(c) Risk committee members can be either executive or non-executive.Required:(i) Distinguish between executive and non-executive directors. (2 marks)

题目

(c) Risk committee members can be either executive or non-executive.

Required:

(i) Distinguish between executive and non-executive directors. (2 marks)

相似考题

更多“(c) Risk committee members can be either executive or non-executive.Required:(i) Distinguish between executive and non-executive directors. (2 marks)”相关问题

-

第1题:

(b) Assess the benefits of the separation of the roles of chief executive and chairman that Alliya Yongvanich

argued for and explain her belief that ‘accountability to shareholders’ is increased by the separation of these

roles. (12 marks)

正确答案:

(b) Separation of the roles of CEO and chairman

Benefits of separation of roles

The separation of the roles of chief executive and chairman was first provided for in the UK by the 1992 Cadbury provisions

although it has been included in all codes since. Most relevant to the case is the terms of the ICGN clause s.11 and OECD

VI (E) both of which provide for the separation of these roles. In the UK it is covered in the combined code section A2.

The separation of roles offers the benefit that it frees up the chief executive to fully concentrate on the management of the

organisation without the necessity to report to shareholders or otherwise become distracted from his or her executive

responsibilities. The arrangement provides a position (that of chairman) that is expected to represent shareholders’ interests

and that is the point of contact into the company for shareholders. Some codes also require the chairman to represent the

interests of other stakeholders such as employees.

Having two people rather than one at the head of a large organisation removes the risks of ‘unfettered powers’ being

concentrated in a single individual and this is an important safeguard for investors concerned with excessive secrecy or

lack of transparency and accountability. The case of Robert Maxwell is a good illustration of a single dominating

executive chairman operating unchallenged and, in so doing, acting illegally. Having the two roles separated reduces

the risk of a conflict of interest in a single person being responsible for company performance whilst also reporting on

that performance to markets. Finally, the chairman provides a conduit for the concerns of non-executive directors who,

in turn, provide an important external representation of external concerns on boards of directors.

Tutorial note: Reference to codes other than the UK is also acceptable. In all cases, detailed (clause number) knowledge

of code provisions is not required.

Accountability and separation of roles

In terms of the separation of roles assisting in the accountability to shareholders, four points can be made.

The chairman scrutinises the chief executive’s management performance on behalf of the shareholders and will be

involved in approving the design of the chief executive’s reward package. It is the responsibility of the chairman to hold

the chief executive to account on shareholders’ behalfs.

Shareholders have an identified person (chairman) to hold accountable for the performance of their investment. Whilst

day-to-day contact will normally be with the investor relations department (or its equivalent) they can ultimately hold

the chairman to account.

The presence of a separate chairman ensures that a system is in place to ensure NEDs have a person to report to outside the

executive structure. This encourages the freedom of expression of NEDs to the chairman and this, in turn, enables issues to

be raised and acted upon when necessary.

The chairman is legally accountable and, in most cases, an experienced person. He/she can be independent and more

dispassionate because he or she is not intimately involved with day-to-day management issues. -

第2题:

(d) Corporate annual reports contain both mandatory and voluntary disclosures.

Required:

(i) Distinguish, using examples, between mandatory and voluntary disclosures in the annual reports of

public listed companies. (6 marks)

正确答案:

(d) (i) Mandatory and voluntary disclosures

Mandatory disclosures

These are components of the annual report mandated by law, regulation or accounting standard.

Examples include (in most jurisdictions) statement of comprehensive income (income or profit and loss statement),

statement of financial position (balance sheet), cash flow statement, statement of changes in equity, operating segmental

information, auditors’ report, corporate governance disclosure such as remuneration report and some items in the

directors’ report (e.g. summary of operating position). In the UK, the business review is compulsory.

Voluntary disclosures

These are components of the annual report not mandated in law or regulation but disclosed nevertheless. They are

typically mainly narrative rather than numerical in nature.

Examples include (in most jurisdictions) risk information, operating review, social and environmental information, and

the chief executive’s review. -

第3题:

(ii) Evaluate the relative advantages and disadvantages of Chen’s risk management committee being

non-executive rather than executive in nature. (7 marks)

正确答案:

(ii) Advantages and disadvantages of being non-executive rather than executive

The UK Combined Code, for example, allows for risk committees to be made up of either executive or non-executive

members.

Advantages of non-executive membership

Separation and detachment from the content being discussed is more likely to bring independent scrutiny.

Sensitive issues relating to one or more areas of executive oversight can be aired without vested interests being present.

Non-executive directors often bring specific expertise that will be more relevant to a risk problem than more

operationally-minded executive directors will have.

Chen’s four members, being from different backgrounds, are likely to bring a range of perspectives and suggested

strategies which may enrich the options open to the committee when considering specific risks.

Disadvantages of non-executive membership (advantages of executive membership)

Direct input and relevant information would be available from executives working directly with the products, systems

and procedures being discussed if they were on the committee. Non-executives are less likely to have specialist

knowledge of products, systems and procedures being discussed and will therefore be less likely to be able to comment

intelligently during meetings.

The membership, of four people, none of whom ‘had direct experience of Chen’s industry or products’ could produce

decisions taken without relevant information that an executive member could provide.

Non-executive directors will need to report their findings to the executive board. This reporting stage slows down the

process, thus requiring more time before actions can be implemented, and introducing the possibility of some

misunderstanding. -

第4题:

(c) Define ‘market risk’ for Mr Allejandra and explain why Gluck and Goodman’s market risk exposure is

increased by failing to have an effective audit committee. (5 marks)

正确答案:

(c) Market risk

Definition of market risk

Market risks are those arising from any of the markets that a company operates in. Most common examples are those risks

from resource markets (inputs), product markets (outputs) or capital markets (finance).

[Tutorial note: markers should exercise latitude in allowing definitions of market risk. IFRS 7, for example, offers a technical

definition: ‘Market risk is the risk that the fair value or cash flows of a financial instrument will fluctuate due to changes in

market prices. Market risk reflects interest rate risk, currency risk, and other price risks’.]

Why non-compliance increases market risk

The lack of a fully compliant committee structure (such as having a non-compliant audit committee) erodes investor

confidence in the general governance of a company. This will, over time, affect share price and hence company value. Low

company value will threaten existing management (possibly with good cause in the case of Gluck and Goodman) and make

the company a possible takeover target. It will also adversely affect price-earnings and hence market confidence in Gluck and

Goodman’s shares. This will make it more difficult to raise funds from the stock market. -

第5题:

TQ Company, a listed company, recently went into administration (it had become insolvent and was being managed by a firm of insolvency practitioners). A group of shareholders expressed the belief that it was the chairman, Miss Heike Hoiku, who was primarily to blame. Although the company’s management had made a number of strategic errors that brought about the company failure, the shareholders blamed the chairman for failing to hold senior management to account. In particular, they were angry that Miss Hoiku had not challenged chief executive Rupert Smith who was regarded by some as arrogant and domineering. Some said that Miss Hoiku was scared of Mr Smith.

Some shareholders wrote a letter to Miss Hoiku last year demanding that she hold Mr Smith to account for a number of previous strategic errors. They also asked her to explain why she had not warned of the strategic problems in her chairman’s statement in the annual report earlier in the year. In particular, they asked if she could remove Mr Smith from office for incompetence. Miss Hoiku replied saying that whilst she understood their concerns, it was difficult to remove a serving chief executive from office.

Some of the shareholders believed that Mr Smith may have performed better in his role had his reward package been better designed in the first place. There was previously a remuneration committee at TQ but when two of its four non-executive members left the company, they were not replaced and so the committee effectively collapsed.

Mr Smith was then able to propose his own remuneration package and Miss Hoiku did not feel able to refuse him.

He massively increased the proportion of the package that was basic salary and also awarded himself a new and much more expensive company car. Some shareholders regarded the car as ‘excessively’ expensive. In addition, suspecting that the company’s performance might deteriorate this year, he exercised all of his share options last year and immediately sold all of his shares in TQ Company.

It was noted that Mr Smith spent long periods of time travelling away on company business whilst less experienced directors struggled with implementing strategy at the company headquarters. This meant that operational procedures were often uncoordinated and this was one of the causes of the eventual strategic failure.

(a) Miss Hoiku stated that it was difficult to remove a serving chief executive from office.

Required:

(i) Explain the ways in which a company director can leave the service of a board. (4 marks)

(ii) Discuss Miss Hoiku’s statement that it is difficult to remove a serving chief executive from a board.

(4 marks)

(b) Assess, in the context of the case, the importance of the chairman’s statement to shareholders in TQ

Company’s annual report. (5 marks)

(c) Criticise the structure of the reward package that Mr Smith awarded himself. (4 marks)

(d) Criticise Miss Hoiku’s performance as chairman of TQ Company. (8 marks)

正确答案:(a) (i) Leaving the service of a board

Resignation with or without notice. Any director is free to withdraw his or her labour at any time but there is normally

a notice period required to facilitate an orderly transition from the outgoing chief executive to the incoming one.

Not offering himself/herself for re-election. Terms of office, which are typically three years, are renewable if the director

offers him or herself for re-election and the shareholders support the renewal. Retirement usually takes place at the end

of a three-year term when the director decides not to seek re-election.

Death in service when, obviously, the director is unable to either provide notice or seek retirement.

Failure of the company. When a company fails, all directors’ contracts are cancelled although this need not signal the

end of the directors’ involvement with company affairs as there may be ongoing legal issues to be resolved.

Being removed e.g. by being dismissed for disciplinary offences. It is relatively easy to ‘prove’ a disciplinary offence but

much more difficult to ‘prove’ incompetence. The nature of disciplinary offences are usually made clear in the terms and

conditions of employment and company policy.

Prolonged absence. Directors unable to perform. their duties owing to protracted absence, for any reason, may be

removed. The length of qualifying absence period varies by jurisdiction.

Being disqualified from being a company director by a court. Directors can be banned from holding directorships by a

court for a number of reasons including personal bankruptcy and other legal issues.

Failing to be re-elected if, having offered him or herself for re-election, shareholders elect not to re-appoint.

An ‘agreed departure’ such as by providing compensation to a director to leave.(ii) Discuss Miss Hoiku’s statement

The way that directors’ contracts and company law are written (in most countries) makes it difficult to remove a director

such as Mr Smith from office during an elected term of office so in that respect, Miss Hoiku is correct. Unless his contract

has highly specific performance targets built in to it, it is difficult to remove Mr Smith for incompetence in the

short-term as it is sometimes difficult to assess the success of strategies until some time has passed. If the alleged

incompetence is within Mr Smith’s term of office (typically three years) then it will usually be necessary to wait until the

director offers himself for re-election. The shareholders can then simply not re-elect the incompetent director (in this

case, Mr Smith). The most likely way to achieve the departure of Mr Smith within his term of office will be to ‘encourage’

him to resign by other directors failing to support him or by shareholders issuing a vote of no confidence at an AGM or

EGM. This would probably involve offering him a suitable financial package to depart at a time chosen by the other

members of the board or company shareholders.

(b) Importance of the chairman’s statement

The chairman’s statement (or president’s letter in some countries) is an important and usually voluntary item, typically carried

at the very beginning of an annual report. In general terms, it is intended to convey important messages to shareholders in

general, strategic terms. As a separate section from other narrative reporting sections of an annual report, it offers the

chairman the opportunity to inform. shareholders about issues that he or she feels it would be beneficial for them to be aware

of. This independent communication is an important part of the separation of the roles of CEO and chairman.

In the case of TQ Company, the role of the chairman is of particular importance because of the dominance of Mr Smith.

Miss Hoiku had a particular responsibility to use her most recent statement to inform. shareholders about going concern issues

notwithstanding the difficulties that might cause in her relationship with Mr Smith. Miss Hoiku has an ethical as well as an

agency responsibility to express her independence in the chairman’s statement and convey issues relevant to company value

to the company’s shareholders. She can use her chairman’s statement for this purpose.(c) Criticise the structure of the reward package that Mr Smith awarded himself

The balance between basic to performance related pay was very poor. Mr Smith, perhaps being aware that the prospect of

gaining much performance related income was low, took the opportunity to increase the fixed element of his income to

compensate. This was not only unprofessional and unethical on Mr Smith’s part, but it also represented very bad value for

shareholders. Having exercised his share options and sold the resulting shares, there was now no element of alignment of

his package with shareholder interests at all. His award to himself of an ‘excessively’ expensive company car was also not

in the shareholders’ interests. The fact that he exercised and sold all of his share options means that he will now have no

personal financial motivation to take strategic decisions intended to increase TQ Company’s share value. This represents a

poor degree of alignment between Mr Smith’s package and the interests of TQ’s shareholders.

(d) Criticise Miss Hoiku’s performance as chairman of TQ Company

The case describes a particularly poor performance by a company chairman. It is a key function of the chairman to represent

the shareholders’ interests in the company and Miss Hoiku has clearly failed in this duty.

A key reason for her poor performance was her reported inability or unwillingness to face up to Mr Smith who was clearly a

domineering personality. A key quality of a company chairman is his or her ability and willingness to personally challenge the

chief executive if necessary.

She failed to ensure that a committee structure was in place, allowing as she did, the remunerations committee to atrophy

when two members left the company.

Linked to this, it appears from the case that the two non-executive directors that left were not replaced and again, it is a part

of the chairman’s responsibility to ensure that an adequate number of non-executives are in place on the board.

She inexplicably allowed Mr Smith to design his own rewards package and presided over him reducing the performance

related element of his package which was clearly misaligned with the shareholders’ interests.

When Mr Smith failed to co-ordinate the other directors because of his unspecified business travel, she failed to hold him to

account thereby allowing the company’s strategy to fail.

There seems to have been some under-reporting of potential strategic problems in the most recent annual report. A ‘future

prospects’ or ‘continuing business’ statement is often a required disclosure in an annual report (in many countries) and there is evidence that this statement may have been missing or misleading in the most recent annual report. -

第6题:

(b) (i) Discuss the relationship between the concepts of ‘business risk’ and ‘financial statement risk’; and

(4 marks)

正确答案:

(b) (i) Business risk is defined as a threat which could mean that a business fails to meet an ongoing business objective.

Business risks represent problems which are faced by the management of a business, and these problems should be

identified and assessed for their possible impact on the business.

Financial statement risk is the risk that components of the financial statements could be misstated, through inaccurate

or incomplete recording of transactions or disclosure. Financial statement risks therefore represent potential errors or

deliberate misstatements in the published accounts of a business.

There is usually a direct relationship between business risk and financial statement risk. Generally a business risk, if not

addressed by management, will have an impact on specific components of the financial statements. For example, for

Medix Co, declining demand for metal surgical equipment has been identified as a business risk. An associated financial

statement risk is the potential over-valuation of obsolete inventory.

Sometimes business risks have a more general effect on the financial statements. Weak internal systems and controls

are often identified as a business risk. Inadequacies in systems and controls could lead to errors or misstatements in

any area of the financial statements so auditors would perceive this as a general audit risk factor.

Business risks are often linked to going concern issues, because if a business is failing to meet objectives such as cash

generation, or revenue maximisation, then it may struggle to continue in operational existence. In terms of financial

statement risk, going concern is a very specific issue, and the risk is normally the inadequate disclosure of going concern

problems. In the extreme situation where a business is definitely not a going concern, then the risk is that the financial

statements have been prepared on the wrong basis, as in this case the ‘break up basis’ should be used.

Business risk and financial statement risk concepts can both be used by auditors in order to identify areas of the financial

statements likely to be misstated at the year end. The business risk approach places the auditor ‘in the shoes’ of

management, and therefore provides deeper insight into the operations of the business and generates extensive business

understanding. -

第7题:

What can we infer from the passage?

A.The Basle Committee's core principles require the minimum capital adequacy requirements.

B.The Basle Committee encourages banks to operate with capital of the minimum.

C.The Basle Committee helps bank supervisors to reduce the risk of loss.

D.The Basle Committee ensures banks to pursue the stability of the banking industry.

正确答案:D

解析:通读第二段,可知道巴塞尔委员会的《有效银行监管的核心原则》要求建立审慎和适当的最低资本充足要求,并且鼓励银行在最低资本金范围之上从事经营活动。所以D选项最接近该段的中心意思。 -

第8题:

You create two shared printers on a Windows 2000 Server computer in Ezonexam.com Ezonexam. One printer is shared as Admin, and the other printer is shared as Executive. Both printers are connected to the same print device. You set the priority of the Admin printer to 90 and the priority of the Executive printer to 50.

You want all users at the Ezonexam network to be able to send print jobs to either printer. However, you do not want the Executive printer to appear in the browse list when employees other than executives and administrative assistants create a new printer connection on their client computers.

What should you do?

A.Change the priority of the Executive printer to 99. Change the priority of the Admin printer to 10.

B.Change the share name of the Executive printer to Executive$. Manually reconfigure client computers that are already connected to the Executive printer.

C.Deny the Everyone group permission to access the Executive printer. Allow access to the users who are allowed to include the printer in their browse lists.

D.Install separate device drivers for the Executive printer. Configure NTFS permissions on the device driver files to allow access only to the System account and to users who are allowed to include the printer in their browse lists.

正确答案:B

解析:Explanation: If a shared resource has a share name with a trailing $, such as Executive$, every one can use the shared resource but it will not be visible when browsing the network.

Incorrect Answers

A: Priority cannot be used to hide a printer.

C: Permission cannot be used to a hide printer.

D: Special device drivers cannot be used to a networked resource. Furthermore, applying special NTFS permissions on the device driver files would not achieve anything.

-

第9题:

Moonstar Co is a property development company which is planning to undertake a $200 million commercial property development. Moonstar Co has had some difficulties over the last few years, with some developments not generating the expected returns and the company has at times struggled to pay its finance costs. As a result Moonstar Co’s credit rating has been lowered, affecting the terms it can obtain for bank finance. Although Moonstar Co is listed on its local stock exchange, 75% of the share capital is held by members of the family who founded the company. The family members who are shareholders do not wish to subscribe for a rights issue and are unwilling to dilute their control over the company by authorising a new issue of equity shares. Moonstar Co’s board is therefore considering other methods of financing the development, which the directors believe will generate higher returns than other recent investments, as the country where Moonstar Co is based appears to be emerging from recession.

Securitisation proposals

One of the non-executive directors of Moonstar Co has proposed that it should raise funds by means of a securitisation process, transferring the rights to the rental income from the commercial property development to a special purpose vehicle. Her proposals assume that the leases will generate an income of 11% per annum to Moonstar Co over a ten-year period. She proposes that Moonstar Co should use 90% of the value of the investment for a collateralised loan obligation which should be structured as follows:

– 60% of the collateral value to support a tranche of A-rated floating rate loan notes offering investors LIBOR plus 150 basis points

– 15% of the collateral value to support a tranche of B-rated fixed rate loan notes offering investors 12%

– 15% of the collateral value to support a tranche of C-rated fixed rate loan notes offering investors 13%

– 10% of the collateral value to support a tranche as subordinated certificates, with the return being the excess of receipts over payments from the securitisation process

The non-executive director believes that there will be sufficient demand for all tranches of the loan notes from investors. Investors will expect that the income stream from the development to be low risk, as they will expect the property market to improve with the recession coming to an end and enough potential lessees to be attracted by the new development.

The non-executive director predicts that there would be annual costs of $200,000 in administering the loan. She acknowledges that there would be interest rate risks associated with the proposal, and proposes a fixed for variable interest rate swap on the A-rated floating rate notes, exchanging LIBOR for 9·5%.

However the finance director believes that the prediction of the income from the development that the non-executive director has made is over-optimistic. He believes that it is most likely that the total value of the rental income will be 5% lower than the non-executive director has forecast. He believes that there is some risk that the returns could be so low as to jeopardise the income for the C-rated fixed rate loan note holders.

Islamic finance

Moonstar Co’s chief executive has wondered whether Sukuk finance would be a better way of funding the development than the securitisation.

Moonstar Co’s chairman has pointed out that a major bank in the country where Moonstar Co is located has begun to offer a range of Islamic financial products. The chairman has suggested that a Mudaraba contract would be the most appropriate method of providing the funds required for the investment.

Required:

(a) Calculate the amounts in $ which each of the tranches can expect to receive from the securitisation arrangement proposed by the non-executive director and discuss how the variability in rental income affects the returns from the securitisation. (11 marks)

(b) Discuss the benefits and risks for Moonstar Co associated with the securitisation arrangement that the non-executive director has proposed. (6 marks)

(c) (i) Discuss the suitability of Sukuk finance to fund the investment, including an assessment of its appeal to potential investors. (4 marks)

(ii) Discuss whether a Mudaraba contract would be an appropriate method of financing the investment and discuss why the bank may have concerns about providing finance by this method. (4 marks)

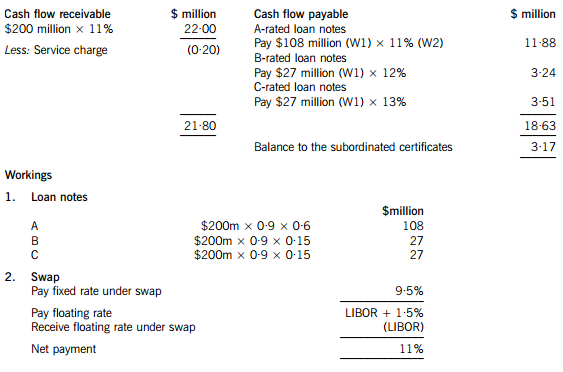

正确答案:(a) An annual cash flow account compares the estimated cash flows receivable from the property against the liabilities within the securitisation process. The swap introduces leverage into the arrangement.

The holders of the certificates are expected to receive $3·17million on $18 million, giving them a return of 17·6%. If the cash flows are 5% lower than the non-executive director has predicted, annual revenue received will fall to $20·90 million, reducing the balance available for the subordinated certificates to $2·07 million, giving a return of 11·5% on the subordinated certificates, which is below the returns offered on the B and C-rated loan notes. The point at which the holders of the certificates will receive nothing and below which the holders of the C-rated loan notes will not receive their full income will be an annual income of $18·83 million (a return of 9·4%), which is 14·4% less than the income that the non-executive director has forecast.

(b) Benefits

The finance costs of the securitisation may be lower than the finance costs of ordinary loan capital. The cash flows from the commercial property development may be regarded as lower risk than Moonstar Co’s other revenue streams. This will impact upon the rates that Moonstar Co is able to offer borrowers.

The securitisation matches the assets of the future cash flows to the liabilities to loan note holders. The non-executive director is assuming a steady stream of lease income over the next 10 years, with the development probably being close to being fully occupied over that period.

The securitisation means that Moonstar Co is no longer concerned with the risk that the level of earnings from the properties will be insufficient to pay the finance costs. Risks have effectively been transferred to the loan note holders.

Risks

Not all of the tranches may appeal to investors. The risk-return relationship on the subordinated certificates does not look very appealing, with the return quite likely to be below what is received on the C-rated loan notes. Even the C-rated loan note holders may question the relationship between the risk and return if there is continued uncertainty in the property sector.

If Moonstar Co seeks funding from other sources for other developments, transferring out a lower risk income stream means that the residual risks associated with the rest of Moonstar Co’s portfolio will be higher. This may affect the availability and terms of other borrowing.

It appears that the size of the securitisation should be large enough for the costs to be bearable. However Moonstar Co may face unforeseen costs, possibly unexpected management or legal expenses.

(c) (i) Sukuk finance could be appropriate for the securitisation of the leasing portfolio. An asset-backed Sukuk would be the same kind of arrangement as the securitisation, where assets are transferred to a special purpose vehicle and the returns and repayments are directly financed by the income from the assets. The Sukuk holders would bear the risks and returns of the relationship.

The other type of Sukuk would be more like a sale and leaseback of the development. Here the Sukuk holders would be guaranteed a rental, so it would seem less appropriate for Moonstar Co if there is significant uncertainty about the returns from the development.

The main issue with the asset-backed Sukuk finance is whether it would be as appealing as certainly the A-tranche of the securitisation arrangement which the non-executive director has proposed. The safer income that the securitisation offers A-tranche investors may be more appealing to investors than a marginally better return from the Sukuk. There will also be costs involved in establishing and gaining approval for the Sukuk, although these costs may be less than for the securitisation arrangement described above.

(ii) A Mudaraba contract would involve the bank providing capital for Moonstar Co to invest in the development. Moonstar Co would manage the investment which the capital funded. Profits from the investment would be shared with the bank, but losses would be solely borne by the bank. A Mudaraba contract is essentially an equity partnership, so Moonstar Co might not face the threat to its credit rating which it would if it obtained ordinary loan finance for the development. A Mudaraba contract would also represent a diversification of sources of finance. It would not require the commitment to pay interest that loan finance would involve.

Moonstar Co would maintain control over the running of the project. A Mudaraba contract would offer a method of obtaining equity funding without the dilution of control which an issue of shares to external shareholders would bring. This is likely to make it appealing to Moonstar Co’s directors, given their desire to maintain a dominant influence over the business.

The bank would be concerned about the uncertainties regarding the rental income from the development. Although the lack of involvement by the bank might appeal to Moonstar Co's directors, the bank might not find it so attractive. The bank might be concerned about information asymmetry – that Moonstar Co’s management might be reluctant to supply the bank with the information it needs to judge how well its investment is performing.

-

第10题:

An account executive is preparing for an initial one-on-one meeting with a high-level executive who recently read about POWER5 technology. The account executive needs technical assistance to prepare for the meeting. How can a pSeries technical specialist best provide assistance in this situation?()

- A、Create a POWER5 technical presentation for the account executive’s use.

- B、Mentor the account executive with the most important POWER5 features and benefits.

- C、Attend the meeting instead of the account executive to present the POWER5 features and benefits.

- D、Join the meeting via teleconference at a prescheduled time to present the POWER5 features and benefits.

正确答案:B -

第11题:

单选题You are designing a security group strategy to meet the business and technical requirements. What should you do?()ACreate one global group named G_Executives. Make all executives user accounts members of that group.

BCreate two global groups named G_Executives and one universal group named U_Executives. Make the two global members of U_Executives. Make the executive user accounts members of the appropriate global group.

CCreate three global groups named G_NY_Executives and G_Chi_Executives and G_Executives. Make G_NY_Executives and G_Chi_Executives members of G_Executives. Make the executive user accounts members of the appropriate global group.

DCreate one domain local group named DL_Executives. Make all executive user accounts members of that group.

正确答案: C解析: 暂无解析 -

第12题:

单选题An account executive is preparing for an initial one-on-one meeting with a high-level executive who recently read about POWER5 technology. The account executive needs technical assistance to prepare for the meeting. How can a pSeries technical specialist best provide assistance in this situation?()ACreate a POWER5 technical presentation for the account executive’s use.

BMentor the account executive with the most important POWER5 features and benefits.

CAttend the meeting instead of the account executive to present the POWER5 features and benefits.

DJoin the meeting via teleconference at a prescheduled time to present the POWER5 features and benefits.

正确答案: A解析: 暂无解析 -

第13题:

(b) Distinguish between strategic and operational risks, and explain why the secrecy option would be a source

of strategic risk. (10 marks)

正确答案:

(b) Strategic and operational risks

Strategic risks

These arise from the overall strategic positioning of the company in its environment. Some strategic positions give rise to

greater risk exposures than others. Because strategic issues typically affect the whole of an organisation and not just one or

more of its parts, strategic risks can potentially concern very high stakes – they can have very high hazards and high returns.

Because of this, they are managed at board level in an organisation and form. a key part of strategic management.

Operational risks

Operational risks refer to potential losses arising from the normal business operations. Accordingly, they affect the day-to-day

running of operations and business systems in contrast to strategic risks that arise from the organisation’s strategic positioning.

Operational risks are managed at risk management level (not necessarily board level) and can be managed and mitigated by

internal control systems.

The secrecy option would be a strategic risk for the following reasons.

It would radically change the environment that SHC is in by reducing competition. This would radically change SHC’s strategic

fit with its competitive environment. In particular, it would change its ‘five forces’ positioning which would change its risk

profile.

It would involve the largest investment programme in the company’s history with new debt substantially changing the

company’s financial structure and making it more vulnerable to short term liquidity problems and monetary pressure (interest

rates).

It would change the way that stakeholders view SHC, for better or worse. It is a ‘crisis issue’, certain to polarise opinion either

way.

It will change the economics of the industry thereby radically affecting future cost, revenue and profit forecasts.

There may be retaliatory behaviour by SHC’s close competitor on 25% of the market.

[Tutorial note: similar reasons if relevant and well argued will attract marks] -

第14题:

2 Chen Products produces four manufactured products: Products 1, 2, 3 and 4. The company’s risk committee recently

met to discuss how the company might respond to a number of problems that have arisen with Product 2. After a

number of incidents in which Product 2 had failed whilst being used by customers, Chen Products had been presented

with compensation claims from customers injured and inconvenienced by the product failure. It was decided that the

risk committee should meet to discuss the options.

When the discussion of Product 2 began, committee chairman Anne Ricardo reminded her colleagues that, apart from

the compensation claims, Product 2 was a highly profitable product.

Chen’s risk management committee comprised four non-executive directors who each had different backgrounds and

areas of expertise. None of them had direct experience of Chen’s industry or products. It was noted that it was

common for them to disagree among themselves as to how risks should be managed and that in some situations,

each member proposed a quite different strategy to manage a given risk. This was the case when they discussed

which risk management strategy to adopt with regard to Product 2.

Required:

(a) Describe the typical roles of a risk management committee. (6 marks)

正确答案:

(a) Typical roles of a risk management committee

The typical roles of a risk management committee are as follows:

To agree and approve the risk management strategy and policies. The design of risk policy will take into account the

environment, the strategic posture towards risk, the product type and a range of other relevant factors.

Receiving and reviewing risk reports from affected departments. Some departments will file regular reports on key risks (such

as liquidity assessments from the accounting department, legal risks from the company secretariat or product risks from the

sales manager).

Monitoring overall exposure and specific risks. If the risk policy places limits on the total risk exposure for a given risk then

this role ensures that limits are adhered to. In the case of certain strategic risks, monitoring could occur on a very frequent

basis whereas for more operational risks, monitoring will more typically occur to coincide with risk management committee

meetings.

Assessing the effectiveness of risk management systems. This involves getting feedback from departments and the internal

audit function on the workings of current management and risk mitigation systems.

Providing general and explicit guidance to the main board on emerging risks and to report on existing risks. This will involve

preparing reports on apparent risks and assessing their probability of being realised and their potential impact if they do.

To work with the audit committee on designing and monitoring internal controls for the management and mitigation of risks.

If the risk committee is part of the executive structure, it will likely have an advisory role in respect of its input into the audit

committee. If it is non-executive, its input may be more directly influential.

[Tutorial note: other roles may be suggested that, if relevant, will be rewarded] -

第15题:

3 Susan Paullaos was recently appointed as a non-executive member of the internal audit committee of Gluck and

Goodman, a public listed company producing complex engineering products. Barney Chester, the executive finance

director who chairs the committee, has always viewed the purpose of internal audit as primarily financial in nature

and as long as financial controls are seen to be fully in place, he is less concerned with other aspects of internal

control. When Susan asked about operational controls in the production facility Barney said that these were not the

concern of the internal audit committee. This, he said, was because as long as the accounting systems and financial

controls were fully functional, all other systems may be assumed to be working correctly.

Susan, however, was concerned with the operational and quality controls in the production facility. She spoke to

production director Aaron Hardanger, and asked if he would be prepared to produce regular reports for the internal

audit committee on levels of specification compliance and other control issues. Mr Hardanger said that the internal

audit committee had always trusted him because his reputation as a manager was very good. He said that he had

never been asked to provide compliance evidence to the internal audit committee and saw no reason as to why he

should start doing so now.

At board level, the non-executive chairman, George Allejandra, said that he only instituted the internal audit committee

in the first place in order to be seen to be in compliance with the stock market’s requirement that Gluck and Goodman

should have one. He believed that internal audit committees didn’t add materially to the company. They were, he

believed, one of those ‘outrageous demands’ that regulatory authorities made without considering the consequences

in smaller companies nor the individual needs of different companies. He also complained about the need to have an

internal auditor. He said that Gluck and Goodman used to have a full time internal auditor but when he left a year

ago, he wasn’t replaced. The audit committee didn’t feel it needed an internal auditor because Barney Chester believed

that only financial control information was important and he could get that information from his management

accountant.

Susan asked Mr Allejandra if he recognised that the company was exposing itself to increased market risks by failing

to have an effective audit committee. Mr Allejandra said he didn’t know what a market risk was.

Required:

(a) Internal control and audit are considered to be important parts of sound corporate governance.

(i) Describe FIVE general objectives of internal control. (5 marks)

正确答案:

3 (a) (i) FIVE general objectives of internal control

An internal control system comprises the whole network of systems established in an organisation to provide reasonable

assurance that organisational objectives will be achieved.

Specifically, the general objectives of internal control are as follows:

To ensure the orderly and efficient conduct of business in respect of systems being in place and fully implemented.

Controls mean that business processes and transactions take place without disruption with less risk or disturbance and

this, in turn, adds value and creates shareholder value.

To safeguard the assets of the business. Assets include tangibles and intangibles, and controls are necessary to ensure

they are optimally utilised and protected from misuse, fraud, misappropriation or theft.

To prevent and detect fraud. Controls are necessary to show up any operational or financial disagreements that might

be the result of theft or fraud. This might include off-balance sheet financing or the use of unauthorised accounting

policies, inventory controls, use of company property and similar.

To ensure the completeness and accuracy of accounting records. Ensuring that all accounting transactions are fully and

accurately recorded, that assets and liabilities are correctly identified and valued, and that all costs and revenues can be

fully accounted for.

To ensure the timely preparation of financial information which applies to statutory reporting (of year end accounts, for

example) and also management accounts, if appropriate, for the facilitation of effective management decision-making.

[Tutorial note: candidates may address these general objectives using different wordings based on analyses of different

study manuals. Allow latitude] -

第16题:

In relation to the law of contract, distinguish between and explain the effect of:

(a) a term and a mere representation; (3 marks)

(b) express and implied terms, paying particular regard to the circumstances under which terms may be implied in contracts. (7 marks)

正确答案:This question requires candidates to consider the law relating to terms in contracts. It specifically requires the candidates to distinguish between terms and mere representations and then to establish the difference between express and implied terms in contracts.

(a) As the parties to a contract will be bound to perform. any promise they have contracted to undertake, it is important to distinguish between such statements that will be considered part of the contract, i.e. terms, and those other pre-contractual statements which are not considered to be part of the contract, i.e. mere representations. The reason for distinguishing between them is that there are different legal remedies available if either statement turns out to be incorrect.

A representation is a statement that induces a contract but does not become a term of the contract. In practice it is sometimes difficult to distinguish between the two, but in attempting to do so the courts will focus on when the statement was made in relation to the eventual contract, the importance of the statement in relation to the contract and whether or not the party making the statement had specialist knowledge on which the other party relied (Oscar Chess v Williams (1957) and Dick

Bentley v Arnold Smith Motors (1965)).

(b) Express terms are statements actually made by one of the parties with the intention that they become part of the contract and

thus binding and enforceable through court action if necessary. It is this intention that distinguishes the contractual term from

the mere representation, which, although it may induce the contractual agreement, does not become a term of the contract.

Failure to comply with the former gives rise to an action for breach of contract, whilst failure to comply with the latter only gives rise to an action for misrepresentation.Such express statements may be made by word of mouth or in writing as long as they are sufficiently clear for them to be enforceable. Thus in Scammel v Ouston (1941) Ouston had ordered a van from the claimant on the understanding that the balance of the purchase price was to be paid ‘on hire purchase terms over two years’. When Scammel failed to deliver the van Ouston sued for breach of contract without success, the court holding that the supposed terms of the contract were too

uncertain to be enforceable. There was no doubt that Ouston wanted the van on hire purchase but his difficulty was that

Scammel operated a range of hire purchase terms and the precise conditions of his proposed hire purchase agreement were

never sufficiently determined.

Implied terms, however, are not actually stated or expressly included in the contract, but are introduced into the contract by implication. In other words the exact meaning and thus the terms of the contract are inferred from its context. Implied terms can be divided into three types.

Terms implied by statute

In this instance a particular piece of legislation states that certain terms have to be taken as constituting part of an agreement, even where the contractual agreement between the parties is itself silent as to that particular provision. For example, under s.5 of the Partnership Act 1890, every member of an ordinary partnership has the implied power to bind the partnership in a contract within its usual sphere of business. That particular implied power can be removed or reduced by the partnership agreement and any such removal or reduction of authority would be effective as long as the other party was aware of it. Some implied terms, however, are completely prescriptive and cannot be removed.

Terms implied by custom or usage

An agreement may be subject to terms that are customarily found in such contracts within a particular market, trade or locality. Once again this is the case even where it is not actually specified by the parties. For example, in Hutton v Warren (1836), it was held that customary usage permitted a farm tenant to claim an allowance for seed and labour on quitting his tenancy. It should be noted, however, that custom cannot override the express terms of an agreement (Les Affreteurs Reunnis SA v Walford (1919)).

Terms implied by the courts Generally, it is a matter for the parties concerned to decide the terms of a contract, but on occasion the court will presume that the parties intended to include a term which is not expressly stated. They will do so where it is necessary to give business efficacy to the contract.Whether a term may be implied can be decided on the basis of the officious bystander test. Imagine two parties, A and B, negotiating a contract, when a third party, C, interrupts to suggest a particular provision. A and B reply that that particular term is understood. In just such a way, the court will decide that a term should be implied into a contract.

In The Moorcock (1889), the appellants, owners of a wharf, contracted with the respondents to permit them to discharge their ship at the wharf. It was apparent to both parties that when the tide was out the ship would rest on the riverbed. When the tide was out, the ship sustained damage by settling on a ridge. It was held that there was an implied warranty in the contract that the place of anchorage should be safe for the ship. As a consequence, the ship owner was entitled to damages for breach of that term.

Alternatively the courts will imply certain terms into unspecific contracts where the parties have not reduced the general agreement into specific details. Thus in contracts of employment the courts have asserted the existence of implied terms to impose duties on both employers and employees, although such implied terms can be overridden by express contractual provision to the contrary. -

第17题:

4 (a) ISA 701 Modifications to The Independent Auditor’s Report includes ‘suggested wording of modifying phrases

for use when issuing modified reports’.

Required:

Explain and distinguish between each of the following terms:

(i) ‘qualified opinion’;

(ii) ‘disclaimer of opinion’;

(iii) ‘emphasis of matter paragraph’. (6 marks)

正确答案:

4 PETRIE CO

(a) Independent auditor’s report terms

(i) Qualified opinion – A qualified opinion is expressed when the auditor concludes that an unqualified opinion cannot be

expressed but that the effect of any disagreement with management, or limitation on scope is not so material and

pervasive as to require an adverse opinion or a disclaimer of opinion.

(ii) Disclaimer of opinion – A disclaimer of opinion is expressed when the possible effect of a limitation on scope is so

material and pervasive that the auditor has not been able to obtain sufficient appropriate audit evidence and accordingly

is unable to express an opinion on the financial statements.

(iii) Emphasis of matter paragraph – An auditor’s report may be modified by adding an emphasis of matter paragraph to

highlight a matter affecting the financial statements that is included in a note to the financial statements that more

extensively discusses the matter. Such an emphasis of matter paragraph does not affect the auditor’s opinion. An

emphasis of matter paragraph may also be used to report matters other than those affecting the financial statements

(e.g. if there is a misstatement of fact in other information included in documents containing audited financial

statements).

(iii) is clearly distinguishable from (i) and (ii) because (i) and (ii) affect the opinion paragraph, whereas (iii) does not.

(i) and (ii) are distinguishable by the degree of their impact on the financial statements. In (i) the effects of any disagreement

or limitation on scope can be identified with an ‘except for …’ opinion. In (ii) the matter is pervasive, that is, affecting the

financial statements as a whole.

(ii) can only arise in respect of a limitation in scope (i.e. insufficient evidence) that has a pervasive effect. (i) is not pervasive

and may also arise from disagreement (i.e. where there is sufficient evidence). -

第18题:

Although they are identical twins their parents can easily ______ between them.A.identify

B.select

C.differ

D.distinguish

正确答案:D

-

第19题:

You can call the front desk directly__.A.Note that even when

B.inelastic prices

C.big-city orientations

D.executive's needs

参考答案:D

-

第20题:

(a) Contrast the role of internal and external auditors. (8 marks)

(b) Conoy Co designs and manufactures luxury motor vehicles. The company employs 2,500 staff and consistently makes a net profit of between 10% and 15% of sales. Conoy Co is not listed; its shares are held by 15 individuals, most of them from the same family. The maximum shareholding is 15% of the share capital.

The executive directors are drawn mainly from the shareholders. There are no non-executive directors because the company legislation in Conoy Co’s jurisdiction does not require any. The executive directors are very successful in running Conoy Co, partly from their training in production and management techniques, and partly from their ‘hands-on’ approach providing motivation to employees.

The board are considering a significant expansion of the company. However, the company’s bankers are

concerned with the standard of financial reporting as the financial director (FD) has recently left Conoy Co. The board are delaying provision of additional financial information until a new FD is appointed.

Conoy Co does have an internal audit department, although the chief internal auditor frequently comments that the board of Conoy Co do not understand his reports or provide sufficient support for his department or the internal control systems within Conoy Co. The board of Conoy Co concur with this view. Anders & Co, the external auditors have also expressed concern in this area and the fact that the internal audit department focuses work on control systems, not financial reporting. Anders & Co are appointed by and report to the board of Conoy Co.

The board of Conoy Co are considering a proposal from the chief internal auditor to establish an audit committee.

The committee would consist of one executive director, the chief internal auditor as well as three new appointees.

One appointee would have a non-executive seat on the board of directors.

Required:

Discuss the benefits to Conoy Co of forming an audit committee. (12 marks)

正确答案:

(a)Roleofinternalandexternalauditors–differencesObjectivesThemainobjectiveofinternalauditistoimproveacompany’soperations,primarilyintermsofvalidatingtheefficiencyandeffectivenessoftheinternalcontrolsystemsofacompany.Themainobjectiveoftheexternalauditoristoexpressanopiniononthetruthandfairnessofthefinancialstatements,andotherjurisdictionspecificrequirementssuchasconfirmingthatthefinancialstatementscomplywiththereportingrequirementsincludedinlegislation.ReportingInternalauditreportsarenormallyaddressedtotheboardofdirectors,orotherpeoplechargedwithgovernancesuchastheauditcommittee.Thosereportsarenotpubliclyavailable,beingconfidentialbetweentheinternalauditorandtherecipient.Externalauditreportsareprovidedtotheshareholdersofacompany.Thereportisattachedtotheannualfinancialstatementsofthecompanyandisthereforepubliclyavailabletotheshareholdersandanyreaderofthefinancialstatements.ScopeofworkTheworkoftheinternalauditornormallyrelatestotheoperationsoftheorganisation,includingthetransactionprocessingsystemsandthesystemstoproducetheannualfinancialstatements.Theinternalauditormayalsoprovideotherreportstomanagement,suchasvalueformoneyauditswhichexternalauditorsrarelybecomeinvolvedwith.Theworkoftheexternalauditorrelatesonlytothefinancialstatementsoftheorganisation.However,theinternalcontrolsystemsoftheorganisationwillbetestedastheseprovideevidenceonthecompletenessandaccuracyofthefinancialstatements.RelationshipwithcompanyInmostorganisations,theinternalauditorisanemployeeoftheorganisation,whichmayhaveanimpactontheauditor’sindependence.However,insomeorganisationstheinternalauditfunctionisoutsourced.Theexternalauditorisappointedbytheshareholdersofanorganisation,providingsomedegreeofindependencefromthecompanyandmanagement.(b)BenefitsofauditcommitteeinConoyCoAssistancewithfinancialreporting(nofinanceexpertise)TheexecutivedirectorsofConoyCodonotappeartohaveanyspecificfinancialskills–asthefinancialdirectorhasrecentlyleftthecompanyandhasnotyetbeenreplaced.ThismaymeanthatfinancialreportinginConoyCoislimitedorthattheothernon-financialdirectorsspendasignificantamountoftimekeepinguptodateonfinancialreportingissues.AnauditcommitteewillassistConoyCobyprovidingspecialistknowledgeoffinancialreportingonatemporarybasis–atleastoneofthenewappointeesshouldhaverelevantandrecentfinancialreportingexperienceundercodesofcorporategovernance.ThiswillallowtheexecutivedirectorstofocusonrunningConoyCo.EnhanceinternalcontrolsystemsTheboardofConoyCodonotnecessarilyunderstandtheworkoftheinternalauditor,ortheneedforcontrolsystems.ThismeansthatinternalcontrolwithinConoyComaybeinadequateorthatemployeesmaynotrecognisetheimportanceofinternalcontrolsystemswithinanorganisation.TheauditcommitteecanraiseawarenessoftheneedforgoodinternalcontrolsystemssimplybybeingpresentinConoyCoandbyeducatingtheboardontheneedforsoundcontrols.Improvingtheinternalcontrol‘climate’willensuretheneedforinternalcontrolsisunderstoodandreducecontrolerrors.RelianceonexternalauditorsConoyCo’sinternalauditorscurrentlyreporttotheboardofConoyCo.Aspreviouslynoted,thelackoffinancialandcontrolexpertiseontheboardwillmeanthatexternalauditorreportsandadvicewillnotnecessarilybeunderstood–andtheboardmayrelytoomuchonexternalauditorsIfConoyCoreporttoanauditcommitteethiswilldecreasethedependenceoftheboardontheexternalauditors.Theauditcommitteecantaketimetounderstandtheexternalauditor’scomments,andthenviathenon-executivedirector,ensurethattheboardtakeactiononthosecomments.AppointmentofexternalauditorsAtpresent,theboardofConoyCoappointtheexternalauditors.Thisraisesissuesofindependenceastheboardmaybecometoofamiliarwiththeexternalauditorsandsoappointonthisfriendshipratherthanmerit.Ifanauditcommitteeisestablished,thenthiscommitteecanrecommendtheappointmentoftheexternalauditors.Thecommitteewillhavethetimeandexpertisetoreviewthequalityofserviceprovidedbytheexternalauditors,removingtheindependenceissue.Corporategovernancerequirements–bestpracticeConoyCodonotneedtofollowcorporategovernancerequirements(thecompanyisnotlisted).However,notfollowingthoserequirementsmaystarttohaveadverseeffectsonConoy.Forexample,ConoyCo’sbankisalreadyconcernedaboutthelackoftransparencyinreporting.EstablishinganauditcommitteewillshowthattheboardofConoyCoarecommittedtomaintainingappropriateinternalsystemsinthecompanyandprovidingthestandardofreportingexpectedbylargecompanies.Obtainingthenewbankloanshouldalsobeeasierasthebankwillbesatisfiedwithfinancialreportingstandards.Givennonon-executives–independentadvicetoboardCurrentlyConoyCodoesnothaveanynon-executivedirectors.Thismeansthatthedecisionsoftheexecutivedirectorsarenotbeingchallengedbyotherdirectorsindependentofthecompanyandwithlittleornofinancialinterestinthecompany.Theappointmentofanauditcommitteewithonenon-executivedirectorontheboardofConoyCowillstarttoprovidesomenon-executiveinputtoboardmeetings.Whilenotsufficientintermsofcorporategovernancerequirements(aboutequalnumbersofexecutiveandnon-executivedirectorsareexpected)itdoesshowtheboardofConoyCoareattemptingtoestablishappropriategovernancesystems.AdviceonriskmanagementFinally,thereareothergeneralareaswhereConoyCowouldbenefitfromanauditcommittee.Forexample,lackofcorporategovernancestructuresprobablymeansConoyCodoesnothaveariskmanagementcommittee.Theauditcommitteecanalsoprovideadviceonriskmanagement,helpingtodecreasetheriskexposureofthecompany. -

第21题:

Changes may be requested by any stakeholder involved with the project, but changes can be authorized only by()

- A、executive IT manager

- B、projectmanger

- C、change control board

- D、projectsponsor

正确答案:C -

第22题:

You are designing a security group strategy to meet the business and technical requirements. What should you do?()

- A、Create one global group named G_Executives. Make all executives user accounts members of that group.

- B、Create two global groups named G_Executives and one universal group named U_Executives. Make the two global members of U_Executives. Make the executive user accounts members of the appropriate global group.

- C、Create three global groups named G_NY_Executives and G_Chi_Executives and G_Executives. Make G_NY_Executives and G_Chi_Executives members of G_Executives. Make the executive user accounts members of the appropriate global group.

- D、Create one domain local group named DL_Executives. Make all executive user accounts members of that group.

正确答案:B -

第23题:

问答题Practice 5 ● The company you work for has decided to join a scheme in which members of staff exchange places for six months with people from other companies overseas. ● The Chief Executive has asked you to suggest which members of staff should be the first to take part in this scheme and why. ● Write your proposal for the Chief Executive: ● suggesting which members of staff should be chosen and why they are suitable ● describing what their current responsibilities are ● explaining what these staff could learn from the exchange scheme ● outlining the benefits to the company as a whole of its participation in the scheme. ● Write 250~300 words on the separate answer paper provided.正确答案: 【参考范文】

Subject: Choosing employees for staff exchange scheme

As requested, I am submitting this report so as to give recommendations on selecting members of staff as the first to participate in a scheme in which members of staff exchange places for six months with people from other companies in England.

As for the ideal candidate, he or she will be a qualified accountant with no less than 3 years’ hands-on experience. He/she is expected to be confident and possesses excellent interpersonal and communication skills in English language. It will be an asset if he/she has a good understanding of American environment and culture.

I believe that most of the junior managers at the financial department are qualified for this scheme, for they can meet the requirements and obviously have an edge over staff of other departments. Their responsibility is about the financial control of the businesses, which includes accounting matters, cash flow management and negotiation with suppliers. Moreover, they can offer commercial support to the local managers and are heavily engaged in operational level, while managing overseas

With this scheme, staff will be more exposed to a different environment, which is bound to broaden their horizon, improve their English and sharpen their skills. I am certain that staff will have an indepth knowledge of and exposure to managing overseas businesses. Surely it would turn out to be a most rewarding experience to them as well. Exposed to different culture, the selected members will be able to share their knowledge with those never been out of China.

Providing staff with a unique experience of working overseas will boost their morale and make them valuable assets for the company. Their knowledge can also be used to expand operation home and abroad. Therefore, it will end up benefiting the company greatly.解析: 暂无解析