16 Which of the following events between the balance sheet date and the date the financial statements areauthorised for issue must be adjusted in the financial statements?1 Declaration of equity dividends.2 Decline in market value of investments.3 The ann

题目

16 Which of the following events between the balance sheet date and the date the financial statements are

authorised for issue must be adjusted in the financial statements?

1 Declaration of equity dividends.

2 Decline in market value of investments.

3 The announcement of changes in tax rates.

4 The announcement of a major restructuring.

A 1

A 1 only

B 2 and 4

C 3 only

D None of them

相似考题

参考答案和解析

更多“16 Which of the following events between the balance sheet date and the date the financial statements areauthorised for issue must be adjusted in the financial statements?1 Declaration of equity dividends.2 Decline in market value of investments.3 The ann”相关问题

-

第1题:

5 Financial statements have seen an increasing move towards the use of fair values in accounting. Advocates of ‘fair

value accounting’ believe that fair value is the most relevant measure for financial reporting whilst others believe that

historical cost provides a more useful measure.

Issues have been raised over the reliability and measurement of fair values, and over the nature of the current level

of disclosure in financial statements in this area.

Required:

(a) Discuss the problems associated with the reliability and measurement of fair values and the nature of any

additional disclosures which may be required if fair value accounting is to be used exclusively in corporate

reporting. (13 marks)

正确答案:

(a) Reliability and Measurement

Fair value can be defined as the price that would be received to sell an asset or paid to transfer a liability. The fair value can

be thought of as an ‘exit price’. A fair value measurement assumes that the transaction to sell the asset or transfer the liability

occurs in the principal market for the asset or liability or, in the absence of a principal market, the most advantageous market

for the asset or liability which is the market in which the reporting entity would sell the asset or transfer the liability with the

price that maximises the amount that would be received or minimises the amount that would be paid. IAS39 ‘Financial

Instruments: Recognition and Measurement’ requires an entity to use the most advantageous active market in measuring the

fair value of a financial asset or liability when multiple markets exist whereas IAS41 ‘Agriculture’ requires an entity to use the

most relevant market. Thus there can be different approaches for estimating exit prices. Additionally valuation techniques and

current replacement cost could be used.

A hierarchy of fair value measurements would have to be developed in order to convey information about the nature of the

information used in creating the fair values. For example quoted prices (unadjusted) in active markets would provide better

quality information than quoted prices for similar assets and liabilities in active markets which would provide better quality

information than prices which reflect the reporting entity’s own thinking about the assumptions that market participants would

use in pricing the asset or liability. Enron made extensive use of what it called ‘mark-to-market’ accounting which was based

on valuation techniques and estimates. IFRSs currently do not have a single hierarchy that applies to all fair value measures.

Instead individual standards indicate preferences for certain inputs and measures of fair value over others, but this guidance

is not consistent among all IFRSs.

Some companies, in order to effectively manage their businesses, have already developed models for determining fair values.

Businesses manage their operations by managing risks. A risk management process often requires measurement of fair values

of contracts, financial instruments, and risk positions.

If markets were liquid and transparent for all assets and liabilities, fair value accounting clearly would give reliable information

which is useful in the decision making process. However, because many assets and liabilities do not have an active market,

the inputs and methods for estimating their fair value are more subjective and, therefore, the valuations are less reliable. Fair

value estimates can vary greatly, depending on the valuation inputs and methodology used. Where management uses

significant judgment in selecting market inputs when market prices are not available, reliability will continue to be an issue.

Management can use significant judgment in the valuation process. Management bias, whether intentional or unintentional,

may result in inappropriate fair value measurements and consequently misstatements of earnings and equity capital. Without

reliable fair value estimates, the potential for misstatements in financial statements prepared using fair value measurements

will be even greater.

Consideration must be given to revenue recognition issues in a fair value system. It must be ensured that unearned revenue

is not recognised early as it recently was by certain high-tech companies.

As the variety and complexity of financial instruments increases, so does the need for independent verification of fair value

estimates. However, verification of valuations that are not based on observable market prices is very challenging. Users of

financial statements will need to place greater emphasis on understanding how assets and liabilities are measured and how

reliable these valuations are when making decisions based on them.

Disclosure

Fair values reflect point estimates and do not result in transparent financial statements. Additional disclosures are necessary

to bring meaning to these fair value estimates. These disclosures might include key drivers affecting valuations, fair-valuerange

estimates, and confidence levels. Another important disclosure consideration relates to changes in fair value amounts.

For example, changes in fair values on securities can arise from movements in interest rates, foreign-currency rates, and credit

quality, as well as purchases and sales from the portfolio. For users to understand fair value estimates, they must be given

adequate disclosures about what factors caused the changes in fair value. It could be argued that the costs involved in

determining fair values may exceed the benefits derived therefrom. When considering how fair value information should be

presented in the financial statements, it is important to consider what type of financial information investors want. There are

indications that some investors desire both fair value information and historical cost information. One of the issues affecting

the credibility of fair value disclosures currently is that a number of companies include ‘health warnings’ with their disclosures

indicating that the information is not used by management. This language may contribute to users believing that the fair value

disclosures lack credibility.

-

第2题:

5 An enterprise has made a material change to an accounting policy in preparing its current financial statements.

Which of the following disclosures are required by IAS 8 Accounting policies, changes in accounting estimates

and errors in these financial statements?

1 The reasons for the change.

2 The amount of the consequent adjustment in the current period and in comparative information for prior periods.

3 An estimate of the effect of the change on future periods, where possible.

A 1 and 2 only

B 1 and 3 only

C 2 and 3 only

D All three items

正确答案:A

-

第3题:

19 Which of the following statements about intangible assets in company financial statements are correct according

to international accounting standards?

1 Internally generated goodwill should not be capitalised.

2 Purchased goodwill should normally be amortised through the income statement.

3 Development expenditure must be capitalised if certain conditions are met.

A 1 and 3 only

B 1 and 2 only

C 2 and 3 only

D All three statements are correct

正确答案:A

-

第4题:

22 Which of the following statements about limited liability companies’ accounting is/are correct?

1 A revaluation reserve arises when a non-current asset is sold at a profit.

2 The authorised share capital of a company is the maximum nominal value of shares and loan notes the company

may issue.

3 The notes to the financial statements must contain details of all adjusting events as defined in IAS10 Events after

the balance sheet date.

A All three statements

B 1 and 2 only

C 2 and 3 only

D None of the statements

正确答案:D

-

第5题:

8 Which of the following statements about accounting concepts and conventions are correct?

(1) The money measurement concept requires all assets and liabilities to be accounted for at historical cost.

(2) The substance over form. convention means that the economic substance of a transaction should be reflected in

the financial statements, not necessarily its legal form.

(3) The realisation concept means that profits or gains cannot normally be recognised in the income statement until

realised.

(4) The application of the prudence concept means that assets must be understated and liabilities must be overstated

in preparing financial statements.

A 1 and 3

B 2 and 3

C 2 and 4

D 1 and 4.

正确答案:B

-

第6题:

17 Which of the following statements are correct?

(1) All non-current assets must be depreciated.

(2) If goodwill is revalued, the revaluation surplus appears in the statement of changes in equity.

(3) If a tangible non-current asset is revalued, all tangible assets of the same class should be revalued.

(4) In a company’s published balance sheet, tangible assets and intangible assets must be shown separately.

A 1 and 2

B 2 and 3

C 3 and 4

D 1 and 4

正确答案:C

-

第7题:

(b) Seymour offers health-related information services through a wholly-owned subsidiary, Aragon Co. Goodwill of

$1·8 million recognised on the purchase of Aragon in October 2004 is not amortised but included at cost in the

consolidated balance sheet. At 30 September 2006 Seymour’s investment in Aragon is shown at cost,

$4·5 million, in its separate financial statements.

Aragon’s draft financial statements for the year ended 30 September 2006 show a loss before taxation of

$0·6 million (2005 – $0·5 million loss) and total assets of $4·9 million (2005 – $5·7 million). The notes to

Aragon’s financial statements disclose that they have been prepared on a going concern basis that assumes that

Seymour will continue to provide financial support. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Goodwill

(i) Matters

■ Cost of goodwill, $1·8 million, represents 3·4% consolidated total assets and is therefore material.

Tutorial note: Any assessments of materiality of goodwill against amounts in Aragon’s financial statements are

meaningless since goodwill only exists in the consolidated financial statements of Seymour.

■ It is correct that the goodwill is not being amortised (IFRS 3 Business Combinations). However, it should be tested

at least annually for impairment, by management.

■ Aragon has incurred losses amounting to $1·1 million since it was acquired (two years ago). The write-off of this

amount against goodwill in the consolidated financial statements would be material (being 61% cost of goodwill,

8·3% PBT and 2·1% total assets).

■ The cost of the investment ($4·5 million) in Seymour’s separate financial statements will also be material and

should be tested for impairment.

■ The fair value of net assets acquired was only $2·7 million ($4·5 million less $1·8 million). Therefore the fair

value less costs to sell of Aragon on other than a going concern basis will be less than the carrying amount of the

investment (i.e. the investment is impaired by at least the amount of goodwill recognised on acquisition).

■ In assessing recoverable amount, value in use (rather than fair value less costs to sell) is only relevant if the going

concern assumption is appropriate for Aragon.

■ Supporting Aragon financially may result in Seymour being exposed to actual and/or contingent liabilities that

should be provided for/disclosed in Seymour’s financial statements in accordance with IAS 37 Provisions,

Contingent Liabilities and Contingent Assets.

(ii) Audit evidence

■ Carrying values of cost of investment and goodwill arising on acquisition to prior year audit working papers and

financial statements.

■ A copy of Aragon’s draft financial statements for the year ended 30 September 2006 showing loss for year.

■ Management’s impairment test of Seymour’s investment in Aragon and of the goodwill arising on consolidation at

30 September 2006. That is a comparison of the present value of the future cash flows expected to be generated

by Aragon (a cash-generating unit) compared with the cost of the investment (in Seymour’s separate financial

statements).

■ Results of any impairment tests on Aragon’s assets extracted from Aragon’s working paper files.

■ Analytical procedures on future cash flows to confirm their reasonableness (e.g. by comparison with cash flows for

the last two years).

■ Bank report for audit purposes for any guarantees supporting Aragon’s loan facilities.

■ A copy of Seymour’s ‘comfort letter’ confirming continuing financial support of Aragon for the foreseeable future. -

第8题:

Apart from borrowing from hanks, a firm or an individual can obtain funds in a financial market in two ways. The most common method is to issue a (61) , such as a bond or a mortgage, which is a (62) by the borrower to pay the holder of it at (63) until a specified date, when a final payment is made. The (64) of it is the time of expiration date. The second method of raising funds is by issuing (65) , such as common stock, which are claims to share in the net income and the assets of a business.

(46)

A.debt instrument

B.letter of credit

C.letter of guarantee

D.certificate of deposit

正确答案:A

解析:句意:最常见的一种方法是发行债务工具,比如债券或抵押。debt instrument债务工具。letter of credit信用证。letter of guarantee保证函。certificate of deposit大额定期存单。 -

第9题:

If the market price of the financial instrument concerned should be higher on the delivery date than the price agreed in the financial future contract ______ will make a profit.

A.the seller

B.the buyer

C.the broker

D.the dealer

正确答案:B

解析:第一段第二句Under such a contract, if the market price…the buyer can obtain a price or yield which is settled at the time the contract is agreed,意指在交易日,如果金融工具的市场价格高于合同约定价格,或者说市场收益率低于合同收益率,卖方有义务弥补差价,买方则获得在合约中约定好的价格或收益。南此可见,买方受益。或者可以根据后面举的情况相反例子,反过来推断出买方受益。 -

第10题:

The book value of a fixed asset reported on the balance sheet represents its market value on that date.()

正确答案:错

-

第11题:

Under certain circumstances, profits made on transactions between members of a group need to be eliminated from the consolidated financial statements under IFRS.

Which of the following statements about intra-group profits in consolidated financial statements is/are correct?

(i) The profit made by a parent on the sale of goods to a subsidiary is only realised when the subsidiary sells the goods to a third party

(ii) Eliminating intra-group unrealised profits never affects non-controlling interests

(iii) The profit element of goods supplied by the parent to an associate and held in year-end inventory must be eliminated in full

A.(i) only

B.(i) and (ii)

C.(ii) and (iii)

D.(iii) only

正确答案:A(i) is the only correct elimination required by IFRS.

-

第12题:

会计报表(Financial Statements)

正确答案: 是会计报告的核心内容,也称财务报表。是指综合反映企业某一特定日期资产、负债和所有者权益及其结构情况,某一特定时期经营成果的实现及分配情况和某一特定时期先紧流入、现金流出及净增加情况的书面文件。它有主表和相关的附表组成,其中主表包括资产负债表、利润表和现金流量表,附表包括资产减值准备明细表、利润分配表等。全面反映企业在一定时期内经营成果、现金流量和截止时点的财务状况的报告文件。 -

第13题:

(b) Discuss the relative costs to the preparer and benefits to the users of financial statements of increased

disclosure of information in financial statements. (14 marks)

Quality of discussion and reasoning. (2 marks)

正确答案:

(b) Increased information disclosure benefits users by reducing the likelihood that they will misallocate their capital. This is

obviously a direct benefit to individual users of corporate reports. The disclosure reduces the risk of misallocation of capital

by enabling users to improve their assessments of a company’s prospects. This creates three important results.

(i) Users use information disclosed to increase their investment returns and by definition support the most profitable

companies which are likely to be those that contribute most to economic growth. Thus, an important benefit of

information disclosure is that it improves the effectiveness of the investment process.

(ii) The second result lies in the effect on the liquidity of the capital markets. A more liquid market assists the effective

allocation of capital by allowing users to reallocate their capital quickly. The degree of information asymmetry between

the buyer and seller and the degree of uncertainty of the buyer and the seller will affect the liquidity of the market as

lower asymmetry and less uncertainty will increase the number of transactions and make the market more liquid.

Disclosure will affect uncertainty and information asymmetry.

(iii) Information disclosure helps users understand the risk of a prospective investment. Without any information, the user

has no way of assessing a company’s prospects. Information disclosure helps investors predict a company’s prospects.

Getting a better understanding of the true risk could lower the price of capital for the company. It is difficult to prove

however that the average cost of capital is lowered by information disclosure, even though it is logically and practically

impossible to assess a company’s risk without relevant information. Lower capital costs promote investment, which can

stimulate productivity and economic growth.

However although increased information can benefit users, there are problems of understandability and information overload.

Information disclosure provides a degree of protection to users. The benefit is fairness to users and is part of corporate

accountability to society as a whole.

The main costs to the preparer of financial statements are as follows:

(i) the cost of developing and disseminating information,

(ii) the cost of possible litigation attributable to information disclosure,

(iii) the cost of competitive disadvantage attributable to disclosure.

The costs of developing and disseminating the information include those of gathering, creating and auditing the information.

Additional costs to the preparers include training costs, changes to systems (for example on moving to IFRS), and the more

complex and the greater the information provided, the more it will cost the company.

Although litigation costs are known to arise from information disclosure, it does not follow that all information disclosure leads

to litigation costs. Cases can arise from insufficient disclosure and misleading disclosure. Only the latter is normally prompted

by the presentation of information disclosure. Fuller disclosure could lead to lower costs of litigation as the stock market would

have more realistic expectations of the company’s prospects and the discrepancy between the valuation implicit in the market

price and the valuation based on a company’s financial statements would be lower. However, litigation costs do not

necessarily increase with the extent of the disclosure. Increased disclosure could reduce litigation costs.

Disclosure could weaken a company’s ability to generate future cash flows by aiding its competitors. The effect of disclosure

on competitiveness involves benefits as well as costs. Competitive disadvantage could be created if disclosure is made relating

to strategies, plans, (for example, planned product development, new market targeting) or information about operations (for

example, production-cost figures). There is a significant difference between the purpose of disclosure to users and

competitors. The purpose of disclosure to users is to help them to estimate the amount, timing, and certainty of future cash

flows. Competitors are not trying to predict a company’s future cash flows, and information of use in that context is not

necessarily of use in obtaining competitive advantage. Overlap between information designed to meet users’ needs and

information designed to further the purposes of a competitor is often coincidental. Every company that could suffer competitive

disadvantage from disclosure could gain competitive advantage from comparable disclosure by competitors. Published figures

are often aggregated with little use to competitors.

Companies bargain with suppliers and with customers, and information disclosure could give those parties an advantage in

negotiations. In such cases, the advantage would be a cost for the disclosing entity. However, the cost would be offset

whenever information disclosure was presented by both parties, each would receive an advantage and a disadvantage.

There are other criteria to consider such as whether the information to be disclosed is about the company. This is both a

benefit and a cost criterion. Users of corporate reports need company-specific data, and it is typically more costly to obtain

and present information about matters external to the company. Additionally, consideration must be given as to whether the

company is the best source for the information. It could be inefficient for a company to obtain or develop data that other, more

expert parties could develop and present or do develop at present.

There are many benefits to information disclosure and users have unmet information needs. It cannot be known with any

certainty what the optimal disclosure level is for companies. Some companies through voluntary disclosure may have

achieved their optimal level. There are no quantitative measures of how levels of disclosure stand with respect to optimal

levels. Standard setters have to make such estimates as best they can, guided by prudence, and by what evidence of benefits

and costs they can obtain. -

第14题:

9 Which of the following items must be disclosed in a company’s published financial statements (including notes)

if material, according to IAS1 Presentation of financial statements?

1 Finance costs.

2 Staff costs.

3 Depreciation and amortisation expense.

4 Movements on share capital.

A 1 and 3 only

B 1, 2 and 4 only

C 2, 3 and 4 only

D All four items

正确答案:D

-

第15题:

20 Which of the following events occurring after the balance sheet date are classified as adjusting, if material?

1 The sale of inventories valued at cost at the balance sheet date for a figure in excess of cost.

2 A valuation of land and buildings providing evidence of an impairment in value at the year end.

3 The issue of shares and loan notes.

4 The insolvency of a customer with a balance outstanding at the year end.

A 1 and 3

B 2 and 4

C 2 and 3

D 1 and 4

正确答案:B

-

第16题:

5 Which of the following events after the balance sheet date would normally qualify as adjusting events according

to IAS 10 Events after the balance sheet date?

1 The bankruptcy of a credit customer with a balance outstanding at the balance sheet date.

2 A decline in the market value of investments.

3 The declaration of an ordinary dividend.

4 The determination of the cost of assets purchased before the balance sheet date.

A 1, 3, and 4

B 1 and 2 only

C 2 and 3 only

D 1 and 4 only

正确答案:D

-

第17题:

12 Which of the following statements are correct?

(1) Contingent assets are included as assets in financial statements if it is probable that they will arise.

(2) Contingent liabilities must be provided for in financial statements if it is probable that they will arise.

(3) Details of all adjusting events after the balance sheet date must be given in notes to the financial statements.

(4) Material non-adjusting events are disclosed by note in the financial statements.

A 1 and 2

B 2 and 4

C 3 and 4

D 1 and 3

正确答案:B

-

第18题:

21 Which of the following items must be disclosed in a company’s published financial statements?

1 Authorised share capital

2 Movements in reserves

3 Finance costs

4 Movements in non-current assets

A 1, 2 and 3 only

B 1, 2 and 4 only

C 2, 3 and 4 only

D All four items

正确答案:D

-

第19题:

听力原文:M: There are several reasons why careful analysis of financial statements is necessary. What are they?

W: First, financial statements are general-purpose statements. Secondly, the relationships between amounts on successive financial statements are not obvious without analysis. And thirdly, users of financial statements may be interested in seeing how well a company is performing.

Q: What are they talking about?

(17)

A.The methods of financial statements.

B.The necessity of careful analysis of financial statements

C.The relationship among financial statements.

D.The purpose of financial statements.

正确答案:B

解析:男士问的是仔细分析财务报表的必要性的理由,故B选项符合。D项说的是财务报表的目的,并非分析财务报表的目的。 -

第20题:

A financial future is a contract to buy or sell certain forms of money at a specified date ______.

A.with spot rate

B.with forward rate

C.at the market price

D.at the price fixed at the time of the deal

正确答案:D

解析:第一段第一句A financial future is…, with the price agreed at the time of the deal. -

第21题:

听力原文:M: Can you tell me something about a balance sheet?

W: Yes. It is divided into three sections: assets, liabilities, and owner's equity and it is used to summarize a company's financial position on a given date.

Q: Which of the following is not a section of a balance sheet?

(15)

A.Profit and Joss

B.Owner's equity.

C.Liabilities

D.Assets.

正确答案:A

解析:根据女士回答资产负债表分为三部分,即"assets", "liabilities" 和"owner's equity",A项未提及。 -

第22题:

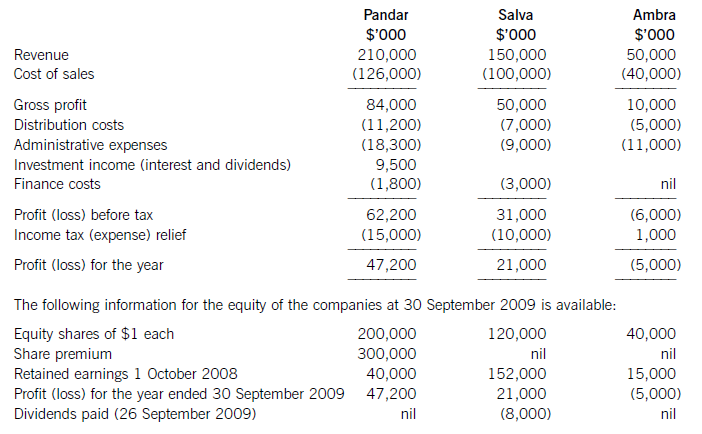

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

正确答案:

-

第23题:

A financial institution is required to store their monthly transaction statements for 7 years. Theremust be proof that upon closure of the statements there is no alteration to the files after that date.Which of the following would the storage specialist discuss as a possible course of action to meetthis requirement?()

- A、archive data to encrypted disk

- B、archive data to LTO-5 WORM media

- C、backup data todeduplicated disk pools

- D、backup data to encrypted LTO-5 using standard media

正确答案:B