问答题Passage 1 The cost of staging the year 2000 Olympics in Sydney is estimated to be a staggering $ 9 million, but (1) the city is preparing to the financial benefits that come from holding such an international event by equaling the commercial success o

题目

相似考题

更多“问答题Passage 1 The cost of staging the year 2000 Olympics in Sydney is estimated to be a staggering $ 9 million, but (1) the city is preparing to the financial benefits that come from holding such an international event by equaling the commercial success o”相关问题

-

第1题:

(c) At 1 June 2006, Router held a 25% shareholding in a film distribution company, Wireless, a public limited

company. On 1 January 2007, Router sold a 15% holding in Wireless thus reducing its investment to a 10%

holding. Router no longer exercises significant influence over Wireless. Before the sale of the shares the net asset

value of Wireless on 1 January 2007 was $200 million and goodwill relating to the acquisition of Wireless was

$5 million. Router received $40 million for its sale of the 15% holding in Wireless. At 1 January 2007, the fair

value of the remaining investment in Wireless was $23 million and at 31 May 2007 the fair value was

$26 million. (6 marks)

Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.

正确答案:

(c) The investment in Wireless is currently accounted for using the equity method of accounting under IAS28 ‘Investments in

Associates’. On the sale of a 15% holding, the investment in Wireless will be accounted for in accordance with IAS39. Router

should recognise a gain on the sale of the holding in Wireless of $7 million (Working 1). The gain comprises the following:

(i) the difference between the sale proceeds and the proportion of the net assets sold and

(ii) the goodwill disposed of.

The total gain is shown in the income statement.

The remaining 10 per cent investment will be classified as an ‘available for sale’ financial asset or at ‘fair value through profit

or loss’ financial asset. Changes in fair value for these categories are reported in equity or in the income statement respectively.

At 1 January 2007, the investment will be recorded at fair value and a gain of $1 million $(23 – 22) recorded. At 31 May

2007 a further gain of $(26 – 23) million, i.e. $3 million will be recorded. In order for the investment to be categorised as

at fair value through profit or loss, certain conditions have to be fulfilled. An entity may use this designation when doing so

results in more relevant information by eliminating or significantly reducing a measurement or recognition inconsistency (an

‘accounting mismatch’) or where a group of financial assets and/or financial liabilities is managed and its performance is

evaluated on a fair value basis, in accordance with a documented risk management or investment strategy, and information

about the assets and/ or liabilities is provided internally to the entity’s key management personnel.

-

第2题:

(c) On 1 May 2007 Sirus acquired another company, Marne plc. The directors of Marne, who were the only

shareholders, were offered an increased profit share in the enlarged business for a period of two years after the

date of acquisition as an incentive to accept the purchase offer. After this period, normal remuneration levels will

be resumed. Sirus estimated that this would cost them $5 million at 30 April 2008, and a further $6 million at

30 April 2009. These amounts will be paid in cash shortly after the respective year ends. (5 marks)

Required:

Draft a report to the directors of Sirus which discusses the principles and nature of the accounting treatment of

the above elements under International Financial Reporting Standards in the financial statements for the year

ended 30 April 2008.

正确答案:

(c) Acquisition of Marne

All business combinations within the scope of IFRS 3 ‘Business Combinations’ must be accounted for using the purchase

method. (IFRS 3.14) The pooling of interests method is prohibited. Under IFRS 3, an acquirer must be identified for all

business combinations. (IFRS 3.17) Sirus will be identified as the acquirer of Marne and must measure the cost of a business

combination at the sum of the fair values, at the date of exchange, of assets given, liabilities incurred or assumed, in exchange

for control of Marne; plus any costs directly attributable to the combination. (IFRS 3.24) If the cost is subject to adjustment

contingent on future events, the acquirer includes the amount of that adjustment in the cost of the combination at the

acquisition date if the adjustment is probable and can be measured reliably. (IFRS 3.32) However, if the contingent payment

either is not probable or cannot be measured reliably, it is not measured as part of the initial cost of the business combination.

If that adjustment subsequently becomes probable and can be measured reliably, the additional consideration is treated as

an adjustment to the cost of the combination. (IAS 3.34) The issue with the increased profit share payable to the directors

of Marne is whether the payment constitutes remuneration or consideration for the business acquired. Because the directors

of Marne fall back to normal remuneration levels after the two year period, it appears that this additional payment will

constitute part of the purchase consideration with the resultant increase in goodwill. It seems as though these payments can

be measured reliably and therefore the cost of the acquisition should be increased by the net present value of $11 million at

1 May 2007 being $5 million discounted for 1 year and $6 million for 2 years. -

第3题:

(c) During the year Albreda paid $0·1 million (2004 – $0·3 million) in fines and penalties relating to breaches of

health and safety regulations. These amounts have not been separately disclosed but included in cost of sales.

(5 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Albreda Co for the year ended

30 September 2005.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(c) Fines and penalties

(i) Matters

■ $0·1 million represents 5·6% of profit before tax and is therefore material. However, profit has fallen, and

compared with prior year profit it is less than 5%. So ‘borderline’ material in quantitative terms.

■ Prior year amount was three times as much and represented 13·6% of profit before tax.

■ Even though the payments may be regarded as material ‘by nature’ separate disclosure may not be necessary if,

for example, there are no external shareholders.

■ Treatment (inclusion in cost of sales) should be consistent with prior year (‘The Framework’/IAS 1 ‘Presentation of

Financial Statements’).

■ The reason for the fall in expense. For example, whether due to an improvement in meeting health and safety

regulations and/or incomplete recording of liabilities (understatement).

■ The reason(s) for the breaches. For example, Albreda may have had difficulty implementing new guidelines in

response to stricter regulations.

■ Whether expenditure has been adjusted for in the income tax computation (as disallowed for tax purposes).

■ Management’s attitude to health and safety issues (e.g. if it regards breaches as an acceptable operational practice

or cheaper than compliance).

■ Any references to health and safety issues in other information in documents containing audited financial

statements that might conflict with Albreda incurring these costs.

■ Any cost savings resulting from breaches of health and safety regulations would result in Albreda possessing

proceeds of its own crime which may be a money laundering offence.

(ii) Audit evidence

■ A schedule of amounts paid totalling $0·1 million with larger amounts being agreed to the cash book/bank

statements.

■ Review/comparison of current year schedule against prior year for any apparent omissions.

■ Review of after-date cash book payments and correspondence with relevant health and safety regulators (e.g. local

authorities) for liabilities incurred before 30 September 2005.

■ Notes in the prior year financial statements confirming consistency, or otherwise, of the lack of separate disclosure.

■ A ‘signed off’ review of ‘other information’ (i.e. directors’ report, chairman’s statement, etc).

■ Written management representation that there are no fines/penalties other than those which have been reflected in

the financial statements. -

第4题:

3 You are the manager responsible for the audit of Volcan, a long-established limited liability company. Volcan operates

a national supermarket chain of 23 stores, five of which are in the capital city, Urvina. All the stores are managed in

the same way with purchases being made through Volcan’s central buying department and product pricing, marketing,

advertising and human resources policies being decided centrally. The draft financial statements for the year ended

31 March 2005 show revenue of $303 million (2004 – $282 million), profit before taxation of $9·5 million (2004

– $7·3 million) and total assets of $178 million (2004 – $173 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) On 1 May 2005, Volcan announced its intention to downsize one of the stores in Urvina from a supermarket to

a ‘City Metro’ in response to a significant decline in the demand for supermarket-style. shopping in the capital.

The store will be closed throughout June, re-opening on 1 July 2005. Goodwill of $5·5 million was recognised

three years ago when this store, together with two others, was bought from a national competitor. It is Volcan’s

policy to write off goodwill over five years. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Volcan for the year ended

31 March 2005.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

3 VOLCAN

(a) Store impairment

(i) Matters

■ Materiality

? The cost of goodwill represents 3·1% of total assets and is therefore material.

? However, after three years the carrying amount of goodwill ($2·2m) represents only 1·2% of total assets –

and is therefore immaterial in the context of the balance sheet.

? The annual amortisation charge ($1·1m) represents 11·6% profit before tax (PBT) and is therefore also

material (to the income statement).

? The impact of writing off the whole of the carrying amount would be material to PBT (23%).

Tutorial note: The temporary closure of the supermarket does not constitute a discontinued operation under IFRS 5

‘Non-Current Assets Held for Sale and Discontinued Operations’.

■ Under IFRS 3 ‘Business Combinations’ Volcan should no longer be writing goodwill off over five years but

subjecting it to an annual impairment test.

■ The announcement is after the balance sheet date and is therefore a non-adjusting event (IAS 10 ‘Events After the

Balance Sheet Date’) insofar as no provision for restructuring (for example) can be made.

■ However, the event provides evidence of a possible impairment of the cash-generating unit which is this store and,

in particular, the value of goodwill assigned to it.

■ If the carrying amount of goodwill ($2·2m) can be allocated on a reasonable and consistent basis to this and the

other two stores (purchased at the same time) Volcan’s management should have applied an impairment test to

the goodwill of the downsized store (this is likely to show impairment).

■ If more than 22% of goodwill is attributable to the City Metro store – then its write-off would be material to PBT

(22% × $2·2m ÷ $9·5m = 5%).

■ If the carrying amount of goodwill cannot be so allocated; the impairment test should be applied to the

cash-generating unit that is the three stores (this may not necessarily show impairment).

■ Management should have considered whether the other four stores in Urvina (and elsewhere) are similarly

impaired.

■ Going concern is unlikely to be an issue unless all the supermarkets are located in cities facing a downward trend

in demand.

Tutorial note: Marks will be awarded for stating the rules for recognition of an impairment loss for a cash-generating

unit. However, as it is expected that the majority of candidates will not deal with this matter, the rules of IAS 36 are

not reproduced here.

(ii) Audit evidence

■ Board minutes approving the store’s ‘facelift’ and documenting the need to address the fall in demand for it as a

supermarket.

■ Recomputation of the carrying amount of goodwill (2/5 × $5·5m = $2·2m).

■ A schedule identifying all the assets that relate to the store under review and the carrying amounts thereof agreed

to the underlying accounting records (e.g. non-current asset register).

■ Recalculation of value in use and/or fair value less costs to sell of the cash-generating unit (i.e. the store that is to

become the City Metro, or the three stores bought together) as at 31 March 2005.

Tutorial note: If just one of these amounts exceeds carrying amount there will be no impairment loss. Also, as

there is a plan NOT to sell the store it is most likely that value in use should be used.

■ Agreement of cash flow projections (e.g. to approved budgets/forecast revenues and costs for a maximum of five

years, unless a longer period can be justified).

■ Written management representation relating to the assumptions used in the preparation of financial budgets.

■ Agreement that the pre-tax discount rate used reflects current market assessments of the time value of money (and

the risks specific to the store) and is reasonable. For example, by comparison with Volcan’s weighted average cost

of capital.

■ Inspection of the store (if this month it should be closed for refurbishment).

■ Revenue budgets and cash flow projections for:

– the two stores purchased at the same time;

– the other stores in Urvina; and

– the stores elsewhere.

Also actual after-date sales by store compared with budget. -

第5题:

(b) Seymour offers health-related information services through a wholly-owned subsidiary, Aragon Co. Goodwill of

$1·8 million recognised on the purchase of Aragon in October 2004 is not amortised but included at cost in the

consolidated balance sheet. At 30 September 2006 Seymour’s investment in Aragon is shown at cost,

$4·5 million, in its separate financial statements.

Aragon’s draft financial statements for the year ended 30 September 2006 show a loss before taxation of

$0·6 million (2005 – $0·5 million loss) and total assets of $4·9 million (2005 – $5·7 million). The notes to

Aragon’s financial statements disclose that they have been prepared on a going concern basis that assumes that

Seymour will continue to provide financial support. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

(b) Goodwill

(i) Matters

■ Cost of goodwill, $1·8 million, represents 3·4% consolidated total assets and is therefore material.

Tutorial note: Any assessments of materiality of goodwill against amounts in Aragon’s financial statements are

meaningless since goodwill only exists in the consolidated financial statements of Seymour.

■ It is correct that the goodwill is not being amortised (IFRS 3 Business Combinations). However, it should be tested

at least annually for impairment, by management.

■ Aragon has incurred losses amounting to $1·1 million since it was acquired (two years ago). The write-off of this

amount against goodwill in the consolidated financial statements would be material (being 61% cost of goodwill,

8·3% PBT and 2·1% total assets).

■ The cost of the investment ($4·5 million) in Seymour’s separate financial statements will also be material and

should be tested for impairment.

■ The fair value of net assets acquired was only $2·7 million ($4·5 million less $1·8 million). Therefore the fair

value less costs to sell of Aragon on other than a going concern basis will be less than the carrying amount of the

investment (i.e. the investment is impaired by at least the amount of goodwill recognised on acquisition).

■ In assessing recoverable amount, value in use (rather than fair value less costs to sell) is only relevant if the going

concern assumption is appropriate for Aragon.

■ Supporting Aragon financially may result in Seymour being exposed to actual and/or contingent liabilities that

should be provided for/disclosed in Seymour’s financial statements in accordance with IAS 37 Provisions,

Contingent Liabilities and Contingent Assets.

(ii) Audit evidence

■ Carrying values of cost of investment and goodwill arising on acquisition to prior year audit working papers and

financial statements.

■ A copy of Aragon’s draft financial statements for the year ended 30 September 2006 showing loss for year.

■ Management’s impairment test of Seymour’s investment in Aragon and of the goodwill arising on consolidation at

30 September 2006. That is a comparison of the present value of the future cash flows expected to be generated

by Aragon (a cash-generating unit) compared with the cost of the investment (in Seymour’s separate financial

statements).

■ Results of any impairment tests on Aragon’s assets extracted from Aragon’s working paper files.

■ Analytical procedures on future cash flows to confirm their reasonableness (e.g. by comparison with cash flows for

the last two years).

■ Bank report for audit purposes for any guarantees supporting Aragon’s loan facilities.

■ A copy of Seymour’s ‘comfort letter’ confirming continuing financial support of Aragon for the foreseeable future. -

第6题:

(a) The following information relates to Crosswire a publicly listed company.

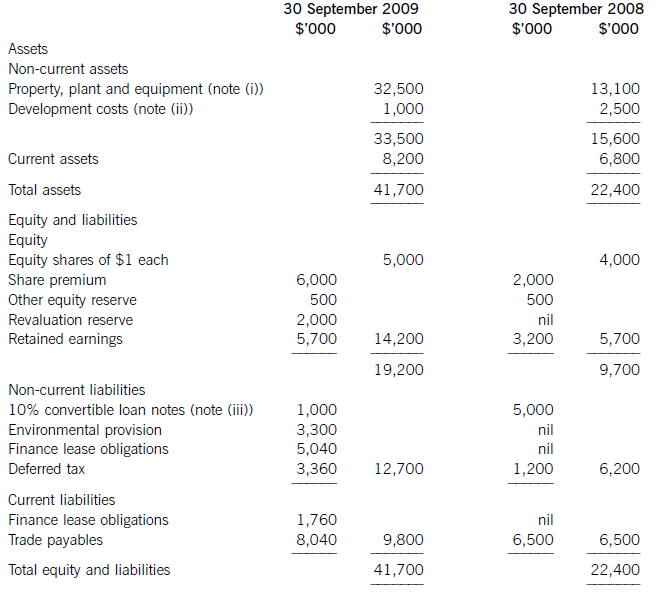

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

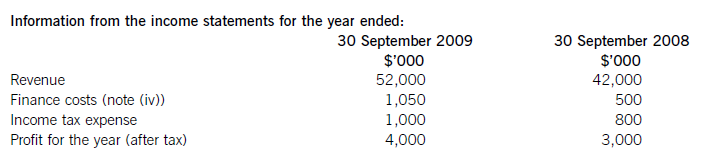

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

正确答案:

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced. -

第7题:

It can be inferred from the passage that international students in the programs __.

A. get full scholarship

B. pay no tuition

C. get no financial support

D. earn more money

正确答案:C

-

第8题:

共用题干

Going Back to Its Birthplace

No sporting event takes hold of the world's attention and imagination like the Olympic

Games.The football World Cup fascinates fans in Europe and South America;baseball's

World Series is required viewing in North America;and the World Table Tennis

Championships attracts the most interest in Asia.

But the Olympics belong to the whole world.Now,after travelling to 17 countries over

108 years,the summer Games are returning to Athens,the place where the first modern

Olympics was held.

Participation in the Games is looked on not only as an achievement,but also as an

honour. The 1 6 days between August 1 3 and 29 will see a record 202 countries compete,

up from Sydney's 199.Afghanistan is back,having been banned from Sydney because the

Taliban government didn't let women do sports.There is also a place for newcomers East

Timor and Kiribati.

A total of 10,500 athletes will compete in 28 sports,watched by 5.3 million ticket-

paying viewers as well as a television audience of 4 billion.

Athens is to use its rich history and culture to make the Olympics as special as

possible.The Games will open with cycling events which start in front of the Parthenon and

Acropolis monuments.The final event will be a historic men's marathon following the original

route run by Phidippides in 490 BC to bring news of victory over the Persians.

The ancient stadium at Olympia,first used for the Games nearly three centuries ago,

will stage the shot put competitions.And the Panathenian Stadium,where the first modern

Olympics was held,is to host the archery(射箭)events.

If the well-known ancient sites deliver a great sense of history to the Games,the 39

new venues add a modern touch to the city of Athens.The main Olympic stadium,with a

giant glass and steel roof, is the landmark(标志)building of the Olympics.

"We believe that we will organize a'magical'Games,"said Athens 2004 President

Gianna Angelopoulos-Daskalaki. "Our history with the Olympic Games goes back nearly

3,000 years,and Athens 2004 could be the best ever."The first modern Olympics was held nearly three centuries ago.

A:Right

B:Wrong

C:Not mentioned答案:B解析: -

第9题:

问答题Is city A closer to city B than it is to city C? (1) City C is 197 miles from city A. (2) City C is 163 miles from city B.正确答案: E解析:

以C为圆心AC为半径画圆,B点在院中,A点位于圆周上,观察图形可知A可能更接近B也可能更接近C,所以结合(1)、(2)两个条件都无法判断,故本题选E项。 -

第10题:

单选题From the last paragraph we learn that the investments by Google. org come from _____.AGoogle’s profits and stock value

Bsome international IT companies

Cthe company’s own interests

Dlocal commercial banks

正确答案: D解析:

主旨归纳题。定位到原文最后一段第一句“The creators of Google have promised to give Google. org about one percent of company profits and one percent of its total stock value every year”,谷歌的这些项目投资资金来自于其公司百分之一的利润和百分之一的股值。A项即是对该句的直接引用,完全符合。B、C、D项在文中没有依据,属于臆造,可以排除。 -

第11题:

填空题The International festival of music and the arts is held every year in the city of()正确答案: Edinburgh解析: 暂无解析 -

第12题:

问答题Directions: In this section, there is one passage followed by a summary. Read the passage carefully and complete the summary below by choosing a maximum of three words from the passage to fill in the spaces 66-70. Remember to write the answers on the Answer Sheet. Questions 1-5 are based on the following passage. In August 2008, athletes from the United States and around the world will compete in the Beijing Olympics. But did you know that in September of next year, disabled athletes will compete in the Paralympic Games in Beijing? The Olympics and the Paralympics are separate movements. But they have always been held in the same year, and since 1988, they have also been held in the same city. The International Olympic Committee and the International Paralympic Committee signed an agreement in 2001 to secure this connection. The next winter games will take place in Vancouver, Canada, in 2010. The Paralympic Games grew out of a sports competition held in 1948 in England and a doctor named Ludwig Guttmann organized it for men who suffered spinal cord injuries in World War II. Four years later, it became an international event as competitors from the Netherlands took part. Then, in 1960, the first Paralympics were held in Rome. 400 athletes from 23 countries competed. By 2004, the Paralympic Games in Athens had almost 4000 athletes from 136 countries, who may have physical or mental limitations and may be blind or in wheelchairs. Yet sometimes they perform better than athletes without disabilities. In 1968, Eunice Kennedy Shriver, the sister of former President John F. Kennedy, started the Special Olympics, which are just for children and adults with mental limitations and whose programs currently serve more than two million people in 160 countries. In November 2006, in Mumbai, India, teams competed in the First Special Olympics International Cricket Cup. In addition to India, there were men’s teams from Afghanistan, Australia, Bangladesh, Nepal, Pakistan, Sri Lanka and the West Indies. There were also women’s cricket teams from India and Pakistan. There are many organizations in the United States that help people with disabilities play sports. Wheelchair tennis is a popular sport. So is basketball. In fact, there are more than one hundred professional teams playing wheelchair basketball thanks to the special wheelchairs for athletes that are lightweight and designed for quick moves. For people who want to go really fast in their chairs, there is a Power Wheelchair Racing Association. In the state of Utah there is a place called the National Ability Center, which teaches all kinds of sports to people with all kinds of physical and mental disabilities and even gives friends and family members a chance to try a sport as if they were disabled. A reporter from the Washington Post wanted to know what it would be like for a blind person to use a climbing wall. So, protected by a safety line, the newspaper reporter closed his eyes and started to feel for places to put his hands and feet. Trainers on the ground urged him on: “Take your time. You can do it.” Finally he reached the top. At the National Ability Center people can learn to ride horses and mountain bikes. They can try winter mountain sports, and learn scuba diving and other water activities. The center also prepares athletes for the Paralympics. These days, the first place many people go when they want to travel is the Internet, where they can get information about hotels, transportation and services like tour companies. The Internet can also help travelers find special services for the disabled. For example, there are groups that help young people with disabilities travel to different countries. Susan Sygall, who uses a wheelchair herself, leads an organization called Mobility International USA, and has traveled to more than twenty-five countries to talk about the rights of people with disabilities. She says people with disabilities are all members of a global family and working together across borders is the most powerful way of making changes. Summary: The Olympics and the Paralympics are 1 but they have always been held in the same year and also in the same city since 1988 when the International Olympic Committee and the International Paralympic Committee signed an agreement in 2001 to secure this connection.The Paralympic Games grew out of a sports competition organized by a doctor named 2 in 1948 in England for men injured in World War II. In 1952, it became an 3 and in 1960, the first Paralympics were held in Rome for people who may have physical or mental limitations or may be blind or in wheelchairs.The 4 was started in 1968 in the United States by Eunice Kennedy Shriver just for children and adults with mental limitations and to help people with disabilities play sports and enjoy other activities, many 5 are founded, such as the Power Wheelchair Racing Association, the National Ability Center and Mobility International USA.正确答案:

1.separate movements 由原文第二段第一句话可知奥运会和残奥会是两项分开的运动盛会。

2.Ludwig Guttmann 由第三段第一句话可知。

3.international event 由第三段中Then, in 1960, the first Paralympics were held in Rome. 400 athletes from 23 countries competed 可知,为脊髓病患者举办的运动会在1960年变成世界性的运动会。

4.Special Olympics 由第四段可知,特殊运动会发源于1968年。

5.organizations 由文中第五段可知,世界各国建立了很多组织,帮助残障人士进行各项运动。解析: 暂无解析 -

第13题:

(b) One of the hotels owned by Norman is a hotel complex which includes a theme park, a casino and a golf course,

as well as a hotel. The theme park, casino, and hotel were sold in the year ended 31 May 2008 to Conquest, a

public limited company, for $200 million but the sale agreement stated that Norman would continue to operate

and manage the three businesses for their remaining useful life of 15 years. The residual interest in the business

reverts back to Norman after the 15 year period. Norman would receive 75% of the net profit of the businesses

as operator fees and Conquest would receive the remaining 25%. Norman has guaranteed to Conquest that the

net minimum profit paid to Conquest would not be less than $15 million. (4 marks)

Norman has recently started issuing vouchers to customers when they stay in its hotels. The vouchers entitle the

customers to a $30 discount on a subsequent room booking within three months of their stay. Historical

experience has shown that only one in five vouchers are redeemed by the customer. At the company’s year end

of 31 May 2008, it is estimated that there are vouchers worth $20 million which are eligible for discount. The

income from room sales for the year is $300 million and Norman is unsure how to report the income from room

sales in the financial statements. (4 marks)

Norman has obtained a significant amount of grant income for the development of hotels in Europe. The grants

have been received from government bodies and relate to the size of the hotel which has been built by the grant

assistance. The intention of the grant income was to create jobs in areas where there was significant

unemployment. The grants received of $70 million will have to be repaid if the cost of building the hotels is less

than $500 million. (4 marks)

Appropriateness and quality of discussion (2 marks)

Required:

Discuss how the above income would be treated in the financial statements of Norman for the year ended

31 May 2008.

正确答案:

(b) Property is sometimes sold with a degree of continuing involvement by the seller so that the risks and rewards of ownership

have not been transferred. The nature and extent of the buyer’s involvement will determine how the transaction is accounted

for. The substance of the transaction is determined by looking at the transaction as a whole and IAS18 ‘Revenue’ requires

this by stating that where two or more transactions are linked, they should be treated as a single transaction in order to

understand the commercial effect (IAS18 paragraph 13). In the case of the sale of the hotel, theme park and casino, Norman

should not recognise a sale as the company continues to enjoy substantially all of the risks and rewards of the businesses,

and still operates and manages them. Additionally the residual interest in the business reverts back to Norman. Also Norman

has guaranteed the income level for the purchaser as the minimum payment to Conquest will be $15 million a year. The

transaction is in substance a financing arrangement and the proceeds should be treated as a loan and the payment of profits

as interest.

The principles of IAS18 and IFRIC13 ‘Customer Loyalty Programmes’ require that revenue in respect of each separate

component of a transaction is measured at its fair value. Where vouchers are issued as part of a sales transaction and are

redeemable against future purchases, revenue should be reported at the amount of the consideration received/receivable less

the voucher’s fair value. In substance, the customer is purchasing both goods or services and a voucher. The fair value of the

voucher is determined by reference to the value to the holder and not the cost to the issuer. Factors to be taken into account

when estimating the fair value, would be the discount the customer obtains, the percentage of vouchers that would be

redeemed, and the time value of money. As only one in five vouchers are redeemed, then effectively the hotel has sold goods

worth ($300 + $4) million, i.e. $304 million for a consideration of $300 million. Thus allocating the discount between the

two elements would mean that (300 ÷ 304 x $300m) i.e. $296·1 million will be allocated to the room sales and the balance

of $3·9 million to the vouchers. The deferred portion of the proceeds is only recognised when the obligations are fulfilled.

The recognition of government grants is covered by IAS20 ‘Accounting for government grants and disclosure of government

assistance’. The accruals concept is used by the standard to match the grant received with the related costs. The relationship

between the grant and the related expenditure is the key to establishing the accounting treatment. Grants should not be

recognised until there is reasonable assurance that the company can comply with the conditions relating to their receipt and

the grant will be received. Provision should be made if it appears that the grant may have to be repaid.

There may be difficulties of matching costs and revenues when the terms of the grant do not specify precisely the expense

towards which the grant contributes. In this case the grant appears to relate to both the building of hotels and the creation of

employment. However, if the grant was related to revenue expenditure, then the terms would have been related to payroll or

a fixed amount per job created. Hence it would appear that the grant is capital based and should be matched against the

depreciation of the hotels by using a deferred income approach or deducting the grant from the carrying value of the asset

(IAS20). Additionally the grant is only to be repaid if the cost of the hotel is less than $500 million which itself would seem

to indicate that the grant is capital based. If the company feels that the cost will not reach $500 million, a provision should

be made for the estimated liability if the grant has been recognised. -

第14题:

(b) The marketing director of CTC has suggested the introduction of a new toy ‘Nellie the Elephant’ for which the

following estimated information is available:

1. Sales volumes and selling prices per unit

Year ending, 31 May 2009 2010 2011

Sales units (000) 80 180 100

Selling price per unit ($) 50 50 50

2. Nellie will generate a contribution to sales ratio of 50% throughout the three year period.

3. Product specific fixed overheads during the year ending 31 May 2009 are estimated to be $1·6 million. It

is anticipated that these fixed overheads would decrease by 10% per annum during each of the years ending

31 May 2010 and 31 May 2011.

4. Capital investment amounting to $3·9 million would be required in June 2008. The investment would have

no residual value at 31 May 2011.

5. Additional working capital of $500,000 would be required in June 2008. A further $200,000 would be

required on 31 May 2009. These amounts would be recovered in full at the end of the three year period.

6. The cost of capital is expected to be 12% per annum.

Assume all cash flows (other than where stated) arise at the end of the year.

Required:

(i) Determine whether the new product is viable purely on financial grounds. (4 marks)

正确答案:

-

第15题:

2 Plaza, a limited liability company, is a major food retailer. Further to the success of its national supermarkets in the

late 1990s it has extended its operations throughout Europe and most recently to Asia, where it is expanding rapidly.

You are a manager in Andando, a firm of Chartered Certified Accountants. You have been approached by Duncan

Seymour, the chief finance officer of Plaza, to advise on a bid that Plaza is proposing to make for the purchase of

MCM. You have ascertained the following from a briefing note received from Duncan.

MCM provides training in management, communications and marketing to a wide range of corporate clients, including

multi-nationals. The ‘MCM’ name is well regarded in its areas of expertise. MCM is currently wholly-owned by

Frontiers, an international publisher of textbooks, whose shares are quoted on a recognised stock exchange. MCM

has a National and an International business.

The National business comprises 11 training centres. The audited financial statements show revenue of

$12·5 million and profit before taxation of $1·3 million for this geographic segment for the year to 31 December

2004. Most of the National business’s premises are owned or held on long leases. Trainers in the National business

are mainly full-time employees.

The International business has five training centres in Europe and Asia. For these segments, revenue amounted to

$6·3 million and profit before tax $2·4 million for the year to 31 December 2004. Most of the International business’s

premises are held on operating leases. International trade receivables at 31 December 2004 amounted to

$3·7 million. Although the International centres employ some full-time trainers, the majority of trainers provide their

services as freelance consultants.

Required:

(a) Define ‘due diligence’ and describe the nature and purpose of a due diligence review. (4 marks)

正确答案:

2 MCM

(a) Nature and purpose of a ‘due diligence’ review

■ ‘Due diligence’ may be defined as the process of systematically obtaining and assessing information in order to identify

and contain the risks associated with a transaction (e.g. buying a business) to an acceptable level.

■ The nature of such a review is therefore that it involves:

? an investigation (e.g. into a company whose equity may be sold); and

? disclosure (e.g. to a potential investor) of findings.

■ A due diligence assignment consists primarily of inquiry and analytical procedures.

Tutorial note: It will not, for example, routinely involve tests of control or substantive procedures.

* As the timescale for a due diligence review is often relatively short, but wider in scope than the financial statements

(e.g. business prospects, market valuation), there may be no expression of assurance.

■ Its purpose is to find all the facts that would be of material interest to an investor or acquirer of a business. It may not

uncover all such factors but should be designed with a reasonable expectation of so doing.

■ Professional accountants will not be held liable for non-disclosure of information that failed to be uncovered if their

review was conducted with ‘due diligence’. -

第16题:

(b) You are the audit manager of Johnston Co, a private company. The draft consolidated financial statements for

the year ended 31 March 2006 show profit before taxation of $10·5 million (2005 – $9·4 million) and total

assets of $55·2 million (2005 – $50·7 million).

Your firm was appointed auditor of Tiltman Co when Johnston Co acquired all the shares of Tiltman Co in March

2006. Tiltman’s draft financial statements for the year ended 31 March 2006 show profit before taxation of

$0·7 million (2005 – $1·7 million) and total assets of $16·1 million (2005 – $16·6 million). The auditor’s

report on the financial statements for the year ended 31 March 2005 was unmodified.

You are currently reviewing two matters that have been left for your attention on the audit working paper files for

the year ended 31 March 2006:

(i) In December 2004 Tiltman installed a new computer system that properly quantified an overvaluation of

inventory amounting to $2·7 million. This is being written off over three years.

(ii) In May 2006, Tiltman’s head office was relocated to Johnston’s premises as part of a restructuring.

Provisions for the resulting redundancies and non-cancellable lease payments amounting to $2·3 million

have been made in the financial statements of Tiltman for the year ended 31 March 2006.

Required:

Identify and comment on the implications of these two matters for your auditor’s reports on the financial

statements of Johnston Co and Tiltman Co for the year ended 31 March 2006. (10 marks)

正确答案:

(b) Tiltman Co

Tiltman’s total assets at 31 March 2006 represent 29% (16·1/55·2 × 100) of Johnston’s total assets. The subsidiary is

therefore material to Johnston’s consolidated financial statements.

Tutorial note: Tiltman’s profit for the year is not relevant as the acquisition took place just before the year end and will

therefore have no impact on the consolidated income statement. Calculations of the effect on consolidated profit before

taxation are therefore inappropriate and will not be awarded marks.

(i) Inventory overvaluation

This should have been written off to the income statement in the year to 31 March 2005 and not spread over three

years (contrary to IAS 2 ‘Inventories’).

At 31 March 2006 inventory is overvalued by $0·9m. This represents all Tiltmans’s profit for the year and 5·6% of

total assets and is material. At 31 March 2005 inventory was materially overvalued by $1·8m ($1·7m reported profit

should have been a $0·1m loss).

Tutorial note: 1/3 of the overvaluation was written off in the prior period (i.e. year to 31 March 2005) instead of $2·7m.

That the prior period’s auditor’s report was unmodified means that the previous auditor concurred with an incorrect

accounting treatment (or otherwise gave an inappropriate audit opinion).

As the matter is material a prior period adjustment is required (IAS 8 ‘Accounting Policies, Changes in Accounting

Estimates and Errors’). $1·8m should be written off against opening reserves (i.e. restated as at 1 April 2005).

(ii) Restructuring provision

$2·3m expense has been charged to Tiltman’s profit and loss in arriving at a draft profit of $0·7m. This is very material.

(The provision represents 14·3% of Tiltman’s total assets and is material to the balance sheet date also.)

The provision for redundancies and onerous contracts should not have been made for the year ended 31 March 2006

unless there was a constructive obligation at the balance sheet date (IAS 37 ‘Provisions, Contingent Liabilities and

Contingent Assets’). So, unless the main features of the restructuring plan had been announced to those affected (i.e.

redundancy notifications issued to employees), the provision should be reversed. However, it should then be disclosed

as a non-adjusting post balance sheet event (IAS 10 ‘Events After the Balance Sheet Date’).

Given the short time (less than one month) between acquisition and the balance sheet it is very possible that a

constructive obligation does not arise at the balance sheet date. The relocation in May was only part of a restructuring

(and could be the first evidence that Johnston’s management has started to implement a restructuring plan).

There is a risk that goodwill on consolidation of Tiltman may be overstated in Johnston’s consolidated financial

statements. To avoid the $2·3 expense having a significant effect on post-acquisition profit (which may be negligible

due to the short time between acquisition and year end), Johnston may have recognised it as a liability in the

determination of goodwill on acquisition.

However, the execution of Tiltman’s restructuring plan, though made for the year ended 31 March 2006, was conditional

upon its acquisition by Johnston. It does not therefore represent, immediately before the business combination, a

present obligation of Johnston. Nor is it a contingent liability of Johnston immediately before the combination. Therefore

Johnston cannot recognise a liability for Tiltman’s restructuring plans as part of allocating the cost of the combination

(IFRS 3 ‘Business Combinations’).

Tiltman’s auditor’s report

The following adjustments are required to the financial statements:

■ restructuring provision, $2·3m, eliminated;

■ adequate disclosure of relocation as a non-adjusting post balance sheet event;

■ current period inventory written down by $0·9m;

■ prior period inventory (and reserves) written down by $1·8m.

Profit for the year to 31 March 2006 should be $3·9m ($0·7 + $0·9 + $2·3).

If all these adjustments are made the auditor’s report should be unmodified. Otherwise, the auditor’s report should be

qualified ‘except for’ on grounds of disagreement. If none of the adjustments are made, the qualification should still be

‘except for’ as the matters are not pervasive.

Johnston’s auditor’s report

If Tiltman’s auditor’s report is unmodified (because the required adjustments are made) the auditor’s report of Johnston

should be similarly unmodified. As Tiltman is wholly-owned by Johnston there should be no problem getting the

adjustments made.

If no adjustments were made in Tiltman’s financial statements, adjustments could be made on consolidation, if

necessary, to avoid modification of the auditor’s report on Johnston’s financial statements.

The effect of these adjustments on Tiltman’s net assets is an increase of $1·4m. Goodwill arising on consolidation (if

any) would be reduced by $1·4m. The reduction in consolidated total assets required ($0·9m + $1·4m) is therefore

the same as the reduction in consolidated total liabilities (i.e. $2·3m). $2·3m is material (4·2% consolidated total

assets). If Tiltman’s financial statements are not adjusted and no adjustments are made on consolidation, the

consolidated financial position (balance sheet) should be qualified ‘except for’. The results of operations (i.e. profit for

the period) should be unqualified (if permitted in the jurisdiction in which Johnston reports).

Adjustment in respect of the inventory valuation may not be required as Johnston should have consolidated inventory

at fair value on acquisition. In this case, consolidated total liabilities should be reduced by $2·3m and goodwill arising

on consolidation (if any) reduced by $2·3m.

Tutorial note: The effect of any possible goodwill impairment has been ignored as the subsidiary has only just been

acquired and the balance sheet date is very close to the date of acquisition. -

第17题:

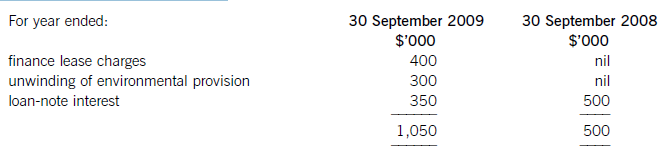

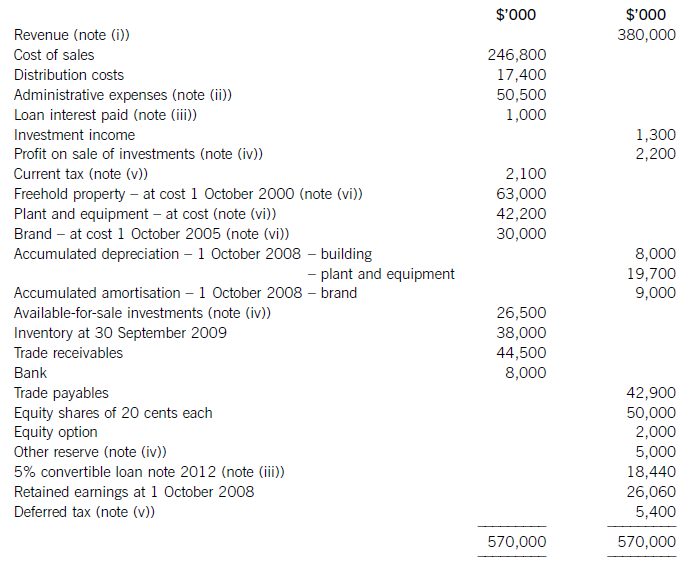

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

正确答案:

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities. -

第18题:

You are an audit manager at Rockwell & Co, a firm of Chartered Certified Accountants. You are responsible for the audit of the Hopper Group, a listed audit client which supplies ingredients to the food and beverage industry worldwide.

The audit work for the year ended 30 June 2015 is nearly complete, and you are reviewing the draft audit report which has been prepared by the audit senior. During the year the Hopper Group purchased a new subsidiary company, Seurat Sweeteners Co, which has expertise in the research and design of sugar alternatives. The draft financial statements of the Hopper Group for the year ended 30 June 2015 recognise profit before tax of $495 million (2014 – $462 million) and total assets of $4,617 million (2014: $4,751 million). An extract from the draft audit report is shown below:

Basis of modified opinion (extract)

In their calculation of goodwill on the acquisition of the new subsidiary, the directors have failed to recognise consideration which is contingent upon meeting certain development targets. The directors believe that it is unlikely that these targets will be met by the subsidiary company and, therefore, have not recorded the contingent consideration in the cost of the acquisition. They have disclosed this contingent liability fully in the notes to the financial statements. We do not feel that the directors’ treatment of the contingent consideration is correct and, therefore, do not believe that the criteria of the relevant standard have been met. If this is the case, it would be appropriate to adjust the goodwill balance in the statement of financial position.

We believe that any required adjustment may materially affect the goodwill balance in the statement of financial position. Therefore, in our opinion, the financial statements do not give a true and fair view of the financial position of the Hopper Group and of the Hopper Group’s financial performance and cash flows for the year then ended in accordance with International Financial Reporting Standards.

Emphasis of Matter Paragraph

We draw attention to the note to the financial statements which describes the uncertainty relating to the contingent consideration described above. The note provides further information necessary to understand the potential implications of the contingency.

Required:

(a) Critically appraise the draft audit report of the Hopper Group for the year ended 30 June 2015, prepared by the audit senior.

Note: You are NOT required to re-draft the extracts from the audit report. (10 marks)

(b) The audit of the new subsidiary, Seurat Sweeteners Co, was performed by a different firm of auditors, Fish Associates. During your review of the communication from Fish Associates, you note that they were unable to obtain sufficient appropriate evidence with regard to the breakdown of research expenses. The total of research costs expensed by Seurat Sweeteners Co during the year was $1·2 million. Fish Associates has issued a qualified audit opinion on the financial statements of Seurat Sweeteners Co due to this inability to obtain sufficient appropriate evidence.

Required:

Comment on the actions which Rockwell & Co should take as the auditor of the Hopper Group, and the implications for the auditor’s report on the Hopper Group financial statements. (6 marks)

(c) Discuss the quality control procedures which should be carried out by Rockwell & Co prior to the audit report on the Hopper Group being issued. (4 marks)

正确答案:(a) Critical appraisal of the draft audit report

Type of opinion

When an auditor issues an opinion expressing that the financial statements ‘do not give a true and fair view’, this represents an adverse opinion. The paragraph explaining the modification should, therefore, be titled ‘Basis of Adverse Opinion’ rather than simply ‘Basis of Modified Opinion’.

An adverse opinion means that the auditor considers the misstatement to be material and pervasive to the financial statements of the Hopper Group. According to ISA 705 Modifications to Opinions in the Independent Auditor’s Report, pervasive matters are those which affect a substantial proportion of the financial statements or fundamentally affect the users’ understanding of the financial statements. It is unlikely that the failure to recognise contingent consideration is pervasive; the main effect would be to understate goodwill and liabilities. This would not be considered a substantial proportion of the financial statements, neither would it be fundamental to understanding the Hopper Group’s performance and position.

However, there is also some uncertainty as to whether the matter is even material. If the matter is determined to be material but not pervasive, then a qualified opinion would be appropriate on the basis of a material misstatement. If the matter is not material, then no modification would be necessary to the audit opinion.

Wording of opinion/report

The auditor’s reference to ‘the acquisition of the new subsidiary’ is too vague; the Hopper Group may have purchased a number of subsidiaries which this phrase could relate to. It is important that the auditor provides adequate description of the event and in these circumstances it would be appropriate to name the subsidiary referred to.

The auditor has not quantified the amount of the contingent element of the consideration. For the users to understand the potential implications of any necessary adjustments, they need to know how much the contingent consideration will be if it becomes payable. It is a requirement of ISA 705 that the auditor quantifies the financial effects of any misstatements, unless it is impracticable to do so.

In addition to the above point, the auditor should provide more description of the financial effects of the misstatement, including full quantification of the effect of the required adjustment to the assets, liabilities, incomes, revenues and equity of the Hopper Group.

The auditor should identify the note to the financial statements relevant to the contingent liability disclosure rather than just stating ‘in the note’. This will improve the understandability and usefulness of the contents of the audit report.

The use of the term ‘we do not feel that the treatment is correct’ is too vague and not professional. While there may be some interpretation necessary when trying to apply financial reporting standards to unique circumstances, the expression used is ambiguous and may be interpreted as some form. of disclaimer by the auditor with regard to the correct accounting treatment. The auditor should clearly explain how the treatment applied in the financial statements has departed from the requirements of the relevant standard.

Tutorial note: As an illustration to the above point, an appropriate wording would be: ‘Management has not recognised the acquisition-date fair value of contingent consideration as part of the consideration transferred in exchange for the acquiree, which constitutes a departure from International Financial Reporting Standards.’

The ambiguity is compounded by the use of the phrase ‘if this is the case, it would be appropriate to adjust the goodwill’. This once again suggests that the correct treatment is uncertain and perhaps open to interpretation.

If the auditor wishes to refer to a specific accounting standard they should refer to its full title. Therefore instead of referring to ‘the relevant standard’ they should refer to International Financial Reporting Standard 3 Business Combinations.

The opinion paragraph requires an appropriate heading. In this case the auditors have issued an adverse opinion and the paragraph should be headed ‘Adverse Opinion’.

As with the basis paragraph, the opinion paragraph lacks authority; suggesting that the required adjustments ‘may’ materially affect the financial statements implies that there is a degree of uncertainty. This is not the case; the amount of the contingent consideration will be disclosed in the relevant purchase agreement, so the auditor should be able to determine whether the required adjustments are material or not. Regardless, the sentence discussing whether the balance is material or not is not required in the audit report as to warrant inclusion in the report the matter must be considered material. The disclosure of the nature and financial effect of the misstatement in the basis paragraph is sufficient.

Finally, the emphasis of matter paragraph should not be included in the audit report. An emphasis of matter paragraph is only used to draw attention to an uncertainty/matter of fundamental importance which is correctly accounted for and disclosed in the financial statements. An emphasis of matter is not required in this case for the following reasons:

– Emphasis of matter is only required to highlight matters which the auditor believes are fundamental to the users’ understanding of the business. An example may be where a contingent liability exists which is so significant it could lead to the closure of the reporting entity. That is not the case with the Hopper Group; the contingent liability does not appear to be fundamental.

– Emphasis of matter is only used for matters where the auditor has obtained sufficient appropriate evidence that the matter is not materially misstated in the financial statements. If the financial statements are materially misstated, in this regard the matter would be fully disclosed by the auditor in the basis of qualified/adverse opinion paragraph and no emphasis of matter is necessary.

(b) Communication from the component auditor

The qualified opinion due to insufficient evidence may be a significant matter for the Hopper Group audit. While the possible adjustments relating to the current year may not be material to the Hopper Group, the inability to obtain sufficient appropriate evidence with regard to a material matter in Seurat Sweeteners Co’s financial statements may indicate a control deficiency which the auditor was not aware of at the planning stage and it could indicate potential problems with regard to the integrity of management, which could also indicate a potential fraud. It could also indicate an unwillingness of management to provide information, which could create problems for future audits, particularly if research and development costs increase in future years. If the group auditor suspects that any of these possibilities are true, they may need to reconsider their risk assessment and whether the audit procedures performed are still appropriate.

If the detail provided in the communication from the component auditor is insufficient, the group auditor should first discuss the matter with the component auditor to see whether any further information can be provided. The group auditor can request further working papers from the component auditor if this is necessary. However, if Seurat Sweeteners has not been able to provide sufficient appropriate evidence, it is unlikely that this will be effective.

If the discussions with the component auditor do not provide satisfactory responses to evaluate the potential impact on the Hopper Group, the group auditor may need to communicate with either the management of Seurat Sweeteners or the Hopper Group to obtain necessary clarification with regard to the matter.

Following these procedures, the group auditor needs to determine whether they have sufficient appropriate evidence to draw reasonable conclusions on the Hopper Group’s financial statements. If they believe the lack of information presents a risk of material misstatement in the group financial statements, they can request that further audit procedures be performed, either by the component auditor or by themselves.

Ultimately the group engagement partner has to evaluate the effect of the inability to obtain sufficient appropriate evidence on the audit opinion of the Hopper Group. The matter relates to research expenses totalling $1·2 million, which represents 0·2% of the profit for the year and 0·03% of the total assets of the Hopper Group. It is therefore not material to the Hopper Group’s financial statements. For this reason no modification to the audit report of the Hopper Group would be required as this does not represent a lack of sufficient appropriate evidence with regard to a matter which is material to the Group financial statements.

Although this may not have an impact on the Hopper Group audit opinion, this may be something the group auditor wishes to bring to the attention of those charged with governance. This would be particularly likely if the group auditor believed that this could indicate some form. of fraud in Seurat Sweeteners Co, a serious deficiency in financial reporting controls or if this could create problems for accepting future audits due to management’s unwillingness to provide access to accounting records.

(c) Quality control procedures prior to issuing the audit report

ISA 220 Quality Control for an Audit of Financial Statements and ISQC 1 Quality Control for Firms that Perform. Audits and Reviews of Historical Financial Information, and Other Assurance and Related Services Agreements require that an engagement quality control reviewer shall be appointed for audits of financial statements of listed entities. The audit engagement partner then discusses significant matters arising during the audit engagement with the engagement quality control reviewer.

The engagement quality control reviewer and the engagement partner should discuss the failure to recognise the contingent consideration and its impact on the auditor’s report. The engagement quality control reviewer must review the financial statements and the proposed auditor’s report, in particular focusing on the conclusions reached in formulating the auditor’s report and consideration of whether the proposed auditor’s opinion is appropriate. The audit documentation relating to the acquisition of Seurat Sweeteners Co will be carefully reviewed, and the reviewer is likely to consider whether procedures performed in relation to these balances were appropriate.

Given the listed status of the Hopper Group, any modification to the auditor’s report will be scrutinised, and the firm must be sure of any decision to modify the report, and the type of modification made. Once the engagement quality control reviewer has considered the necessity of a modification, they should consider whether a qualified or an adverse opinion is appropriate in the circumstances. This is an important issue, given that it requires judgement as to whether the matters would be material or pervasive to the financial statements.

The engagement quality control reviewer should ensure that there is adequate documentation regarding the judgements used in forming the final audit opinion, and that all necessary matters have been brought to the attention of those charged with governance.

The auditor’s report must not be signed and dated until the completion of the engagement quality control review.

Tutorial note: In the case of the Hopper Group’s audit, the lack of evidence in respect of research costs is unlikely to be discussed unless the audit engagement partner believes that the matter could be significant, for example, if they suspected the lack of evidence is being used to cover up a financial statements fraud.

-

第19题:

共用题干

Going Back to Its Birthplace

No sporting event takes hold of the world's attention and imagination like the Olympic

Games.The football World Cup fascinates fans in Europe and South America;baseball's

World Series is required viewing in North America;and the World Table Tennis

Championships attracts the most interest in Asia.

But the Olympics belong to the whole world.Now,after travelling to 17 countries over

108 years,the summer Games are returning to Athens,the place where the first modern

Olympics was held.

Participation in the Games is looked on not only as an achievement,but also as an

honour. The 1 6 days between August 1 3 and 29 will see a record 202 countries compete,

up from Sydney's 199.Afghanistan is back,having been banned from Sydney because the

Taliban government didn't let women do sports.There is also a place for newcomers East

Timor and Kiribati.

A total of 10,500 athletes will compete in 28 sports,watched by 5.3 million ticket-

paying viewers as well as a television audience of 4 billion.

Athens is to use its rich history and culture to make the Olympics as special as

possible.The Games will open with cycling events which start in front of the Parthenon and

Acropolis monuments.The final event will be a historic men's marathon following the original

route run by Phidippides in 490 BC to bring news of victory over the Persians.

The ancient stadium at Olympia,first used for the Games nearly three centuries ago,

will stage the shot put competitions.And the Panathenian Stadium,where the first modern

Olympics was held,is to host the archery(射箭)events.

If the well-known ancient sites deliver a great sense of history to the Games,the 39

new venues add a modern touch to the city of Athens.The main Olympic stadium,with a

giant glass and steel roof, is the landmark(标志)building of the Olympics.

"We believe that we will organize a'magical'Games,"said Athens 2004 President

Gianna Angelopoulos-Daskalaki. "Our history with the Olympic Games goes back nearly

3,000 years,and Athens 2004 could be the best ever."The Panathenian Stadium is the landmark building of Olympics.

A:Right

B:Wrong

C:Not mentioned答案:B解析: -

第20题:

The International festival of music and the arts is held every year in the city of()

正确答案:Edinburgh -

第21题: