007 it has been occupied rent-free by the senior sales executive. (6 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Lamont Co for the year ended

31 March 2007.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(c) Rent-free accommodation

(i) Matters

■ The senior sales executive is a member of Lamont’s key management personnel and is therefore a related party.

■ The occupation of Lamont’s residential apartment by the senior sales executive is therefore a related party

transaction, even though no price is charged (IAS 24 Related Party Disclosures).

■ Related party transactions are material by nature and information about them should be disclosed so that users of

financial statements understand the potential effect of related party relationships on the financial statements.

■ The provision of ‘housing’ is a non-monetary benefit that should be included in the disclosure of key management

personnel compensation (within the category of short-term employee benefits).

■ The financial statements for the year ended 31 March 2007 should disclose the arrangement for providing the

senior sales executive with rent-free accommodation and its fair value (i.e. $3,000 per month).

Tutorial note: Since no price is charged for the transaction, rote-learned disclosures such as ‘the amount of outstanding

balances’ and ‘expense recognised in respect of bad debts’ are irrelevant.

(ii) Audit evidence

■ Physical inspection of the apartment to confirm that it is occupied.

■ Written representation from the senior sales executive that he is occupying the apartment free of charge.

■ Written representation from the management board confirming that there are no related party transactions requiring

disclosure other than those that have been disclosed.

■ Inspection of the lease agreement with (or payments received from) the previous tenant to confirm the $3,000

monthly rental value. -

第7题:

(iii) Can internal audit services be undertaken for an audit client? (4 marks)

Required:

For each of the three questions, explain the threats to objectivity that may arise and the safeguards that

should be available to manage them to an acceptable level.

NOTE: The mark allocation is shown against each of the three questions above.

正确答案:(iii) Internal audit services

A self-review threat may be created when a firm, or network firm, provides internal audit services to a financial statement

audit client. Internal audit services may comprise:

■ an extension of the firm’s audit service beyond requirements of International Standards on Auditing (ISAs);

■ assistance in the performance of a client’s internal audit activities; or

■ outsourcing of the activities.

The nature of the service must be considered in evaluating any threats to independence. (For this purpose, internal audit

services do not include operational internal audit services unrelated to the internal accounting controls, financial systems

or financial statements.)

Services involving an extension of the procedures required to conduct a financial statement audit in accordance with

ISAs would not be considered to impair independence with respect to the audit client provided that the firm’s or network

firm’s personnel do not act or appear to act in a capacity equivalent to a member of audit client management.When the firm, or a network firm, provides an audit client with assistance in the performance of internal audit activities

or undertakes the outsourcing, any self-review threat created may be reduced to an acceptable level by a clear separation

of:

■ the management and control of the internal audit by client management;

■ the internal audit activities.

Performing a significant portion of an audit client’s internal audit activities may create a self-review threat. Appropriate

safeguards should include the audit client’s acknowledgement of its responsibilities for establishing, maintaining and

monitoring the system of internal controls.

Other safeguards include:

■ the audit client designating a competent employee, preferably within senior management, to be responsible for

internal audit activities;

■ the audit client, audit committee or supervisory body approving the scope, risk and frequency of internal audit

work;

■ the audit client being responsible for evaluating and determining which recommendations of the firm should be

implemented;

■ the audit client evaluating the adequacy of the internal audit procedures performed and the resultant findings by

obtaining and acting on reports from the firm; and

■ appropriate reporting of findings and recommendations resulting from the internal audit activities to the audit

committee or supervisory body.

Consideration should also be given to whether such non-assurance services should be provided only by personnel not

involved in the financial statement audit engagement and with different reporting lines within the firm. -

第8题:

(b) Describe the principal audit procedures to be carried out in respect of the following:

(i) The measurement of the share-based payment expense; (6 marks)

正确答案:

(b) (i) Principal audit procedures – measurement of share-based payment expense

– Obtain management calculation of the expense and agree the following from the calculation to the contractual

terms of the scheme:

– Number of employees and executives granted options

– Number of options granted per employee

– The official grant date of the share options

– Vesting period for the scheme

– Required performance conditions attached to the options.

– Recalculate the expense and check that the fair value has been correctly spread over the stated vesting period.

– Agree fair value of share options to specialist’s report and calculation, and evaluate whether the specialist report is

a reliable source of evidence.

– Agree that the fair value calculated is at the grant date.

Tutorial note: A specialist such as a chartered financial analyst would commonly be used to calculate the fair value

of non-traded share options at the grant date, using models such as the Black-Scholes Model.

– Obtain and review a forecast of staffing levels or employee turnover rates for the duration of the vesting period, and

scrutinise the assumptions used to predict level of staff turnover.

– Discuss previous levels of staff turnover with a representative of the human resources department and query why

0% staff turnover has been predicted for the next three years.

– Check the sensitivity of the calculations to a change in the assumptions used in the valuation, focusing on the

assumption of 0% staff turnover.

– Obtain written representation from management confirming that the assumptions used in measuring the expense

are reasonable.

Tutorial note: A high degree of scepticism must be used by the auditor when conducting the final three procedures

due to the management assumption of 0% staff turnover during the vesting period. -

第9题:

(b) You are the manager responsible for the audit of Poppy Co, a manufacturing company with a year ended

31 October 2008. In the last year, several investment properties have been purchased to utilise surplus funds

and to provide rental income. The properties have been revalued at the year end in accordance with IAS 40

Investment Property, they are recognised on the statement of financial position at a fair value of $8 million, and

the total assets of Poppy Co are $160 million at 31 October 2008. An external valuer has been used to provide

the fair value for each property.

Required:

(i) Recommend the enquiries to be made in respect of the external valuer, before placing any reliance on their

work, and explain the reason for the enquiries; (7 marks)

正确答案:

(b) (i) Enquiries in respect of the external valuer

Enquiries would need to be made for two main reasons, firstly to determine the competence, and secondly the objectivity

of the valuer. ISA 620 Using the Work of an Expert contains guidance in this area.

Competence

Enquiries could include:

– Is the valuer a member of a recognised professional body, for example a nationally or internationally recognised

institute of registered surveyors?

– Does the valuer possess any necessary licence to carry out valuations for companies?

– How long has the valuer been a member of the recognised body, or how long has the valuer been licensed under

that body?

– How much experience does the valuer have in providing valuations of the particular type of investment properties

held by Poppy Co?

– Does the valuer have specific experience of evaluating properties for the purpose of including their fair value within

the financial statements?

– Is there any evidence of the reputation of the valuer, e.g. professional references, recommendations from other

companies for which a valuation service has been provided?

– How much experience, if any, does the valuer have with Poppy Co?

Using the above enquiries, the auditor is trying to form. an opinion as to the relevance and reliability of the valuation

provided. ISA 500 Audit Evidence requires that the auditor gathers evidence that is both sufficient and appropriate. The

auditor needs to ensure that the fair values provided by the valuer for inclusion in the financial statements have been

arrived at using appropriate knowledge and skill which should be evidenced by the valuer being a member of a

professional body, and, if necessary, holding a licence under that body.

It is important that the fair values have been arrived at using methods allowed under IAS 40 Investment Property. If any

other valuation method has been used then the value recognised in the statement of financial position may not be in

accordance with financial reporting standards. Thus it is important to understand whether the valuer has experience

specifically in providing valuations that comply with IAS 40, and how many times the valuer has appraised properties

similar to those owned by Poppy Co.

In gauging the reliability of the fair value, the auditor may wish to consider how Poppy Co decided to appoint this

particular valuer, e.g. on the basis of a recommendation or after receiving references from companies for which

valuations had previously been provided.

It will also be important to consider how familiar the valuer is with Poppy Co’s business and environment, as a way to

assess the reliability and appropriateness of any assumptions used in the valuation technique.

Objectivity

Enquiries could include:

– Does the valuer have any financial interest in Poppy Co, e.g. shares held directly or indirectly in the company?

– Does the valuer have any personal relationship with any director or employee of Poppy Co?

– Is the fee paid for the valuation service reasonable and a fair, market based price?

With these enquiries, the auditor is gaining assurance that the valuer will perform. the valuation from an independent

point of view. If the valuer had a financial interest in Poppy Co, there would be incentive to manipulate the valuation in

a way best suited to the financial statements of the company. Equally if the valuer had a personal relationship with a

senior member of staff at Poppy Co, the valuer may feel pressured to give a favourable opinion on the valuation of the

properties.

The level of fee paid is important. It should be commensurate with the market rate paid for this type of valuation. If the

valuer was paid in excess of what might be considered a normal fee, it could indicate that the valuer was encouraged,

or even bribed, to provide a favourable valuation. -

第10题:

(c) Identify and discuss the implications for the audit report if:

(i) the directors refuse to disclose the note; (4 marks)

正确答案:

(c) (i) Audit report implications

Audit procedures have shown that there is a significant level of doubt over Dexter Co’s going concern status. IAS 1

requires that disclosure is made in the financial statements regarding material uncertainties which may cast significant

doubt on the ability of the entity to continue as a going concern. If the directors refuse to disclose the note to the financial

statements, there is a clear breach of financial reporting standards.

In this case the significant uncertainty is caused by not knowing the extent of the future availability of finance needed

to fund operating activities. If the note describing this uncertainty is not provided, the financial statements are not fairly

presented.

The audit report should contain a qualified or an adverse opinion due to the disagreement. The auditors need to make

a decision as to the significance of the non-disclosure. If it is decided that without the note the financial statements are

not fairly presented, and could be considered misleading, an adverse opinion should be expressed. Alternatively, it could

be decided that the lack of the note is material, but not pervasive to the financial statements; then a qualified ‘except

for’ opinion should be expressed.

ISA 570 Going Concern and ISA 701 Modifications to the Independent Auditor’s Report provide guidance on the

presentation of the audit report in the case of a modification. The audit report should include a paragraph which contains

specific reference to the fact that there is a material uncertainty that may cast significant doubt about the entity’s ability

to continue as a going concern. The paragraph should include a clear description of the uncertainties and would

normally be presented immediately before the opinion paragraph. -

第11题:

Following a competitive tender, your audit firm Cal & Co has just gained a new audit client Tirrol Co. You are the manager in charge of planning the audit work. Tirrol Co’s year end is 30 June 2009 with a scheduled date to complete the audit of 15 August 2009. The date now is 3 June 2009.

Tirrol Co provides repair services to motor vehicles from 25 different locations. All inventory, sales and purchasing systems are computerised, with each location maintaining its own computer system. The software in each location is

the same because the programs were written specifically for Tirrol Co by a reputable software house. Data from each location is amalgamated on a monthly basis at Tirrol Co’s head office to produce management and financial accounts.

You are currently planning your audit approach for Tirrol Co. One option being considered is to re-write Cal & Co’s audit software to interrogate the computerised inventory systems in each location of Tirrol Co (except for head office)

as part of inventory valuation testing. However, you have also been informed that any computer testing will have to be on a live basis and you are aware that July is a major holiday period for your audit firm.

Required:

(a) (i) Explain the benefits of using audit software in the audit of Tirrol Co; (4 marks)

(ii) Explain the problems that may be encountered in the audit of Tirrol Co and for each problem, explain

how that problem could be overcome. (10 marks)

(b) Following a discussion with the management at Tirrol Co you now understand that the internal audit department are prepared to assist with the statutory audit. Specifically, the chief internal auditor is prepared to provide you with documentation on the computerised inventory systems at Tirrol Co. The documentation provides details of the software and shows diagrammatically how transactions are processed through the inventory system. This documentation can be used to significantly decrease the time needed to understand the computer systems and enable audit software to be written for this year’s audit.

Required:

Explain how you will evaluate the computer systems documentation produced by the internal audit

department in order to place reliance on it during your audit. (6 marks)

正确答案:

(a)(i)BenefitsofusingauditsoftwareStandardsystemsatclientThesamecomputerisedsystemsandprogramsasusedinall25branchesofTirrolCo.Thismeansthatthesameauditsoftwarecanbeusedineachlocationprovidingsignificanttimesavingscomparedtothesituationwhereclientsystemsaredifferentineachlocation.UseactualcomputerfilesnotcopiesorprintoutsUseofauditsoftwaremeansthattheTirrolCo’sactualinventoryfilescanbetestedratherthanhavingtorelyonprintoutsorscreenimages.Thelattercouldbeincorrect,byaccidentorbydeliberatemistake.Theauditfirmwillhavemoreconfidencethatthe‘real’fileshavebeentested.TestmoreitemsUseofsoftwarewillmeanthatmoreinventoryrecordscanbetested–itispossiblethatallproductlinescouldbetestedforobsolescenceratherthanasampleusingmanualtechniques.Theauditorwillthereforegainmoreevidenceandhavegreaterconfidencethatinventoryisvaluedcorrectly.CostTherelativecostofusingauditsoftwaredecreasesthemoreyearsthatsoftwareisused.Anycostoverrunsthisyearcouldbeoffsetagainsttheauditfeesinfutureyearswhentheactualexpensewillbeless.(ii)ProblemsontheauditofTirrolTimescale–sixweekreportingdeadline–auditplanningTheauditreportisduetobesignedsixweeksaftertheyearend.Thismeansthattherewillbeconsiderablepressureontheauditortocompleteauditworkwithoutcompromisingstandardsbyrushingprocedures.Thisproblemcanbeovercomebycarefulplanningoftheaudit,useofexperiencedstaffandensuringotherstaffsuchassecondpartnerreviewsarebookedwellinadvance.Timescale–sixweekreportingdeadline–softwareissuesTheauditreportisduetobesignedaboutsixweeksaftertheyearend.Thismeansthatthereislittletimetowriteandtestauditsoftware,letaloneusethesoftwareandevaluatetheresultsoftesting.Thisproblemcanbealleviatedbycarefulplanning.AccesstoTirrolCo’ssoftwareanddatafilesmustbeobtainedassoonaspossibleandworkcommencedontailoringCal&Co’ssoftwarefollowingthis.Specialistcomputerauditstaffshouldbebookedassoonaspossibletoperform.thiswork.FirstyearauditcostsTherelativecostsofanauditinthefirstyearataclienttendtobegreaterduetotheadditionalworkofascertainingclientsystems.ThismeansthatCal&Comayhavealimitedbudgettodocumentsystemsincludingcomputersystems.Thisproblemcanbealleviatedtosomeextentagainbygoodauditplanning.Themanagermustalsomonitortheauditprocesscarefully,ensuringthatanyadditionalworkcausedbytheclientnotprovidingaccesstosystemsinformationincludingcomputersystemsisidentifiedandaddedtothetotalbillingcostoftheaudit.StaffholidaysMostoftheauditworkwillbecarriedoutinJuly,whichisalsothemonthwhenmanyofCal&Costafftaketheirannualholiday.Thismeansthattherewillbeashortageofauditstaff,particularlyasauditworkforTirrolCoisbeingbookedwithlittlenotice.Theproblemcanbealleviatedbybookingstaffassoonaspossibleandthenidentifyinganyshortages.Wherenecessary,staffmaybeborrowedfromotherofficesorevendifferentcountriesonasecondmentbasiswhereshortagesareacute.Non-standardsystemsTirrolCo’scomputersoftwareisnon-standard,havingbeenwrittenspecificallyfortheorganisation.Thismeansthatmoretimewillbenecessarytounderstandthesystemthanifstandardsystemswereused.Thisproblemcanbealleviatedeitherbyobtainingdocumentationfromtheclientorbyapproachingthesoftwarehouse(withTirrolCo’spermission)toseeiftheycanassistwithprovisionofinformationondatastructuresfortheinventorysystems.ProvisionofthisinformationwilldecreasethetimetakentotailorauditsoftwareforuseinTirrolCo.IssuesoflivetestingCal&Cohasbeeninformedthatinventorysystemsmustbetestedonalivebasis.Thisincreasestheriskofaccidentalamendmentordeletionofclientdatasystemscomparedtotestingcopyfiles.Tolimitthepossibilityofdamagetoclientsystems,Cal&CocanconsiderperforminginventorytestingondayswhenTirrolCoisnotoperatinge.g.weekends.Attheworst,backupsofdatafilestakenfromthepreviousdaycanbere-installedwhenCal&Co’stestingiscomplete.ComputersystemsTheclienthas25locations,witheachlocationmaintainingitsowncomputersystem.Itispossiblethatcomputersystemsarenotcommonacrosstheclientduetoamendmentsmadeatthebranchlevel.Thisproblemcanbeovercometosomeextentbyaskingstaffateachbranchwhethersystemshavebeenamendedandfocusingauditworkonmaterialbranches.UsefulnessofauditsoftwareTheuseofauditsoftwareatTirrolCodoesappeartohavesignificantproblemsthisyear.Thismeansthateveniftheauditsoftwareisready,theremaystillbesomeriskofincorrectconclusionsbeingderivedduetolackoftesting,etc.Thisproblemcanbealleviatedbyseriouslyconsideringthepossibilityofusingamanualauditthisyear.Themanagermayneedtoinvestigatewhetheramanualauditisfeasibleandifsowhetheritcouldbecompletedwithinthenecessarytimescalewithminimalauditrisk.(b)RelianceoninternalauditdocumentationTherearetwoissuestoconsider;theabilityofinternalaudittoproducethedocumentationandtheactualaccuracyofthedocumentationitself.Theabilityoftheinternalauditdepartmenttoproducethedocumentationcanbedeterminedby:–Ensuringthatthedepartmenthasstaffwhohaveappropriatequalifications.Provisionofarelevantqualificatione.g.membershipofacomputerrelatedinstitutewouldbeappropriate.–Ensuringthatthisandsimilardocumentationisproducedusingarecognisedplanandthatthedocumentationistestedpriortouse.Theuseofdifferentstaffintheinternalauditdepartmenttoproduceandtestdocumentationwillincreaseconfidenceinitsaccuracy.–Ensuringthatthedocumentationisactuallyusedduringinternalauditworkandthatproblemswithdocumentationarenotedandinvestigatedaspartofthatwork.Beinggivenaccesstointernalauditreportsontheinventorysoftwarewillprovideappropriateevidence.Regardingtheactualdocumentation:–Reviewingthedocumentationtoensurethatitappearslogicalandthattermsandsymbolsareusedconsistentlythroughout.Thiswillprovideevidencethattheflowcharts,etcshouldbeaccurate.–Comparingthedocumentationagainstthe‘live’inventorysystemtoensureitcorrectlyreflectstheinventorysystem.Thiscomparisonwillincludetracingindividualtransactionsthroughtheinventorysystems.–UsingpartofthedocumentationtoamendCal&Co’sauditsoftware,andthenensuringthatthesoftwareprocessesinventorysystemdataaccurately.However,thisstagemaybelimitedduetotheneedtouselivefilesatTirrolCo. -

第12题:

You are the audit supervisor of Maple & Co and are currently planning the audit of an existing client, Sycamore Science Co (Sycamore), whose year end was 30 April 2015. Sycamore is a pharmaceutical company, which manufactures and supplies a wide range of medical supplies. The draft financial statements show revenue of $35·6 million and profit before tax of $5·9 million.

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

正确答案:(a) Fraud responsibility

Maple & Co must conduct an audit in accordance with ISA 240 The Auditor’s Responsibilities Relating to Fraud in an Audit of Financial Statements and are responsible for obtaining reasonable assurance that the financial statements taken as a whole are free from material misstatement, whether caused by fraud or error.

In order to fulfil this responsibility, Maple & Co is required to identify and assess the risks of material misstatement of the financial statements due to fraud.

They need to obtain sufficient appropriate audit evidence regarding the assessed risks of material misstatement due to fraud, through designing and implementing appropriate responses. In addition, Maple & Co must respond appropriately to fraud or suspected fraud identified during the audit.

When obtaining reasonable assurance, Maple & Co is responsible for maintaining professional scepticism throughout the audit, considering the potential for management override of controls and recognising the fact that audit procedures which are effective in detecting error may not be effective in detecting fraud.

To ensure that the whole engagement team is aware of the risks and responsibilities for fraud and error, ISAs require that a discussion is held within the team. For members not present at the meeting, Sycamore’s audit engagement partner should determine which matters are to be communicated to them.

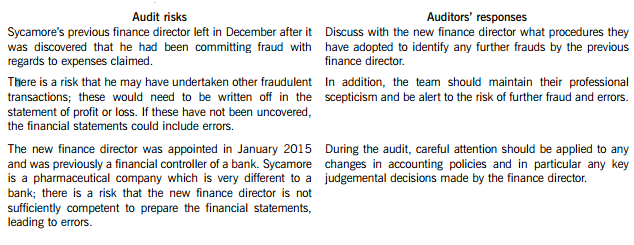

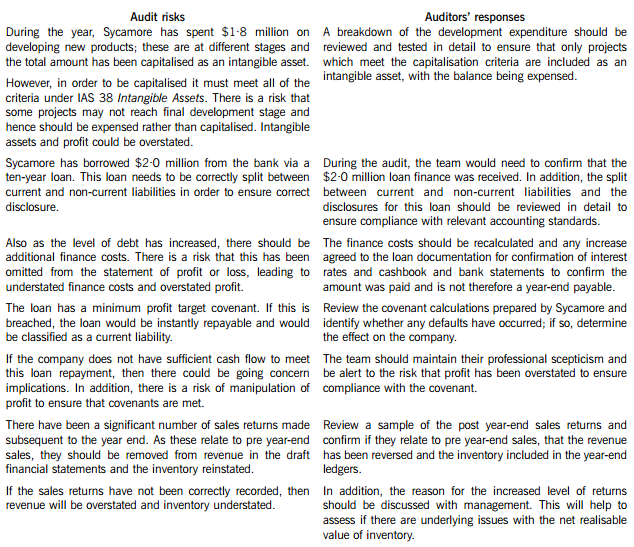

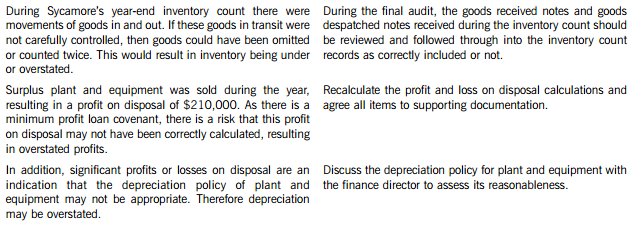

(b) Audit risks and auditors’ responses

(c) (i) Review engagements

Review engagements are often undertaken as an alternative to an audit, and involve a practitioner reviewing financial data, such as six-monthly figures. This would involve the practitioner undertaking procedures to state whether anything has come to their attention which causes the practitioner to believe that the financial data is not in accordance with the financial reporting framework.

A review engagement differs to an external audit in that the procedures undertaken are not nearly as comprehensive as those in an audit, with procedures such as analytical review and enquiry used extensively. In addition, the practitioner does not need to comply with ISAs as these only relate to external audits.

(ii) Levels of assurance

The level of assurance provided by audit and review engagements is as follows:

External audit – A high but not absolute level of assurance is provided, this is known as reasonable assurance. This provides comfort that the financial statements present fairly in all material respects (or are true and fair) and are free of material misstatements.

Review engagements – where an opinion is being provided, the practitioner gathers sufficient evidence to be satisfied that the subject matter is plausible; in this case negative assurance is given whereby the practitioner confirms that nothing has come to their attention which indicates that the subject matter contains material misstatements.

-

第13题:

(c) Critically discuss the statement (in note 12) of the managing director of GBC and suggest how the company

could calculate the value of the service provision to the population of the Western region. (6 marks)

正确答案:

(c) It would appear that in operating a bus service to the Western region of Geeland that GBC is fulfilling a social objective since

a contribution loss amounting to $38,400 ($230,400 – $268,800) was made as a consequence of operating the route to

the Western region during 2007. As an organisation which is partially funded by the government it is highly probable that

GBC has objectives which differ from those of TTC which is a profit-seeking organisation.

The value of a social service such as the provision of public transport can be quantified, albeit, in non-financial times. It is

possible to apply quantitative measures to the bus service itself, the most obvious ones being the number of passengers

carried and the number of passenger miles travelled.

The cost of the provision of alternative transport to the Western region might also enable a value to be placed on the current

service by GBC.

It might be possible to estimate quantitatively some of the social benefits resulting from the provision of the transport facility

to and from the Western region. For example, GBC could undertake a survey of the population of the Western region in order

to help estimate the extent to which rural depopulation would otherwise have occurred had the transport facility not been

made.

The application of the technique of cost-benefit analysis makes it possible to estimate money values for non-monetary

benefits. Social benefits can therefore be expressed in financial terms. It is highly probable that the fact that the Western region

is served by GBC will increase the attractiveness of living in a rural area, which may in turn precipitate an increase in property

values in the Western region and the financial benefit could be expressed in terms of the aggregate increase in property values

in the region as a whole. -

第14题:

(b) Describe the audit work to be performed in respect of the carrying amount of the following items in the

balance sheet of GVF as at 30 September 2005:

(i) goat herd; (4 marks)

正确答案:

(b) Audit work on carrying amounts

Tutorial note: This part concerns audit work to be undertaken in respect of non-current tangible assets (the production

animals in the goat herd and certain equipment) and inventories (the for-sale animals and cheese). One of the ‘tests’ for

assessing whether or not a point is worthy of a mark will be whether or not the asset to which it relates is apparent. Points

which are so vague that they could apply to ANY non-current asset for ANY entity, rather than those of GVF are unlikely to

attract many marks, if any, at this level.

(i) Goat herd

■ Physical inspection of the number and condition of animals in the herd and confirming, on a test basis, that they

are tagged (or otherwise ‘branded’ as being owned by GVF).

■ Tests of controls on management’s system of identifying and distinguishing held-for-sale animals (inventory) from

the production herd (depreciable non-current assets).

■ Comparison of GVF’s depreciation policies (including useful lives, depreciation methods and residual values) with

those used by other farming entities.

■ ‘Proof in total’, or other reasonableness check, of the depreciation charge for the herd for the year.

■ Observing test counts or total counts of animals held for sale.

■ Comparing carrying amounts of the kids, according to their weight and age, as at 30 September 2005 with their

market values. (These may approximate to actual invoiced selling prices obtained by GVF.)

Tutorial note: Market value of the production herd could also be compared with its carrying amount to assess possible

impairment. However, if value in use appears to be less than market value the herd should be sold rather than used

for production. -

第15题:

6 The explosive growth of investing and raising capital in the global markets has put new emphasis on the development

of international accounting, auditing and ethical standards. The International Federation of Accountants (IFAC) has

been at the forefront of the development of the worldwide accountancy profession through its activities in ethics,

auditing and education.

Required:

Explain the developments in each of the following areas and indicate how they affect Chartered Certified

Accountants:

(a) IFAC’s ‘Code of Ethics for Professional Accountants’; (5 marks)

正确答案:

6 DEVELOPMENTS AND CERTIFIED CHARTERED ACCOUNTANTS

Tutorial note: The answer which follows is indicative of the range of points which might be made. Other relevant material will

be given suitable credit.

(a) IFAC’s ‘Code of Ethics for Professional Accountants’

Since its issue in 1996, IFAC’s ‘Code of Ethics for Professional Accountants’ (‘The Code’) has undergone several revisions

(1996, 1998, 2001, 2004 and 2005). IFAC holds the view that due to national differences (of culture, language, legal and

social systems) the task of preparing detailed ethical requirements is primarily that of the member bodies in each country

concerned (and that they also have the responsibility to implement and enforce such requirements).

In recognizing the responsibilities of the accountancy profession, IFAC considers its own role to be in providing guidance and

promoting harmonization. IFAC has established ‘The Code’ to provide a basis on which the ethical requirements for

professional accountants in each country should be founded.

IFAC’s conceptual approach is principles-based. It provides a route to convergence that emphasises the profession’s integrity.

This approach may be summarised as:

■ identifying and evaluating circumstances and relationships that create threats (e.g. to independence); and

■ taking appropriate action to:

– eliminate these threats; or

– reduce them to an acceptable level by the application of safeguards.

If no safeguards are available to reduce a threat to an acceptable level an assurance engagement must be refused or

discontinued.

This approach was first introduced to Section 8 of The Code, on independence, and is applicable to assurance engagements

when the assurance report is dated on or after 31 December 2004.

Further to the cases of Enron, Worldcom and Parmalat, IFAC issued a revised Code in July 2005 that applies to all professional

accountants, whether in public practice, business, industry or government2.

A member body of IFAC may not apply less stringent standards than those stated in the Code. The Code is effective from

30 June 2006.

Practicing accountants and members in business must maintain the high standards of professional ethics that are expected

by their professional bodies (such as ACCA). These developments codify current best practice in the wake of the

aforementioned recent corporate scandals.

The developments in The Code have wider application in that it:

■ applies to all assurance services (not just audit);

■ considers the standpoints of the firm and of the assurance team.

Since ACCA is a member-body of IFAC the elevation of The Code to a standard will affect all Chartered Certified Accountants.

. -

第16题:

6 Certain practices have developed that threaten to damage the integrity and objectivity of professional accountants and

the reputation of the accounting profession.

Required:

Explain the following practices and associated ethical risks and discuss whether current ethical guidance is

sufficient:

(a) ‘lowballing’; (5 marks)

正确答案:

6 CERTAIN PRACTICES

Tutorial note: The answer which follows is indicative of the range of points which might be made. Other relevant material will

be given suitable credit.

(a) ‘Lowballing’

Explanation of term

‘Lowballing’ is the ‘loss-leading’ practice in which auditors compete for clients by reducing their fees for statutory audits.

Lower audit fees are then compensated by the auditor carrying out more lucrative non-audit work (e.g. consultancy and tax

advice). Audits may even be offered for free.

Such ‘predatory pricing’ may undercut an incumbent auditor to secure an appointment into which higher price consultancy

services may be sold.

Ethical risks

There is a risk of incompetence if the non-audit work does not materialise and the lowballing firm comes under pressure to

cut corners or resort to irregular practices (e.g. the falsification of audit working papers) in order to ‘keep within budget’.

However, a lack of audit quality may only be discovered if the situation arises that the company collapses and the auditors

are charged with negligence.

If, rather than comprise the quality of the audit, an audit firm substantially increases audit fees, a fee dispute could arise. In

this case the client might refuse to pay the higher fee. It could be difficult then for the firm to take the matter to arbitration

if the client was misled. Thus an advocacy threat may arise.

Financial dependence is a direct incentive that threatens independence. A self-interest threat therefore arises when, having

secured the audit, the audit firm needs the client to retain its services in order to recoup any losses initially incurred.

The provision of many other services gives rise to a self-review threat (as well as a self-interest threat).

Sufficiency of current ethical guidance

In current ethical guidance, the fact that an accountancy firm quotes a lower fee than other tendering firms is not improper,

providing that the prospective client is not misled about:

– the precise range of services that the quoted fee is intended to cover; and

– the likely level of fees for any other work undertaken.

This is clearly insufficient to prevent the practice of lowballing.

Legal prohibitions on the provision of many non-audit services (e.g. bookkeeping, financial information systems design and

implementation, valuation services, actuarial services, internal audit (outsourced), human resource services for executive

positions, investment and legal services) should make lowballing a riskier pricing strategy. This may curb the tendency to

lowball.

Lowballing could be eliminated if, for example, auditors were required to act ‘exclusively as auditors’. Although regulatory

environments have moved towards this there is not a total prohibition on non-audit services. -

第17题:

(b) While the refrigeration units were undergoing modernisation Lamont outsourced all its cold storage requirements

to Hogg Warehousing Services. At 31 March 2007 it was not possible to physically inspect Lamont’s inventory

held by Hogg due to health and safety requirements preventing unauthorised access to cold storage areas.

Lamont’s management has provided written representation that inventory held at 31 March 2007 was

$10·1 million (2006 – $6·7 million). This amount has been agreed to a costing of Hogg’s monthly return of

quantities held at 31 March 2007. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Lamont Co for the year ended

31 March 2007.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Outsourced cold storage

(i) Matters

■ Inventory at 31 March 2007 represents 21% of total assets (10·1/48·0) and is therefore a very material item in the

balance sheet.

■ The value of inventory has increased by 50% though revenue has increased by only 7·5%. Inventory may be

overvalued if no allowance has been made for slow-moving/perished items in accordance with IAS 2 Inventories.

■ Inventory turnover has fallen to 6·6 times per annum (2006 – 9·3 times). This may indicate a build up of

unsaleable items.

Tutorial note: In the absence of cost of sales information, this is calculated on revenue. It may also be expressed

as the number of days sales in inventory, having increased from 39 to 55 days.

■ Inability to inspect inventory may amount to a limitation in scope if the auditor cannot obtain sufficient audit

evidence regarding quantity and its condition. This would result in an ‘except for’ opinion.

■ Although Hogg’s monthly return provides third party documentary evidence concerning the quantity of inventory it

does not provide sufficient evidence with regard to its valuation. Inventory will need to be written down if, for

example, it was contaminated by the leakage (before being moved to Hogg’s cold storage) or defrosted during

transfer.

■ Lamont’s written representation does not provide sufficient evidence regarding the valuation of inventory as

presumably Lamont’s management did not have access to physically inspect it either. If this is the case this may

call into question the value of any other representations made by management.

■ Whether, since the balance sheet date, inventory has been moved back from Hogg’s cold storage to Lamont’s

refrigeration units. If so, a physical inspection and roll-back of the most significant fish lines should have been

undertaken.

Tutorial note: Credit will be awarded for other relevant accounting issues. For example a candidate may question

whether, for example, cold storage costs have been capitalised into the cost of inventory. Or whether inventory moves

on a FIFO basis in deep storage (rather than LIFO).

(ii) Audit evidence

■ A copy of the health and safety regulation preventing the auditor from gaining access to Hogg’s cold storage to

inspect Lamont’s inventory.

■ Analysis of Hogg’s monthly returns and agreement of significant movements to purchase/sales invoices.

■ Analytical procedures such as month-on-month comparison of gross profit percentage and inventory turnover to

identify any trend that may account for the increase in inventory valuation (e.g. if Lamont has purchased

replacement inventory but spoiled items have not been written off).

■ Physical inspection of any inventory in Lamont’s refrigeration units after the balance sheet date to confirm its

condition.

■ An aged-inventory analysis and recalculation of any allowance for slow-moving items.

■ A review of after-date sales invoices for large quantities of fish to confirm that fair value (less costs to sell) exceed

carrying amount.

■ A review of after-date credit notes for any returns of contaminated/perished or otherwise substandard fish. -

第18题:

(ii) If a partner, who is an actuary, provides valuation services to an audit client, can we continue with the audit?

(3 marks)

Required:

For each of the three questions, explain the threats to objectivity that may arise and the safeguards that

should be available to manage them to an acceptable level.

NOTE: The mark allocation is shown against each of the three questions above.

正确答案:

(ii) Actuarial services to an audit client

IFAC’s ‘Code of Ethics for Professional Accountants’ does not deal specifically with actuarial valuation services but with

valuation services in general.

A valuation comprises:

■ making assumptions about the future;

■ applying certain methodologies and techniques;

■ computing a value (or range of values) for an asset, a liability or for a business as a whole.

A self-review threat may be created when a firm or network firm2 performs a valuation for a financial statement audit

client that is to be incorporated into the client’s financial statements.

As an actuarial valuation service is likely to involve the valuation of matters material to the financial statements (e.g. the

present value of obligations) and the valuation involves a significant degree of subjectivity (e.g. length of service), the

self-review threat created cannot be reduced to an acceptable level of the application of any safeguard. Accordingly:

■ such valuation services should not be provided; or

■ the firm should withdraw from the financial statement audit engagement.

If the net liability was not material to the financial statements the self-review threat may be reduced to an acceptable

level by the application of safeguards such as:

■ involving an additional professional accountant who was not a member of the audit team to review the work done

by the actuary;

■ confirming with the audit client their understanding of the underlying assumptions of the valuation and the

methodology to be used and obtaining approval for their use;

■ obtaining the audit client‘s acknowledgement of responsibility for the results of the work performed by the firm; and

■ making arrangements so that the partner providing the actuarial services does not participate in the audit

engagement. -

第19题:

(c) With specific reference to Hugh Co, discuss the objective of a review engagement and contrast the level of

assurance provided with that provided in an audit of financial statements. (6 marks)

正确答案:

(c) The objective of a review engagement is to enable the auditor to obtain moderate assurance as to whether the financial

statements have been prepared in accordance with an identified financial reporting framework. This is defined in ISRE 2400

Engagements to Review Financial Statements.

In order to obtain this assurance, it is necessary to gather evidence using analytical procedures and enquiries with

management. Detailed substantive procedures will not be performed unless the auditor has reason to believe that the

information may be materially misstated.

The auditor should approach the engagement with a high degree of professional scepticism, looking for circumstances that

may cause the financial statements to be misstated. For example, in Hugh Co, the fact that the preparer of the financial

statements is part-qualified may lead the auditor to believe that there is a high inherent risk that the figures are misstated.

As a result of procedures performed, the auditor’s objective is to provide a clear written expression of negative assurance on

the financial statements. In a review engagement the auditor would state that ‘we are not aware of any material modifications

that should be made to the financial statements….’

This is normally referred to as an opinion of ‘negative assurance’.

Negative assurance means that the auditor has performed limited procedures and has concluded that the financial statements

appear reasonable. The user of the financial statements gains some comfort that the figures have been subject to review, but

only a moderate level of assurance is provided. The user may need to carry out additional procedures of their own if they

want to rely on the financial statements. For example, if Hugh Co were to use the financial statements as a means to raise

further bank finance, the bank would presumably perform, or require Hugh Co to perform, additional procedures to provide

a higher level of assurance as to the validity of the figures contained in the financial statements.

In comparison, in an audit, a high level of assurance is provided. The auditors provide an opinion of positive, but not absolute

assurance. The user is assured that the figures are free from material misstatement and that the auditor has based the opinion

on detailed procedures. -

第20题:

3 (a) Financial statements often contain material balances recognised at fair value. For auditors, this leads to additional

audit risk.

Required:

Discuss this statement. (7 marks)

正确答案:

3 Poppy Co

(a) Balances held at fair value are frequently recognised as material items in the statement of financial position. Sometimes it is

required by the financial reporting framework that the measurement of an asset or liability is at fair value, e.g. certain

categories of financial instruments, whereas it is sometimes the entity’s choice to measure an item using a fair value model

rather than a cost model, e.g. properties. It is certainly the case that many of these balances will be material, meaning that

the auditor must obtain sufficient appropriate evidence that the fair value measurement is in accordance with the

requirements of financial reporting standards. ISA 540 (Revised and Redrafted) Auditing Accounting Estimates Including Fair

Value Accounting Estimates and Related Disclosures and ISA 545 Auditing Fair Value Measurements and Disclosures

contain guidance in this area.

As part of the understanding of the entity and its environment, the auditor should gain an insight into balances that are stated

at fair value, and then assess the impact of this on the audit strategy. This will include an evaluation of the risk associated

with the balance(s) recognised at fair value.

Audit risk comprises three elements; each is discussed below in the context of whether material balances shown at fair value

will lead to increased risk for the auditor.

Inherent risk

Many measurements based on estimates, including fair value measurements, are inherently imprecise and subjective in

nature. The fair value assessment is likely to involve significant judgments, e.g. regarding market conditions, the timing of

cash flows, or the future intentions of the entity. In addition, there may be a deliberate attempt by management to manipulate

the fair value to achieve a desired aim within the financial statements, in other words to attempt some kind of window

dressing.

Many fair value estimation models are complicated, e.g. discounted cash flow techniques, or the actuarial calculations used

to determine the value of a pension fund. Any complicated calculations are relatively high risk, as difficult valuation techniques

are simply more likely to contain errors than simple valuation techniques. However, there will be some items shown at fair

value which have a low inherent risk, because the measurement of fair value may be relatively straightforward, e.g. assets

that are regularly bought and sold on open markets that provide readily available and reliable information on the market prices

at which actual exchanges occur.

In addition to the complexities discussed above, some fair value measurement techniques will contain significant

assumptions, e.g. the most appropriate discount factor to use, or judgments over the future use of an asset. Management

may not always have sufficient experience and knowledge in making these judgments.

Thus the auditor should approach some balances recognised at fair value as having a relatively high inherent risk, as their

subjective and complex nature means that the balance is prone to contain an error. However, the auditor should not just

assume that all fair value items contain high inherent risk – each balance recognised at fair value should be assessed for its

individual level of risk.

Control risk

The risk that the entity’s internal monitoring system fails to prevent and detect valuation errors needs to be assessed as part

of overall audit risk assessment. One problem is that the fair value assessment is likely to be performed once a year, outside

the normal accounting and management systems, especially where the valuation is performed by an external specialist.

Therefore, as a non-routine event, the assessment of fair value is likely not to have the same level of monitoring or controls