In 2014 Mr Yuan inherited an estate of RMB2 million from his uncle who had died two months earlier.What is the correct treatment of the estate income for individual income tax purposes?A.The estate income is not taxableB.The estate income will be taxed as

题目

In 2014 Mr Yuan inherited an estate of RMB2 million from his uncle who had died two months earlier.

What is the correct treatment of the estate income for individual income tax purposes?

A.The estate income is not taxable

B.The estate income will be taxed as occasional (ad hoc) income

C.The estate income will be taxed as other income

D.The estate income will be taxed as service income

相似考题

更多“In 2014 Mr Yuan inherited an estate of RMB2 million from his uncle who had died two months earlier.What is the correct treatment of the estate income for individual income tax purposes?A.The estate income is not taxableB.The estate income will be taxed as”相关问题

-

第1题:

(ii) Explain how the inclusion of rental income in Coral’s UK income tax computation could affect the

income tax due on her dividend income. (2 marks)

You are not required to prepare calculations for part (b) of this question.

Note: you should assume that the tax rates and allowances for the tax year 2006/07 and for the financial year to

31 March 2007 will continue to apply for the foreseeable future.

正确答案:

(ii) The effect of taxable rental income on the tax due on Coral’s dividend income

Remitting rental income to the UK may cause some of Coral’s dividend income currently falling within the basic rate

band to fall within the higher rate band. The effect of this would be to increase the tax on the gross dividend income

from 0% (10% less the 10% tax credit) to 221/2% (321/2% less 10%).

Tutorial note

It would be equally acceptable to state that the effective rate of tax on the dividend income would increase from 0%

to 25%. -

第2题:

The above chart shows individual income tax in China. The tax free threshold is 3,500 RMB per month. The tax rates are divided into 7 brackets. The lowest rate is 3% for income between 3,501 and 5,000, while the highest rate is 45% for income over 80,000. Therefore, the higher our income is, the more tax we should pay. Tax, which can be used in public services such as education, road construction, public health and so on, is very important to our country. As we all know, tax makes up a great part of our country’s revenue, and the development of our country depends on it. From what has been discussed above, we can see that it is everyone’s legal duty to pay tax because taxes contribute to the country and create benefits for everyone. Those who try to evade taxation are sure to be punished. In short, paying tax is our responsibility to society.Decide if each of the following statements is TRUE (T) or FALSE (F).

1. The purpose of the passage is to help people know the tips how to pay less tax.()

2. According to the chart, if a person’s monthly is 3600 yuan, he doesn’t need to pay tax.()

3. How much income tax a person pays each month depends on how much his/her income is.()

4. The underlined word “evade” in the last paragraph means increase.()

5. Personal income taxes are included in a government’s revenue.()

参考答案:FFTFT

-

第3题:

听力原文:The tax return does not show accrued income.

(8)

A.The tax return is not shown in the income.

B.The income is not accurate in taxation.

C.The tax should be returned according to the income.

D.The tax return is not in accordance with the income that should be taxed.

正确答案:D

解析:单句意思为“纳税申报单不能反映应计收入”,D项意思与之接近。 -

第4题:

The income statement is prepared from ().A.the income statement columns of the work sheet

B.the adjusted trial balance

C.either the adjusted trial balance or the income statement columns of the work sheet

D.both the adjusted trial balance and the income statement columns of the work sheet

正确答案:C

-

第5题:

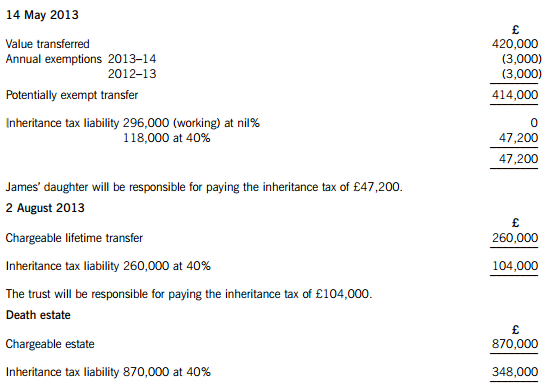

James died on 22 January 2015. He had made the following gifts during his lifetime:

(1) On 9 October 2007, a cash gift of £35,000 to a trust. No lifetime inheritance tax was payable in respect of this gift.

(2) On 14 May 2013, a cash gift of £420,000 to his daughter.

(3) On 2 August 2013, a gift of a property valued at £260,000 to a trust. No lifetime inheritance tax was payable in respect of this gift because it was covered by the nil rate band. By the time of James’ death on 22 January 2015, the property had increased in value to £310,000.

On 22 January 2015, James’ estate was valued at £870,000. Under the terms of his will, James left his entire estate to his children.

The nil rate band of James’ wife was fully utilised when she died ten years ago.

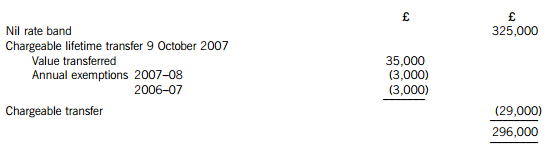

The nil rate band for the tax year 2007–08 is £300,000, and for the tax year 2013–14 it is £325,000.

Required:

(a) Calculate the inheritance tax which will be payable as a result of James’ death, and state who will be responsible for paying the tax. (6 marks)

(b) Explain why it might have been beneficial for inheritance tax purposes if James had left a portion of his estate to his grandchildren rather than to his children. (2 marks)

(c) Explain why it might be advantageous for inheritance tax purposes for a person to make lifetime gifts even when such gifts are made within seven years of death.

Notes:

1. Your answer should include a calculation of James’ inheritance tax saving from making the gift of property to the trust on 2 August 2013 rather than retaining the property until his death.

2. You are not expected to consider lifetime exemptions in this part of the question. (2 marks)

正确答案:(a) James – Inheritance tax arising on death

Lifetime transfers within seven years of death

The personal representatives of James’ estate will be responsible for paying the inheritance tax of £348,000.

Working – Available nil rate band

(b) Skipping a generation avoids a further charge to inheritance tax when the children die. Gifts will then only be taxed once before being inherited by the grandchildren, rather than twice.

(c) (1) Even if the donor does not survive for seven years, taper relief will reduce the amount of IHT payable after three years.

(2) The value of potentially exempt transfers and chargeable lifetime transfers are fixed at the time they are made.

(3) James therefore saved inheritance tax of £20,000 ((310,000 – 260,000) at 40%) by making the lifetime gift of property.

-

第6题:

Income tax【个人所得税】

For many young Americans, graduating from college means finding a job, moving out of the dorm room and beginning to register one's annual earnings with the US government.

That last item is the law, though sometimes it's a hassle(难事)to obey.

Independent tax advisor Bob Gilbert calls the US income tax system "amazingly complicated". But he adds that "very little of the complicated tax law applies to young people who are just beginning their careers". According to Gilbert, 80 to 90 percent of Americans are not really burdened by the system's complications.

Still, all the numbers and forms can be a little confusing to those who are just starting their careers. Some pull out their calculators and try to do the math alone. Some use income tax software. Others just hand the whole responsibility over to tax firms like Gilbert's. According to income tax law expert Linda Beale, young people will often follow their parents' lead when filling their income forms.

"Young people who grow up in wealthy households typically use professional tax services because their parents have always done so," said Beale, a professor at Wayne State University in Michigan State.

"On the other hand, most poorer young people probably try to do their own taxes, unless they want a quick 'refund' with the help of a tax advisor".

In fact, obeying the law has its benefits. For one, many young people can expect a tax refund. This means that, over the course of the year, they have paid too much in monthly federal or state taxes and are entitled to the difference.

Bob Thalman, a 20-year-old university student, expects he will get a refund of about 100, which will probably go in the bank, or perhaps be used to pay for car insurance or credit card bills.

Thalman called the whole process a "hassle", but added that he didn't wat to test the law by not filling his income tax papers.

"I'm worried about what would happen if I failed to file," he said. "I know one individual who did not report his income tax for many years, and he's now in federal prison. I certainly don’t want that."

文章(16~22)

A college student with a part-time job is not required to file an income tax form.A.Right

B.Wrong

C.Not mentioned答案:C解析: -

第7题:

Young people from poorer families needn't file their income tax forms.A.Right

B.Wrong

C.Not mentioned答案:B解析: -

第8题:

Income Income may be national income and personal income. Whereas national income is defined as the total earned income of all the factors of production-namely, profits, interest, rent, wages, and other compensation for labor, personal income may be defined as total money income received by individuals before personal taxes are paid. National income does not equal GNP (Gross National Product) because the factors of production do not receive payment for either capital consumption allowances or indirect business taxes, both of which are included in GNP. The money put aside for capital consumption is for replacement and thus is not counted as income. Indirect taxes include sales taxes, property taxes , and excise taxes that are paid by businesses directly to the government and so reduce the income left to pay for the factors of production. Three-fourths of national income goes for wages, salaries, and other forms of compensation to employees. Whereas national income shows the income that the factors of production earn, personal income measures the income that individuals or households receive. Corporation profits are included in national income because they are earned. Out of these profits, however, corporation profit taxes must be paid to the government, and some money must be put into the business for expansion. Only that part of profits distributed as dividends goes to the individual; therefore, out of corporation profits only dividends count as personal income. The factors of production earn money for social security and unemployment insurance contributions, but this money goes to government (which is not a factor of production), not to individuals. It is therefore part of national income but not part of personal income. On the other hand, money received by individuals when they collect social security or unemployment compensation is not money earned but money received. Interest received on government bonds is also in this category, because much of the money received from the sale of bonds went to pay for war production and that production no longer furnishes a service to the economy. The money people receive as personal income may be either spent or saved. However, not all spending is completely voluntary. A significant portion of our income goes to pay personal taxes. Most workers never receive the money they pay in personal taxes, because it is withheld from their paychecks. The money that individuals are left with after they have met their tax obligations is disposable personal income. Disposable income can be divided between personal consumption expenditures and personal savings. It is important to remember that personal saving is what is left after spending. This passage is mainly about()

- A、the difference between national income and GNP

- B、the difference between national income and personal income

- C、the concept of income

- D、the difference between disposable income and nondisposable income

正确答案:B -

第9题:

单选题Which of the following statements about the financial situation of the Alaska government is NOT true?A89 percent of the state income comes from the oil revenue.

BState sales tax and personal income tax constitute only a fraction of the state revenue.

CWith a two-month shutdown, the government may well find it difficult to make ends meet.

DThe state income is heavily dependent upon the Prudhoe Bay.

正确答案: B解析:

事实细节的找寻和判断。在谈到阿拉斯加州的财政状况时,录音中提到“Alaska has no state sales tax and no personal income tax.”,可知该州并没有营业税和个人收入所得税。而B项指出“营业税和个人收入所得税只占该州财政收入很小的一部分),因此与录音原文不符。 -

第10题:

单选题Income Income may be national income and personal income. Whereas national income is defined as the total earned income of all the factors of production-namely, profits, interest, rent, wages, and other compensation for labor, personal income may be defined as total money income received by individuals before personal taxes are paid. National income does not equal GNP (Gross National Product) because the factors of production do not receive payment for either capital consumption allowances or indirect business taxes, both of which are included in GNP. The money put aside for capital consumption is for replacement and thus is not counted as income. Indirect taxes include sales taxes, property taxes , and excise taxes that are paid by businesses directly to the government and so reduce the income left to pay for the factors of production. Three-fourths of national income goes for wages, salaries, and other forms of compensation to employees. Whereas national income shows the income that the factors of production earn, personal income measures the income that individuals or households receive. Corporation profits are included in national income because they are earned. Out of these profits, however, corporation profit taxes must be paid to the government, and some money must be put into the business for expansion. Only that part of profits distributed as dividends goes to the individual; therefore, out of corporation profits only dividends count as personal income. The factors of production earn money for social security and unemployment insurance contributions, but this money goes to government (which is not a factor of production), not to individuals. It is therefore part of national income but not part of personal income. On the other hand, money received by individuals when they collect social security or unemployment compensation is not money earned but money received. Interest received on government bonds is also in this category, because much of the money received from the sale of bonds went to pay for war production and that production no longer furnishes a service to the economy. The money people receive as personal income may be either spent or saved. However, not all spending is completely voluntary. A significant portion of our income goes to pay personal taxes. Most workers never receive the money they pay in personal taxes, because it is withheld from their paychecks. The money that individuals are left with after they have met their tax obligations is disposable personal income. Disposable income can be divided between personal consumption expenditures and personal savings. It is important to remember that personal saving is what is left after spending. The passage implies that()Apeople willingly pay taxes because they want to do something useful to the country

Bpeople willingly pay taxes because they do not want to be looked down upon by others

Cpeople pay taxes unwillingly because they feel they will be arrested if they do not

Dpeople pay taxes somewhat unwillingly

正确答案: A解析: 文章最后一段表明,并不是所有的开支都是自愿的,个人收入的很大一部分用来付种种税款即是如此。因此选项D是正确的答案。答案为D。 -

第11题:

单选题Income Income may be national income and personal income. Whereas national income is defined as the total earned income of all the factors of production-namely, profits, interest, rent, wages, and other compensation for labor, personal income may be defined as total money income received by individuals before personal taxes are paid. National income does not equal GNP (Gross National Product) because the factors of production do not receive payment for either capital consumption allowances or indirect business taxes, both of which are included in GNP. The money put aside for capital consumption is for replacement and thus is not counted as income. Indirect taxes include sales taxes, property taxes , and excise taxes that are paid by businesses directly to the government and so reduce the income left to pay for the factors of production. Three-fourths of national income goes for wages, salaries, and other forms of compensation to employees. Whereas national income shows the income that the factors of production earn, personal income measures the income that individuals or households receive. Corporation profits are included in national income because they are earned. Out of these profits, however, corporation profit taxes must be paid to the government, and some money must be put into the business for expansion. Only that part of profits distributed as dividends goes to the individual; therefore, out of corporation profits only dividends count as personal income. The factors of production earn money for social security and unemployment insurance contributions, but this money goes to government (which is not a factor of production), not to individuals. It is therefore part of national income but not part of personal income. On the other hand, money received by individuals when they collect social security or unemployment compensation is not money earned but money received. Interest received on government bonds is also in this category, because much of the money received from the sale of bonds went to pay for war production and that production no longer furnishes a service to the economy. The money people receive as personal income may be either spent or saved. However, not all spending is completely voluntary. A significant portion of our income goes to pay personal taxes. Most workers never receive the money they pay in personal taxes, because it is withheld from their paychecks. The money that individuals are left with after they have met their tax obligations is disposable personal income. Disposable income can be divided between personal consumption expenditures and personal savings. It is important to remember that personal saving is what is left after spending. Which of the following statements is true according to the first paragraph?()AGNP equals national income plus indirect business taxes.

BGNP excludes both capital consumption allowances and indirect business taxes.

CPersonal income is regarded as the total money income received by an individual after his or her taxes are paid.

DThe money that goes for capital consumption is not regarded as income.

正确答案: B解析: 本题的依据是第一段的The money put aside for capital consumption is for replacement and thus is not counted as income 这个句子。对原句的词语选项D用了别的表达方法,但大意仍保持不变。答案为D。 -

第12题:

单选题Since red flags are likely to be raised at the IRS by the reporting of gambling income, business owners who declare their income as business revenue is less likely to receive an audit.ASince red flags are likely to be raised at the IRS by the reporting of gambling income, business owners who declare their income as business revenue is less likely to receive an andit.

BBecause the reporting of gambling income is likely to raise red flags at the IRS, business owners can reduce their chances of receiving an audit by declaring that income as business revenue.

CBusiness owners can reduce their chances of receiving an audit by declaring the income as business revenue, since the reporting of gambling income is likely to raise red flags at the IRS.

DTheir chances of receiving an audit are reduced by business owners who report that income as business revenue. because the reporting of gambling income is likely to raise red flags at the IRS.

EThe reporting of that income as business revenue can reduce the chances of business owners of receiving an audit, because of the red flags not having been raised at the IRS by the reporting of gambling income.

正确答案: E解析:

A项中存在主谓不一致问题。C、D、E三项表述不清,故本题应选B项。 -

第13题:

5 Crusoe has contacted you following the death of his father, Noland. Crusoe has inherited the whole of his father’s

estate and is seeking advice on his father’s capital gains tax position and the payment of inheritance tax following his

death.

The following information has been extracted from client files and from telephone conversations with Crusoe.

Noland – personal information:

– Divorcee whose only other relatives are his sister, Avril, and two grandchildren.

– Died suddenly on 1 October 2007 without having made a will.

– Under the laws of intestacy, the whole of his estate passes to Crusoe.

Noland – income tax and capital gains tax:

– Has been a basic rate taxpayer since the tax year 2000/01.

– Sales of quoted shares resulted in:

– Chargeable gains of £7,100 and allowable losses of £17,800 in the tax year 2007/08.

– Chargeable gains of approximately £14,000 each tax year from 2000/01 to 2006/07.

– None of the shares were held for long enough to qualify for taper relief.

Noland – gifts made during lifetime:

– On 1 December 1999 Noland gave his house to Crusoe.

– Crusoe has allowed Noland to continue living in the house and has charged him rent of £120 per month

since 1 December 1999. The market rent for the house would be £740 per month.

– The house was worth £240,000 at the time of the gift and £310,000 on 1 October 2007.

– On 1 November 2004 Noland transferred quoted shares worth £232,000 to a discretionary trust for the benefit

of his grandchildren.

Noland – probate values of assets held at death: £

– Portfolio of quoted shares 370,000

Shares in Kurb Ltd 38,400

Chattels and cash 22,300

Domestic liabilities including income tax payable (1,900)

– It should be assumed that these values will not change for the foreseeable future.

Kurb Ltd:

– Unquoted trading company

– Noland purchased the shares on 1 December 2005.

Crusoe:

– Long-standing personal tax client of your firm.

– Married with two young children.

– Successful investment banker with very high net worth.

– Intends to gift the portfolio of quoted shares inherited from Noland to his aunt, Avril, who has very little personal

wealth.

Required:

(a) Prepare explanatory notes together with relevant supporting calculations in order to quantify the tax relief

potentially available in respect of Noland’s capital losses realised in 2007/08. (4 marks)

正确答案:

-

第14题:

The mansion and the estate are part of his().

A、legacy

B、heritage

C、hope

D、things

参考答案:B

-

第15题:

During the current year, Eleanor receives land valued at $30,000 from the estate of her grandfather. Her grandfather's basis in the land was $8,000. Eleanor sells the land for $34,000 late in the year. Eleanor's gross income is:()。

A、$0

B、$4,000

C、$8,000

D、$16,000

E、$26,000

答案:B

-

第16题:

Mr Li, a photographer, had his photos published in the July 2014 edition of the tourism journal. The total fee was RMB20,000 and the publisher agreed to pay Mr Li by two instalments, one of RMB18,000 in June 2014 and the balance of RMB2,000 in August 2014. The same photos were republished by the government in a promotion brochure in August 2014 and Mr Li was paid a further fee of RMB3,000 by the government.

What is the total amount of individual income tax (IIT) which Mr Li will pay on the above incomes?

A.RMB2,492

B.RMB2,576

C.RMB2,548

D.RMB3,680

正确答案:C20,000 x (1 – 20%) x 20% x 70% + (3,000 – 800) x 20% x 70% = RMB2,548

-

第17题:

It's pretty easy for a beginner to report his or her income tax.A.Right

B.Wrong

C.Not mentioned答案:B解析: -

第18题:

The US income tax system does not wholly apply to a college graduate who is just beginning his or her career.A.Right

B.Wrong

C.Not mentioned答案:A解析: -

第19题:

Income Income may be national income and personal income. Whereas national income is defined as the total earned income of all the factors of production-namely, profits, interest, rent, wages, and other compensation for labor, personal income may be defined as total money income received by individuals before personal taxes are paid. National income does not equal GNP (Gross National Product) because the factors of production do not receive payment for either capital consumption allowances or indirect business taxes, both of which are included in GNP. The money put aside for capital consumption is for replacement and thus is not counted as income. Indirect taxes include sales taxes, property taxes , and excise taxes that are paid by businesses directly to the government and so reduce the income left to pay for the factors of production. Three-fourths of national income goes for wages, salaries, and other forms of compensation to employees. Whereas national income shows the income that the factors of production earn, personal income measures the income that individuals or households receive. Corporation profits are included in national income because they are earned. Out of these profits, however, corporation profit taxes must be paid to the government, and some money must be put into the business for expansion. Only that part of profits distributed as dividends goes to the individual; therefore, out of corporation profits only dividends count as personal income. The factors of production earn money for social security and unemployment insurance contributions, but this money goes to government (which is not a factor of production), not to individuals. It is therefore part of national income but not part of personal income. On the other hand, money received by individuals when they collect social security or unemployment compensation is not money earned but money received. Interest received on government bonds is also in this category, because much of the money received from the sale of bonds went to pay for war production and that production no longer furnishes a service to the economy. The money people receive as personal income may be either spent or saved. However, not all spending is completely voluntary. A significant portion of our income goes to pay personal taxes. Most workers never receive the money they pay in personal taxes, because it is withheld from their paychecks. The money that individuals are left with after they have met their tax obligations is disposable personal income. Disposable income can be divided between personal consumption expenditures and personal savings. It is important to remember that personal saving is what is left after spending. It can be easily seen from this passage that the government levies tax on()

- A、corporation profits

- B、every individual even though his income is very low

- C、those who work in joint ventures

- D、those who work in government departments

正确答案:A -

第20题:

问答题Inheritance tax is a tax which many countries levy on the total taxable value of the estate of a deceased person. Inheritance tax is paid by the inheritor of the estate or by the person in charge of its assets. In most cases, if the estate is left to a charitable organization or a surviving spouse, no inheritance tax is due. In China, inheritance tax does not exist. Should inheritance tax be introduced to China? The controversy that has raged over levying inheritance tax in China currently shows little sign of abating. The following are opinions from both sides. Read the excerpt carefully and write your response in about 300 words, in which you should: 1. summarize briefly the opinions from both sides, and then 2. give your comment. Marks will be awarded for content relevance, content sufficiency, organization and language quality. Failure to follow the above instructions may result in a loss of marks. Opponents of inheritance tax typically refer to it as “death tax.” They argue first that concern over burdening their children with this tax may lead elderly to make unwise investment decisions late in life, and that it may also discourage entrepreneurship earlier in life. Opponents also claim that morally it should be only the choice of the person who earned the money what should be done with it, not the government. They see taxing wealth at death as a kind of forced income redistribution that goes against the market economy. Proponents of inheritance tax say that it helps prevent consolidation of wealth in the hands of a few powerful families and is a basic building block of the nation’s system of taxation. They also feel that inheriting large sums without tax undermines people’s motives to work hard in the future and, thus, undercuts the principles of the market economy, encouraging people to become idle and unproductive, which hurts the country overall.正确答案:

【参考范文】

Should Inheritance Tax be Introduced to China? An inheritance tax is a tax paid by a person who inherits money or property or a levy on the estate of a person who has died. Many countries have inheritance tax, while China does not. Whether China should levy inheritance tax has become a hot topic of discussion. Supporters hold that it helps prevent the wealth from being always in the hands of a few powerful families. Inheriting large sums without tax weakens people’s enthusiasm for work, encouraging people to become lazy and unproductive, which is not conducive to the whole country. However, opponents argue that this tax may result in unwise investment decisions late in life, and discourage entrepreneurship earlier in life. It is a kind of forced income redistribution, ignoring the right of people earned the money.

From my points of view, inheritance tax should not be introduced to China. Firstly, it is a violation of human rights. In any country that has recognized the private property rights, a person’s private property can be handled without violating others all a person likes. The inheritance tax violates the rights of the people to dispose of their property. Secondly, inheritance tax will encourage abnormal consumption, conspicuous consumption of rich people, further intensifying contradictions and conflicts among social members. It may stimulate the rich to spend their money excessively before death and lead to hostility to the rich. Thirdly, inheritance tax will reduce the enthusiasm of entrepreneurs, exacerbate capital flight, economic migration and impede investment and capital inflows, inhibiting economic development. It may drive wealthy people to move assets out of the country or emigrate in order to avoid the tax, resulting in capital loss and brain drain.

To summarize, inheritance tax might not be an effective enough tool to narrow income disparity. Therefore, other measures are needed if the government wants to ensure a more equitable distribution of wealth in society.解析:

【审题构思】

本题要求考生围绕是否应该征收遗产税这一话题展开讨论。文章可以支持也可以反对,只要言之有理即可。考生首先要总结材料中的观点,然后明确陈述自己的观点。接下来论证自己的观点,注意要分点列举,这样才能做到内容充实,条理清晰。最后总结全文,重申观点;也可进一步补充观点,深化主题。 -

第21题:

单选题Mortgage and other financing income decreased $8.8 million to $18.8 for the year ended December 31, 2006.The income in 2006 was reducedAto $ 8.8 million.

Bto $18.8 million.

Cfrom $18.8 million to $8.8 million.

正确答案: A解析:

正确理解“decrease…”和“decrease to…”是本题解题的关键。前者的意思是“减少了…”,后者的意思是“减少到…”。根据原文可以知道“截止到2006年12月31日,抵押借款和其他融资收益减少了880万美元,是1880万美元”。所以,选项B正确。 -

第22题:

单选题Income Income may be national income and personal income. Whereas national income is defined as the total earned income of all the factors of production-namely, profits, interest, rent, wages, and other compensation for labor, personal income may be defined as total money income received by individuals before personal taxes are paid. National income does not equal GNP (Gross National Product) because the factors of production do not receive payment for either capital consumption allowances or indirect business taxes, both of which are included in GNP. The money put aside for capital consumption is for replacement and thus is not counted as income. Indirect taxes include sales taxes, property taxes , and excise taxes that are paid by businesses directly to the government and so reduce the income left to pay for the factors of production. Three-fourths of national income goes for wages, salaries, and other forms of compensation to employees. Whereas national income shows the income that the factors of production earn, personal income measures the income that individuals or households receive. Corporation profits are included in national income because they are earned. Out of these profits, however, corporation profit taxes must be paid to the government, and some money must be put into the business for expansion. Only that part of profits distributed as dividends goes to the individual; therefore, out of corporation profits only dividends count as personal income. The factors of production earn money for social security and unemployment insurance contributions, but this money goes to government (which is not a factor of production), not to individuals. It is therefore part of national income but not part of personal income. On the other hand, money received by individuals when they collect social security or unemployment compensation is not money earned but money received. Interest received on government bonds is also in this category, because much of the money received from the sale of bonds went to pay for war production and that production no longer furnishes a service to the economy. The money people receive as personal income may be either spent or saved. However, not all spending is completely voluntary. A significant portion of our income goes to pay personal taxes. Most workers never receive the money they pay in personal taxes, because it is withheld from their paychecks. The money that individuals are left with after they have met their tax obligations is disposable personal income. Disposable income can be divided between personal consumption expenditures and personal savings. It is important to remember that personal saving is what is left after spending. According to this passage, the money you get as interest from government bonds is()Athe money earned

Bthe money not earned but received

Cthe money received for the contribution you have made to the economy

Dthe money earned for the service you have furnished to the economy

正确答案: D解析: 根据第三段第一句:money received by individuals when they collect social security or unemployment compensation is not money earned but money received… 以及下句Interest received on government bonds is also in this category…,可知B是答案。C项中的原因状语从句是不对的,所以C不能作为答案。答案为B。 -

第23题:

单选题Income tax rates are()to one's annual income.Arelated

Bdependent

Cbased

Dassociated

正确答案: C解析: 暂无解析