(ii) the strategy of the business regarding its treasury policies. (3 marks)(Marks will be awarded in part (b) for the identification and discussion of relevant points and for the style. of thereport.)

题目

(ii) the strategy of the business regarding its treasury policies. (3 marks)

(Marks will be awarded in part (b) for the identification and discussion of relevant points and for the style. of the

report.)

相似考题

更多“(ii) the strategy of the business regarding its treasury policies. (3 marks)(Marks will be awarded in part (b) for the identification and discussion of relevant points and for the style. of thereport.)”相关问题

-

第1题:

(c) Discuss the ethical and social responsibilities of the Beth Group and whether a change in the ethical and

social attitudes of the management could improve business performance. (7 marks)

Note: requirement (c) includes 2 professional marks for development of the discussion of the ethical and social

responsibilities of the Beth Group.

正确答案:

(c) Corporate social responsibility (CSR) is concerned with business ethics and the company’s accountability to its stakeholders,

and about the way it meets its wider obligations. CSR emphasises the need for companies to adopt a coherent approach to

a range of stakeholders including investors, employees, suppliers, and customers. Beth has paid little regard to the promotion

of socially and ethically responsible policies. For example, the decision to not pay the SME creditors on the grounds that they

could not afford to sue the company is ethically unacceptable. Additionally, Beth pays little regard to local customs and

cultures in its business dealings.

The stagnation being suffered by Beth could perhaps be reversed if it adopted more environmentally friendly policies. The

corporate image is suffering because of its attitude to the environment. Environmentally friendly policies could be cost effective

if they help to increase market share and reduce the amount of litigation costs it has to suffer. The communication of these

policies would be through the environmental report, and it is critical that stakeholders feel that the company is being

transparent in its disclosures.

Evidence of corporate misbehaviour (Enron, World.com) has stimulated interest in the behaviour of companies. There has

been pressure for companies to show more awareness and concern, not only for the environment but for the rights and

interests of the people they do business with. Governments have made it clear that directors must consider the short-term

and long-term consequences of their actions, and take into account their relationships with employees and the impact of the

business on the community and the environment. The behaviour of Beth will have had an adverse effect on their corporate

image.

CSR requires the directors to address strategic issues about the aims, purposes, and operational methods of the organisation,

and some redefinition of the business model that assumes that profit motive and shareholder interests define the core purpose

of the company. The profits of Beth will suffer if employees are not valued and there is poor customer support.

Arrangements should be put in place to ensure that the business is conducted in a responsible manner. The board should

look at broad social and environmental issues affecting the company and set policy and targets, monitoring performance and

improvements.

-

第2题:

(b) Discuss the relative costs to the preparer and benefits to the users of financial statements of increased

disclosure of information in financial statements. (14 marks)

Quality of discussion and reasoning. (2 marks)

正确答案:

(b) Increased information disclosure benefits users by reducing the likelihood that they will misallocate their capital. This is

obviously a direct benefit to individual users of corporate reports. The disclosure reduces the risk of misallocation of capital

by enabling users to improve their assessments of a company’s prospects. This creates three important results.

(i) Users use information disclosed to increase their investment returns and by definition support the most profitable

companies which are likely to be those that contribute most to economic growth. Thus, an important benefit of

information disclosure is that it improves the effectiveness of the investment process.

(ii) The second result lies in the effect on the liquidity of the capital markets. A more liquid market assists the effective

allocation of capital by allowing users to reallocate their capital quickly. The degree of information asymmetry between

the buyer and seller and the degree of uncertainty of the buyer and the seller will affect the liquidity of the market as

lower asymmetry and less uncertainty will increase the number of transactions and make the market more liquid.

Disclosure will affect uncertainty and information asymmetry.

(iii) Information disclosure helps users understand the risk of a prospective investment. Without any information, the user

has no way of assessing a company’s prospects. Information disclosure helps investors predict a company’s prospects.

Getting a better understanding of the true risk could lower the price of capital for the company. It is difficult to prove

however that the average cost of capital is lowered by information disclosure, even though it is logically and practically

impossible to assess a company’s risk without relevant information. Lower capital costs promote investment, which can

stimulate productivity and economic growth.

However although increased information can benefit users, there are problems of understandability and information overload.

Information disclosure provides a degree of protection to users. The benefit is fairness to users and is part of corporate

accountability to society as a whole.

The main costs to the preparer of financial statements are as follows:

(i) the cost of developing and disseminating information,

(ii) the cost of possible litigation attributable to information disclosure,

(iii) the cost of competitive disadvantage attributable to disclosure.

The costs of developing and disseminating the information include those of gathering, creating and auditing the information.

Additional costs to the preparers include training costs, changes to systems (for example on moving to IFRS), and the more

complex and the greater the information provided, the more it will cost the company.

Although litigation costs are known to arise from information disclosure, it does not follow that all information disclosure leads

to litigation costs. Cases can arise from insufficient disclosure and misleading disclosure. Only the latter is normally prompted

by the presentation of information disclosure. Fuller disclosure could lead to lower costs of litigation as the stock market would

have more realistic expectations of the company’s prospects and the discrepancy between the valuation implicit in the market

price and the valuation based on a company’s financial statements would be lower. However, litigation costs do not

necessarily increase with the extent of the disclosure. Increased disclosure could reduce litigation costs.

Disclosure could weaken a company’s ability to generate future cash flows by aiding its competitors. The effect of disclosure

on competitiveness involves benefits as well as costs. Competitive disadvantage could be created if disclosure is made relating

to strategies, plans, (for example, planned product development, new market targeting) or information about operations (for

example, production-cost figures). There is a significant difference between the purpose of disclosure to users and

competitors. The purpose of disclosure to users is to help them to estimate the amount, timing, and certainty of future cash

flows. Competitors are not trying to predict a company’s future cash flows, and information of use in that context is not

necessarily of use in obtaining competitive advantage. Overlap between information designed to meet users’ needs and

information designed to further the purposes of a competitor is often coincidental. Every company that could suffer competitive

disadvantage from disclosure could gain competitive advantage from comparable disclosure by competitors. Published figures

are often aggregated with little use to competitors.

Companies bargain with suppliers and with customers, and information disclosure could give those parties an advantage in

negotiations. In such cases, the advantage would be a cost for the disclosing entity. However, the cost would be offset

whenever information disclosure was presented by both parties, each would receive an advantage and a disadvantage.

There are other criteria to consider such as whether the information to be disclosed is about the company. This is both a

benefit and a cost criterion. Users of corporate reports need company-specific data, and it is typically more costly to obtain

and present information about matters external to the company. Additionally, consideration must be given as to whether the

company is the best source for the information. It could be inefficient for a company to obtain or develop data that other, more

expert parties could develop and present or do develop at present.

There are many benefits to information disclosure and users have unmet information needs. It cannot be known with any

certainty what the optimal disclosure level is for companies. Some companies through voluntary disclosure may have

achieved their optimal level. There are no quantitative measures of how levels of disclosure stand with respect to optimal

levels. Standard setters have to make such estimates as best they can, guided by prudence, and by what evidence of benefits

and costs they can obtain. -

第3题:

(d) Draft a letter for Tim Blake to send to WM’s investors to include the following:

(i) why you believe robust internal controls to be important; and

(ii) proposals on how internal systems might be improved in the light of the overestimation of mallerite at

WM.

Note: four professional marks are available within the marks allocated to requirement (d) for the structure,

content, style. and layout of the letter.

(16 marks)

正确答案:

You will be aware of the importance of accurate resource valuation to Worldwide Minerals (WM). Unfortunately, I have to

inform. you that the reserve of mallerite, one of our key minerals in a new area of exploration, was found to have been

overestimated after the purchase of a mine. It has been suggested that this information may have an effect on shareholder

value and so I thought it appropriate to write to inform. you of how the board intends to respond to the situation.

In particular, I would like to address two issues. It has been suggested that the overestimation arose because of issues with

the internal control systems at WM. I would firstly like to reassure you of the importance that your board places on sound

internal control systems and then I would like to highlight improvements to internal controls that we shall be implementing

to ensure that the problem should not recur.

(i) Importance of internal control

Internal control systems are essential in all public companies and Worldwide Minerals (WM) is no exception. If anything,

WM’s strategic position makes internal control even more important, operating as it does in many international situations

and dealing with minerals that must be guaranteed in terms of volume, grade and quality. Accordingly, your board

recognises that internal control underpins investor confidence. Investors have traditionally trusted WM’s management

because they have assumed it capable of managing its internal operations. This has, specifically, meant becoming aware

of and controlling known risks. Risks would not be known about and managed without adequate internal control

systems. Internal control, furthermore, helps to manage quality throughout the organisation and it provides

management with information on internal operations and compliance. These features are important in ensuring quality

at all stages in the WM value chain from the extraction of minerals to the delivery of product to our customers. Linked

to this is the importance of internal control in helping to expose and improve underperforming internal operations.

Finally, internal control systems are essential in providing information for internal and external reporting upon which, in

turn, investor confidence rests.

(ii) Proposals to improve internal systems at WM

As you may be aware, mineral estimation and measurement can be problematic, particularly in some regions. Indeed,

there are several factors that can lead to under or overestimation of reserves valuations as a result of geological survey

techniques and regional cultural/social factors. In the case of mallerite, however, the issues that have been brought to

the board’s attention are matters of internal control and it is to these that I would now like to turn.

In first instance, it is clear from the fact that the overestimate was made that we will need to audit geological reports at

an appropriate (and probably lower) level in the organisation in future.

Once a claim has been made about a given mineral resource level, especially one upon which investor returns might

depend, appropriate systems will be instituted to ask for and obtain evidence that such reserves have been correctly and

accurately quantified.

We will recognise that single and verbal source reports of reserve quantities may not necessarily be accurate. This was

one of the apparent causes of the overestimation of mallerite. A system of auditing actual reserves rather than relying

on verbal evidence will rectify this.

The purchase of any going concern business, such as the mallerite mine, is subject to due diligence. WM will be

examining its procedures in this area to ensure that they are fit for purpose in the way that they may not have been in

respect of the purchase of the mallerite mine. I will be taking all appropriate steps to ensure that all of these internal

control issues can be addressed in future.

Thank you for your continued support of Worldwide Minerals and I hope the foregoing goes some way to reassure you

that the company places the highest value on its investors and their loyalty.

Yours faithfully,

Tim Blake

Chairman -

第4题:

(ii) Determine whether your decision in (b)(i) would change if you were to use the Maximin and Minimax

regret decision criteria. Your answer should be supported by relevant workings. (6 marks)

正确答案:

-

第5题:

(ii) Comment briefly on the use of its own tree plantations as a source of raw materials by Our Timbers Ltd.

(3 marks)

正确答案:

(ii) The use of its own tree plantations as a source of raw materials not only ensures available supplies of timber but may

also demonstrate that the directors of Our Timbers Ltd are mindful of the need for careful planning in the consumption

of natural resources. This concern with the need to protect the environment will enhance the reputation of Our Timbers

Ltd as an environmentally-conscious organisation which in turn may translate into a source of competitive advantage

since contemporary thought is very much focused on the environmental responsibilities of organisations with particular

regard to the use of natural resources such as timber.

-

第6题:

(ii) Recommend which of the refrigeration systems should be purchased. You should state your reasons

which must be supported by relevant calculations. (3 marks)

正确答案:

-

第7题:

(iii) Whether or not you agree with the statement of the marketing director in note (9) above. (5 marks)

Professional marks for appropriateness of format, style. and structure of the report. (4 marks)

正确答案:(iii) The marketing director is certainly correct in recognising that success is dependent on levels of service quality provided

by HFG to its clients. However, whilst the number of complaints is an important performance measure, it needs to be

used with caution. The nature of a complaint is, very often, far more indicative of the absence, or a lack, of service

quality. For example, the fact that 50 clients complained about having to wait for a longer time than they expected to

access gymnasium equipment is insignificant when compared to an accident arising from failure to maintain properly a

piece of gymnasium equipment. Moreover, the marketing director ought to be aware that the absolute number of

complaints may be misleading as much depends on the number of clients serviced during any given period. Thus, in

comparing the number of complaints received by the three centres then a relative measure of complaints received per

1,000 client days would be far more useful than the absolute number of complaints received.

The marketing director should also be advised that the number of complaints can give a misleading picture of the quality

of service provision since individuals have different levels of willingness to complain in similar situations.

The marketing director seems to accept the current level of complaints but is unwilling to accept any increase above this

level. This is not indicative of a quality-oriented organisation which would seek to reduce the number of complaints over

time via a programme of ‘continuous improvement’.

From the foregoing comments one can conclude that it would be myopic to focus on the number of client complaints

as being the only performance measure necessary to measure the quality of service provision. Other performance

measures which may indicate the level of service quality provided to clients by HFG are as follows:

– Staff responsiveness assumes critical significance in service industries. Hence the time taken to resolve client

queries by health centre staff is an important indicator of the level of service quality provided to clients.

– Staff appearance may be viewed as reflecting the image of the centres.

– The comfort of bedrooms and public rooms including facilities such as air-conditioning, tea/coffee-making and cold

drinks facilities, and office facilities such as e-mail, facsimile and photocopying.

– The availability of services such as the time taken to gain an appointment with a dietician or fitness consultant.

– The cleanliness of all areas within the centres will enhance the reputation of HFG. Conversely, unclean areas will

potentially deter clients from making repeat visits and/or recommendations to friends, colleagues etc.

– The presence of safety measures and the frequency of inspections made regarding gymnasium equipment within

the centres and compliance with legislation are of paramount importance in businesses like that of HFG.

– The achievement of target reductions in weight that have been agreed between centre consultants and clients.

(Other relevant measures would be acceptable.)

-

第8题:

(c) Explanatory notes, together with relevant supporting calculations, in connection with the loan. (8 marks)

Additional marks will be awarded for the appropriateness of the format and presentation of the schedules, the

effectiveness with which the information is communicated and the extent to which the schedules are structured in

a logical manner. (3 marks)

Notes: – you should assume that the tax rates and allowances for the tax year 2006/07 and for the financial year

to 31 March 2007 apply throughout the question.

– you should ignore value added tax (VAT).

正确答案:

(c) Tax implications of there being a loan from Flores Ltd to Banda

Flores Ltd should have paid tax to HMRC equal to 25% of the loan, i.e. £5,250. The tax should have been paid on the

company’s normal due date for corporation tax in respect of the accounting period in which the loan was made, i.e. 1 April

following the end of the accounting period.

The tax is due because Flores Ltd is a close company that has made a loan to a participator and that loan is not in the ordinary

course of the company’s business.

HMRC will repay the tax when the loan is either repaid or written off.

Flores Ltd should have included the loan on Banda’s Form. P11D in order to report it to HMRC.

Banda should have paid income tax on an annual benefit equal to 5% of the amount of loan outstanding during each tax

year. Accordingly, for each full year for which the loan was outstanding, Banda should have paid income tax of £231

(£21,000 x 5% x 22%).

Interest and penalties may be charged in respect of the tax underpaid by both Flores Ltd and Banda and in respect of the

incorrect returns made to HMRC

Willingness to act for Banda

We would not wish to be associated with a client who has engaged in deliberate tax evasion as this poses a threat to the

fundamental principles of integrity and professional behaviour. Accordingly, we should refuse to act for Banda unless she is

willing to disclose the details regarding the loan to HMRC and pay the ensuing tax liabilities. Even if full disclosure is made,

we should consider whether the loan was deliberately hidden from HMRC or Banda’s previous tax adviser.

In addition, companies are prohibited from making loans to directors under the Companies Act. We should advise Banda to

seek legal advice on her own position and that of Flores Ltd. -

第9题:

(ii) Identify the points that must be confirmed and any action necessary in order for capital treatment to

apply to the transaction. (4 marks)

正确答案:

(ii) Ensuring capital treatment

For the capital treatment to apply, a number of conditions need to be satisfied such that the following points need to be

confirmed.

– The business of Acrux Ltd consists wholly or mainly of the carrying on of a trade as opposed to the making of

investments.

– Spica is UK resident and ordinarily resident despite living in both the UK and Solaris.

– The transaction is being carried out for the purpose of the company’s trade and is not part of a scheme intended

to avoid tax. This is likely to be the case as HMRC accept that a management disagreement over the running of

the company has an adverse effect on the running of the business.

In addition, Spica must have owned the shares for at least five years so the transaction must not take place until

1 October 2008. -

第10题:

(ii) The answers to any questions that the potential investors may raise in connection with the maximum

possible investment, borrowing to finance the subscription and the implications of selling the shares.

(7 marks)

Note: you should assume that Vostok Ltd and its trade qualify for the purposes of the enterprise investment

scheme and you are not required to list the conditions that need to be satisfied by the company, its

shares or its business activities.

正确答案:

(ii) Answers to questions from potential investors

Maximum investment

– For the relief to be available, a shareholder (together with spouse and children) cannot own more than 30% of the

company. Accordingly, the maximum investment by a single subscriber will be £315,000 (15,000 x £21).

Borrowing to finance the purchase

– There would normally be tax relief for the interest paid on a loan taken out to acquire shares in a close company

such as Vostok Ltd. However, this relief is not available when the shares qualify for relief under the enterprise

investment scheme.

Implications of a subscriber selling the shares in Vostok Ltd

– The income tax relief will be withdrawn if the shares in Vostok Ltd are sold within three years of subscription.

– Any profit arising on the sale of the shares in Vostok Ltd on which income tax relief has been given will be exempt

from capital gains tax provided the shares have been held for three years.

– Any capital loss arising on the sale of the shares will be allowable regardless of how long the shares have been

held. However, the loss will be reduced by the amount of income tax relief obtained in respect of the investment.

The loss may be used to reduce the investor’s taxable income, and hence his income tax liability, for the tax year

of loss and/or the preceding tax year.

– Any gain deferred at the time of subscription will become chargeable in the year in which the shares in Vostok Ltd

are sold. -

第11题:

3 (a) Discuss why the identification of related parties, and material related party transactions, can be difficult for

auditors. (5 marks)

正确答案:

3 Pulp Co

(a) Identification of related parties

Related parties and associated transactions are often difficult to identify, as it can be hard to establish exactly who, or what,

are the related parties of an entity. IAS 24 Related Party Disclosures contains definitions which in theory serve to provide a

framework for identifying related parties, but deciding whether a definition is met can be complex and subjective. For example,

related party status can be obtained via significant interest, but in reality it can be difficult to establish the extent of influence

that potential related parties can actually exert over a company.

The directors may be reluctant to disclose to the auditors the existence of related parties or transactions. This is an area of

the financial statements where knowledge is largely confined to management, and the auditors often have little choice but to

rely on full disclosure by management in order to identify related parties. This is especially the case for a close family member

of those in control or having influence over the entity, whose identity can only be revealed by management.

Identification of material related party transactions

Related party transactions may not be easy to identify from the accounting systems. Where accounting systems are not

capable of separately identifying related party transactions, management need to carry out additional analysis, which if not

done makes the transactions extremely difficult for auditors to find. For example sales made to a related party will not

necessarily be differentiated from ‘normal’ sales in the accounting systems.

Related party transactions may be concealed in whole, or in part, from auditors for fraudulent purposes. A transaction may

not be motivated by normal business considerations, for example, a transaction may be recognised in order to improve the

appearance of the financial statements by ‘window dressing’. Clearly if the management is deliberately concealing the true

nature of these items it will be extremely difficult for the auditor to discover the rationale behind the transaction and to consider

the impact on the financial statements.

Finally, materiality is a difficult concept to apply to related party transactions. Once a transaction has been identified, the

auditor must consider whether it is material. However, materiality has a particular application in this situation. ISA 550

Related Parties states that the auditor should consider the effect of a related party transaction on the financial statements.

The problem is that a transaction could occur at an abnormally small, even nil, value. Determining materiality based on

monetary value is therefore irrelevant, and the auditor should instead be alert to the unusual nature of the transaction making

it material. -

第12题:

问答题Advances in technology and science have solved many problems. However,they have also created new problems,among which pollution has attracted much attention of the public. Write a composition of about 400 words on the following topic,discussion the problems caused by pollution.ON POLLUTIONIn the first part of your writing you should present your thesis statement, and in the second part you should support the thesis statement with appropriate details. In the last part you should bring what you have written to a natural conclusion or a summary. Marks will be awarded for content, organization, grammar and appropriateness. Failure to follow the above instructions may result in a loss of marks.正确答案:

ON POLLUTION Nowadays we have many conveniences in our society, which have been brought through technology and science. However, these same advancements in technology and science have caused some very dangerous problems. These problems will not go away easily because people do not want to give up the conveniences of a modem lifestyle. The most critical problems that should be dealt with immediately are those of pollution.

Pollution caused by chemicals is a very serious problem because it causes the loss of the ozone layer. Without our ozone, not only we ourselves but also plant and animal life are exposed to dangerous rays from the sun. Aerosol cans emit chemicals that break down our ozone layer. Refrigeration and air-conditioning systems and ears also have dangerous emissions. A very serious threat to the planet—the warming of the earth's atmosphere—is primarily caused by carbon dioxide emissions. Many scientists think that the warming could be sufficient to melt the polar ice caps, thus raising the sea levels. This would mean that many parts of the world would be submerged below sea level.

There are other problems caused by pollution. Factories that make our modem conveniences emit poisonous gases onto the air we breathe. The chemicals we use for cleaning and wastes from factories go into our water systems and pollute the water we drink and the fish we eat. They also kill much of the wildlife we depend on for food. Some of the pesticides we have sprayed on our crops have been found to be dangerous. This kind of pollution may stay in the ground for a very long period of time.

Last but not the least, nuclear pollution will lead directly to nuclear damage. The explosions at Three Mile Island in the United States in 1979 and at Chernobyl in the Soviet Union in 1986 provided lessons to the global nuclear industry. The exposure to very high radiation levels released by nuclear plants within a short period of time may harm the environment many years, and usually will cause fatal injuries to human health.

In conclusion, the problems created by pollution are growing daily. Because people do not want to change their lifestyles, we must invent a way to neutralize the pollutants we are putting into our environment. People need to be educated so that will stop damaging the planet. Furthermore, government must take action to prevent individuals and companies from harming their environment.解析:

本文讨论了人们一直关心的话题——污染问题。作者首先指出:随着科技 的发展,出现了许多问题,而污染问题则是最严峻的问题。然后作者用三段就污染问题进行了论述:臭氧层被破坏使全球气候变暖、空气与水污染严重以及核污染。在最后一段作者指出,为了避免环境污染进一步恶化,个人与政府都应采取相应措施。 -

第13题:

(b) Discuss the key issues which will need to be addressed in determining the basic components of an

internationally agreed conceptual framework. (10 marks)

Appropriateness and quality of discussion. (2 marks)

正确答案:

(b) There are several issues which have to be addressed if an international conceptual framework is to be successfully developed.

These are:

(i) Objectives

Agreement will be required as to whether financial statements are to be produced for shareholders or a wide range of

users and whether decision usefulness is the key criteria or stewardship. Additionally there is the question of whether

the objective is to provide information in making credit and investment decisions.

(ii) Qualitative Characteristics

The qualities to be sought in making decisions about financial reporting need to be determined. The decision usefulness

of financial reports is determined by these characteristics. There are issues concerning the trade-offs between relevance

and reliability. An example of this concerns the use of fair values and historical costs. It has been argued that historical

costs are more reliable although not as relevant as fair values. Additionally there is a conflict between neutrality and the

traditions of prudence or conservatism. These characteristics are constrained by materiality and benefits that justify

costs.

(iii) Definitions of the elements of financial statements

The principles behind the definition of the elements need agreement. There are issues concerning whether ‘control’

should be included in the definition of an asset or become part of the recognition criteria. Also the definition of ‘control’

is an issue particularly with financial instruments. For example, does the holder of a call option ‘control’ the underlying

asset? Some of the IASB’s standards contravene its own conceptual framework. IFRS3 requires the capitalisation of

goodwill as an asset despite the fact that it can be argued that goodwill does not meet the definition of an asset in the

Framework. IAS12 requires the recognition of deferred tax liabilities that do not meet the liability definition. Similarly

equity and liabilities need to be capable of being clearly distinguished. Certain financial instruments could either be

liabilities or equity. For example obligations settled in shares.

(iv) Recognition and De-recognition

The principles of recognition and de-recognition of assets and liabilities need reviewing. Most frameworks have

recognition criteria, but there are issues over the timing of recognition. For example, should an asset be recognised when

a value can be placed on it or when a cost has been incurred? If an asset or liability does not meet recognition criteria

when acquired or incurred, what subsequent event causes the asset or liability to be recognised? Most frameworks do

not discuss de-recognition. (The IASB’s Framework does not discuss the issue.) It can be argued that an item should be

de-recognised when it does not meet the recognition criteria, but financial instruments standards (IAS39) require other

factors to occur before financial assets can be de-recognised. Different attributes should be considered such as legal

ownership, control, risks or rewards.

(v) Measurement

More detailed discussion of the use of measurement concepts, such as historical cost, fair value, current cost, etc are

required and also more guidance on measurement techniques. Measurement concepts should address initial

measurement and subsequent measurement in the form. of revaluations, impairment and depreciation which in turn

gives rise to issues about classification of gains or losses in income or in equity.

(vi) Reporting entity

Issues have arisen over what sorts of entities should issue financial statements, and which entities should be included

in consolidated financial statements. A question arises as to whether the legal entity or the economic unit should be the

reporting unit. Complex business arrangements raise issues over what entities should be consolidated and the basis

upon which entities are consolidated. For example, should the basis of consolidation be ‘control’ and what does ‘control’

mean?

(vii) Presentation and disclosure

Financial reporting should provide information that enables users to assess the amounts, timing and uncertainty of the

entity’s future cash flows, its assets, liabilities and equity. It should provide management explanations and the limitations

of the information in the reports. Discussions as to the boundaries of presentation and disclosure are required. -

第14题:

(c) State one advantage to a business of keeping its working capital cycle as short as possible.

(2 Marks)

正确答案:

(c) The advantage to a company of keeping its working capital cycle short is that fewer resources are tied up in working capital,

thus freeing them for other purposes.

(Other answers considered on their merits) -

第15题:

(b) ‘Strategic positioning’ is about the way that a company as a whole is placed in its environment and concerns its

‘fit’ with the factors in its environment.

With reference to the case as appropriate, explain how a code of ethics can be used as part of a company’s

overall strategic positioning. (7 marks)

正确答案:

(b) Code of ethics and strategic positioning

Strategic positioning is about the way that a whole company is placed in its environment as opposed to the operational level,

which considers the individual parts of the organisation.

Ethical reputation and practice can be a key part of environmental ‘fit’, along with other strategic issues such as generic

strategy, quality and product range.

The ‘fit’ enables the company to more fully meet the expectations, needs and demands of its relevant stakeholders – in this

case, European customers.

The ‘quality’ of the strategic ‘fit’ is one of the major determinants of business performance and so is vital to the success of

the business.

HPC has carefully manoeuvred itself to have the strategic position of being the highest ethical performer locally and has won

orders on that basis.

It sees its strategic position as being the ethical ‘benchmark’ in its industry locally and protects this position against its parent

company seeking to impose a new code of ethics.

The ethical principles are highly internalised in Mr Hogg and in the company generally, which is essential for effective strategic

implementation. -

第16题:

(b) Comment (with relevant calculations) on the performance of the business of Quicklink Ltd and Celer

Transport during the year ended 31 May 2005 and, insofar as the information permits, its projected

performance for the year ending 31 May 2006. Your answer should specifically consider:

(i) Revenue generation per vehicle

(ii) Vehicle utilisation and delivery mix

(iii) Service quality. (14 marks)

正确答案:

difference will reduce in the year ending 31 May 2006 due to the projected growth in sales volumes of the Celer Transport

business. The average mail/parcels delivery of mail/parcels per vehicle of the Quicklink Ltd part of the business is budgeted

at 12,764 which is still 30·91% higher than that of the Celer Transport business.

As far as specialist activities are concerned, Quicklink Ltd is budgeted to generate average revenues per vehicle amounting to

£374,850 whilst Celer Transport is budgeted to earn an average of £122,727 from each of the vehicles engaged in delivery

of processed food. It is noticeable that all contracts with major food producers were renewed on 1 June 2005 and it would

appear that there were no increases in the annual value of the contracts with major food producers. This might have been

the result of a strategic decision by the management of the combined entity in order to secure the future of this part of the

business which had been built up previously by the management of Celer Transport.

Each vehicle owned by Quicklink Ltd and Celer Transport is in use for 340 days during each year, which based on a

365 day year would give an in use % of 93%. This appears acceptable given the need for routine maintenance and repairs

due to wear and tear.

During the year ended 31 May 2005 the number of on-time deliveries of mail and parcel and industrial machinery deliveries

were 99·5% and 100% respectively. This compares with ratios of 82% and 97% in respect of mail and parcel and processed

food deliveries made by Celer Transport. In this critical area it is worth noting that Quicklink Ltd achieved their higher on-time

delivery target of 99% in respect of each activity whereas Celer Transport were unable to do so. Moreover, it is worth noting

that Celer Transport missed their target time for delivery of food products on 975 occasions throughout the year 31 May 2005

and this might well cause a high level of customer dissatisfaction and even result in lost business.

It is interesting to note that whilst the businesses operate in the same industry they have a rather different delivery mix in

terms of same day/next day demands by clients. Same day deliveries only comprise 20% of the business of Quicklink Ltd

whereas they comprise 75% of the business of Celer Transport. This may explain why the delivery performance of Celer

Transport with regard to mail and parcel deliveries was not as good as that of Quicklink Ltd.

The fact that 120 items of mail and 25 parcels were lost by the Celer Transport business is most disturbing and could prove

damaging as the safe delivery of such items is the very substance of the business and would almost certainly have resulted

in a loss of customer goodwill. This is an issue which must be addressed as a matter of urgency.

The introduction of the call management system by Quicklink Ltd on 1 June 2004 is now proving its worth with 99% of calls

answered within the target time of 20 seconds. This compares favourably with the Celer Transport business in which only

90% of a much smaller volume of calls were answered within a longer target time of 30 seconds. Future performance in this

area will improve if the call management system is applied to the Celer Transport business. In particular, it is likely that the

number of abandoned calls will be reduced and enhance the ‘image’ of the Celer Transport business.

-

第17题:

(ii) Briefly discuss TWO factors which could reduce the rate of return earned by the investment as per the

results in part (a). (4 marks)

正确答案:

(ii) Two factors which might reduce the return earned by the investment are as follows:

(i) Poor product quality

The very nature of the product requires that it is of the highest quality i.e. the cakes are made for human

consumption. Bad publicity via a ‘product recall’ could potentially have a catastrophic effect on the total sales to

Superstores plc over the eighteen month period.

(ii) The popularity of the Mighty Ben character

There is always the risk that the popularity of the character upon which the product is based will diminish with a

resultant impact on sales volumes achieved. In this regard it would be advisable to attempt to negotiate with

Superstores plc in order to minimise potential future losses. -

第18题:

(ii) Briefly explain the extent to which the application of sensitivity analysis might be useful in deciding

which refrigeration system to purchase and discuss the limitations inherent in its use. (3 marks)

正确答案:

(ii) Sensitivity analysis could be used to assess how responsive the NPV calculated in part (a) in respect of each decision

option change is to changes in the variables used to calculate it. The application of sensitivity analysis requires that the

net present values are calculated under alternative assumptions in order to determine how sensitive they are to changing

conditions. In this particular example then a relatively small change in the forecast cash flows might lead to a change

in the investment decision. The application of sensitivity analysis can indicate those variables to which the NPV is most

sensitive and the extent to which these variables may change before an investment results in a negative NPV. Thus the

application of sensitivity analysis may provide management with an indication of why a particular project might fail. The

directors of Stay Cool Ltd should give consideration to the potential variations in the independent variables which feature

in the decision-making process such as:

– estimated revenues

– estimated operating costs

– estimated working lives

– estimated repair costs

– the estimated discount rate i.e. cost of capital of each alternative investment.

Sensitivity analysis has some serious limitations. The use of the method requires changes in each variable under

consideration are isolated. However management may be focused on what happens if changes occur in two or more

critical variables. Another problem relating to the use of sensitivity analysis to forecast outcomes lies in the fact that it

provides no indication of the likelihood of the occurrence of changes in critical variables. -

第19题:

(ii) Advise Clifford of the capital gains tax implications of the alternative of selling the Oxford house and

garden by means of two separate disposals as proposed. Calculations are not required for this part of

the question. (3 marks)

正确答案:

(ii) The implications of selling the Oxford house and garden in two separate disposals

The additional sales proceeds would result in an increase in Clifford’s capital gains and consequently his tax liability.

When computing the gain on the sale of the house together with a small part of the garden, the allowable cost would

be a proportion of the original cost. That proportion would be A/A + B where A is the value of the house and garden

that has been sold and B is the value of the part of the garden that has been retained. Principal private residence relief

and taper relief would be available in the same way as that set out in (i) above.

When computing the gain on the sale of the remainder of the garden, the cost would be the original cost of the property

less the amount used in computing the gain on the earlier disposal. Principal private residence relief would not be

available as the land sold is not a dwelling house or part of one. -

第20题:

(iv) The stamp duty and/or stamp duty land tax payable by the Saturn Ltd group; (2 marks)

Additional marks will be awarded for the appropriateness of the format and presentation of the memorandum

and the effectiveness with which the information is communicated. (2 marks)

正确答案:

(iv) Stamp duty and stamp duty land tax

– The purchase of Tethys Ltd will give rise to a liability to ad valorem stamp duty of £1,175 (£235,000 x 0·5%).

The stamp duty must be paid by Saturn Ltd within 30 days of the share transfer in order to avoid interest being

charged. It is not an allowable expense for the purposes of corporation tax. -

第21题:

(ii) Explain why Galileo is able to pay the inheritance tax due in instalments, state when the instalments are

due and identify any further issues relevant to Galileo relating to the payments. (3 marks)

正确答案:

(ii) Payment by instalments

The inheritance tax can be paid by instalments because Messier Ltd is an unquoted company controlled by Kepler at

the time of the gift and is still unquoted at the time of his death.

The tax is due in ten equal annual instalments starting on 30 November 2008.

Interest will be charged on any instalments paid late; otherwise the instalments will be interest free because Messier is

a trading company that does not deal in property or financial assets.

All of the outstanding inheritance tax will become payable if Galileo sells the shares in Messier Ltd.

Tutorial note

Candidates were also given credit for stating that payment by instalments is available because the shares represent at

least 10% of the company’s share capital and are valued at £20,000 or more. -

第22题:

(ii) vehicles. (3 marks)

正确答案:

(ii) Vehicles

■ Agreeing opening ledger balances of cost and accumulated depreciation (and impairment losses) to the non-current

asset register to confirm the comparative amounts.

■ Physically inspecting a sample of vehicles (selected from the asset register) to confirm existence and condition (for

evidence of impairment). If analytical procedures use management information on mileage records this should be

checked (e.g. against milometers) at the same time.

■ Agreeing additions to purchase invoices to confirm cost.

■ Reviewing the terms of all lease contracts entered into during the year to ensure that finance leases have been

capitalised.

■ Agreeing the depreciation rates applied to finance lease assets to those applied to similar purchased assets.

■ Reviewing repairs and maintenance accounts (included in materials expense) to ensure that there are no material

items of capital nature that have been expensed (i.e. a test for completeness). -

第23题:

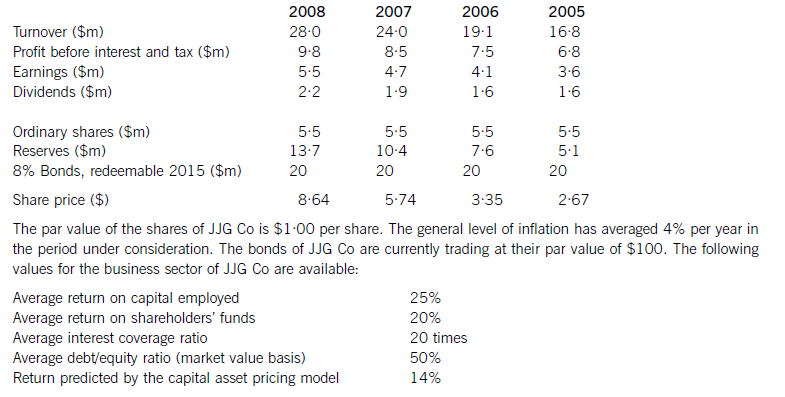

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion.