In relation to company law, explain:(a) the limitations on the use of company names; (4 marks)(b) the tort of ‘passing off’; (4 marks)(c) the role of the company names adjudicators under the Companies Act 2006. (2 marks)

题目

In relation to company law, explain:

(a) the limitations on the use of company names; (4 marks)

(b) the tort of ‘passing off’; (4 marks)

(c) the role of the company names adjudicators under the Companies Act 2006. (2 marks)

相似考题

更多“In relation to company law, explain:(a) the limitations on the use of company names; (4 marks)(b) the tort of ‘passing off’; (4 marks)(c) the role of the company names adjudicators under the Companies Act 2006. (2 marks)”相关问题

-

第1题:

Churchill Ice Cream has to date made two unsuccessful attempts to become an international company.

(d) What reasons would you suggest to explain this failure of Churchill Ice Cream to become an international

company? (5 marks)

正确答案:

(d) The two international strategies pursued to date are through organic growth (the stores in North America) and acquisition (the

companies in Germany and Italy). Neither seems to have worked. Here there seem to be some contradictions while global

tastes and lifestyles are argued to have developed – convergence of consumer tastes lies at the heart of this – but this does

not seem to have benefited Churchill. One questions the learning that these two unfortunate experiences have created. Of the

three core methods of achieving growth, namely organic, acquisition and joint venture, only joint venture remains to be tried.

The reasons for the international failures are clearly complex but one could argue that the strategy has been curiously na?ve.

Certainly, it has pursued a high-risk strategy. Exporting, perhaps through identifying a suitable partner, might create the

learning to lead to a more significant market entry. There is a need to understand local tastes; indeed the whole of the

marketing mix in the chosen market(s), and decide on appropriate strategy. A strategy based upon the acquisition of

companies and their consequent development represents a large investment of capital and requires considerable managerial

attention and expertise. Equally, the attempt to use the Churchill domestic format of opening its own stores creates both a

major financial commitment and the need to manage a radically different operation. One must seriously question whether

Churchill has these capabilities within a family-owned business. Clearly there are differences between the ice cream markets

in various countries, though the emergence of global brands suggests some convergence of tastes. Such differences reflect

differing cultures, tastes and competitive behaviour in each country. The lesson from Churchill’s international initiatives is that

national differences need to be carefully understood. There is little evidence that Churchill has understood these differencesor indeed learnt from them. -

第2题:

(b) Discuss the key issues which the statement of cash flows highlights regarding the cash flow of the company.

(10 marks)

正确答案:

(b) Financial statement ratios can provide useful measures of liquidity but an analysis of the information in the cash flow

statement, particularly cash flow generated from operations, can provide specific insights into the liquidity of Warrburt. It is

important to look at the generation of cash and its efficient usage. An entity must generate cash from trading activity in order

to avoid the constant raising of funds from non-trading sources. The ‘quality of the profits’ is a measure of an entity’s ability

to do this. The statement of cash flow shows that the company has generated cash in the period despite sustaining a

significant loss ($92m cash flow but $21m loss). The problem is the fact that the entity will not be able to sustain this level

of cash generation if losses continue.

An important measure of cash flow is the comparison of the cash from operating activity to current liabilities. In the case of

Warrburt, this is $92m as compared to $155m. Thus the cash flow has not covered the current liabilities.

Operating cash flow ($92 million) determines the extent to which Warrburt has generated sufficient funds to repay loans,

maintain operating capability, pay dividends and make new investments without external financing. Operating cash flow

appears to be healthy, partially through the release of cash from working capital. This cash flow has been used to pay

contributions to the pension scheme, pay finance costs and income taxes. These uses of cash generated would be normal for

any entity. However, the release of working capital has also financed in part the investing activities of the entity which includes

the purchase of an associate and property, plant and equipment. The investing activities show a net cash outflow of

$43 million which has been financed partly out of working capital, partly from the sale of PPE and AFS financial assets and

partly out of cash generated from operations which include changes in working capital. It seems also that the issue of share

capital has been utilised to repay the long term borrowings and pay dividends. Also a significant amount of cash has been

raised through selling AFS investments. This may not continue in the future as it will depend on the liquidity of the market.

This action seems to indicate that the long term borrowings have effectively been ‘capitalised’. The main issue raised by the

cash flow statement is the use of working capital to partially finance investing activities. However, the working capital ratio

and liquidity ratios are still quite healthy but these ratios will deteriorate if the trend continues. -

第3题:

4 (a) A company may choose to finance its activities mainly by equity capital, with low borrowings (low gearing) or by

relying on high borrowings with relatively low equity capital (high gearing).

Required:

Explain why a highly geared company is generally more risky from an investor’s point of view than a company

with low gearing. (3 marks)

正确答案:

(a) A highly-geared company has an obligation to pay interest on its loans regardless of its profit level. It will show high profits if

its overall rate of return on capital is greater than the rate of interest being paid on its borrowings, but a low profit or a loss if

there is a down-turn in its profit such that the rate of interest to be paid exceeds the return on its assets. -

第4题:

4 (a) Explain the meaning of the term ‘working capital cycle’ for a trading company. (4 marks)

正确答案:

(a) The working capital cycle illustrates the changing make-up of working capital in the course of the trading operations of a

business:

1 Purchases are made on credit and the goods go into inventory.

2 Inventory is sold and converted into receivables

3 Credit customers pay their accounts

4 Cash is used to pay suppliers. -

第5题:

(b) ‘Strategic positioning’ is about the way that a company as a whole is placed in its environment and concerns its

‘fit’ with the factors in its environment.

With reference to the case as appropriate, explain how a code of ethics can be used as part of a company’s

overall strategic positioning. (7 marks)

正确答案:

(b) Code of ethics and strategic positioning

Strategic positioning is about the way that a whole company is placed in its environment as opposed to the operational level,

which considers the individual parts of the organisation.

Ethical reputation and practice can be a key part of environmental ‘fit’, along with other strategic issues such as generic

strategy, quality and product range.

The ‘fit’ enables the company to more fully meet the expectations, needs and demands of its relevant stakeholders – in this

case, European customers.

The ‘quality’ of the strategic ‘fit’ is one of the major determinants of business performance and so is vital to the success of

the business.

HPC has carefully manoeuvred itself to have the strategic position of being the highest ethical performer locally and has won

orders on that basis.

It sees its strategic position as being the ethical ‘benchmark’ in its industry locally and protects this position against its parent

company seeking to impose a new code of ethics.

The ethical principles are highly internalised in Mr Hogg and in the company generally, which is essential for effective strategic

implementation. -

第6题:

(c) Define ‘retirement by rotation’ and explain its importance in the context of Rosh and Company.

(5 marks)

正确答案:

(c) Retirement by rotation.

Definition

Retirement by rotation is an arrangement in a director’s contract that specifies his or her contract to be limited to a specific

period (typically three years) after which he or she must retire from the board or offer himself (being eligible) for re-election.

The director must be actively re-elected back onto the board to serve another term. The default is that the director retires

unless re-elected.

Importance of

Retirement by rotation reduces the cost of contract termination for underperforming directors. They can simply not be

re-elected after their term of office expires and they will be required to leave the service of the board as a retiree (depending

on contract terms).

It encourages directors’ performance (they know they are assessed by shareholders and reconsidered every three years) and

focuses their minds upon the importance of meeting objectives in line with shareholders’ aims.

It is an opportunity, over time, to replace the board membership whilst maintaining medium term stability of membership

(one or two at a time).

Applied to Rosh

Retirement by rotation would enable the board of Rosh to be changed over time. There is evidence that some directors may

have stayed longer than is ideal because of links with other board members going back many years. -

第7题:

(ii) Briefly explain the extent to which the application of sensitivity analysis might be useful in deciding

which refrigeration system to purchase and discuss the limitations inherent in its use. (3 marks)

正确答案:

(ii) Sensitivity analysis could be used to assess how responsive the NPV calculated in part (a) in respect of each decision

option change is to changes in the variables used to calculate it. The application of sensitivity analysis requires that the

net present values are calculated under alternative assumptions in order to determine how sensitive they are to changing

conditions. In this particular example then a relatively small change in the forecast cash flows might lead to a change

in the investment decision. The application of sensitivity analysis can indicate those variables to which the NPV is most

sensitive and the extent to which these variables may change before an investment results in a negative NPV. Thus the

application of sensitivity analysis may provide management with an indication of why a particular project might fail. The

directors of Stay Cool Ltd should give consideration to the potential variations in the independent variables which feature

in the decision-making process such as:

– estimated revenues

– estimated operating costs

– estimated working lives

– estimated repair costs

– the estimated discount rate i.e. cost of capital of each alternative investment.

Sensitivity analysis has some serious limitations. The use of the method requires changes in each variable under

consideration are isolated. However management may be focused on what happens if changes occur in two or more

critical variables. Another problem relating to the use of sensitivity analysis to forecast outcomes lies in the fact that it

provides no indication of the likelihood of the occurrence of changes in critical variables. -

第8题:

(ii) State the taxation implications of both equity and loan finance from the point of view of a company.

(3 marks)

正确答案:

(ii) A company needs to be aware of the following issues:

Equity

(1) Costs incurred in issuing share capital are not allowed as a trading deduction.

(2) Distributions to investors are not allowed as a trading deduction.

(3) The cost of making distributions to shareholders are disallowable.

(4) Where profits are taxed at an effective rate of less than 19%, any profits used to make a distribution to noncorporate

shareholders will themselves be taxed at the full 19% rate.

Loan finance/debt

(1) The incidental costs of obtaining/raising loan finance are broadly deductible as a trading expense.

(2) Capital costs of raising loan finance (for example, loans issued at a discount) are not deductible for tax purposes.

(3) Interest incurred on a loan to finance a business is deductible from trading income. -

第9题:

(ii) The shares held in Date Inc and the dividend income received from that company. (7 marks)

正确答案:

(ii) Shares held in Date Inc and the related dividend income

Degrouping charge

There will be a degrouping charge in Nikau Ltd in the year ending 31 March 2008 in respect of the shares in Date Inc.

This is because Nikau Ltd has left the Facet Group within six years of the no gain, no loss transfer of the shares whilst

still owning them.

Nikau Ltd is treated as if it has sold the shares in Date Inc for their market value as at the time of the no gain, no loss

transfer. This will give rise to a gain, ignoring indexation allowance, of £201,000 (£338,000 – £137,000).

This gain will give rise to additional corporation tax of £60,300 (£201,000 x 30%).

Controlled foreign company

Date Inc is a controlled foreign company. The profits of such a company are normally attributed to its UK resident

shareholders such that they are subject to UK corporation tax.

However, none of the profits of Date Inc will be attributed to Nikau Ltd because Date Inc distributes more than 90%

(£115,000/£120,000 = 95·8%) of its chargeable profits to its shareholders.

Dividend income

Nikau Ltd is a UK resident company and is therefore subject to corporation tax on its worldwide income.

The dividend income will be grossed up in respect of the withholding tax giving rise to taxable income of £39,792

(£38,200 x 100/96). There is no underlying tax as there are no taxes on income or capital profits in Palladia.

The corporation tax of £11,938 (£39,792 x 30%) will be reduced by unilateral double tax relief equal to the withholding

tax suffered of £1,592 (£39,792 x 4%) resulting in corporation tax due of £10,346 (£11,938 – £1,592). -

第10题:

In relation to the law of contract, distinguish between and explain the effect of:

(a) a term and a mere representation; (3 marks)

(b) express and implied terms, paying particular regard to the circumstances under which terms may be implied in contracts. (7 marks)

正确答案:This question requires candidates to consider the law relating to terms in contracts. It specifically requires the candidates to distinguish between terms and mere representations and then to establish the difference between express and implied terms in contracts.

(a) As the parties to a contract will be bound to perform. any promise they have contracted to undertake, it is important to distinguish between such statements that will be considered part of the contract, i.e. terms, and those other pre-contractual statements which are not considered to be part of the contract, i.e. mere representations. The reason for distinguishing between them is that there are different legal remedies available if either statement turns out to be incorrect.

A representation is a statement that induces a contract but does not become a term of the contract. In practice it is sometimes difficult to distinguish between the two, but in attempting to do so the courts will focus on when the statement was made in relation to the eventual contract, the importance of the statement in relation to the contract and whether or not the party making the statement had specialist knowledge on which the other party relied (Oscar Chess v Williams (1957) and Dick

Bentley v Arnold Smith Motors (1965)).

(b) Express terms are statements actually made by one of the parties with the intention that they become part of the contract and

thus binding and enforceable through court action if necessary. It is this intention that distinguishes the contractual term from

the mere representation, which, although it may induce the contractual agreement, does not become a term of the contract.

Failure to comply with the former gives rise to an action for breach of contract, whilst failure to comply with the latter only gives rise to an action for misrepresentation.Such express statements may be made by word of mouth or in writing as long as they are sufficiently clear for them to be enforceable. Thus in Scammel v Ouston (1941) Ouston had ordered a van from the claimant on the understanding that the balance of the purchase price was to be paid ‘on hire purchase terms over two years’. When Scammel failed to deliver the van Ouston sued for breach of contract without success, the court holding that the supposed terms of the contract were too

uncertain to be enforceable. There was no doubt that Ouston wanted the van on hire purchase but his difficulty was that

Scammel operated a range of hire purchase terms and the precise conditions of his proposed hire purchase agreement were

never sufficiently determined.

Implied terms, however, are not actually stated or expressly included in the contract, but are introduced into the contract by implication. In other words the exact meaning and thus the terms of the contract are inferred from its context. Implied terms can be divided into three types.

Terms implied by statute

In this instance a particular piece of legislation states that certain terms have to be taken as constituting part of an agreement, even where the contractual agreement between the parties is itself silent as to that particular provision. For example, under s.5 of the Partnership Act 1890, every member of an ordinary partnership has the implied power to bind the partnership in a contract within its usual sphere of business. That particular implied power can be removed or reduced by the partnership agreement and any such removal or reduction of authority would be effective as long as the other party was aware of it. Some implied terms, however, are completely prescriptive and cannot be removed.

Terms implied by custom or usage

An agreement may be subject to terms that are customarily found in such contracts within a particular market, trade or locality. Once again this is the case even where it is not actually specified by the parties. For example, in Hutton v Warren (1836), it was held that customary usage permitted a farm tenant to claim an allowance for seed and labour on quitting his tenancy. It should be noted, however, that custom cannot override the express terms of an agreement (Les Affreteurs Reunnis SA v Walford (1919)).

Terms implied by the courts Generally, it is a matter for the parties concerned to decide the terms of a contract, but on occasion the court will presume that the parties intended to include a term which is not expressly stated. They will do so where it is necessary to give business efficacy to the contract.Whether a term may be implied can be decided on the basis of the officious bystander test. Imagine two parties, A and B, negotiating a contract, when a third party, C, interrupts to suggest a particular provision. A and B reply that that particular term is understood. In just such a way, the court will decide that a term should be implied into a contract.

In The Moorcock (1889), the appellants, owners of a wharf, contracted with the respondents to permit them to discharge their ship at the wharf. It was apparent to both parties that when the tide was out the ship would rest on the riverbed. When the tide was out, the ship sustained damage by settling on a ridge. It was held that there was an implied warranty in the contract that the place of anchorage should be safe for the ship. As a consequence, the ship owner was entitled to damages for breach of that term.

Alternatively the courts will imply certain terms into unspecific contracts where the parties have not reduced the general agreement into specific details. Thus in contracts of employment the courts have asserted the existence of implied terms to impose duties on both employers and employees, although such implied terms can be overridden by express contractual provision to the contrary. -

第11题:

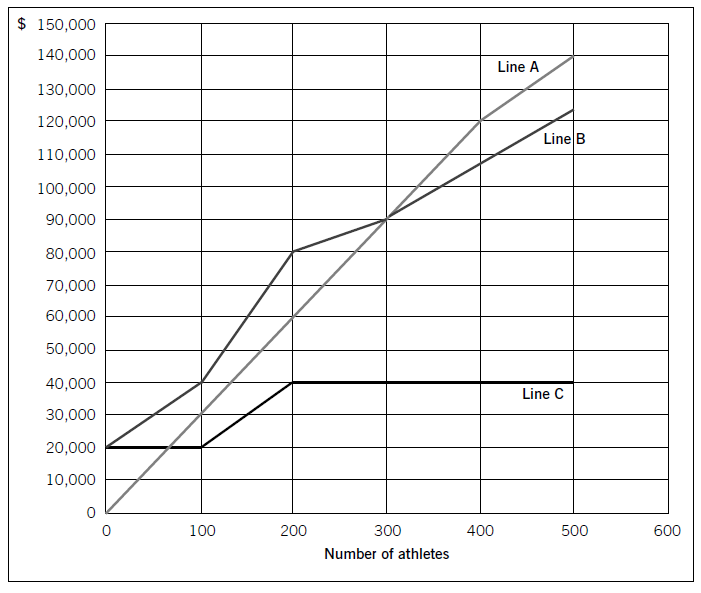

Swim Co offers training courses to athletes and has prepared the following breakeven chart:

Required:

(a) State the breakeven sales revenue for Swim Co and estimate, to the nearest $10,000, the company’s profit if 500 athletes attend a training course. (2 marks)

(b) Using the chart above, explain the cost and revenue structure of the company. (8 marks)

正确答案:

(a)ThebreakevensalesrevenueforSwimCois$90,000.Thecompany’sprofit,tothenearest$10,000,if500athletesattendthecourseis$20,000($140,000–$120,000).(Fromthegraph,itisclearthatthepreciseamountwillbenearer$17,000,i.e.$140,000–approximately$123,000.)(b)CoststructureFromthechart,itisclearthatLineCrepresentsfixedcosts,LineBrepresentstotalcostsandLineArepresentstotalrevenue.LineCshowsthatinitially,fixedcostsare$20,000evenifnoathletesattendthecourse.Thisleveloffixedcostsremainsthesameif100athletesattendbutoncethenumberofattendeesincreasesabovethislevel,fixedcostsincreaseto$40,000.LineBrepresentstotalcosts.If100athletesattend,totalcostsare$40,000($400perathlete).Since$20,000ofthisrelatestofixedcosts,thevariablecostperathletemustbe$200.Whenfixedcostsstepupbeyondthispointatthelevelof200athletes,totalcostsobviouslyincreaseaswellandLineBconsequentlygetsmuchsteeper.However,sincetherearenow200athletestoabsorbthefixedcosts,thecostperathleteremainsthesameat$400perathlete($80,000/200),eventhoughfixedcostshavedoubled.If300athletesattendthecourse,totalcostperathletebecomes$300each($90,000/300).Sincefixedcostsaccountfor$40,000ofthistotalcost,variablecoststotal$50,000,i.e.$166·67perathlete.So,economiesofscaleariseatthislevel,asdemonstratedbythefactthatLineBbecomesflatter.At400athletes,thegradientofthetotalcostslineisunchangedfrom300athleteswhichindicatesthatthevariablecostshaveremainedthesame.Thereisnofurtherchangeat500athletes;fixedandvariablecostsremainsteady.RevenuestructureAsregardstherevenuestructure,itcanbeseenfromLineAthatfor100–400athletesthepriceremainsthesameat$300perathlete.However,if500athletesattend,thepricehasbeenreducedasthetotalrevenuelinebecomesflatter.$140,000/500meansthatthepricehasgonedownto$280perathlete.Thiswasobviouslynecessarytoincreasethenumberofattendeesandatthispoint,profitismaximised.1 -

第12题:

问答题Task I (10 marks) Write a letter to a company declining a job offer. In the letter, you: ● Express your gratitude to the company for the job offer ● Explain the reason(s) why you have to decline the offer ● Apologise and extend your good wishes to the company Write a letter of between 100 and 120 words in an appropriate style on the answer sheet. Do not write your name or address.正确答案:

Dear Mr. Frank,

Thank you for the time and effort you spent considering me for a position as seminar leader. I am grateful for your offer of employment.

While I believe firmly in the mission of your company and appreciate the challenging opportunity you offer, I have had another offer which I believe more closely matches my current career goals and interests. Therefore, although it was a difficult decision, I must decline your offer and offer you my sincere apologies.

I do appreciate all the courtesy and hospitality extended to me by your office, and I wish you well in your endeavors. I hope our paths will cross again in the future.

Thank you again for your time and consideration.

Sincerely,

Jane Chole

(Word Count: 123)解析: 暂无解析 -

第13题:

(d) What criteria would you use to assess whether Universal is an ‘excellent’ company? (5 marks)

正确答案:

(d) One of the most widely used models to identify excellence is that of Peters and Waterman developed in their research into

excellent American companies. Interestingly, they agreed with Leavitt in that the companies identified as excellent, whether

they were manufacturers or service businesses, could be seen as offering an excellent service to their customers. This required

them to understand what their customers really valued and then put in place the resources, competences and decision making

processes that delivered the desired attributes. Excellence was positively associated with innovation. Using their checklist of

excellent attributes, Universal could see to be excellent in the following ways:

A bias for action – there is evidence to suggest that both Matthew and Simon are action orientated. They showed an admirable

willingness to experiment and develop a service that added significant value to the customer experience.

Hands-on, value driven – again, the commitment to deliver a quality service – one that they are totally familiar with and able

to deliver themselves – suggests that this value is communicated and shared with staff. The use of self employed installers

and sales people make this commitment particularly important.

Close to the customer – all the evidence points to a real and deep understanding of customer needs. The opportunity for the

business stems from the poor customer service provided by their small competitors. Systems are designed to achieve the ‘no

surprises’ service, which leads to significant levels of customer recommendation and advocacy.

Autonomy and entrepreneurship – there is evidence of a strong belief that individuals and teams should be encouraged to

compete with one another, but not in ways that compromise the quality of the service delivered.

Simple form. – lean staff – Universal is a small functionally managed firm. There is no evidence of creating a large

headquarters, since managers are closely involved with the day-to-day management of their function.

Productivity through people – people are key to the service provided and there is recognition that teams are crucial to the

firm’s growth and success.

Simultaneous loose-tight properties – more difficult to identify in a small company, but there is clearly commitment to shared

values and giving people the freedom to achieve results within this value framework.

These measures of excellence again show the importance of ‘hard’ and ‘soft’ factors in achieving outstanding performance.

An alternative interpretation is to see these attributes as critical success factors, which if achieved, are clearly linked to key

performance indicators. Universal’s growth shows the link between strategy and the qualities needed to achieve this growth.

The ubiquitous balanced scorecard could also be used to measure four key criteria of company performance and

benchmarking the company against the major installers could also provide evidence of excellence. The recent gaining of a

government award for Universal’s contribution to inner city job creation is also a useful indicator of all round excellence. -

第14题:

(c) Discuss the ethical responsibility of the company accountant in ensuring that manipulation of the statement

of cash flows, such as that suggested by the directors, does not occur. (5 marks)

Note: requirements (b) and (c) include 2 professional marks in total for the quality of the discussion.

正确答案:

(c) Companies can give the impression that they are generating more cash than they are, by manipulating cash flow. The way

in which acquisitions, loans and, as in this case, the sale of assets, is shown in the statement of cash flows, can change the

nature of operating cash flow and hence the impression given by the financial statements. The classification of cash flows

can give useful information to users and operating cash flow is a key figure. The role of ethics in the training and professional

lives of accountants is extremely important. Decision-makers expect the financial statements to be true and fair and fairly

represent the underlying transactions.

There is a fine line between deliberate misrepresentation and acceptable presentation of information. Pressures on

management can result in the misrepresentation of information. Financial statements must comply with International

Financial Reporting Standards (IFRS), the Framework and local legislation. Transparency, and full and accurate disclosure is

important if the financial statements are not to be misleading. Accountants must possess a high degree of professional

integrity and the profession’s reputation depends upon it. Ethics describe a set of moral principles taken as a reference point.

These principles are outside the technical and practical application of accounting and require judgement in their application.

Professional accountancy bodies set out ethical guidelines within which their members operate covering standards of

behaviour, and acceptable practice. These regulations are supported by a number of codes, for example, on corporate

governance which assist accountants in making ethical decisions. The accountant in Warrburt has a responsibility not to mask

the true nature of the statement of cash flow. Showing the sale of assets as an operating cash flow would be misleading if

the nature of the transaction was masked. Users of financial statements would not expect its inclusion in this heading and

could be misled. The potential misrepresentation is unacceptable. The accountant should try and persuade the directors to

follow acceptable accounting principles and comply with accounting standards. There are implications for the truth and

fairness of the financial statements and the accountant should consider his position if the directors insist on the adjustments

by pointing the inaccuracies out to the auditors. -

第15题:

5 The directors of Quapaw, a limited liability company, are reviewing the company’s draft financial statements for the

year ended 31 December 2004.

The following material matters are under discussion:

(a) During the year the company has begun selling a product with a one-year warranty under which manufacturing

defects are remedied without charge. Some claims have already arisen under the warranty. (2 marks)

Required:

Advise the directors on the correct treatment of these matters, stating the relevant accounting standard which

justifies your answer in each case.

NOTE: The mark allocation is shown against each of the three matters

正确答案:

(a) The correct treatment is to provide for the best estimate of the costs likely to be incurred under the warranty, as required by

IAS37 Provisions, contingent liabilities and contingent assets. -

第16题:

(ii) Explain why the disclosure of voluntary information in annual reports can enhance the company’s

accountability to equity investors. (4 marks)

正确答案:

(ii) Accountability to equity investors

Voluntary disclosures are an effective way of redressing the information asymmetry that exists between management and

investors. In adding to mandatory content, voluntary disclosures give a fuller picture of the state of the company.

More information helps investors decide whether the company matches their risk, strategic and ethical criteria, and

expectations.

Makes the annual report more forward looking (predictive) whereas the majority of the numerical content is backward

facing on what has been.

Helps transparency in communicating more fully thereby better meeting the agency accountability to investors,

particularly shareholders.

There is a considerable amount of qualitative information that cannot be conveyed using statutory numbers (such as

strategy, ethical content, social reporting, etc).

Voluntary disclosure gives a more rounded and more complete view of the company, its activities, strategies, purposes

and values.

Voluntary disclosure enables the company to address specific shareholder concerns as they arise (such as responding

to negative publicity).

[Tutorial note: other valid points will attract marks] -

第17题:

(b) Explain the roles of a nominations committee and assess the potential usefulness of a nominations committee

to the board of Rosh and Company. (8 marks)

正确答案:

(b) Nominations committees

General roles of a nominations committee.

It advises on the balance between executives and independent non-executive directors and establishes the appropriate

number and type of NEDs on the board. The nominations committee is usually made up of NEDs.

It establishes the skills, knowledge and experience possessed by current board and notes any gaps that will need to be filled.

It acts to meet the needs for continuity and succession planning, especially among the most senior members of the board.

It establishes the desirable and optimal size of the board, bearing in mind the current size and complexity of existing and

planned activities and strategies.

It seeks to ensure that the board is balanced in terms of it having board members from a diversity of backgrounds so as to

reflect its main constituencies and ensure a flow of new ideas and the scrutiny of existing strategies.

In the case of Rosh, the needs that a nominations committee could address are:

To recommend how many directors would be needed to run the business and plan for recruitment accordingly. The perceived

similarity of skills and interests of existing directors is also likely to be an issue.

To resolve the issues over numbers of NEDs. It seems likely that the current number is inadequate and would put Rosh in a

position of non-compliance with many of the corporate governance guidelines pertaining to NEDs.

To resolve the issues over the independence of NEDs. The closeness that the NEDs have to existing executive board members

potentially undermines their independence and a nominations committee should be able to identify this as an issue and make

recommendations to rectify it.

To make recommendations over the succession of the chairmanship. It may not be in the interests of Rosh for family members

to always occupy senior positions in the business. -

第18题:

(b) Briefly explain THREE limitations of negotiated transfer prices. (3 marks)

正确答案:

(b) Negotiated transfer prices suffer from the following limitations:

– The transfer price which is the final outcome of negotiations may not be close to the transfer price that would be optimal

for the organisation as a whole since it can be dependent on the negotiating skills and bargaining powers of individual

managers.

– They can lead to conflict between divisions which may necessitate the intervention of top management to mediate.

– The measure of divisional profitability can be dependent on the negotiating skills of managers who may have unequal

bargaining power.

– They can be time-consuming for the managers involved, particularly where large numbers of transactions are involved. -

第19题:

(c) State the tax consequences for both Glaikit Limited and Alasdair if he borrows money from the company, as

proposed, on 1 January 2006. (3 marks)

正确答案:

(c) Alasdair is not employed, nor is he a director, of Glaikit Limited. As he holds 25% of the shares in Glaikit Limited, he is a

participator in a close company and therefore the special close company provisions will apply. Thus Alsadair will be taxed

under the ‘loans to participator’ rules.

When the loan is written off, the amount waived will be treated as a gross distribution of £16,667 (£15,000 x 10/9). This

will be assessed in the tax year in which the loan is written off (expected to be 2006/07 or 2007/08). To the extent that this

additional income makes Alasdair a higher rate taxpayer in that year, he will have to pay additional income tax of 32·5% of

the gross amount, less the available 10% tax credit.

From the company’s perspective, Glaikit Limited will have to pay 25% of the net value of any loan made to Alasdair which

has not been repaid to the company (or written off) within nine months of the year end. As the loan will remain outstanding

as at 31 March 2006, Glaikit Limited will have to pay £3,750 (25% x £15,000) to the Revenue by 1 January 2007. This

amount will not be repaid until the loan is repaid or written off. This usually takes place nine months after the year end in

which the loan is written off, so Glaikit Limited should ensure that any write-off occurs prior to 31 March 2007, or else the

repayment may be delayed for up to one year.

As the loan is tax free, the Revenue may also seek to tax Alasdair under the beneficial loan rules. If the Revenue were to seek

an assessment in this manner, the value of the benefit would be calculated and taxed as a deemed distribution. However, as

Alasdair has no connection with the company other than as an investor, it is unlikely that the beneficial loan benefit will lead

to such a deemed distribution. -

第20题:

(ii) Explain whether or not Carver Ltd will become a close investment-holding company as a result of

acquiring either the office building or the share portfolio and state the relevance of becoming such a

company. (2 marks)

正确答案:

(ii) Close investment holding company status

Carver Ltd will not become a close investment-holding company if it purchases the office building as, although it will no

longer be a trading company, it intends to rent out the building to a number of tenants none of whom is connected to

the company.

Carver Ltd will become a close investment holding company if it purchases a portfolio of quoted shares as it will no

longer be a trading company. As a result it will pay corporation tax at the full rate of 30% regardless of the level of its

profits. -

第21题:

In relation to the courts’ powers to interpret legislation, explain and differentiate between:

(a) the literal approach, including the golden rule; and (5 marks)

(b) the purposive approach, including the mischief rule. (5 marks)

正确答案:Tutorial note:

In order to apply any piece of legislation, judges have to determine its meaning. In other words they are required to interpret the

statute before them in order to give it meaning. The diffi culty, however, is that the words in statutes do not speak for themselves and

interpretation is an active process, and at least potentially a subjective one depending on the situation of the person who is doing

the interpreting.

Judges have considerable power in deciding the actual meaning of statutes, especially when they are able to deploy a number of

competing, not to say contradictory, mechanisms for deciding the meaning of the statute before them. There are, essentially, two

contrasting views as to how judges should go about determining the meaning of a statute – the restrictive, literal approach and the

more permissive, purposive approach.

(a) The literal approach

The literal approach is dominant in the English legal system, although it is not without critics, and devices do exist for

circumventing it when it is seen as too restrictive. This view of judicial interpretation holds that the judge should look primarily

to the words of the legislation in order to construe its meaning and, except in the very limited circumstances considered below,

should not look outside of, or behind, the legislation in an attempt to fi nd its meaning.

Within the context of the literal approach there are two distinct rules:

(i) The literal rule

Under this rule, the judge is required to consider what the legislation actually says rather than considering what it might

mean. In order to achieve this end, the judge should give words in legislation their literal meaning, that is, their plain,

ordinary, everyday meaning, even if the effect of this is to produce what might be considered an otherwise unjust or

undesirable outcome (Fisher v Bell (1961)) in which the court chose to follow the contract law literal interpretation of

the meaning of offer in the Act in question and declined to consider the usual non-legal literal interpretation of the word

(offer).(ii) The golden rule

This rule is applied in circumstances where the application of the literal rule is likely to result in what appears to the court

to be an obviously absurd result. It should be emphasised, however, that the court is not at liberty to ignore, or replace,

legislative provisions simply on the basis that it considers them absurd; it must fi nd genuine diffi culties before it declines

to use the literal rule in favour of the golden one. As examples, there may be two apparently contradictory meanings to a

particular word used in the statute, or the provision may simply be ambiguous in its effect. In such situations, the golden

rule operates to ensure that preference is given to the meaning that does not result in the provision being an absurdity.

Thus in Adler v George (1964) the defendant was found guilty, under the Offi cial Secrets Act 1920, with obstruction

‘in the vicinity’ of a prohibited area, although she had actually carried out the obstruction ‘inside’ the area.

(b) The purposive approach

The purposive approach rejects the limitation of the judges’ search for meaning to a literal construction of the words of

legislation itself. It suggests that the interpretative role of the judge should include, where necessary, the power to look beyond

the words of statute in pursuit of the reason for its enactment, and that meaning should be construed in the light of that purpose

and so as to give it effect. This purposive approach is typical of civil law systems. In these jurisdictions, legislation tends to set

out general principles and leaves the fi ne details to be fi lled in later by the judges who are expected to make decisions in the

furtherance of those general principles.

European Community (EC) legislation tends to be drafted in the continental manner. Its detailed effect, therefore, can only be

determined on the basis of a purposive approach to its interpretation. This requirement, however, runs counter to the literal

approach that is the dominant approach in the English system. The need to interpret such legislation, however, has forced

a change in that approach in relation to Community legislation and even with respect to domestic legislation designed to

implement Community legislation. Thus, in Pickstone v Freemans plc (1988), the House of Lords held that it was permissible,

and indeed necessary, for the court to read words into inadequate domestic legislation in order to give effect to Community

law in relation to provisions relating to equal pay for work of equal value. (For a similar approach, see also the House of Lords’

decision in Litster v Forth Dry Dock (1989) and the decision in Three Rivers DC v Bank of England (No 2) (1996).) However,

it has to recognise that the purposive rule is not particularly modern and has its precursor in a long established rule of statutory

interpretation, namely the mischief rule.The mischief rule

This rule permits the court to go behind the actual wording of a statute in order to consider the problem that the statute is

supposed to remedy.

In its traditional expression it is limited by being restricted to using previous common law rules in order to decide the operation

of contemporary legislation. Thus in Heydon’s case (1584) it was stated that in making use of the mischief rule the court

should consider what the mischief in the law was which the common law did not adequately deal with and which statute law

had intervened to remedy. Use of the mischief rule may be seen in Corkery v Carpenter (1950), in which a man was found

guilty of being drunk in charge of a carriage although he was in fact only in charge of a bicycle. -

第22题:

John Pentanol was appointed as risk manager at H&Z Company a year ago and he decided that his first task was to examine the risks that faced the company. He concluded that the company faced three major risks, which he assessed by examining the impact that would occur if the risk were to materialise. He assessed Risk 1 as being of low potential impact as even if it materialised it would have little effect on the company’s strategy. Risk 2 was assessed as being of medium potential impact whilst a third risk, Risk 3, was assessed as being of very high potential impact.

When John realised the potential impact of Risk 3 materialising, he issued urgent advice to the board to withdraw from the activity that gave rise to Risk 3 being incurred. In the advice he said that the impact of Risk 3 was potentially enormous and it would be irresponsible for H&Z to continue to bear that risk.

The company commercial director, Jane Xylene, said that John Pentanol and his job at H&Z were unnecessary and that risk management was ‘very expensive for the benefits achieved’. She said that all risk managers do is to tell people what can’t be done and that they are pessimists by nature. She said she wanted to see entrepreneurial risk takers in H&Z and not risk managers who, she believed, tended to discourage enterprise.

John replied that it was his job to eliminate all of the highest risks at H&Z Company. He said that all risk was bad and needed to be eliminated if possible. If it couldn’t be eliminated, he said that it should be minimised.

(a) The risk manager has an important role to play in an organisation’s risk management.

Required:

(i) Describe the roles of a risk manager. (4 marks)

(ii) Assess John Pentanol’s understanding of his role. (4 marks)

(b) With reference to a risk assessment framework as appropriate, criticise John’s advice that H&Z should

withdraw from the activity that incurs Risk 3. (6 marks)

(c) Jane Xylene expressed a particular view about the value of risk management in H&Z Company. She also said that she wanted to see ‘entrepreneurial risk takers’.

Required:

(i) Define ‘entrepreneurial risk’ and explain why it is important to accept entrepreneurial risk in business

organisations; (4 marks)

(ii) Critically evaluate Jane Xylene’s view of risk management. (7 marks)

正确答案:(a) (i) Roles of a risk manager

Providing overall leadership, vision and direction, involving the establishment of risk management (RM) policies,

establishing RM systems etc. Seeking opportunities for improvement or tightening of systems.

Developing and promoting RM competences, systems, culture, procedures, protocols and patterns of behaviour. It is

important to understand that risk management is as much about instituting and embedding risk systems as much as

issuing written procedure. The systems must be capable of accurate risk assessment which seem not to be the case at

H&Z as he didn’t account for variables other than impact/hazard.

Reporting on the above to management and risk committee as appropriate. Reporting information should be in a form

able to be used for the generation of external reporting as necessary. John’s issuing of ‘advice’ will usually be less useful

than full reporting information containing all of the information necessary for management to decide on risk policy.Ensuring compliance with relevant codes, regulations, statutes, etc. This may be at national level (e.g. Sarbanes Oxley)

or it may be industry specific. Banks, oil, mining and some parts of the tourism industry, for example, all have internal

risk rules that risk managers are required to comply with.

[Tutorial note: do not reward bullet lists. Study texts both use lists but question says ‘describe’.]

(ii) John Pentanol’s understanding of his role

John appears to misunderstand the role of a risk manager in four ways.

Whereas the establishment of RM policies is usually the most important first step in risk management, John launched

straight into detailed risk assessments (as he saw it). It is much more important, initially, to gain an understanding of

the business, its strategies, controls and risk exposures. The assessment comes once the policy has been put in place.

It is important for the risk manager to report fully on the risks in the organisation and John’s issuing of ‘advice’ will usually

be less useful than full reporting information. Full reporting would contain all of the information necessary for

management to decide on risk policy.

He told Jane Xylene that his role as risk manager involved eliminating ‘all of the highest risks at H&Z Company’ which

is an incorrect view. Jane Xylene was correct to say that entrepreneurial risk was important, for example.

The risk manager is an operational role in a company such as H&Z Company and it will usually be up to senior

management to decide on important matters such as withdrawal from risky activities. John was being presumptuous

and overstepping his role in issuing advice on withdrawal from Risk 3. It is his job to report on risks to senior

management and for them to make such decisions based on the information he provides.(b) Criticise John’s advice

The advice is based on an incomplete and flawed risk assessment. Most simple risk assessment frameworks comprise at least

two variables of which impact or hazard is only one. The other key variable is probability. Risk impact has to be weighed

against probability and the fact that a risk has a high potential impact does not mean the risk should be avoided as long as

the probability is within acceptable limits. It is the weighted combination of hazard/impact and probability that forms the basis

for meaningful risk assessment.

John appears to be very certain of his impact assessments but the case does not tell us on what information the assessment

is made. It is important to recognise that ‘hard’ data is very difficult to obtain on both impact and probability. Both measures

are often made with a degree of assumption and absolute measures such as John’s ranking of Risks 1, 2 and 3 are not as

straightforward as he suggests.

John also overlooks a key strategic reason for H&Z bearing the risks in the first place, which is the return achievable by the

bearing of risk. Every investment and business strategy carries a degree of risk and this must be weighed against the financial

return that can be expected by the bearing of the risk.

(c) (i) Define ‘entrepreneurial risk’

Entrepreneurial risk is the necessary risk associated with any new business venture or opportunity. It is most clearly seen

in entrepreneurial business activity, hence its name. In ‘Ansoff’ terms, entrepreneurial risk is expressed in terms of the

unknowns of the market/customer reception of a new venture or of product uncertainties, for example product design,

construction, etc. There is also entrepreneurial risk in uncertainties concerning the competences and skills of the

entrepreneurs themselves.

Entrepreneurial risk is necessary, as Jane Xylene suggested, because it is from taking these risks that business

opportunities arise. The fact that the opportunity may not be as hoped does not mean it should not be pursued. Any

new product, new market development or new activity is a potential source of entrepreneurial risk but these are also the

sources of future revenue streams and hence growth in company value.(ii) Critically evaluate Jane Xylene’s view of risk management

There are a number of arguments against risk management in general. These arguments apply against the totality of risk

management and also of the employment of inappropriate risk measures.

There is a cost associated with all elements of risk management which must obviously be borne by the company.

Disruption to normal organisational practices and procedures as risk systems are complied with.

Slowing (introducing friction to) the seizing of new business opportunities or the development of internal systems as they

are scrutinised for risk.

‘STOP’ errors can occur as a result of risk management systems where a practice or opportunity has been stopped on

the grounds of its risk when it should have been allowed to proceed. This may be the case with Risk 3 in the case.

(Contrast with ‘GO’ errors which are the opposite of STOP errors.)

There are also arguments for risk management people and systems in H&Z. The most obvious benefit is that an effective

risk system identifies those risks that could detract from the achievements of the company’s strategic objectives. In this

respect, it can prevent costly mistakes by advising against those actions that may lose the company value. It also has

the effect of reassuring investors and capital markets that the company is aware of and is in the process of managing

its risks. Where relevant, risk management is necessary for compliance with codes, listing rules or statutory instruments. -

第23题:

(a) List and explain FOUR methods of selecting a sample of items to test from a population in accordance with ISA 530 (Redrafted) Audit Sampling and Other Means of Testing. (4 marks)

(b) List and explain FOUR assertions from ISA 500 Audit Evidence that relate to the recording of classes of

transactions. (4 marks)

(c) In terms of audit reports, explain the term ‘modified’. (2 marks)

正确答案:

(a)SamplingmethodsMethodsofsamplinginaccordancewithISA530AuditSamplingandOtherMeansofTesting:Randomselection.Ensureseachiteminapopulationhasanequalchanceofselection,forexamplebyusingrandomnumbertables.Systematicselection.Inwhichanumberofsamplingunitsinthepopulationisdividedbythesamplesizetogiveasamplinginterval.Haphazardselection.Theauditorselectsthesamplewithoutfollowingastructuredtechnique–theauditorwouldavoidanyconsciousbiasorpredictability.Sequenceorblock.Involvesselectingablock(s)ofcontinguousitemsfromwithinapopulation.Tutorialnote:Othermethodsofsamplingareasfollows:MonetaryUnitSampling.Thisselectionmethodensuresthateachindividual$1inthepopulationhasanequalchanceofbeingselected.Judgementalsampling.Selectingitemsbasedontheskillandjudgementoftheauditor.(b)Assertions–classesoftransactionsOccurrence.Thetransactionsandeventsthathavebeenrecordedhaveactuallyoccurredandpertaintotheentity.Completeness.Alltransactionsandeventsthatshouldhavebeenrecordedhavebeenrecorded.Accuracy.Theamountsandotherdatarelatingtorecordedtransactionsandeventshavebeenrecordedappropriately.Cut-off.Transactionsandeventshavebeenrecordedinthecorrectaccountingperiod.Classification.Transactionsandeventshavebeenrecordedintheproperaccounts.(c)AuditreporttermModified.Anauditormodifiesanauditreportinanysituationwhereitisinappropriatetoprovideanunmodifiedreport.Forexample,theauditormayprovideadditionalinformationinanemphasisofmatter(whichdoesnotaffecttheauditor’sopinion)orqualifytheauditreportforlimitationofscopeordisagreement.