(c) Discuss the ways in which budgets and the budgeting process can be used to motivate managers toendeavour to meet the objectives of the company. Your answer should refer to:(i) setting targets for financial performance;(ii) participation in the budget-

题目

(c) Discuss the ways in which budgets and the budgeting process can be used to motivate managers to

endeavour to meet the objectives of the company. Your answer should refer to:

(i) setting targets for financial performance;

(ii) participation in the budget-setting process. (12 marks)

相似考题

参考答案和解析

(c) Examiner’s Note:

The topic of managerial motivation and budgeting has been a subject of discussion for a number of years. There are links

here to the topics of performance measurement and responsibility accounting. Discussion should be focused on the area of

budgets and the budgeting process, as specified in the question.

Setting targets for financial performance

It has been reasonably established that managers respond better in motivation and performance terms to a clearly defined,

quantitative target than to the absence of such targets. However, budget targets must be accepted by the responsible

managers if they are to have any motivational effect. Acceptance of budget targets will depend on several factors, including

the personality of an individual manager and the quality of communication in the budgeting process.

The level of difficulty of the budget target will also influence the level of motivation and performance. Budget targets that are

seen as average or above average will increase motivation and performance up to the point where such targets are seen as

impossible to achieve. Beyond this point, personal desire to achieve a particular level of performance falls off sharply. Careful

thought must therefore go into establishing budget targets, since the best results in motivation and performance terms will

arise from the most difficult goals that individual managers are prepared to accept4.

While budget targets that are seen as too difficult will fail to motivate managers to improve their performance, the same is

true of budget targets that are seen as being too easy. When budget targets are easy, managers are likely to outperform. the

budget but will fail to reach the level of performance that might be expected in the absence of a budget.

One consequence of the need for demanding or difficult budget targets is the frequent reporting of adverse variances. It is

important that these are not used to lay blame in the budgetary control process, since they have a motivational (or planning)

origin rather than an operational origin. Managerial reward systems may need to reward almost achieving, rather than

achieving, budget targets if managers are to be encouraged by receiving financial incentives.

Participation in the budget-setting process

A ‘top-down’ approach to budget setting leads to budgets that are imposed on managers. Where managers within an

organisation are believed to behave in a way that is consistent with McGregor’s Theory X perspective, imposed budgets may

improve performance, since accepting the budget is consistent with reduced responsibility and avoiding work.

It is also possible that acceptance of imposed budgets by managers who are responsible for their implementation and

achievement is diminished because they feel they have not been able to influence budget targets. Such a view is consistent

with McGregor’s Theory Y perspective, which holds that managers naturally seek responsibility and do not need to be tightly

controlled. According to this view, managers respond well to participation in the budget-setting process, since being able to

influence the budget targets for which they will be responsible encourages their acceptance. A participative approach to

budget-setting is also referred to as a ‘bottom-up’ approach.

In practice, many organisations adopt a budget-setting process that contains elements of both approaches, with senior

management providing strategic leadership of the budget-setting process and other management tiers providing input in terms

of identifying what is practical and offering detailed knowledge of their area of the organisation.

更多“(c) Discuss the ways in which budgets and the budgeting process can be used to motivate managers toendeavour to meet the objectives of the company. Your answer should refer to:(i) setting targets for financial performance;(ii) participation in the budget-”相关问题

-

第1题:

(b) Discuss how the operating statement you have produced can assist managers in:

(i) controlling variable costs;

(ii) controlling fixed production overhead costs. (8 marks)

正确答案:(b) Controlling variable costs

The first step in the process of controlling costs is to measure actual costs. The second step is to calculate variances that show

the difference between actual costs and budgeted or standard costs. These variances then need to be reported to those

managers who have responsibility for them. These managers can then decide whether action needs to be taken to bring actual

costs back into line with budgeted or standard costs. The operating statement therefore has a role to play in reporting

information to management in a way that assists in the decision-making process.

The operating statement quantifies the effect of the volume difference between budgeted and actual sales so that the actual

cost of the actual output can be compared with the standard (or budgeted) cost of the actual output. The statement clearly

differentiates between adverse and favourable variances so that managers can identify areas where there is a significant

difference between actual results and planned performance. This supports management by exception, since managers can

focus their efforts on these significant areas in order to obtain the most impact in terms of getting actual operations back in

line with planned activity.

In control terms, variable costs can be affected in the short term and so an operating statement for the last month showing

variable cost variances will highlight those areas where management action may be effective. In the short term, for example,

managers may be able to improve labour efficiency through training, or through reducing or eliminating staff actions which

do not assist the production process. In this way the adverse direct labour efficiency variance of £252, which is 7·3% of the

standard direct labour cost of the actual output, could be reduced.

Controlling fixed production overhead costs

In the short term, it is unlikely that fixed production overhead costs can be controlled. An operating statement from last month

showing fixed production overhead variances may not therefore assist in controlling fixed costs. Managers will not be able to

take any action to correct the adverse fixed production overhead expenditure variance, for example, which may in fact simply

show the need for improvement in the area of budget planning. Investigation of the component parts of fixed production

overhead will show, however, whether any of these are controllable. In general, this is not the case2.

Absorption costing gives rise to a fixed production overhead volume variance, which shows the effect of actual production

being different from planned production. Since fixed production overheads are a sunk cost, the volume variance shows little

more than that the standard hours for actual production were different from budgeted standard hours3. Similarly, the fixed

production overhead efficiency variance offers little more in information terms than the direct labour efficiency variance. While

fixed production overhead variances assist in reconciling budgeted profit with actual profit, therefore, their reporting in an

operating statement is unlikely to assist in controlling fixed costs. -

第2题:

(c) Discuss how the manipulation of financial statements by company accountants is inconsistent with their

responsibilities as members of the accounting profession setting out the distinguishing features of a

profession and the privileges that society gives to a profession. (Your answer should include reference to the

above scenario.) (7 marks)

Note: requirement (c) includes 2 marks for the quality of the discussion.

正确答案:

(c) Accounting and ethical implications of sale of inventory

Manipulation of financial statements often does not involve breaking laws but the purpose of financial statements is to present

a fair representation of the company’s position, and if the financial statements are misrepresented on purpose then this could

be deemed unethical. The financial statements in this case are being manipulated to show a certain outcome so that Hall

may be shown to be in a better financial position if the company is sold. The retained earnings of Hall will be increased by

$4 million, and the cash received would improve liquidity. Additionally this type of transaction was going to be carried out

again in the interim accounts if Hall was not sold. Accountants have the responsibility to issue financial statements that do

not mislead the public as the public assumes that such professionals are acting in an ethical capacity, thus giving the financial

statements credibility.

A profession is distinguished by having a:

(i) specialised body of knowledge

(ii) commitment to the social good

(iii) ability to regulate itself

(iv) high social status

Accountants should seek to promote or preserve the public interest. If the idea of a profession is to have any significance,

then it must make a bargain with society in which they promise conscientiously to serve the public interest. In return, society

allocates certain privileges. These might include one or more of the following:

– the right to engage in self-regulation

– the exclusive right to perform. particular functions

– special status

There is more to being an accountant than is captured by the definition of the professional. It can be argued that accountants

should have the presentation of truth, in a fair and accurate manner, as a goal. -

第3题:

Discuss the principles and practices which should be used in the financial year to 30 November 2008 to account

for:(c) the purchase of handsets and the recognition of revenue from customers and dealers. (8 marks)

Appropriateness and quality of discussion. (2 marks)

正确答案:Handsets and revenue recognition

The inventory of handsets should be measured at the lower of cost and net realisable value (IAS2, ‘Inventories’, para 9). Johan

should recognise a provision at the point of purchase for the handsets to be sold at a loss. The inventory should be written down

to its net realisable value (NRV) of $149 per handset as they are sold both to prepaid customers and dealers. The NRV is $51

less than cost. Net realisable value is the estimated selling price in the normal course of business less the estimated selling costs.

IAS18, ‘Revenue’, requires the recognition of revenue by reference to the stage of completion of the transaction at the reporting

date. Revenue associated with the provision of services should be recognised as service as rendered. Johan should record the

receipt of $21 per call card as deferred revenue at the point of sale. Revenue of $18 should be recognised over the six month

period from the date of sale. The unused call credit of $3 would be recognised when the card expires as that is the point at which

the obligation of Johan ceases. Revenue is earned from the provision of services and not from the physical sale of the card.

IAS18 does not deal in detail with agency arrangements but says the gross inflows of economic benefits include amounts collected

on behalf of the principal and which do not result in increases in equity for the entity. The amounts collected on behalf of the

principal are not revenue. Revenue is the amount of the ‘commission’. Additionally where there are two or more transactions, they

should be taken together if the commercial effect cannot be understood without reference to the series of transactions as a whole.

As a result of the above, Johan should not recognise revenue when the handset is sold to the dealer, as the dealer is acting as an

agent for the sale of the handset and the service contract. Johan has retained the risk of the loss in value of the handset as they

can be returned by the dealer and the price set for the handset is under the control of Johan. The handset sale and the provision

of the service would have to be assessed as to their separability. However, the handset cannot be sold separately and is

commercially linked to the provision of the service. Johan would, therefore, recognise the net payment of $130 as a customer

acquisition cost which may qualify as an intangible asset under IAS38, and the revenue from the service contract will be recognised

as the service is rendered. The intangible asset would be amortised over the 12 month contract. The cost of the handset from the

manufacturer will be charged as cost of goods sold ($200). -

第4题:

(b) Discuss ways in which the traditional budgeting process may be seen as a barrier to the achievement of the

aims of EACH of the following models for the implementation of strategic change:

(i) benchmarking;

(ii) balanced scorecard; and

(iii) activity-based models. (12 marks)

正确答案:

(b) Benchmarking

Benchmarks enable goals to be set that may be based on either external measures of ‘best practice’ organisations or internal

cross-functional comparisons which exhibit ‘best practice’. A primary aim of the traditional budgeting process is the setting of

realistic targets that can be achieved within the budget period. The setting of realistic targets means that the extent of

underperformance against ‘best practice’ standards loses visibility, and thus short-term financial targets remain the

predominant focus of the traditional budgeting process. It is arguable that because the budgetary reporting system purports

to give managers ‘control’, there is very little real incentive to seek out benchmarks which may be used to raise budgeted

performance targets. Much depends upon the prevailing organisational culture since benchmarking may be viewed as an

attempt by top management to impose impossible targets upon operational managers. The situation is further exacerbated

where organisations do not measure their success relative to their competition.

Balanced scorecard

The Balanced scorecard is often misunderstood as a consequence of the failure by top management to ensure that it is

implemented effectively within the organisation. Thus it may be viewed as the addition of a few non-financial measures to

the conventional budget. In an attempt to overcome this misperception many management teams now establish a

performance-rewards linkage based upon the achievement of Scorecard targets for the forthcoming budget period.

Unfortunately this can precipitate dysfunctional behaviour at every level within the organisation.

Even in situations where the Scorecard has been well-designed and well-implemented it is difficult for it to gain widespread

acceptance. This is because all too often there exists a culture which places a very high value upon the achievement of the

fixed annual targets in order to avoid the loss of status, recognition and rewards.

A well-constructed Scorecard contains a mix of long-term and short-term measures and therefore drives the company in the

direction of medium-term strategic goals which are supported by cross-functional initiatives. On the other hand, the budgeting

process focuses the organisation on the achievement of short-term financial goals supported by the initiatives of individual

departments. Budgets can also act as an impediment to the acceptance of responsibility by local managers for the

achievement of the Scorecard targets. This is often the case in situations where a continued emphasis exists on meeting shortterm

e.g. quarterly targets.

Activity-based models

Traditional budgets show the costs of functions and departments (e.g. staff costs and establishment costs) instead of the costs

of those activities that are performed by people (e.g. receipt of goods inwards, processing and dispatch of orders etc). Thus

managers have no visibility of the real ‘cost drivers’ of their business. In addition, it is probable that a traditional budget

contains a significant amount of non-value-added costs that are not visible to the managers. The annual budget also tends

to fix capacity for the forthcoming budget period thereby undermining the potential of Activity-based management (ABM)

analysis to determine required capacity from a customer demand perspective. Those experienced in the use of ABM

techniques are used to dealing with such problems, however their tasks would be much easier to perform. and their results

made more reliable if these problems were removed. -

第5题:

(b) Using the information contained in Appendix 1.1, discuss the financial performance of HLP and MAS,

incorporating details of the following in your discussion:

(i) Overall client fees (total and per consultation)

(ii) Advisory protection scheme consultation ‘utilisation levels’ for both property and commercial clients

(iii) Cost/expense levels. (10 marks)

正确答案:

(ii) As far as annual agreements relating to property work are concerned, HLP had a take up rate of 82·5% whereas MAS

had a take up rate of only 50%. Therefore, HLP has ‘lost out’ to competitor MAS in relative financial terms as regards

the ‘take-up’ of consultations relating to property work. This is because both HLP and MAS received an annual fee from

each property client irrespective of the number of consultations given. MAS should therefore have had a better profit

margin from this area of business than HLP. However, the extent to which HLP has ‘lost out’ cannot be quantified since

we would need to know the variable costs per consultation and this detail is not available. What we do know is that

HLP earned actual revenue per effective consultation amounting to £90·90 whereas the budgeted revenue per

consultation amounted to £100. MAS earned £120 per effective consultation.

The same picture emerges from annual agreements relating to commercial work. HLP had a budgeted take up rate of

50%, however the actual take up rate during the period was 90%. MAS had an actual take up rate of 50%. The actual

revenue per effective consultation earned by HLP amounted to £167 whereas the budgeted revenue per consultation

amounted to £300. MAS earned £250 per effective consultation.

There could possibly be an upside to this situation for HLP in that it might be the case that the uptake of 90% of

consultations without further charge by clients holding annual agreements in respect of commercial work might be

indicative of a high level of customer satisfaction. It could on the other hand be indicative of a mindset which says ‘I

have already paid for these consultations therefore I am going to request them’.

(iii) Budgeted and actual salaries in HLP were £50,000 per annum, per advisor. Two additional advisors were employed

during the year in order to provide consultations in respect of commercial work. MAS paid a salary of £60,000 to each

advisor which is 20% higher than the salary of £50,000 paid to each advisor by HLP. Perhaps this is indicative that

the advisors employed by MAS are more experienced and/or better qualified than those employed by HLP.

HLP paid indemnity insurance of £250,000 which is £150,000 (150%) more than the amount of £100,000 paid by

MAS. This excess cost may well have arisen as a consequence of successful claims against HLP for negligence in

undertaking commercial work. It would be interesting to know whether HLP had been the subject of any successful

claims for negligent work during recent years as premiums invariably reflect the claims history of a business. Rather

worrying is the fact that HLP was subject to three such claims during the year ended 31 May 2007.

Significant subcontract costs were incurred by HLP during the year probably in an attempt to satisfy demand and retain

the goodwill of its clients. HLP incurred subcontract costs in respect of commercial properties which totalled £144,000.

These consultations earned revenue amounting to (320 x £150) = £48,000, hence a loss of £96,000 was incurred

in this area of the business.

HLP also paid £300,000 for 600 subcontract consultations in respect of litigation work. These consultations earned

revenue amounting to (600 x £250) = £150,000, hence a loss of £150,000 was incurred in this area of the business.

In contrast, MAS paid £7,000 for 20 subcontract consultations in respect of commercial work and an identical amount

for 20 subcontract consultations in respect of litigation work. These consultations earned revenue amounting to

20 x (£150 + £200) =£7,000. Therefore, a loss of only £7,000 was incurred in respect of subcontract consultations

by MAS.

Other operating expenses were budgeted at 53·0% of sales revenue. The actual level incurred was 40·7% of sales

revenue. The fixed/variable split of such costs is not given but it may well be the case that the fall in this percentage is

due to good cost control by HLP. However, it might simply be the case that the original budget was flawed. Competitor

MAS would appear to have a slightly superior cost structure to that of HLP since its other operating expenses amounted

to 38·4% of sales revenue. Further information is required in order to draw firmer conclusions regarding cost control

within both businesses. -

第6题:

(ii) Briefly discuss THREE disadvantages of using EVA? in the measurement of financial performance.

(3 marks)

正确答案:

(ii) Disadvantages of an EVA approach to the measurement of financial performance include:

(i) The calculation of EVA may be complicated due to the number of adjustments required.

(ii) It is difficult to use EVA for inter-firm and inter-divisional comparisons because it is not a ratio measure.

(iii) Economic depreciation is difficult to estimate and conflicts with generally accepted accounting principles.

Note: Other relevant discussion would be acceptable. -

第7题:

Which three statements correctly describe the features of the I/O calibration process?()A. Only one I/O calibration process can run at a time.

B. It automates the resource allocation for the Automated Maintenance Tasks.

C. It improves the performance of the performance-critical sessions while running.

D. It can be used to estimate the maximum number of I/Os and maximum latency time for the system.

E. The latency time is computed only when the TIMED_STATISTICS initialization parameter is set to TRUE.

参考答案:A, D, E

-

第8题:

Section B – TWO questions ONLY to be attempted

Perkin manufactures electronic components for export worldwide, from factories in Ceeland, for use in smartphones and hand held gaming devices. These two markets are supplied with similar components by two divisions, Phones Division (P) and Gaming Division (G). Each division has its own selling, purchasing, IT and research and development functions, but separate IT systems. Some manufacturing facilities, however, are shared between the two divisions.

Perkin’s corporate objective is to maximise shareholder wealth through innovation and continuous technological improvement in its products. The manufacturers of smartphones and gaming devices, who use Perkin’s components, update their products frequently and constantly compete with each other to launch models which are technically superior.

Perkin has a well-established incremental budgeting process. Divisional managers forecast sales volumes and costs months in advance of the budget year. These divisional budgets are then scrutinised by the main board, and revised significantly by them in line with targets they have set for the business. The finalised budgets are often approved after the start of the accounting year. Under pressure to deliver consistent returns to institutional shareholders, the board does not tolerate failure by either division to achieve the planned net profit for the year once the budget is approved. Last year’s results were poor compared to the annual budget. Divisional managers, who are appraised on the financial performance of their own division, have complained about the length of time that the budgeting process takes and that the performance of their divisions could have been better but was constrained by the budgets which were set for them.

In P Division, managers had failed to anticipate the high popularity of a new smartphone model incorporating a large screen designed for playing games, and had not made the necessary technical modifications to the division’s own components. This was due to the high costs of doing so, which had not been budgeted for. Based on the original sales forecast, P Division had already committed to manufacturing large quantities of the existing version of the component and so had to heavily discount these in order to achieve the planned sales volumes.

A critical material in the manufacture of Perkin’s products is silver, which is a commodity which changes materially in price according to worldwide supply and demand. During the year supplies of silver were reduced significantly for a short period of time and G Division paid high prices to ensure continued supply. Managers of G Division were unaware that P Division held large inventories of silver which they had purchased when the price was much lower.

Initially, G Division accurately forecasted demand for its components based on the previous years’ sales volumes plus the historic annual growth rate of 5%. However, overall sales volumes were much lower than budgeted. This was due to a fire at the factory of their main customer, which was then closed for part of the year. Reacting to this news, managers at G Division took action to reduce costs, including closing one of the three R&D facilities in the division.

However, when the customer’s factory reopened, G Division was unwilling to recruit extra staff to cope with increased demand; nor would P Division re-allocate shared manufacturing facilities to them, in case demand increased for its own products later in the year. As a result, Perkin lost the prestigious preferred supplier status from their main customer who was unhappy with G Division’s failure to effectively respond to the additional demand. The customer had been forced to purchase a more expensive, though technically superior, component from an alternative manufacturer.

The institutional shareholders’ representative, recently appointed to the board, has asked you as a performance management expert for your advice. ‘We need to know whether Perkin’s budgeting process is appropriate for the business, and how this contributed to last year’s poor performance’, she said, ‘and more importantly, how do we need to change the process to prevent this happening in the future, such as a move to beyond budgeting.’

Required:

(a) Evaluate the weaknesses in Perkin’s current budgeting system and whether it is suitable for the environment in which Perkin operates. (13 marks)

(b) Evaluate the impact on Perkin of moving to beyond budgeting. (12 marks)

正确答案:Tutor note: This is a detailed solution and candidates would not be expected to produce an answer of this length.

(a) Weaknesses in the current budget process at Perkin

Perkin uses a traditional approach to budgeting, which has a number of weaknesses.

First of all the budgeting system does not seem aligned with Perkin’s corporate objective which focuses on innovation and continuous product improvement. Innovation is a key competitive advantage to both component and device manufacturers in this industry and the products which incorporate Perkin’s components are subject to rapid technological change as well as changes in consumer trends. The markets in which the two divisions operate appear to be evolving, as seen by the high popularity of the smartphone model which was designed for playing games. This may mean the distinction between smartphone and gaming devices could be becoming less clear cut. Management time would probably be better spent considering these rapid changes and currently the budgeting process does not facilitate that.

In reality, the budget process at Perkin is time consuming and probably therefore a costly exercise. Divisional budgets go through a lengthy process of drafting and then revision by the main board before they are approved. The approval often happens after the start of the period to which they relate, at which point the budgets are already out of date. This also means divisional managers are trying to plan activities for the next financial year without a set of finalised targets agreed, which could impact the effectiveness of decisions made.

Another weakness is that the budgets are only prepared annually, which is clearly too infrequent for a business such as Perkin. The process is also rigid and inflexible as deviations from the planned targets are not tolerated. Sticking to rigid, annual budgets can lead to problems such as P Division not being able to cope with increasing popularity of a particular product and even other short-term changes in demand like those driven by seasonal factors, or one-off events such as the factory fire. Linked to this problem of budgetary constraints is that to cut costs to achieve the budgeted net profit, managers closed one of the three research and development facilities in G Division. As identified at the outset, a successful research and development function is a key source of long-term competitive advantage to Perkin.

It also appears that Perkin fails to flex the budgets and consequently the fixed budgets had discouraged divisional managers from deviating from the original plan. P Division did not make technical modifications to its components due to the cost of doing so, which meant they were unable to supply components for use in the new model of smartphone and had to discount the inventories of the old version. It is unclear why G Division did not take on additional staff to cope with increased demand following reopening of their customer’s factory, but it may be because managers felt constrained by the budget. This then caused long-term detriment to Perkin as they lost the preferred supplier status with their main customer.

Another problem created by annual budgeting is the management of short-term changes in costs and prices. A key component of Perkin’s products is silver, which fluctuates in price, and though it is not clear how much effect this has on Perkin’s costs, any problems in supply could disrupt production even if only a small amount of silver were required. Also Perkin exports goods worldwide and probably also purchases materials, including silver, from overseas. The business is therefore exposed to short-term movements in foreign currency exchange rates which may affect costs and selling prices.

Similarly, there also seems to be considerable uncertainty in sales volumes and prices which creates problems in the forecasting process for the two divisions. P Division did not anticipate the high demand for the new component which meant P Division had to discount products it had already manufactured in order to achieve its forecast sales volumes. G Division did correctly forecast the demand, but based on past growth in the market which may be too simplistic in a rapidly changing industry. Lack of up-to-date information will hinder decision-making and overall performance at Perkin. Perkin would perhaps be better adopting a rolling basis for forecasting.

The two divisions share manufacturing facilities and are likely to compete for other resources during the budgeting process. The current budgeting system does not encourage resource, information or knowledge sharing, for example, expertise in forecasting silver requirements. Divisional managers are appraised on the financial performance of their own division and hence are likely to prioritise the interests of their own division above those of Perkin as a whole. P Division would not re-allocate its manufacturing facilities to G Division, even though G Division needed this to cope with extra demand following reopening of the customer’s factory. The current system is therefore not encouraging goal congruence between the divisions and Perkin as a whole and a budgeting system, if done effectively, should encourage co-ordination and co-operation.

Managers may find the budgeting process demotivating because it is time-consuming for them and then the directors override the forecast which they had made. It is also unfair and demotivating to staff to appraise them on factors which are outside their control. This also identifies another weakness in Perkin’s budgeting system related to control as there does not seem to be any planning and operating variance analysis performed to assess exactly where performance is lacking and so no appropriate management information is provided. In fact it is not even clear just how often divisional managers receive reports on performance throughout the year. Any budgeting system without regular feedback would be ineffective. It should even be noted that for the industry in which Perkin operates the use of only budgetary targets as a measure of performance is narrow and internal. It should be utilising information from external sources as well to assess performance in a more relevant and contextual way.

Given the rapidly changing external environment and the emphasis on innovation and continuous product development, the current traditional budgeting method does not seem appropriate for Perkin.

(b) Beyond budgeting moves away from traditional budgeting processes and is suitable for businesses operating in a rapidly changing external environment and has the following features:

1. Encourages management to focus on the present and the future. Performance is assessed by reference to external benchmarks, utilising rolling forecasts and more non-financial information. This encourages a longer term view.

2. More freedom is given to managers to make decisions, which are consistent with the organisation’s goals and achieving competitive success.

3. Resources are made available on demand, for example, to enable a division to take advantage of an opportunity in the market, rather than being constrained by budgets.

4. Management focus is switched to the customer and managers are motivated towards actions which benefit the whole organisation, not just their own divisions.

5. Effective information systems are required to provide fast and easily accessible information across the whole organisation to allow for robust planning and control at all levels.

Taking each of the elements of beyond budgeting in turn, the impact of introducing this technique into Perkin can be assessed.

At Perkin, there are rapid technological changes in the products being produced by customers and competitors as a result of changes demanded by the market, which mean that Perkin must respond and continuously innovate and develop its products. This will support Perkin’s corporate objective. Consequently, this means that Perkin must change its plans frequently to be able to compete effectively with other component manufacturers and therefore will need to move away from annual incremental budgeting to introducing regular rolling forecasts. This process will need supporting by KPIs which will have a longer term focus. The impact of this will be that Perkin will need to develop a coherent set of strategies which supports its corporate objective, which will then need to be translated into targets and appropriate KPIs selected and developed. It will also mean that performance measures at the operational level will need to be revised from annual budgetary targets to these longer term objectives. Management at all levels will require training on the production of rolling forecasts and Perkin will need to assess if additional resources will also be required to run this new system.

Beyond budgeting focuses on the long-term success of the business by division managers working towards targets which may be non-financial. The use of external benchmarks and non-financial information will mean Perkin will need to put processes in place to collect this information and analyse it to assess performance. This will be a learning process as Perkin does not currently do this. The status of preferred supplier with key customers, for example, would be important to the long-term success of the business and this could be an objective which Perkin sets for its divisional managers.

Beyond budgeting allows authority to be delegated to suitably trained and supported managers to take decisions in the long-term interests of the business. It allows managers to respond quickly and effectively to changes in the external environment, and encourages them to develop innovative solutions to external change. In Perkin, budgets proposed by divisional managers are changed by the board to reflect its overall plans for the business. This means that a change in the approach to communication between the board and the divisions will be necessary as Perkin would need to switch from the top down process currently adopted to a more devolved decision-making structure. This will again require training for management to enable them to be ready to deal with this delegated authority as it will be very different from their existing approach.

Traditional budgeting may constrain managers who are not allowed to fail to meet the approved budget. This can be seen when P Division did not adapt its components because it did not want to incur the costs of doing so, which had not been budgeted for. Similarly, prices of raw materials are known to be volatile. Beyond budgeting makes resources available for managers to take advantage of opportunities in the market, such as the smartphone designed for playing games. Managers would also be able to react to changes in the price of materials or changes in foreign currency exchange rates, for example, by having the authority to purchase silver for inventory at times when the price of silver is low. This will mean that as a result there will be fewer budgetary constraints; however, these resources and targets will still need to be effectively managed. This management will mean that strategic initiatives invested in will need monitoring rather than closely scrutinising departmental budgets, which will be a significant change in Perkin.

In Perkin, the two divisions share some manufacturing facilities and are likely to compete for other resources, for example, when setting budgets. When manufacturing facilities are in short supply, each division will prioritise its own requirements rather than those of the business as a whole. Beyond budgeting encourages managers to work together for the good of the business and to share knowledge and resources. This is important in a business such as Perkin where product innovation is key and where the activities and products of the two divisions are similar. This coordinated approach will be new to Perkin so there will be a culture change. Also, the customer-oriented element of beyond budgeting is key here and will require the setup of customer focused teams which will require more harmonised actions in the divisions.

Each division currently has its own IT systems. In order to effectively share knowledge and to be able to respond to the external environment, which are key elements of beyond budgeting, it would be preferable for them to have shared IT facilities. This will mean that Perkin may have to invest in new technology capable of sharing information across the organisation in a rapid and open fashion but also be able to collect all relevant comparative data to allow for continuous monitoring of performance. This will facilitate better planning and control across all levels of Perkin.

With appropriate training of managers and investment in information systems, it would be relevant for Perkin to adopt beyond budgeting because of the rapid changes in the external environment in which it operates.

-

第9题:

A System p administrator found a process on the server that should be stopped. Which of the following commands can be used to list all the signal actions defined for this process()

- A、ps

- B、pstat

- C、lssig

- D、procsig

正确答案:D -

第10题:

Which three statements correctly describe the features of the I/O calibration process?()

- A、 Only one I/O calibration process can run at a time

- B、 It automates the resource allocation for the Automated Maintenance Tasks

- C、 It improves the performance of the performance-critical sessions while running

- D、 It can be used to estimate the maximum number of I/Os and maximum latency time for the system

- E、 The latency time is computed only when the TIMED_STATISTICS initialization parameter is set to TRUE

正确答案:A,D,E -

第11题:

填空题What’s the relationship between the type of policy and your financial plan?The type of policy should meet your ____.正确答案: coverage goals解析:

细节题。“你选择的险种与你的理财计划是什么关系?”从文章的第一段第四句“Finally, you must choose the type of policy that meets your coverage goals and fits into your financial plan”可知,你一定要选择既满足你的保险类别目标,又符合你的理财计划的险种。此处填写coverage goals。 -

第12题:

问答题Task II (20 marks) Read the following poem and write an essay in which you discuss its moral and express your personal views.LifeBy Langston HughesLife can be good,Life can be bad,Life is mostly cheerful,But sometimes sad.Life can be dreams,Life can be great thoughts;Life can mean a personSitting in court.Life can be dirty,Life can even be painful;but life is what you make it.So try to make it beautiful. You should write no less than 160 words. Now write the essay on the Answer Sheet.正确答案:

In this little poem, the poet conveys to us that we ourselves are the masters of our life. There are many kinds of life: good, bad, cheerful, painful, thoughtful or dirty. Which kind we are going to live depends on our own choice.

I can’t agree more with the poet’s view. To make our life beautiful, we have many things to do. The first and foremost is to know that the meaning of life is to love and to give. Too many of us are waiting to be loved and given and complaining if disappointed, never knowing the greater happiness of giving. Secondly, we need to have an optimistic and positive attitude. If we see the life as good and colorful, then it is good and colorful. The last but not least is that we should always have dreams and make efforts to realize them. The content of achieving goals is the spring of happiness in life.

Life is what we make it. Try to love and to give, to have an optimistic and positive mind and to keep on striving for dreams, and then we will have a beautiful life to enjoy.解析: 暂无解析 -

第13题:

(b) (i) Discuss the main factors that should be taken into account when determining how to treat gains and

losses arising on tangible non-current assets in a single statement of financial performance. (8 marks)

正确答案:

(b) (i) Currently there are many rules on how gains and losses on tangible non current assets should be reported and these

have traditionally varied from country to country. The main issues revolve around the reporting of depreciation,

disposal/revaluation gains and losses, and impairment losses. The reporting of such elements should take into account

whether the tangible non current assets have been revalued or held at historical cost. The problem facing standard

setters is where to report such gains and losses.The question is whether they should be reported as part of operating

activities or as ‘other gains and losses’.

Holding gains arising on the sale of tangible non current assets could be reported separately from operating results so

that the latter is not obscured by an asset realisation that reflects more a change in market prices than any increase in

the operating activity of the entity. Other changes in the carrying amounts of tangible non current assets will be reported

as part of the operating results. For example, the depreciation charge tries to reflect the consumption of the asset by the

entity and as such is not a holding loss. There may be cases where the depreciation charge does not reflect the

consumption of economic benefits. For example, the pattern and rate of depreciation could have been misjudged

because the asset’s useful life has been assessed incorrectly. In this case, when an asset is sold any excess or shortfall

of depreciation may need to be dealt with in the operating result.

Impairment is another factor to consider in reporting gains and losses on tangible non current assets. Impairment is

effectively accelerated depreciation. Impairment arises when the carrying amount of the asset is above its recoverable

amount. It follows therefore that any impairment loss should be reported as part of the operating result. Any losses on

disposal, to the extent that they represent impairment, could therefore be reported as part of the operating results. Any

losses which represent holding losses could be reported in ‘other gains and losses’. The difficulty will be differentiating

between holding losses and impairment losses. There will have to be clear and concise definitions of these terms or it

could lead to abuse by companies in their quest to maximise operating profits.

A distinction should be made between gains and losses arising on tangible non current assets as a result of revaluations

and those arising on disposal. The nature of the gain or loss is essentially the same although the timing and certainty

of the gain/loss is different. Therefore revaluation gains/losses may be reported in the ‘other gains and losses’ section.

Where an asset has been revalued, any loss on disposal that represents an impairment would be charged to operating

results and any remaining loss reported in ‘other gains and losses’.

Essentially, gains and losses should be reported on the basis of the characteristics of the gains and losses themselves.

Gains and losses with similar characteristics should be reported together thus helping the comparability of financial

performance nationally and internationally. -

第14题:

Required:

Discuss the principles and practices which should be used in the financial year to 30 November 2008 to account

for:(b) the costs incurred in extending the network; (7 marks)

正确答案:

Costs incurred in extending network

The cost of an item of property, plant and equipment should be recognised when

(i) it is probable that future economic benefits associated with the item will flow to the entity, and

(ii) the cost of the item can be measured reliably (IAS16, ‘Property, plant and equipment’ (PPE))

It is necessary to assess the degree of certainty attaching to the flow of economic benefits and the basis of the evidence available

at the time of initial recognition. The cost incurred during the initial feasibility study ($250,000) should be expensed as incurred,

as the flow of economic benefits to Johan as a result of the study would have been uncertain.

IAS16 states that the cost of an item of PPE comprises amongst other costs, directly attributable costs of bringing the asset to the

location and condition necessary for it to be capable of operating in a manner intended by management (IAS16, para 16).

Examples of costs given in IAS16 are site preparation costs, and installation and assembly costs. The selection of the base station

site is critical for the optimal operation of the network and is part of the process of bringing the network assets to a working

condition. Thus the costs incurred by engaging a consultant ($50,000) to find an optimal site can be capitalised as it is part of

the cost of constructing the network and depreciated accordingly as planning permission has been obtained.

Under IAS17, ‘Leases’, a lease is defined as an agreement whereby the lessor conveys to the lessee, in return for a payment or

series of payments, the right to use an asset for an agreed period of time. A finance lease is a lease that transfers substantially all

the risks and rewards incidental to ownership of the leased asset to the lessee. An operating lease is a lease other than a finance

lease. In the case of the contract regarding the land, there is no ownership transfer and the term is not for the major part of the

asset’s life as it is land which has an indefinite economic life. Thus substantially all of the risks and rewards incidental to ownership

have not been transferred. The contract should be treated, therefore, as an operating lease. The payment of $300,000 should be

treated as a prepayment in the statement of financial position and charged to the income statement over the life of the contract on

the straight line basis. The monthly payments will be expensed and no value placed on the lease contract in the statement of

financial position -

第15题:

(ii) Determine whether your decision in (b)(i) would change if you were to use the Maximin and Minimax

regret decision criteria. Your answer should be supported by relevant workings. (6 marks)

正确答案:

-

第16题:

(ii) Briefly discuss FOUR non-financial factors which might influence the above decision. (4 marks)

正确答案:

(ii) Four factors that could be considered are as follows:

(i) The quality of the service provided by NSC as evidenced by, for example, the comfort of the ferries, on-board

facilities, friendliness and responsiveness of staff.

(ii) The health and safety track record of NSC – passenger safety is a ‘must’ in such operations.

(iii) The reliability, timeliness and dependability of NSC as a service provider.

(iv) The potential loss of image due to redundancies within Wonderland plc. -

第17题:

(ii) Suggest THREE other performance measures (not applied in (i)) which might be used to assess the

customer perspective of the balanced scorecard of GER. (3 marks)

正确答案:

(ii) Performance measures that may be used to assess the customer perspective of the balanced scorecard of GER include

the following:

Lost or damaged luggage per 1,000 passengers

Train cancellation rate

Denied boarding rate

Number of passenger complaints.

Note: Only three measures were required.

-

第18题:

___is a program mainly used to assist managers in setting and carrying out their plans.A.Management by objectives (MBO)

B.Participative management

C.Operational Management

D.Instructional Management

正确答案:A

-

第19题:

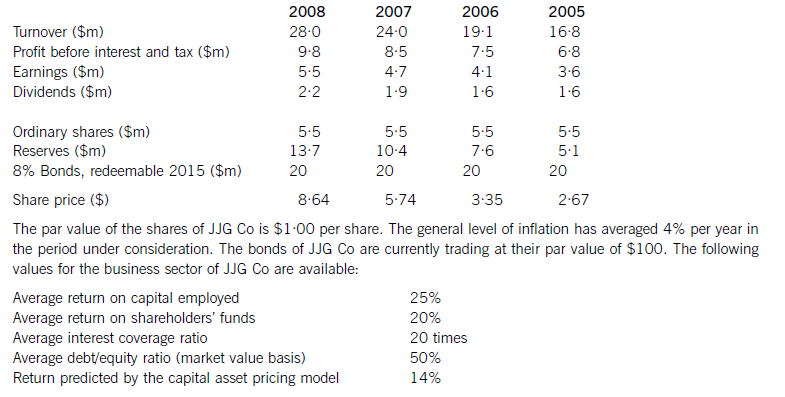

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion. -

第20题:

A firm can be seen as nothing more than a collection of projects.A firm must allocate cash to projects within its budgets.Therefore, the process of deciding which projects to undertake and which projects lo pass up is called capital budgeting.Capital bud答案:解析:一家公司可以看成是一系列项目的集合,公司必须要在其预算范围内向项目投放资金。 因此,决定哪个项目该投资,哪个项目该放弃的过程就是资本预箅a资本预算是公司决策的核心。 只要考虑到融资,每一个项目都是一系列现金流。大多数项目需要一笔现金流出(即投资或者花费成本)及随后的一系列现金流入(即回报或者收入).至于现金流来自垃圾搬运或是钻石销售是没有关系的。现金流就是现金,然而,很需要的是所有收益和成本要换算或现金价值。如果你要在搬运垃圾上花更多时间或者不喜欢垃圾搬运,你要把这些换算成负向现金流。同样地,如果做意个项 -

第21题:

Which of the following commands should be used to determine which disk of a system is experiencing a disk I/O performance problem?()

- A、 filemon

- B、 istat

- C、 vmstat

- D、 iostat

正确答案:D -

第22题:

单选题Which of the following commands should be used to determine which disk of a system is experiencing a disk I/O performance problem?()Afilemon

Bistat

Cvmstat

Diostat

正确答案: A解析: 暂无解析 -

第23题:

多选题Which three statements correctly describe the features of the I/O calibration process?()AOnly one I/O calibration process can run at a time.

BIt automates the resource allocation for the Automated Maintenance Tasks.

CIt improves the performance of the performance-critical sessions while running.

DIt can be used to estimate the maximum number of I/Os and maximum latency time for the system.

EThe latency time is computed only when the TIMED_STATISTICS initialization parameter is set to TRUE.

正确答案: B,C解析: 暂无解析